The notion of the Federal Reserve's independence has long been a cornerstone of economic discourse in the United States, taught in business schools and economics classrooms as a fundamental principle of the nation’s monetary system.

However, this independence is increasingly being called into question, particularly as the incoming administration seeks to reshape the interplay between monetary policy and governmental authority.

Recent developments suggest a seismic shift may be underway, with the executive branch aiming to consolidate control over monetary policy in alignment with broader national priorities.

In this weeks podcast we dive into the historical context, current tensions, and potential implications of this evolving dynamic, drawing on a detailed analysis of the Federal Reserve's role and the political pressures it faces.

The Myth of Independence

At its core, the Federal Reserve was established by an act of Congress in 1913, a legislative creation that underscores its dependence on governmental authority.

The idea that an entity created by the stroke of a pen could be wholly independent is inherently flawed.

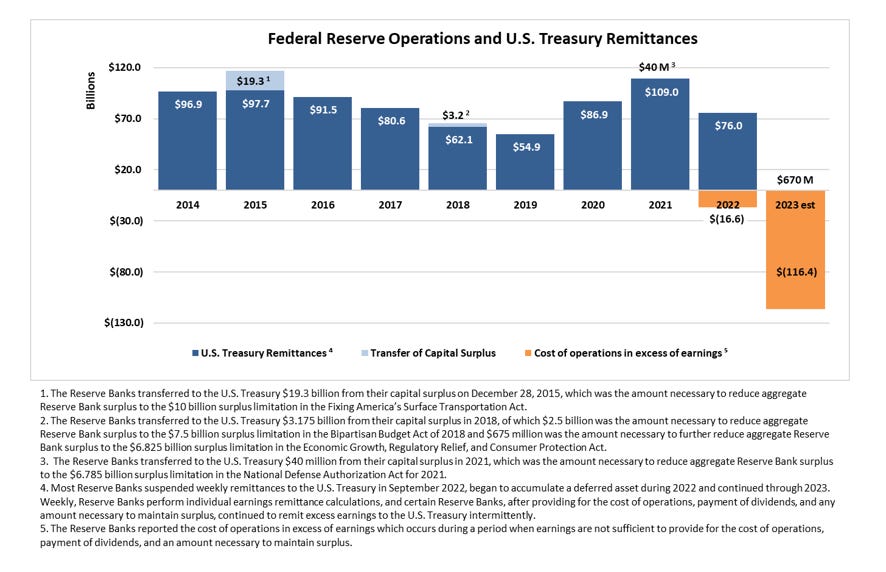

While the Fed operates with a degree of autonomy, its accountability to Congress…through biannual testimonies…and its obligation to remit profits to the U.S. Treasury reveal a hierarchical relationship.

These profits, derived from the Fed’s operations, are funneled back to the government, highlighting that the Treasury holds ultimate authority.

If the Fed were truly independent, it would not be subject to such oversight or financial obligations.

Historically, the Federal Reserve has maintained a delicate balance of autonomy and accountability.

Its ability to set monetary policy, such as interest rates and quantitative easing, grants it significant influence over the economy.

Yet, this power is not unchecked.

The Fed’s actions are scrutinized by Congress, and its leadership must navigate political pressures from the executive branch.

This tension has surfaced repeatedly since the Fed’s inception, with notable battles shaping the narrative of its independence.

