Download this weeks full chart deck by clicking on the button below. A zip file will be provided from SantiagoCapital.com.

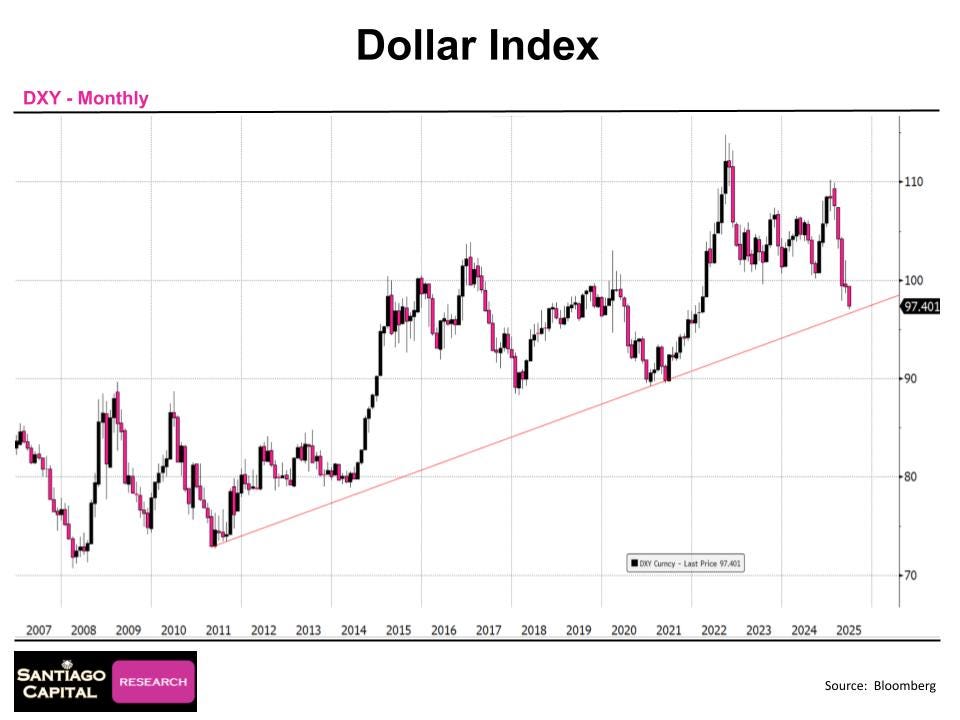

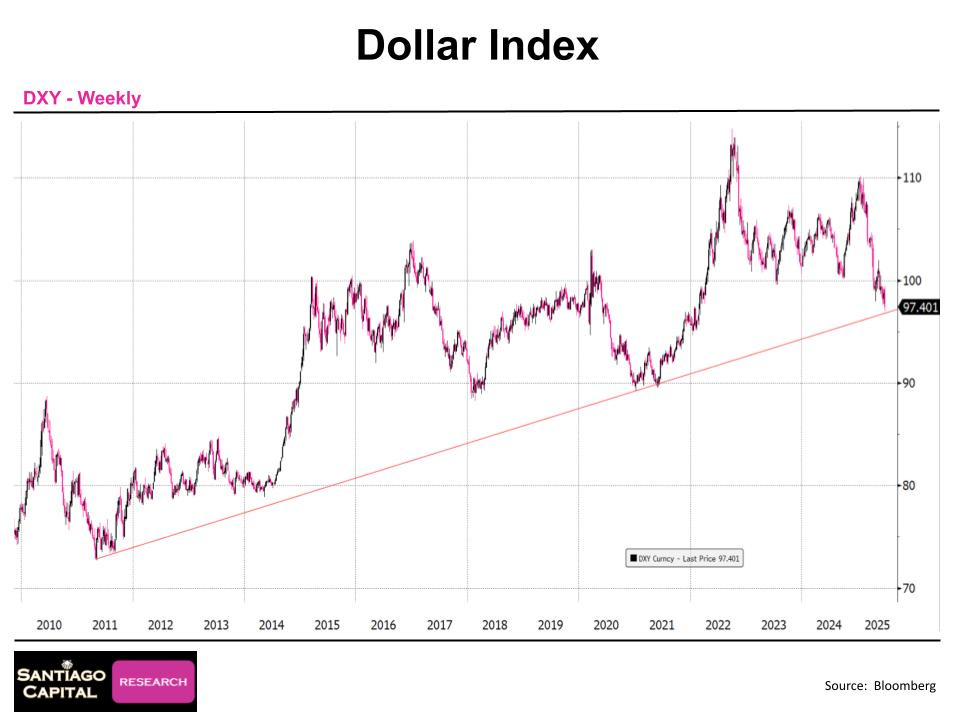

The U.S. dollar index has plummeted nearly 10% in 2025, closing the first half at 97.5 after starting at 108 and peaking at 110.

