The financial world got a jolt yesterday when the Consumer Price Index (CPI) numbers landed softer than anyone anticipated. Stocks surged in a heartbeat, as traders bet on the Federal Reserve easing up on rates sooner rather than later.

But this quick rally sparked a heated debate: if rate cuts are coming, could they actually fuel more inflation, undoing the very disinflation the CPI just signaled?

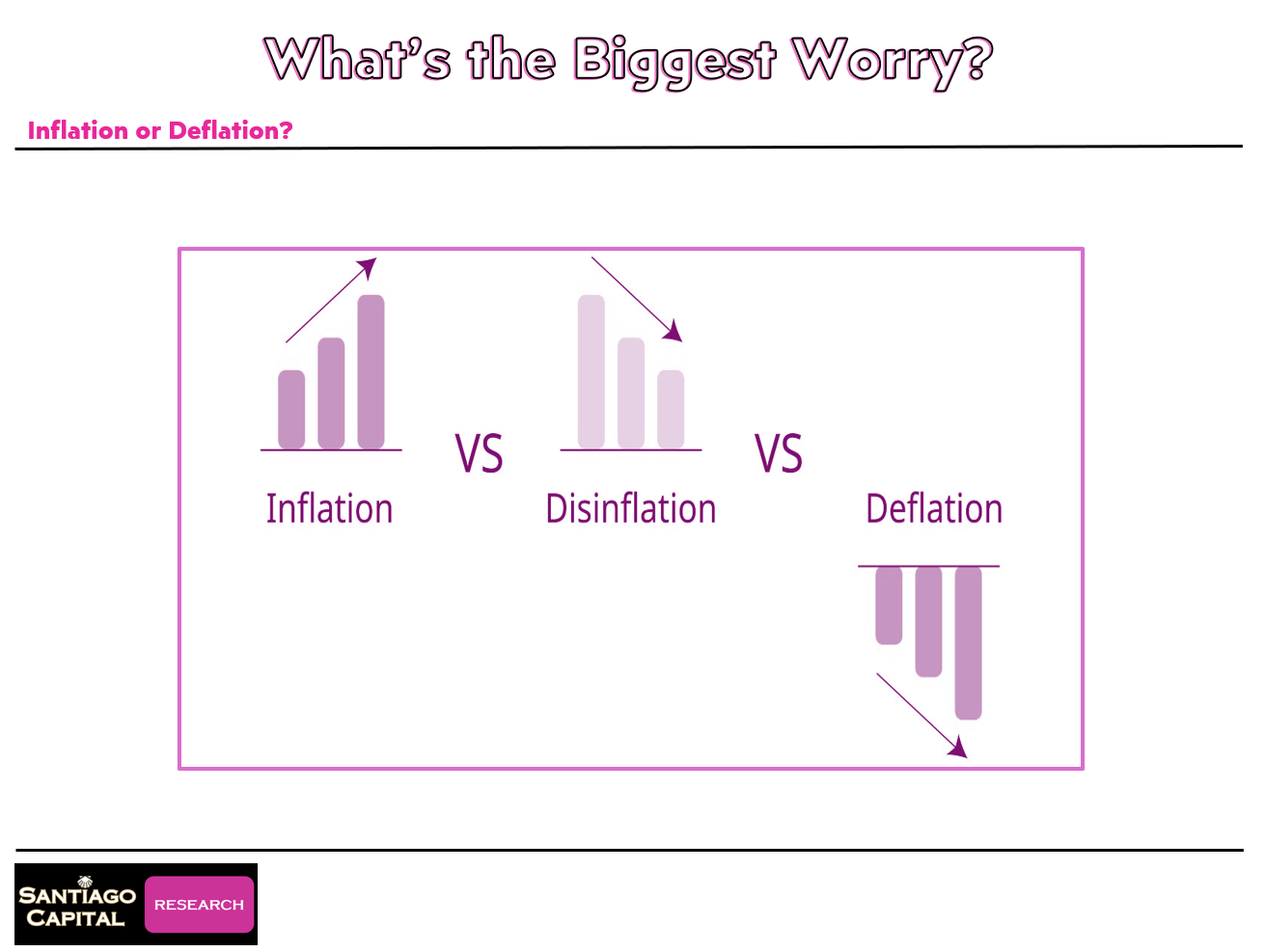

Suddenly, the conversation shifted to the big risks lurking in the economy...inflation, deflation, or even stagflation. It’s a puzzle that keeps investors up at night, blending optimism with underlying fears.

But what if the real danger isn’t just rising prices, but a system wired for sudden collapses that no one sees coming?