Historical Battles Between the Fed and the Executive Branch

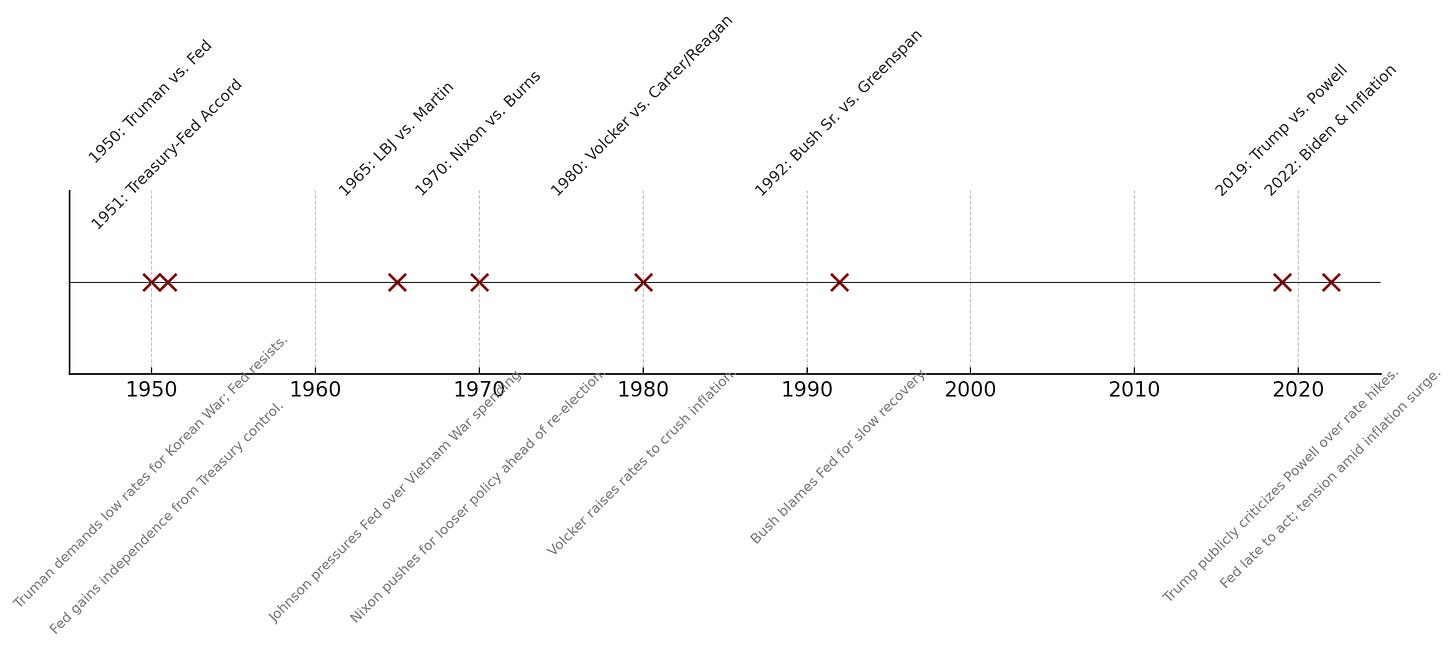

The post-World War II era provides several examples of conflicts between the Federal Reserve and the executive branch, illustrating the limits of the Fed’s autonomy.

One of the earliest significant clashes occurred during the Truman administration in the early 1950s.

President Harry Truman, grappling with the financial demands of the Korean War, sought lower interest rates to ease the cost of borrowing.

The Federal Reserve, under Chairman Thomas McChesney Martin Jr., resisted, prioritizing inflation control.

The public dispute culminated in the 1951 Treasury-Fed Accord, which reaffirmed the Fed’s independence from direct executive control.

This agreement was a victory for the Fed, solidifying its ability to prioritize economic stability over political demands.

A decade later, during the Vietnam War, President Lyndon B. Johnson clashed with Fed Chairman William McChesney Martin over high interest rates.

Johnson, frustrated by the economic constraints imposed by the Fed’s policies, summoned Martin to his Texas ranch in a dramatic confrontation.

Accusing Martin of undermining the war effort and contributing to American casualties, Johnson physically intimidated the chairman, demanding lower rates.

Martin, however, stood firm, refusing to bow to political pressure.

This episode underscored the Fed’s resolve to maintain its policy stance, even in the face of aggressive executive intervention.

The early 1970s saw another battle under President Richard Nixon, who pressured Fed Chairman Arthur Burns to lower rates to support his domestic and war-related expenditures.

Unlike Martin, Burns eventually acquiesced, a decision that contributed to the rampant inflation of the 1970s.

Burns’ capitulation tarnished his legacy, marking him as a weaker chairman and setting a precedent that subsequent Fed leaders have sought to avoid.