This marks the weakest first-half performance in approximately 40 years, fueling speculation about the end of its reign as the global reserve currency.

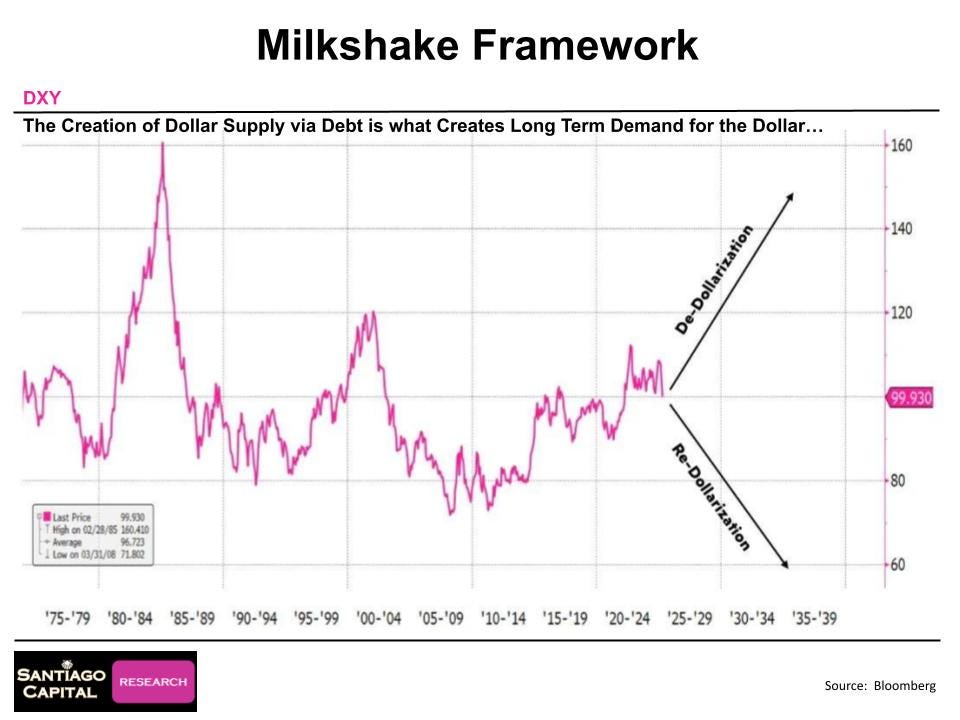

As markets grapple with this shift, the Dollar Milkshake Theory offers a lens to understand the implications.

With the July 4th holiday looming, investors are left wondering: Is this the beginning of the dollar’s demise, or a setup for a dramatic reversal?

The answer may lie in the dollar’s historical behavior…so what does the past tell us about the dollar during crises? Let’s take a look.

Dollar’s Historical Role in Crises

The dollar’s movements have long been a barometer for global economic health.

Over the past 25 to 30 years, nearly every major crisis has coincided with a rising U.S. dollar, not a falling one.

This pattern emerged during the late 1990s Russian debt crisis and Long-Term Capital Management collapse, continued through the dot-com bust and 9/11, and intensified during the Global Financial Crisis, the Euro sovereign debt crisis, and COVID-19.

In 2022, the dollar surged as the Federal Reserve raised rates and geopolitical tensions escalated, peaking before retreating to 97.5 by mid-2025.

Some recall when 97.5 was seen as a ceiling, with skeptics doubting it could rise further, yet here it stands again, with many declaring the dollar’s end.

Brent Johnson notes a near 100% correlation between a slowing global economy, crises, and a rising dollar, suggesting a falling dollar may signal reflation rather than collapse.

But what drives this consistent link between dollar strength and global distress, and how might it play out now?