Decoding the Inflation Spectrum: From Boom to Bust

To make sense of this, let’s break down the terms flying around. Inflation hits when prices climb steadily, eroding purchasing power over time. Disinflation is a slowdown in that rise...prices still go up, but not as aggressively as before.

Then there’s deflation, the scary opposite where prices plummet and keep dropping, potentially grinding the economy to a halt.

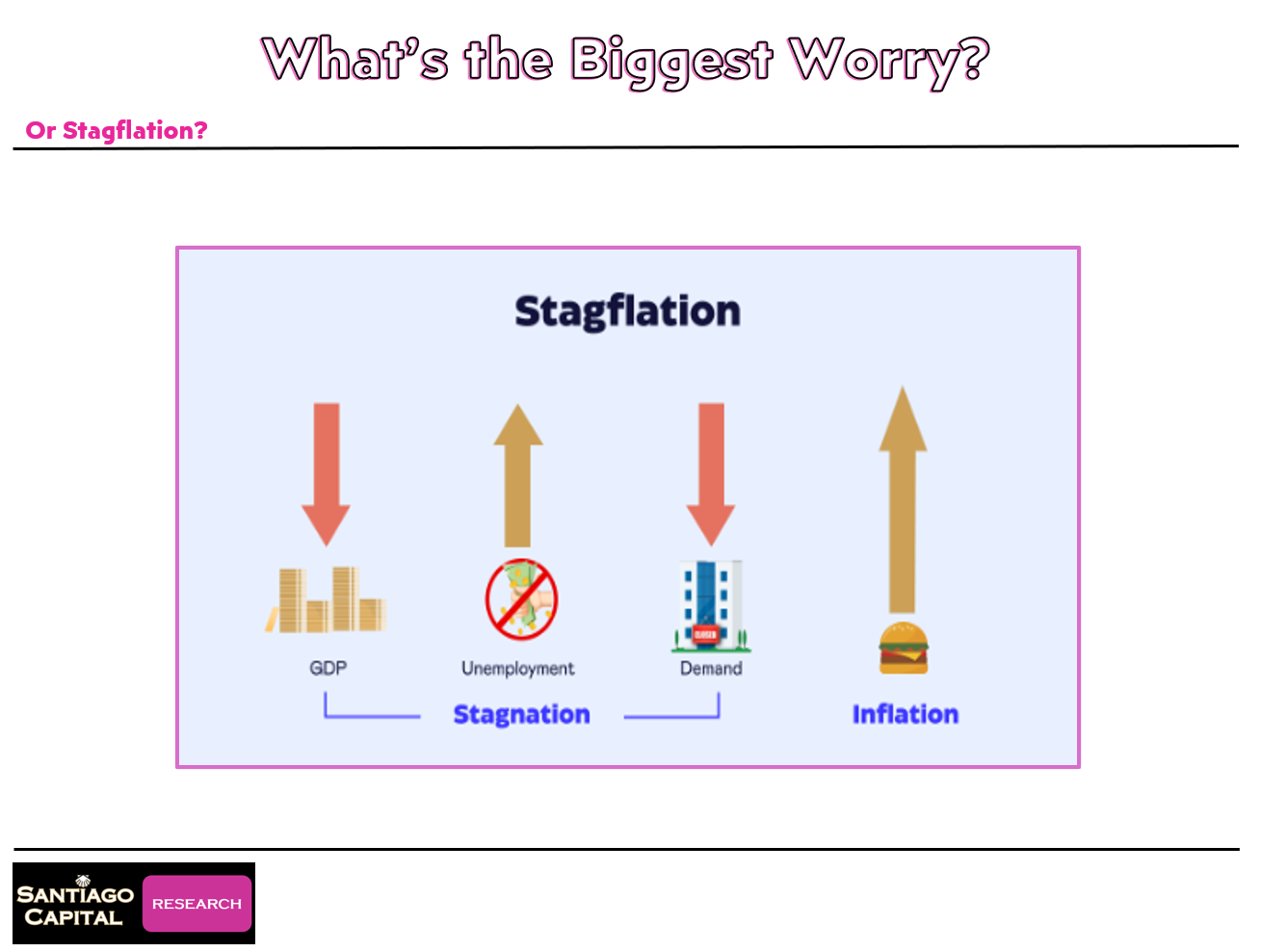

And don’t forget stagflation, that tricky mix of stagnant growth and persistent price hikes in certain sectors, often fueled by supply shortages or geopolitical tensions.

