The world is watching.

From the bustling markets of Tokyo to the war-torn borders of Eastern Europe, the question on everyone’s mind is: Has the United States retreated from its role as the world’s hegemon, or is it merely redefining its dominance?

The narrative of a fading American empire has gained traction in recent years, fueled by headlines of domestic focus and an “America First” mantra. But what if the story isn’t that simple?

What if the U.S. is not retreating but instead reshaping global power dynamics in ways that could redefine markets for decades? Buckle up, because the reality might surprise you—and it’s already shaking up the financial world.

The “America First” Misconception: Retreat or Strategic Pivot?

The phrase “America First” has been plastered across headlines, social media, and political debates, often painted as a signal of U.S. withdrawal from global affairs.

Critics argue it’s a sign of a weakened nation, an empire overextended and forced to retreat inward to lick its wounds.

They point to a supposed decline in U.S. influence, with rising powers like China and Russia filling the void.

But is this narrative grounded in reality, or is it a misunderstanding of a bold new strategy?

Far from retreating, the U.S. appears to be recalibrating its global engagement with a laser focus on national interests.

The policy doesn’t mean “America Only” but rather a shift from multilateral cooperation for the “greater good” to a more pragmatic approach: if it doesn’t benefit the U.S., it’s not worth doing.

This pivot is already having profound effects on global markets, from trade deals to military spending.

So, what does this mean for investors? Are we witnessing the decline of a superpower or the dawn of a new era of American influence?