The Dollar Milkshake Theory As A Market Guide

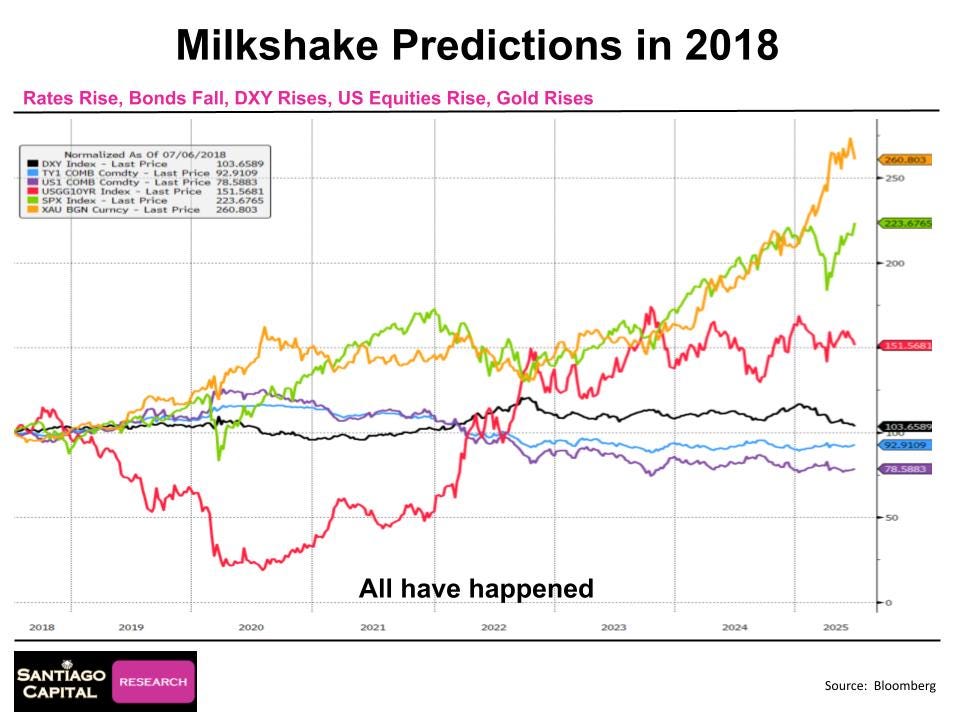

Introduced in 2018 when the dollar index was around 88-89…well below today’s 97.5…the Dollar Milkshake Theory isn’t a call to hoard cash or predict a perpetual rise.

It’s a framework to decode the global monetary system, linking dollar trends to asset performance.

The DXY index serves as a “weather vane” or “temperature gauge,” guiding portfolio decisions rather than acting as an investment.

A rising dollar often tightens liquidity and sparks asset drops, while a falling dollar aligns with reflation and price gains.

The theory emerged from research suggesting the dollar was set to rise, a view that defied widespread predictions of decline to 90 or lower.

Predictions included rising rates, the end of a 40-year bond bull market, and increases in U.S. equities and gold…all of which occurred by 2025, despite no sovereign debt crisis by 2024.

The 2022 near-miss, with the European Central Bank bailing out Italy, England supporting its gilt market, the Bank of Japan stabilizing its currency and JGBs, and China’s real estate decline accelerating, tested this framework.

How might this framework help navigate the current environment, and what lessons can be drawn from 2022?