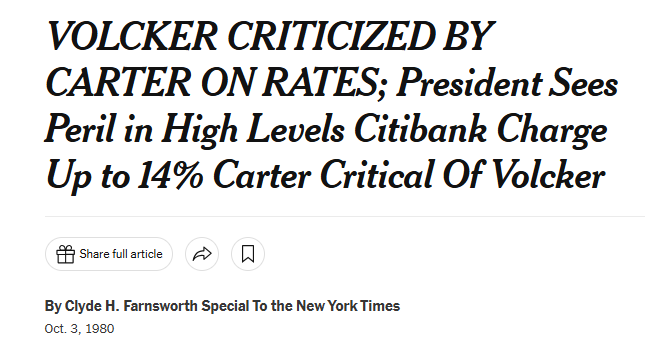

In the late 1970s, Paul Volcker took the helm of the Federal Reserve and adopted an aggressive stance against inflation, raising interest rates to unprecedented levels.

Despite public criticism from Presidents Jimmy Carter and Ronald Reagan, who blamed Volcker’s policies for exacerbating the recession, Volcker remained steadfast.

His refusal to yield demonstrated the Fed’s capacity to resist political pressure, though it came at the cost of economic hardship for many Americans.

The early 1990s brought another clash, this time between Fed Chairman Alan Greenspan and President George H.W. Bush.

Facing a recession, Bush urged Greenspan to cut rates to stimulate the economy ahead of his re-election campaign.

Greenspan’s refusal to comply contributed to economic discontent, which Bill Clinton capitalized on with his campaign slogan, “It’s the economy, stupid.”

Bush’s electoral loss highlighted the political consequences of the Fed’s independent stance.

More recently, the Federal Reserve’s actions under Chairmen Ben Bernanke and Janet Yellen reflected a period of relatively dovish monetary policy, with low interest rates and extensive quantitative easing.

This alignment with executive priorities reduced tensions during the Obama administration.

However, the dynamic shifted with the Trump administration’s first term.

Trump, who nominated Jerome Powell as Fed Chairman, later criticized Powell’s rate hikes in 2018, accusing the Fed of undermining his economic agenda.

These public disputes underscored the persistent friction between the executive branch and the Fed.

Current Tensions and the Push for Consolidation

The current political landscape marks a pivotal moment in the debate over Federal Reserve independence.

The incoming administration, led by a president with a strong “America First” agenda, is seeking to consolidate control over various governmental functions, including monetary policy.

This push is driven by a desire to align all aspects of policy…domestic, international, economic, and social…under a unified strategy.

Monetary policy, as a critical tool influencing economic performance, is a natural target for this consolidation.

The administration’s dissatisfaction with Federal Reserve Chairman Jerome Powell stems from his refusal to cut interest rates in line with political expectations.

Critics argue that Powell’s policies have not adequately supported economic growth, particularly in the context of global economic challenges and domestic priorities.

In response, the administration is exploring multiple avenues to exert influence over the Fed, including public criticism and potential legal challenges.

One proposed strategy involves accusing Powell of perjury during his congressional testimonies, a charge that could provide grounds for his removal “for cause.”

Treasury Secretary Steve Bessent has publicly stated that the president has the authority to remove the Fed chairman under such circumstances, though no concrete action has been taken as of July 20, 2025.

Additionally, the administration’s allies in Congress are amplifying these efforts, signaling a coordinated push to challenge Powell’s leadership.

A particularly contentious issue is the Federal Reserve’s $2.5 billion renovation of its Washington, D.C., headquarters.

Critics argue that this expenditure, funded by the Fed’s operations, deprives the Treasury of profits that would otherwise be remitted.

The optics of such a lavish project are damaging, particularly in an era of heightened public scrutiny over government spending.

The administration is likely to leverage this issue to portray the Fed as out of touch with the needs of ordinary Americans, further eroding public support for its independence.

The Path to a Merged Fed and Treasury

The trajectory of these developments suggests a potential merger of the Federal Reserve and the Treasury Department, effectively dismantling the myth of central bank independence.

Such a consolidation would place monetary policy under direct executive control, aligning it with the administration’s broader economic and geopolitical objectives.

While this shift may take years to fully materialize, the groundwork is being laid through legislative and public pressure.

The separation of powers, a foundational principle of the U.S. government, complicates this process.

The legislative branch, currently supportive of the administration’s agenda, may back efforts to curb the Fed’s autonomy.