Right now, with trade wars escalating and supply chains rerouting for national security, we’re seeing pockets of both: some goods getting cheaper amid slowdowns, while others spike due to limited availability.

It’s not a clean narrative of all-inflation or all-deflation...it’s messier, more nuanced. Central banks crave mild inflation to keep the wheels turning...it’s why fiat currencies gradually lose value. But prolonged deflation? That’s a non-starter in our setup... it could unravel everything.

Ever wondered why deflation is treated like economic kryptonite, baked right into the system’s DNA?

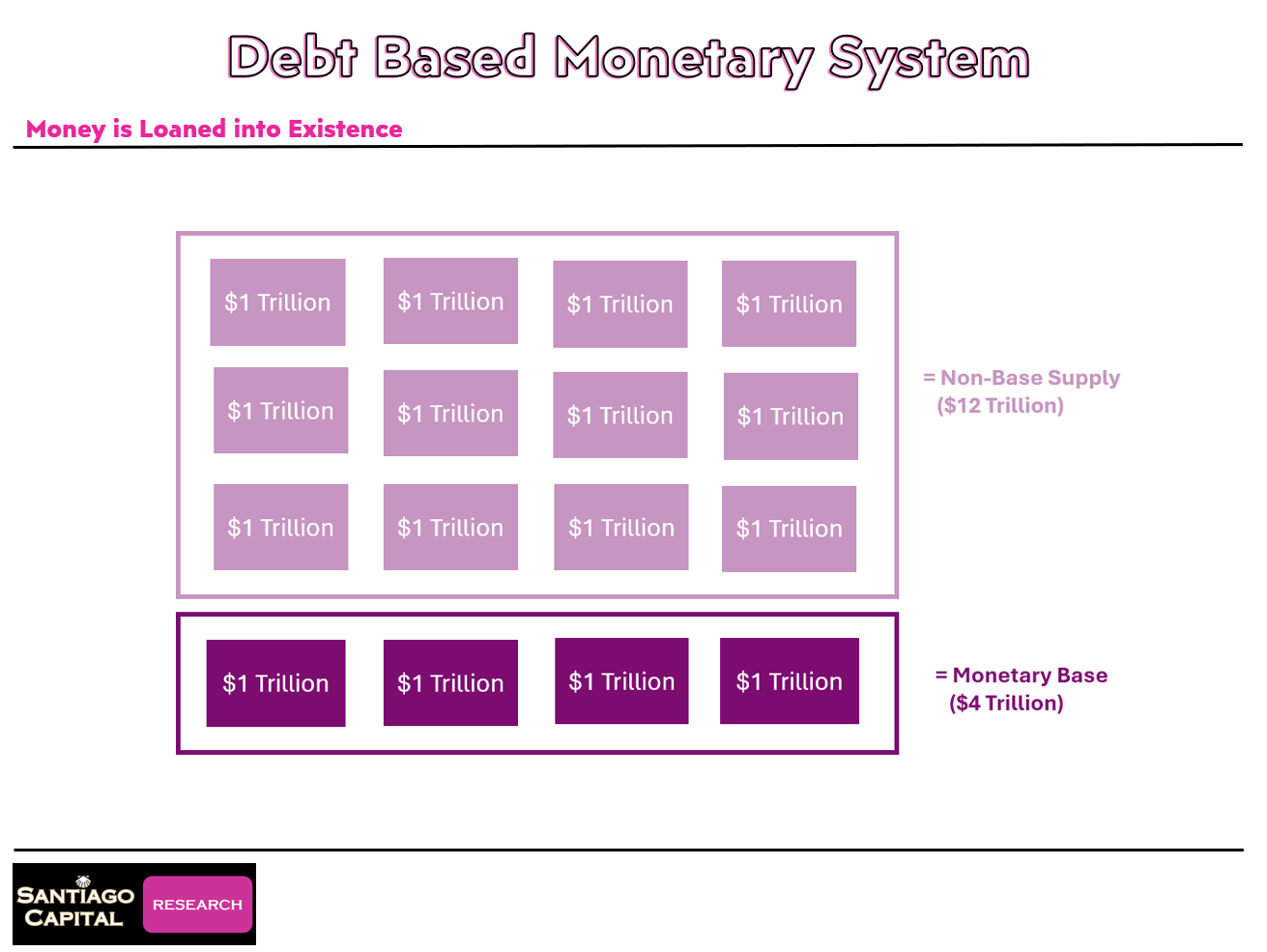

The Debt Machine: How Money Really Gets Made

Our monetary system runs on debt, pure and simple. At its core is the monetary base...actual cash, coins, and reserves held at central banks, totaling around $4 trillion (in this example below). This isn’t loaned out directly...it’s collateral for creating new money through loans.