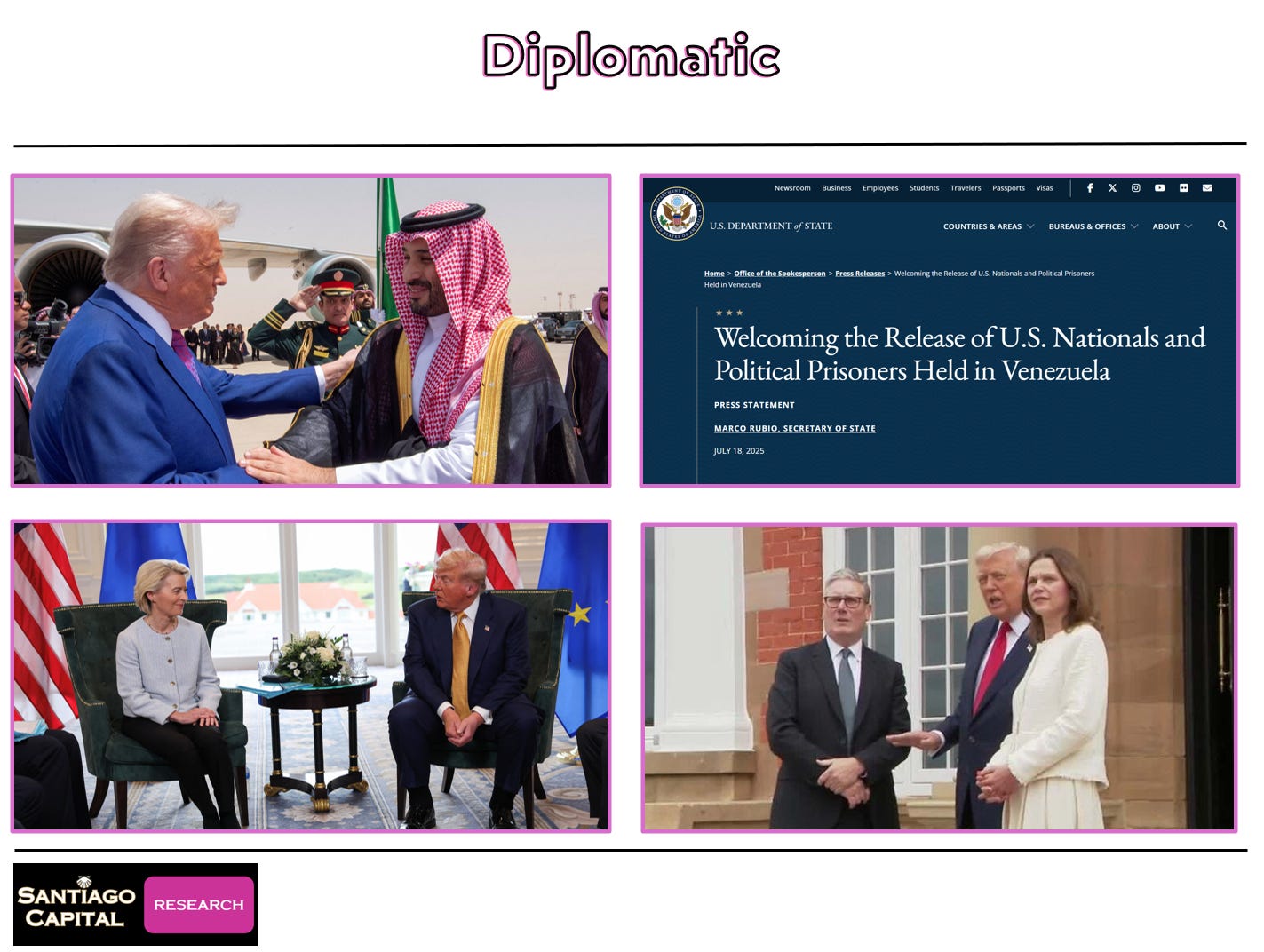

Diplomatic Power Plays: The U.S. Still Calls the Shots

Let’s start with diplomacy. If the U.S. were truly retreating, you’d expect its leaders to be sidelined on the global stage, begging for meetings in foreign capitals. The reality?

World leaders are lining up to meet on American terms. Take Saudi Arabia, for instance.

When the U.S. president visited, the Kingdom didn’t just roll out the red carpet—they practically threw a parade.

The pomp and circumstance rivaled royal receptions, signaling that the U.S. remains a prized partner, not a pariah. This isn’t the behavior of a nation cozying up to BRICS or turning its back on Washington.

Then there’s the case of Venezuela.

For years, political prisoners languished under the Maduro regime, with previous administrations struggling to secure their release.

Yet, within months of a new U.S. leadership focus, those prisoners were back on American soil. Coincidence?

Hardly. And when it came to trade talks with the EU and UK, where did the meetings happen?

Not in Brussels or London, but at a golf course owned by Trump in Scotland—on U.S. terms. European leaders didn’t summon the U.S.; they went to it.

These aren’t the actions of a nation retreating but one flexing its diplomatic muscle. But how does this translate to economic power?