However, opposition from Democrats, who may resist ceding such power to a Republican administration, could prolong the battle.

The judicial branch may also play a role if legal challenges, such as Powell contesting his removal, reach the Supreme Court.

A protracted conflict could introduce significant uncertainty into tyranny into global financial markets, potentially leading to volatility.

Market Implications and Public Perception

The potential removal or resignation of Jerome Powell could have profound implications for financial markets.

A swift change in leadership, particularly if replaced by a more dovish chairman, could lead to a short-term market sell-off followed by a rally driven by expectations of looser monetary policy.

However, a drawn-out battle, especially if escalated to the Supreme Court, could result in prolonged volatility, as uncertainty over monetary policy direction weighs on investor confidence.

Public perception will play a critical role in this saga.

The administration’s populist rhetoric, framing the Federal Reserve as an elitist institution disconnected from the needs of ordinary Americans, is likely to resonate with a significant portion of the public.

The $2.5 billion renovation project serves as a potent symbol of excess, potentially galvanizing public support for greater executive control over the Fed.

Broader Economic and Geopolitical Context

The push to consolidate monetary policy aligns with the administration’s broader “America First” strategy, which seeks to integrate domestic and international policies under a unified framework.

Money, as a fundamental driver of global influence, is central to this vision.

Control over monetary policy would enable the administration to pursue economic policies that prioritize domestic growth, potentially at the expense of international cooperation.

Geopolitical tensions and upcoming tariffs, set to take effect on August 1, 2025, further complicate the economic landscape.

The NASDAQ, currently at all-time highs and exhibiting overbought conditions, is vulnerable to catalysts such as Fed policy changes or trade disruptions.

Earnings reports and ongoing geopolitical issues could exacerbate market volatility in the third quarter of 2025.

Conclusion

The Federal Reserve’s independence, long a subject of academic reverence, is facing an unprecedented challenge.

Historical battles between the Fed and the executive branch reveal a pattern of resistance and compromise, but the current administration’s aggressive push for control may mark the beginning of the end for the Fed’s autonomy.

The potential merger of the Fed and the Treasury, while fraught with legal and political hurdles, appears increasingly plausible in the context of a populist-driven agenda.

The coming months will be critical, with the Federal Reserve’s next meeting likely to intensify the debate over interest rate policies.

Whether Powell remains in his position or is replaced, the outcome will have far-reaching implications for the U.S. economy and global markets.

As the administration leverages public sentiment and legislative support, the myth of Federal Reserve independence may soon be relegated to history, ushering in a new era of centralized monetary authority.

For investors, policymakers, and the public, the stakes could not be higher.

You're Smart Enough to Know This Isn't "Normal"

You can feel it, can't you?

Markets aren’t reacting to fundamentals. Policy is no longer predictable. And the headlines? They're distractions…noise wrapped in narrative.

If you’re managing your own capital…or responsible for other people’s…you know this game isn’t played on CNBC.

It’s played behind closed doors. In quiet corners of the macro landscape. Long before the crowd catches on.

But that edge is getting harder to find. The old signals are distorted. The usual sources? Watered down. Everyone’s either chasing yield or selling hopium.

And here’s the thing most won’t admit:

If you’re not getting access to serious, conviction-level macro research…you’re playing defense in a game that punishes hesitation.