Asset Performance Over Decades

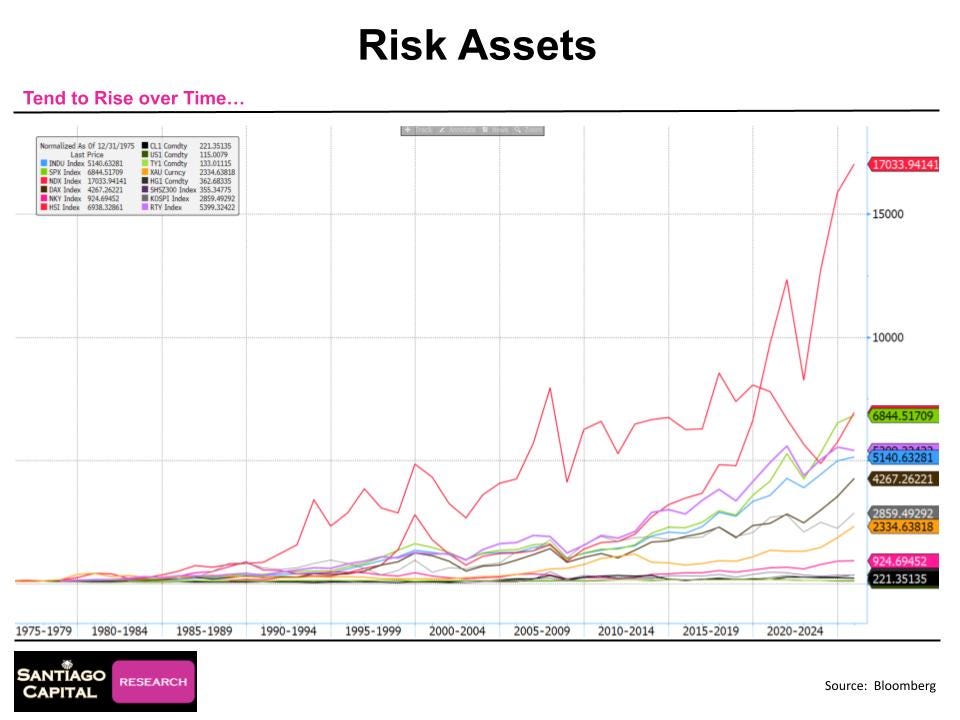

A 50-year perspective reveals risk assets, including global equity indices, trending upward, with the NASDAQ significantly outperforming others.

However, these gains are marred by severe drawdowns during crises, often tied to a stronger dollar, such as seen during the Global Financial Crisis.

A diversified approach, resembling the Permanent Portfolio concept, mitigates this volatility, losing money only six times in 50 years with a maximum drawdown of 12% in 2008…far less than the swings of a 60/40 equity-bond mix.

This Permanent Portfolio concept aims for steady returns, avoiding the rollercoaster of concentrated portfolios, and simply helps investors sleep at night.

The dollar’s role in these drawdowns underscores its importance, yet the focus remains on assets, not fiat currency. Johnson highlights that while risk assets rise over time, not everyone can ride out drawdowns, making dollar awareness key.

Could mastering dollar trends unlock a smoother investment path, and which assets might benefit most?

De-Dollarization Misconceptions

A falling dollar is often misread as de-dollarization, but Johnson clarifies this misconception.

De-dollarization occurs when the dollar rises, triggering defaults and debt destruction.

Dollars aren’t printed en masse but loaned into existence through global banks, shadow finance, and corporate credit, creating short-term liquidity that weakens the dollar.

Repayment reverses this, strengthening it…as seen in the 2022 surge from 103 to higher levels, which stressed markets and prompted interventions in Europe, Japan, and the UK.

The European Central Bank bailed out Italy, England supported its gilt market, the Bank of Japan stabilized its currency and JGBs, and China’s real estate sector accelerated its decline.

A declining dollar reflects increased leverage, not a shift away, and de-leveraging requires pain, with Brent noting Putin’s recent acknowledgment of Western dollar confiscation as a necessary but painful step.

De-dollarization won’t be painless, contrasting with the current leverage increase.

What could this mean for the current market setup, and how might pain reshape the system?

