Gold has been a financial lightning rod for centuries, sparking debates that range from passionate advocacy to outright dismissal.

Critics, including some of the world’s most prominent investors, have long scoffed at gold, calling it a “barbarous relic” or a shiny rock that sits idly in vaults, producing nothing but dust.

They argue it’s an unproductive asset, dug up from one hole only to be buried in another, offering no yield or growth.

Yet, gold has surged in recent years, defying naysayers with a performance that demands attention. So, what’s the real story behind this ancient metal?

Is it merely a speculative bet on price spikes, or could it be something more…a productive cornerstone of a portfolio that offers both stability and opportunity?

Let’s dive into the evolving role of gold in today’s financial landscape and explore a groundbreaking approach that’s turning heads in the investment world.

But first, let’s unpack why gold’s reputation needs a serious rethink.

Gold’s Resurgence: More Than Just a Safe Haven?

Gold’s recent rally isn’t just a blip on the radar…it’s a signal that investors are waking up to its enduring value.

Over the past few years, gold has outperformed many traditional assets, climbing steadily as global uncertainties, from geopolitical tensions to monetary policy missteps, have shaken confidence in fiat currencies.

The metal’s allure as a hedge against inflation and currency debasement is well-known, rooted in its scarcity and historical role as a store of value.

But here’s where the critics chime in: gold doesn’t pay dividends, it doesn’t generate cash flow, and it doesn’t “work” for you like stocks or bonds.

Or does it?

The traditional view of gold as a static asset…something you buy, bury, and hope to sell at a higher price…misses a critical shift happening in the market.

What if gold could be more than a hedge?

What if it could generate a return, much like bonds or dividend-paying stocks, without sacrificing its unique ability to protect wealth?

This isn’t a hypothetical question…it’s a reality being forged by an innovative company that is redefining how gold fits into the modern financial system.

But before we explore this new frontier, let’s consider why gold’s role as “money” is so misunderstood and why that misunderstanding creates a massive opportunity for investors.

The Money Question: Is Gold Still King?

To understand gold’s potential, we need to grapple with a fundamental question: Is gold money?

For some, the answer is a resounding yes. Gold has been a medium of exchange, a unit of account, and a store of value for thousands of years.

Its physical properties…durability, divisibility, and scarcity…make it uniquely suited to serve as money.

In many parts of the world, particularly in places like Turkey, India, and the Middle East, gold is still treated as a form of money, with millions of people holding gold-denominated accounts or buying jewelry not just for adornment but as a portable store of wealth.

In Turkey alone, a population of 80 million supports over 115 million gold-denominated accounts…a statistic that underscores gold’s enduring appeal outside the U.S.

Yet, in the Western world, particularly in America, gold is often viewed as a commodity, not a currency. It’s something you buy to hedge against a collapsing dollar or a stock market crash, not something you use to pay for groceries or settle debts.

This disconnect stems from the dominance of fiat currencies…government-issued money backed by nothing more than trust in central banks.

Since the U.S. abandoned the gold standard in 1971, the dollar has been an “IOU nothing,” a promise to pay that lacks any tangible backing.

Meanwhile, gold’s role as a medium of exchange has faded, replaced by credit cards, digital payments, and paper bills.

Here’s where it gets interesting: even if gold isn’t widely used as a medium of exchange today, its function as a store of value persists.

And it’s the most marketable naturally occuring commodity, with a bid-ask spread in places like Dubai’s Gold Souk as tight as a dollar or two per ounce.

It’s the ultimate extinguisher of debt, unlike fiat currency, which is itself a debt instrument.

When you pay a debt with dollars, you’re merely shifting the obligation around; with gold, you settle it outright.

This distinction is critical because it highlights gold’s stability in a world where fiat currencies are perpetually debased.

But if gold is so stable, why isn’t it being used more productively? And what happens when it is?

Hold that thought…we’re about to explore a game-changing approach that could redefine gold’s role in your portfolio.

The Productivity Problem: Can Gold Work for You?

One of the biggest knocks against gold is that it’s “unproductive.”

Unlike a stock that pays dividends or a bond that offers interest, gold traditionally sits in a vault, doing nothing but waiting for its price to rise.

This perception fuels the argument that gold is a speculative bet, not an investment.

But what if this view is outdated?

What if gold could generate a yield, much like traditional financial assets, while still preserving its role as a hedge against chaos?

Enter a new approach to gold investing, one that challenges the status quo by putting gold to work.

Imagine a world where gold isn’t just a static asset but a dynamic one, leased to businesses that need it or lent to companies that produce it.

This isn’t a pipe dream…it’s happening now, and it’s creating a bridge between gold’s traditional role as a safe haven and its potential as a productive asset.

The key lies in understanding the gold market’s untapped potential and the innovative financial products that are filling the gap.