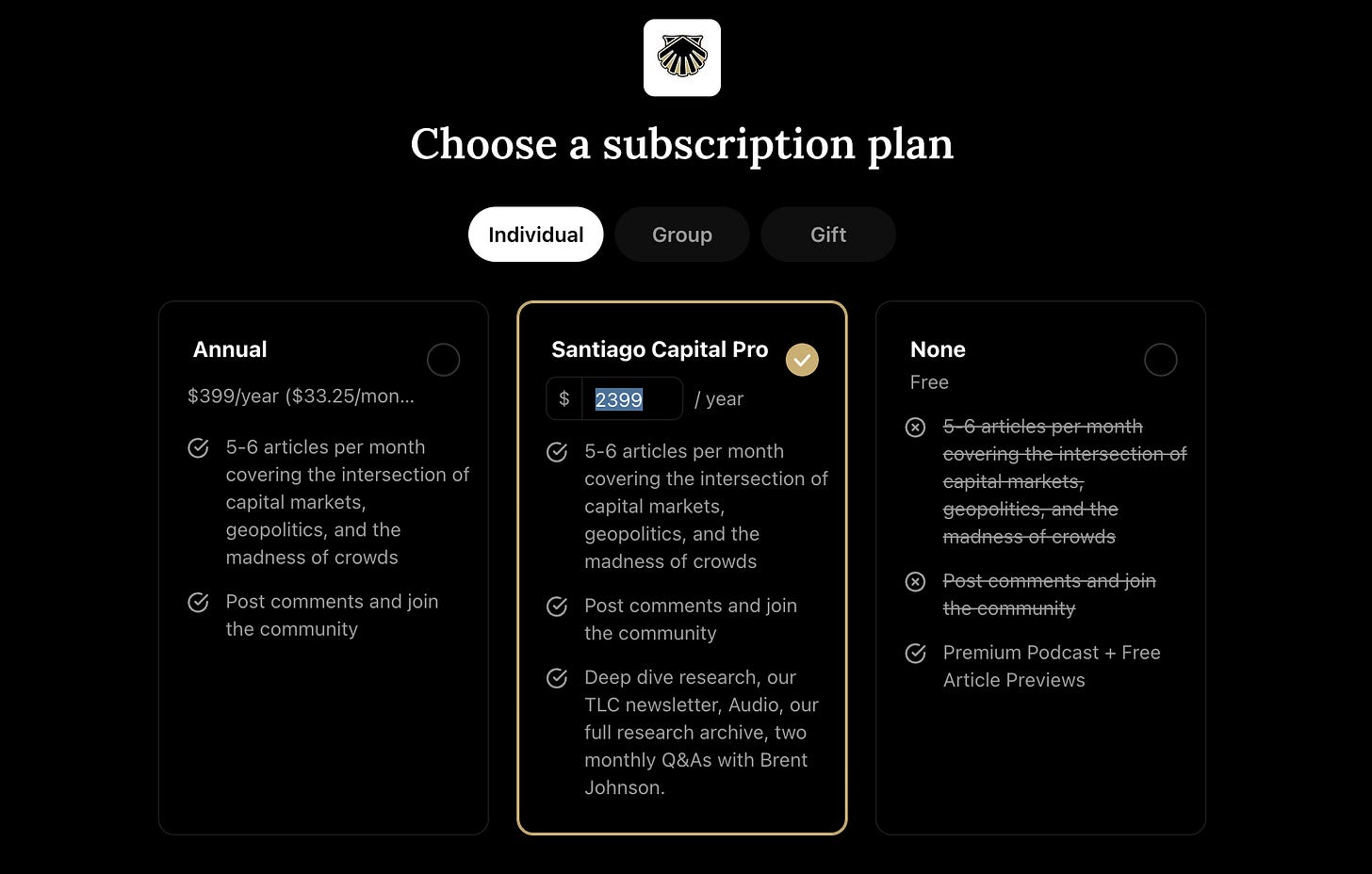

That’s Why We Built Santiago Capital Pro

This isn’t your typical newsletter.

It’s a high-level research terminal for serious investors who want to front-run the global narrative shifts most only recognize in hindsight.

Inside Santiago Capital Pro, you get:

Two Deep Dives per month – Original, proprietary macro research you won’t find anywhere else (think: Argentina, global real estate, central bank plays, capital flow maps).

TLC Reports – Think, Laugh, Cry. These brief thought pieces are designed for self-reflection and entertainment. You’ll think, you’ll laugh, you’ll cry.

Live Q&A calls – Twice monthly, with Brent Johnson. Bring your hardest questions…we don’t do softballs.

3-4 premium articles per month – Real-time context to stay ahead of the narrative.

All grandfathered in at our introductory rate. For life.

The Asymmetric Edge You're Looking For

The price of admission: $2,399/year.

For that, you get a front-row seat to the thinking behind real capital allocation…while others are still waiting for confirmation.

Seats are limited. And when the window closes, it closes.

👉 Upgrade to Santiago Capital Pro Now

If you're allocating capital in a world this uncertain, you owe it to yourself to do it with insight, not guesswork.