Picture it: from that base, banks and institutions lever up, birthing an extra $12 trillion or so into existence, pushing the total money supply to about $16 trillion (though real figures hover near $22 trillion today).

This loaned money comes with interest attached...quarterly, annually, whatever the terms dictate.

But here’s the twist: if that’s all the money in the system, where does the cash for interest payments come from?

It doesn’t magically appear... it demands either rapid circulation or fresh injections.

What happens when the money stops moving, and the whole house of cards starts wobbling?

Velocity vs. Supply: The Lifeblood of the Economy

Enter the two heroes (or villains, depending on your view) of the system: velocity of money and new liquidity supply.

Velocity is money zipping through the economy...like paying a bill, which funds someone’s car payment, which buys gas, which covers a mortgage. One dollar does the work of many, covering interest on multiple loans. It’s like a shark that must swim or sink.

But if fear grips the market...say, during a downturn...people hoard cash, velocity stalls, and defaults spike.

Loans go unpaid, money vanishes as credit contracts, prices tumble, and in extreme cases, even reserves get tapped. Without movement or new supply, deflation spirals, threatening systemic collapse.

We’ve skirted this abyss a few times in the last quarter-century. So, why do central banks exist if not to swoop in like caped crusaders?

Central Banks to the Rescue: Refilling the Pool

When credit crunches and money evaporates, central banks step up. They pump up the monetary base through quantitative easing (QE), stimulus, or bailouts, restoring confidence so lending resumes. It’s their raison d’être...to re-collateralize and reignite the credit engine.

But timing is everything. They’re not infallible gods...markets can outpace them.

In the dot-com bust, the 2008 crisis, COVID meltdown, 2022’s hiccup, and even this year’s early wobble, we saw S&P 500 drawdowns of 50%, 50%, 35%, 25%, and 20% respectively. Assets cratered before rescues arrived, wiping out the overleveraged or unprepared.

Is new money from the Fed always enough to stem the tide, or could it just be plugging a leaking dam?

New Money Isn’t Always More Money: The Liquidity Illusion

Here’s a key misconception: stimulus doesn’t instantly mean abundance.

Imagine a pool draining from a hole at the bottom while someone pours water in from the top. If the leak outpaces the inflow, liquidity still shrinks.

During contractions, old money destroys faster than new arrives, dragging prices down and making fresh loans harder as collateral values tank.

In those past crises, even as interventions loomed, margin calls and short-term squeezes ruined many. The Fed only acts after pain hits...sacrificial lambs pave the way for salvation. If no one’s getting hammered, why intervene? Survival demands preparation, not blind faith in bailouts.

But in a world of potential collapses, what’s the ultimate insurance policy that endures any storm?