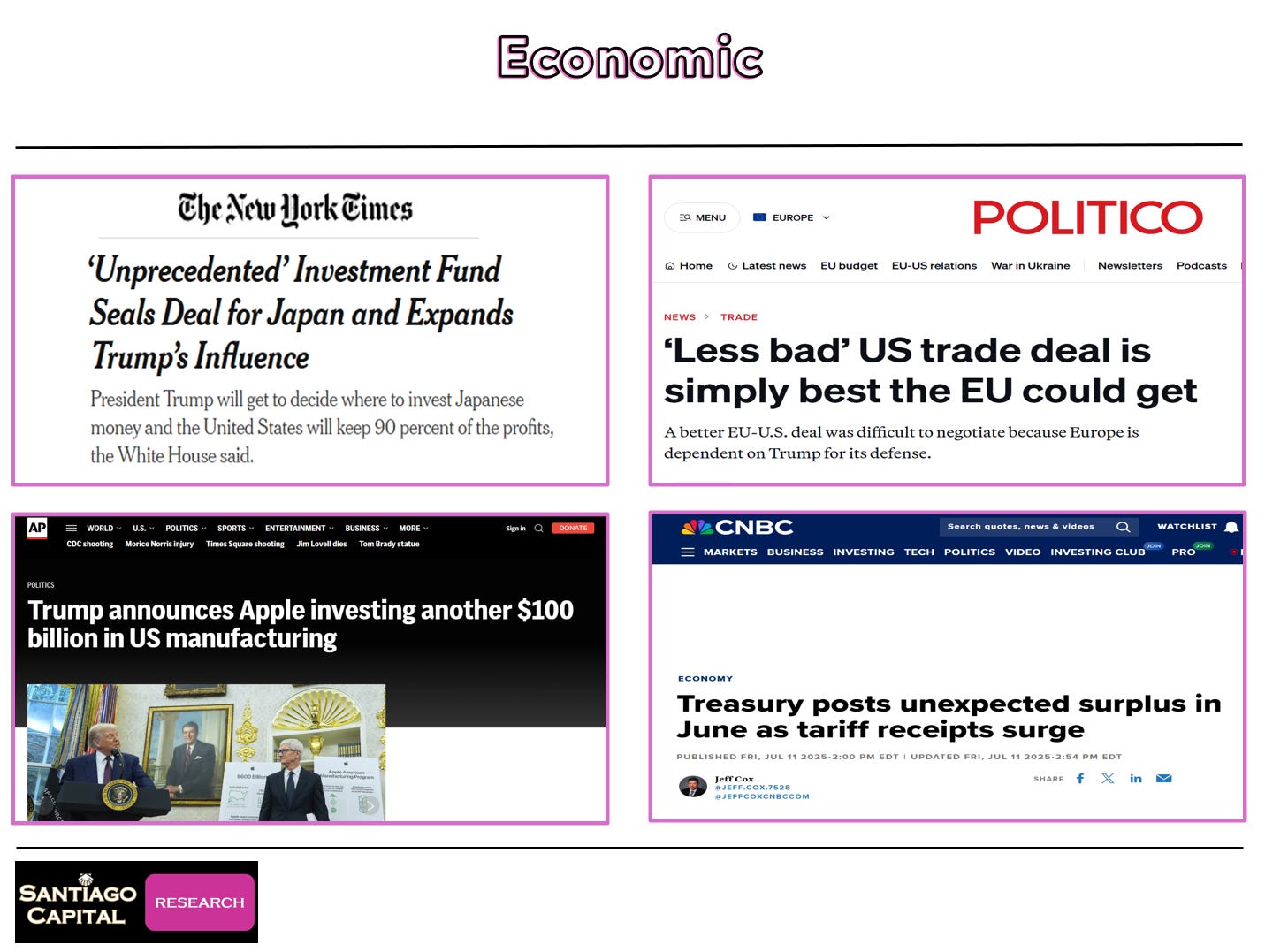

Economic Dominance: Trade Deals and Manufacturing Resurgence

The economic front tells a similar story. Critics scoffed at the idea of favorable trade deals, dismissing them as pipe dreams.

Yet, the U.S. has secured agreements with Japan, the EU, and the UK—deals that tilt in America’s favor.

Even the New York Times, no cheerleader for the current administration, called the Japan deal “unprecedented,” with Japanese firms committing billions to U.S. manufacturing. The EU deal?

European business leaders weren’t thrilled, but they signed anyway. Why? Because the U.S. market remains too big to ignore.

Then there’s the tech giant Apple, reportedly investing $100 billion in U.S. manufacturing. Would this have happened without a strong U.S. push for economic nationalism?

Doubtful.

And here’s a kicker: in June 2025, the U.S. Treasury posted a surplus…a rarity in recent decades.

While not a trend, it’s a signal that the U.S. isn’t just sitting back but actively reshaping global economic flows.

These moves ripple outward, affecting currencies, supply chains, and markets worldwide.

But what about the military? Can the U.S. still project power abroad?