Current Market Snapshot: Sentiment and Positioning

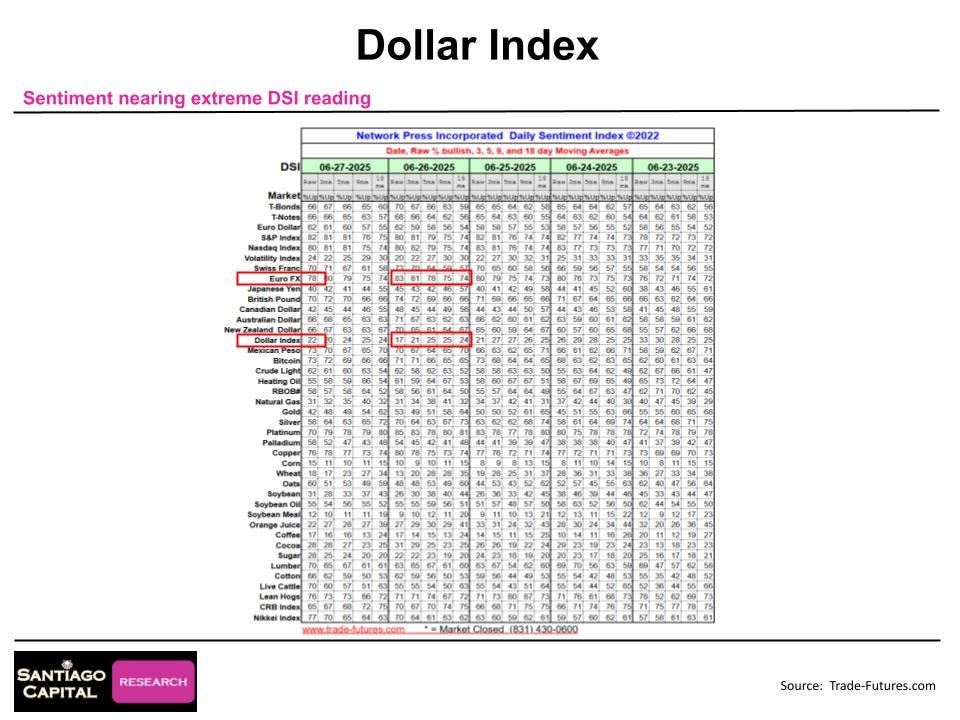

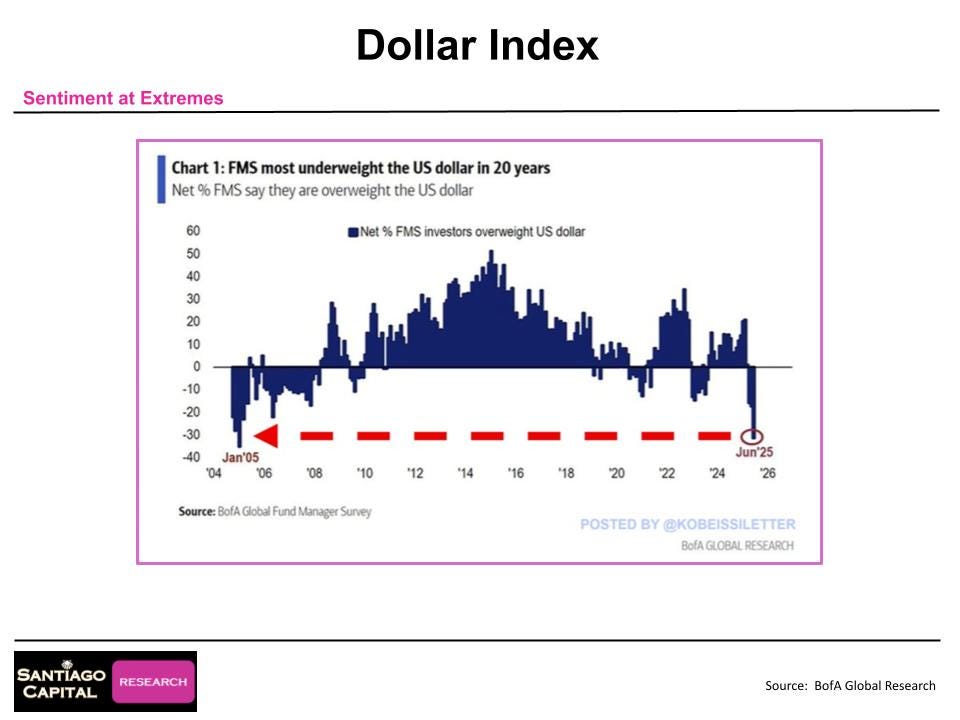

As of mid-2025, the dollar index sits below its 200-day moving average, with Relative Strength Index (RSI) and stochastics nearing 20-year lows, signaling extreme bearish sentiment.

The Daily Sentiment Index hit 17 midweek…nearing an extreme low of 10…while the euro reached 83, close to an extreme high of 90, though they closed the week at 76 and 22, respectively.

Positioning data from Bank of America shows fund managers are the second-most short on the dollar in 20 years, a level last seen in 2018, with the FX Strat US Dollar Positioning Score at -1.5 and a -40% FMS underweight.

Technical support spans daily, weekly, monthly, quarterly, and yearly charts, with stochastics at 4…near their lowest in 20 years…and RSI at 50.29, in a neutral zone.