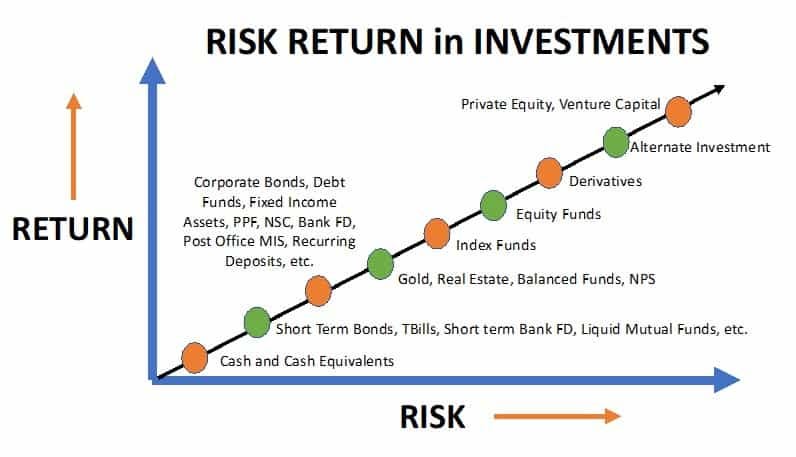

In the traditional financial world, there’s a well-developed spectrum of risk and return.

On one end, you have cash or Treasury bills…low risk, low return.

On the other, you have speculative ventures like startup equities…high risk, potentially astronomical returns.

Gold, however, has historically been a “barbell” asset: you either own physical gold, which offers no return and minimal risk (in terms of losing its intrinsic value), or you invest in gold mining stocks, which are fraught with risks like geological uncertainties, political instability, and operational mishaps.

There’s been little in between…until now.

Bridging the Gap

A new (old?) financial innovation is emerging to fill this void, offering investors a way to earn a yield on their gold without venturing into the wild west of mining equities.

Monetary Metals is pioneering this space by creating products that allow gold to be used productively.

They operate on a simple but powerful thesis: if you offer interest on gold, investors will bring their gold to the market, and businesses will use it to create value.

This approach is not only practical but also has the potential to reshape the monetary system from the ground up.

Here’s how it works. Monetary Metals offers two primary products: gold leases and gold bonds.

How a Gold Lease Works

In a gold lease, investors provide gold to businesses that need it as inventory or work-in-progress, such as jewelers in the Middle East or refineries processing scrap gold.

These businesses lease the gold, using it to stock their shelves or fuel their operations, and pay interest in gold…say, 4% per year.

This means if you lease 100 ounces of gold, you get back 104 ounces at the end of the year.

The lessee benefits by avoiding the price risk of borrowing dollars to buy gold (if gold’s price drops, they’d be stuck with a devalued asset but a full dollar debt).

The investor, meanwhile, earns a yield while still holding gold, not dollars, preserving their exposure to gold’s long-term value.

How Gold Bonds Work

Gold bonds, on the other hand, are higher-risk, higher-reward.

These are loans made in gold to companies that generate gold income, such as mining firms.

Investors receive interest rates in the double digits, often 10-18%, reflecting the increased risk of lending to a business with operational and market uncertainties.

Unlike mining equities, which are at the far end of the risk spectrum, gold bonds offer a middle ground…higher returns than leases but lower risk than stocks, as bondholders are paid before shareholders in the event of financial trouble.

What makes this model compelling is its alignment with market principles.

It’s not about waiting for governments to reinstate a gold standard; it’s about creating a free-market solution that leverages gold’s unique properties.

By offering interest, Monetary Metals attracts gold from investors who might otherwise hoard it, putting it to work in real businesses that create value.

This creates a virtuous cycle: businesses get the capital they need without the risks of fiat-based financing, and investors earn a return while maintaining their gold exposure.

But how does this fit into a broader portfolio, and why should investors care?

Let’s explore the numbers.

The Portfolio Power-Up: Gold with a Yield

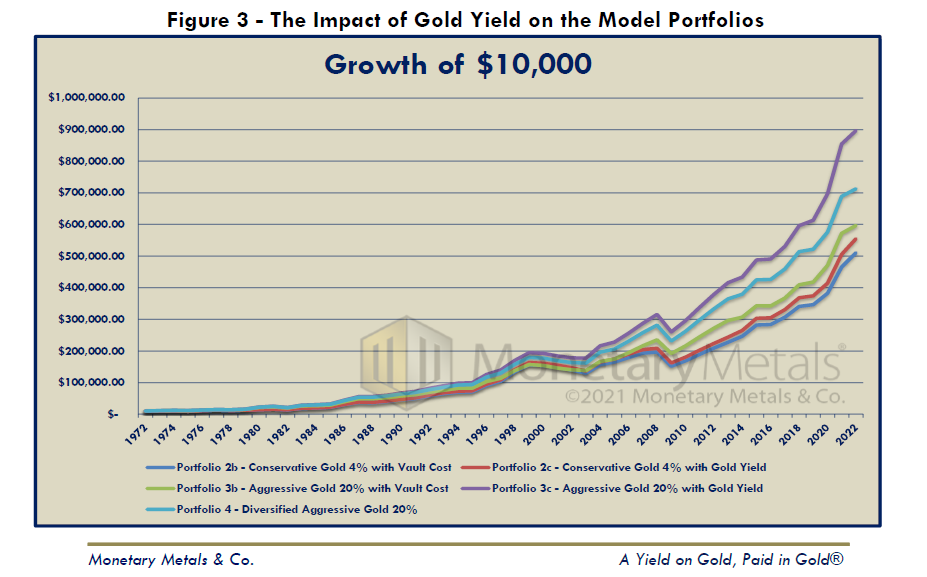

Studies have long shown that adding gold to a diversified portfolio can enhance returns and reduce risk.