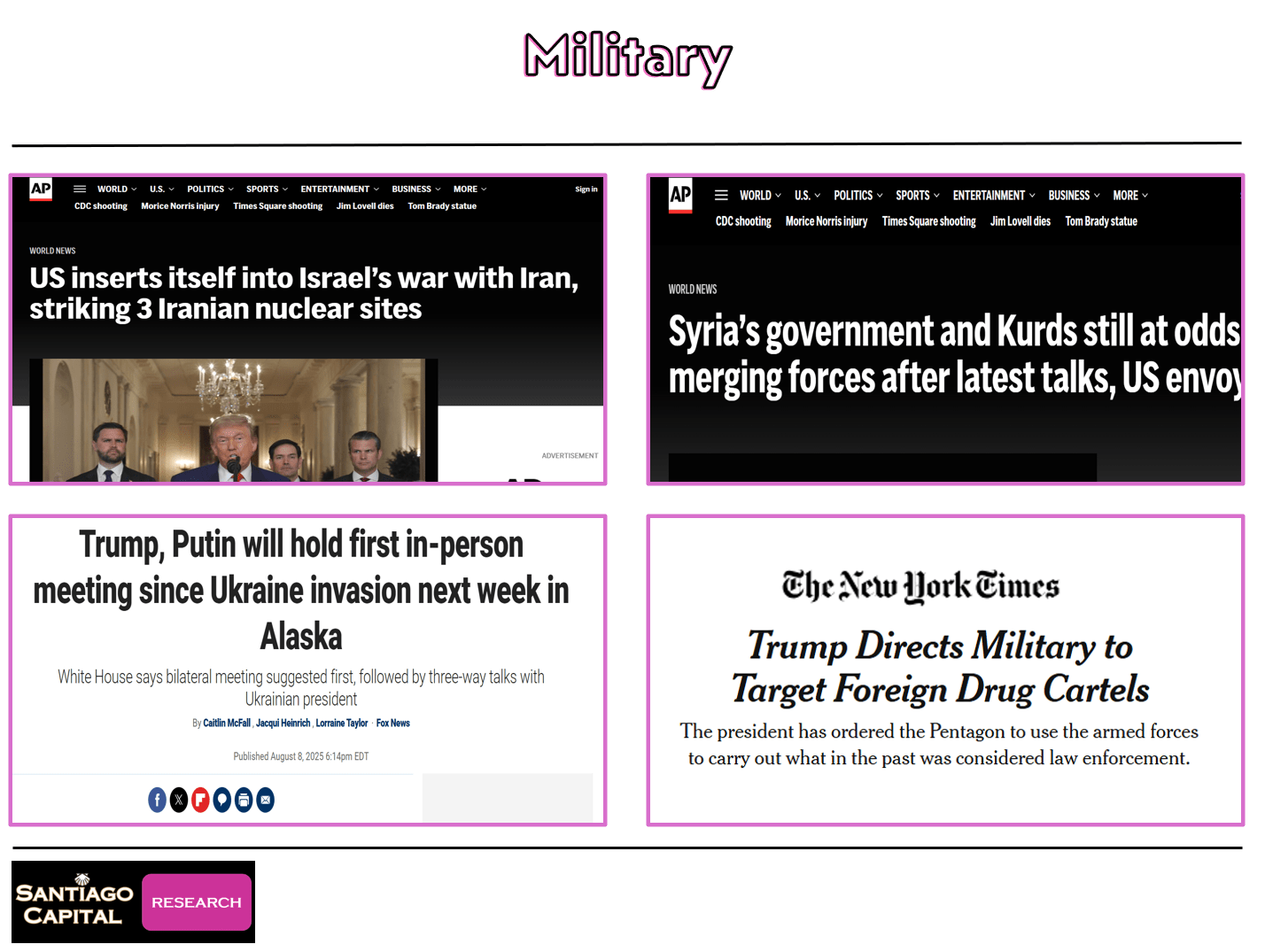

Military Might: A Global Force That Won’t Back Down

If diplomacy and economics show a U.S. still engaged, the military sphere cements it.

The idea of a retreating hegemon doesn’t hold up when you consider recent actions.

The U.S. has been deeply involved in conflicts from Israel-Iran to Syria and Ukraine-Russia.

Meetings with world leaders like Zelensky and Netanyahu underscore continued U.S. influence in volatile regions.

More striking, the U.S. has dictated military spending policies to NATO allies, mandating a 5% budget allocation for defense.