Meanwhile, the euro’s RSI hits 83 and stochastics near 90, the British pound reaches 70.796 and 97.589, the Canadian dollar hits 61.6343 and 94.2252, and the Swiss franc achieves unprecedented relative strength and stochastics levels.

A rising yen alongside a dollar surge could spell a liquidity disaster, a scenario that Brent Johnson warns against. Are these extremes a warning sign, and what might tip the balance?

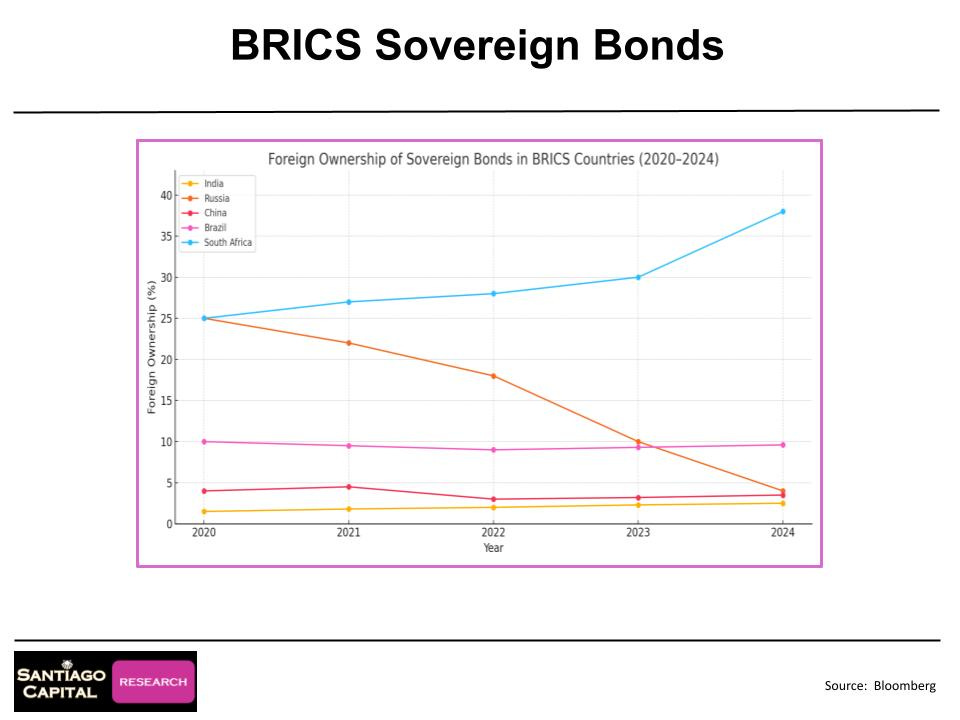

BRICS and Sovereign Bonds: A Reality Check

The BRICS nations (Brazil, Russia, India, China, South Africa) are often cited as dollar challengers, with a summit in Rio de Janeiro next week or the following week.

However, with key leaders absent, a competing currency remains unlikely, with expected statements echoing past years’ vague commitments to future collaboration.

Foreign investment in BRICS sovereign bonds has stagnated, except for a 35% increase in South African exposure since 2020, with no significant growth in China, Brazil, or India while seeing a dramatic fall in Russia.

European nations face fiscal pressure, with potential NATO defense spending commitments of 5% of GDP possibly requiring money printing, raising questions about currency stability.

Johnson notes similar concerns across Eurozone countries, where foreign ownership of sovereign bonds in Austria, Finland, Germany, France, Greece, Ireland, Italy, Portugal, and Spain has not grown significantly since 2014, mirroring U.S. trends.

Some speculate gold purchases have replaced bond investments. How might these fiscal challenges reshape global currency dynamics, and could Europe’s defense commitments tip the scales?