A typical portfolio of 60% stocks and 40% bonds benefits from a small allocation…say, 4%…to gold, which lowers volatility and drawdowns (the peak-to-trough declines during market stress).

Gold’s lack of correlation with other assets makes it an ideal hedge; when stocks and bonds zig, gold often zags.

However, traditional gold ownership comes with a catch: storage costs.

At 50-75 basis points per year, these costs can erode the benefits, making gold less attractive to institutional investors.

Now, imagine flipping that script.

Instead of paying to store gold, what if you earned a 3-4% yield?

Research shows that a portfolio with a yielding gold allocation…say, 4% earning 3% annually…doesn’t just match the performance of a traditional portfolio; it significantly outperforms it.

Over decades, the compounded return from gold’s yield can dramatically boost overall portfolio returns while further reducing volatility.

This is because gold’s non-correlated nature amplifies the benefits of diversification, and the yield adds a turbo charge to the equation.

It’s like finding a cheat code for portfolio management: higher returns, lower risk, and a hedge against fiat currency debasement.

But there’s a catch…or is there?

Many gold investors are hesitant to part with their physical metal, fearing counterparty risk or missing out on a massive price revaluation. The beauty of this model is that it doesn’t require you to give up your “stash.”

You can keep your emergency gold buried in the backyard (or lost in that infamous boating accident) while allocating a portion of your portfolio to productive gold investments.

The lease model, in particular, is designed to minimize risk, with physical gold held on-site, insured, and monitored daily to ensure it’s there.

It’s not zero risk…no investment is…but it’s as close as you can get while still earning a return.

The Global Gold Rush: Where’s the Action?

The gold market isn’t the same everywhere.

In the U.S., gold is often seen as a niche investment, with less than 1% of Americans holding physical gold.

The U.S. gold trade is, frankly, a bit sleepy.

Contrast that with places like Dubai, where jewelry stores are stacked with 50 kilos of gold each, and necklaces can weigh nearly three ounces…purchased not for fashion but as a store of wealth.

In Asia, Europe, and the Middle East, gold is deeply embedded in the culture and economy, with markets like India and Turkey treating it as a form of money. This global appetite for gold creates a fertile ground for innovative financial products.

For investors, the opportunity lies in tapping into these vibrant markets.

Monetary Metals is seeing strong demand from both investors and businesses outside the U.S., particularly in regions where gold is already a trusted asset.

On the investor side, about 60% of clients are U.S.-based, but the rest come from around the world, and that share is growing.

On the business side, the majority of lessees and borrowers are international, reflecting the global nature of the gold trade.

The biggest growth opportunities?

Places like Dubai, where the sheer volume of gold activity is mind-boggling, and Asia, where cultural affinity for gold runs deep. But the U.S. market, with its untapped potential, could be a sleeping giant as more investors wake up to gold’s potential.

Why Gold Matters Now

The world’s financial system is built on a shaky foundation of fiat currencies, with debt levels soaring and central banks struggling to maintain stability.

Gold’s role as a hedge against this uncertainty is undeniable, but its potential as a productive asset is just beginning to be realized.

By offering a yield, gold can compete with traditional investments while preserving its unique ability to protect wealth. This IS NOT about waiting for a gold standard to return…it’s about creating a market-driven solution that works today.

For investors, the message is clear: gold doesn’t have to be a static asset.

By allocating a portion of your portfolio to yielding gold products, you can enhance returns, reduce risk, and stay true to the metal’s role as a hedge.

Whether it’s leasing gold to jewelers or lending to miners, these opportunities fill a gap in the market that’s been ignored for too long.

And with a $20 trillion global gold market lying “strewn about on the side of the road,” as one expert put it, the potential for growth is staggering.

So, what’s stopping you? Is it fear of counterparty risk, or skepticism about gold’s productivity? Or perhaps it’s simply a lack of awareness about these new possibilities.

Whatever the reason, the gold market is evolving, and those who get in early stand to benefit the most.

Want to learn more? Check out Monetary Metals for a deeper dive into how gold can work for you. Because in a world of uncertainty, gold isn’t just a safe haven…it’s a chance to build wealth on your terms.

Up next… Two countries. Two systems. One entanglement so complete that any attempt to pull the threads apart now threatens to unmake the fabric itself.

It started with a promise: open markets, cheap goods, mutual gain. What followed was something far more complex. Factories crossed borders. Capital changed flags.

Strategic industries rewired themselves across oceans. And for years, the model worked…until it didn’t.

What happens when dependence begins to feel like exposure?