Shadow Banks Rising: The Opaque Underbelly

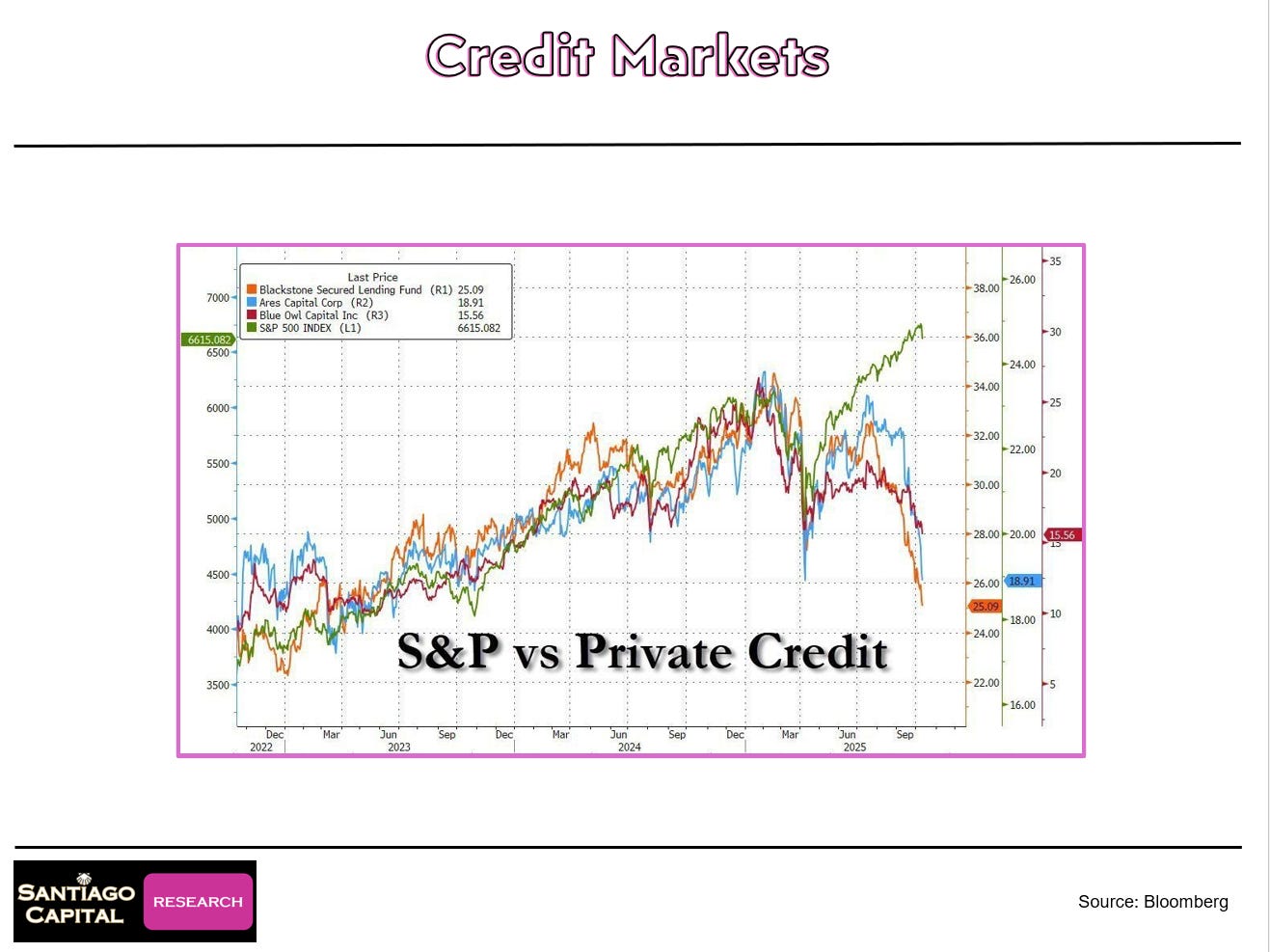

Enter shadow banking and private credit, exploding in recent years. These non-traditional lenders...private equity firms, direct lenders...fill gaps where banks fear to tread, funding small businesses and buyouts deemed too risky. But without strict regulations, transparency lags, and systemic risks mount.

Over the past few years, private credit surged past traditional banking, driven by yield hunts. Deals often feature juicier returns but steeper borrower costs, with tricks like payment-in-kind (PIK) where interest accrues without cash changing hands. It eases short-term pain but amps up long-term liquidity crunches.

A year ago, warnings flagged this growth as a ticking bomb...opaque, overleveraged, primed for trouble in slowdowns. Now, it’s materializing.

How are these cracks showing up today, and what could they mean for your portfolio?

Cracks in the Foundation: Private Credit’s Warning Signs

Recent months reveal the strain: bankruptcies in private funds, defaults rising, credit contracting. While the S&P 500 climbs, private markets falter, hinting at divergence.

Correlations suggest either private credit rebounds or stocks tumble...echoing past drawdowns.

Regional banks roll over, echoing 2023’s tariff scares, 2022’s SVB collapse, or 2020’s COVID freeze. Liquidity vanishes fast when loans sour. Bankruptcy rates climb even as credit spreads tighten...not from reduced risk, but scarce new issuance chasing demand.

In this debt-fueled setup, quick contractions blindside the unprepared, even amid rate cuts or inflation worries. Passive investing and mega-stock concentration amplify volatility...a 10-30% drop could strike suddenly.

So, with stagflation’s mix looming, how do you navigate without becoming collateral damage?

Staying Ahead: Preparation in an Unpredictable World

Awareness is your shield. You don’t need to panic-sell or short everything... just recognize the system’s fragility.

Debt-based money demands perpetual growth...velocity or supply...or risks implosion. Central banks will intervene, but only after pain thresholds are crossed.

Diversify thoughtfully: hold assets like gold for endurance, explore yielding options to optimize.

Monitor shadows...private credit’s woes could cascade. In stagflation’s patchwork, some sectors deflate while others inflate... agility wins.

The economy’s not doomed, but blind optimism invites ruin. By understanding the mechanics, you position to thrive, not just survive. What’s next? Only time tells, but being ready turns threats into opportunities.