Risk Assets: Overconfidence Looms

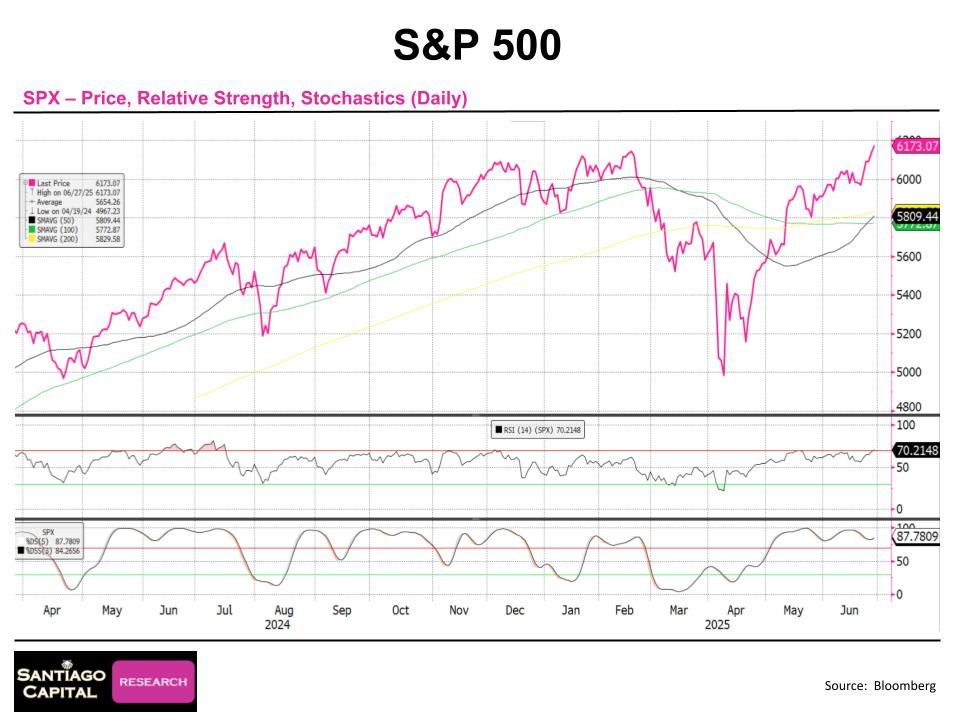

Risk assets have surged back to all-time highs, with the S&P 500’s RSI above 70 and stochastics at 88…levels that preceded sell-offs in July 2024 and earlier this year.

The NASDAQ mirrors this, while semiconductors show even more extreme sentiment and positioning, echoing last summer’s peak, which led to a sell-off.

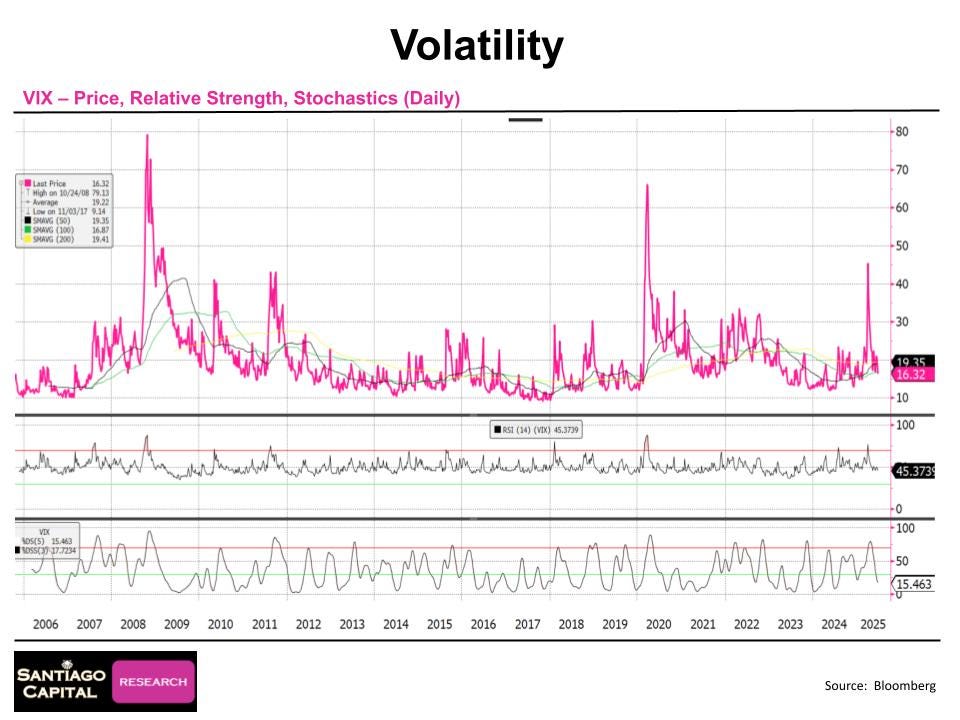

The VIX, a volatility gauge, has dropped to 16 from a high of 55 in April, signaling complacency, with no current worry about market risks.