Imagine China or Russia trying to enforce such a policy on another continent—they’d be laughed off. Yet, NATO complies, proving the U.S. still calls the shots.

Closer to home, the U.S. is now targeting Latin American drug cartels, a move straight out of a 1990s action flick.

This isn’t a nation focused solely on its borders but one willing to project force wherever its interests are at stake.

And then there’s the upcoming Alaska summit with Russia’s Putin to discuss Ukraine.

Why would a global leader travel to U.S. soil if America’s influence were waning? The answer is clear: it’s not. But what does this mean for the dollar and global finance?

The Dollar’s Enduring Reign: Stablecoins and Tax Havens

If you think the U.S. is losing its financial grip, think again. The U.S. dollar remains the world’s reserve currency, and new developments suggest it’s not going anywhere.

Stablecoins—digital currencies pegged to assets like the dollar—are poised to extend U.S. financial hegemony. By tying global transactions to U.S. treasuries, stablecoins could amplify demand for American debt, reinforcing the dollar’s dominance.

The GENIUS Act, though not yet fully detailed, is generating buzz as a potential paradigm shift in this space.

Here’s another surprise: for the world’s wealthy, the U.S. is the ultimate tax haven.

From Asia to Europe, billionaires are funneling money into the U.S., not away from it.

Forget the Caymans or Monaco—America’s financial system is the go-to for global elites. Why?

Stability, scale, and influence.

This influx of capital strengthens U.S. markets, even as other nations struggle. But with great power comes great risk—what happens if this strategy backfires?

The Risks of a Bold Strategy: A Boxing Match for the Ages

The U.S. isn’t stepping into this new era unscathed. Like a boxer in a brutal fight, it’s taking hits.

The 1983 Hagler-Hearns bout comes to mind—a bloody, three-round slugfest where both fighters landed devastating blows.

The U.S., like Hagler, is bloodied but still swinging. Mistakes will happen.

Unintended consequences, from trade wars to geopolitical missteps, are inevitable.

Yet, in a relative game, the U.S. still has knockout power that others lack.

Consider the global map.

Europe faces a war on its doorstep and sluggish growth. Africa and South America offer opportunities but lack stability. Russia and China have their own challenges, from economic sanctions to internal pressures.

Where would you park your money for five years if you had to choose?

The U.S., with all its flaws, remains the safest bet for many. But what about the markets right now—are they reflecting this strength or signaling trouble?

Market Signals: A Correction Looms?

The U.S.’s global maneuvers are already impacting financial markets. The Dow Jones, S&P 500, and NASDAQ have shown signs of strain.

Since late June 2025, the Dow has gone sideways, with momentum and relative strength diverging from price—a classic warning sign.

The S&P 500 is flatlining at its highs, while the NASDAQ has pushed to new peaks but with weakening momentum.

This fragility, driven by concentration in a few mega-cap stocks like the “Magnificent Seven,” suggests a correction could be near.

Take Microsoft, for example. Its chart is a marvel—months of steady gains, only to gap higher post-earnings and then falter.

It’s now teetering at support, and a break could ripple across markets, given the influence of big tech.

Gold and silver, meanwhile, are in a holding pattern, with commercial short positions hinting at a potential pullback.

The message?

Markets are jittery, and the U.S.’s bold global moves could amplify volatility. So, what’s the takeaway for investors?

The Bottom Line: A New World Order or More of the Same?

The narrative of a retreating U.S. is compelling but flawed. From diplomatic triumphs to economic wins and military muscle, America is not stepping back but stepping up—on its own terms.

This shift, driven by a deal-maker’s mindset, is reshaping global markets, from trade flows to currency dominance.

Yet, like any fighter, the U.S. will take punches. The question isn’t whether it will bleed but whether it can land the knockout blow.

For investors, this means geopolitics now trumps spreadsheets.

National interests, not just numbers, will drive returns.

The U.S. remains the best bet in a relative game, but risks loom—market corrections, policy missteps, or global pushback.

So, where will you place your money in this brave new world? And more importantly, are you ready for the punches to come?