Financial conditions tightened with tariff announcements but have eased as markets dismiss the threat, despite a 20% drawdown earlier this year…17% if excluding a specific week.

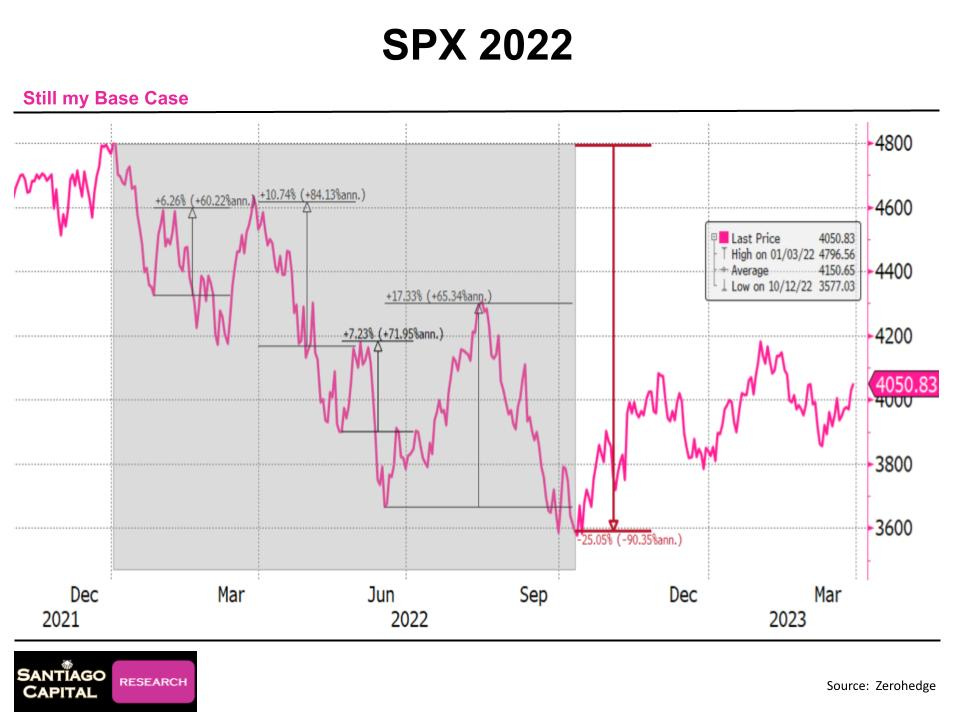

Johnson compares this to 2022’s 25% drawdown, marked by rallies of 6%, 10%, 7%, and 17% from mid-June to early August, followed by a Q3 collapse.

It suggests 2025 may follow suit, with tariffs potentially resurfacing, driven by a regime change similar to 2022’s interest rate shift.

Could this overconfidence set the stage for a fall, and how might tariffs alter the trajectory?

Looking Ahead: A Potential Reversal

Markets are heavily positioned, with bets against the dollar and long positions in risk assets.

A shock…such as renewed tariffs or a liquidity crisis…could propel the dollar higher, a trend seen in the last 30 years during crises.

Historical gaps in the S&P 500 and NASDAQ suggest the first two may fill in Q3 2025, though the third is uncertain, with Johnson noting a 17% rally this year akin to 2022.

A long-term bullish outlook persists for U.S. equities and gold, but straight-line growth is unlikely, warning of potential snapbacks if extremes persist, especially with everyone on one side.

Johnson recalls 2018’s short positioning leading to a dollar rise, hinting at a similar setup now.

What could trigger this shift, and how should investors brace for it, especially with Q3 gaps looming? Q3 awaits to see if it will deliver and answer.

Conclusion

The dollar’s 10% decline in 2025 has ignited debate about its future, but the Dollar Milkshake Theory frames it as a signal, not a death knell. With sentiment at extremes, risk assets overbought, and tariff risks ignored, a turning point may be near.

As markets head into the July 4th break, the question remains: Are investors ready for a dollar that defies expectations?

Understanding these dynamics will be crucial in navigating the months ahead, but will the next move catch them off guard?

Upgrade to Annual or Pro for in-depth research so you’re not caught off guard when markets throw you a curve-ball.