Picture this: The stock market has been soaring like a rocket fueled by endless optimism, shattering records left and right. But beneath the glitz of all-time highs, cracks are forming.

Whispers of a long-overdue correction are growing louder, not the apocalyptic crash that sends economies spiraling, but a sharp pullback that could jolt portfolios and force investors to rethink their strategies.

As we head into a pivotal week packed with potential triggers, the signs are stacking up that the party might be winding down.

From sky-high valuations to hidden leverage lurking in the shadows, the market's vulnerabilities are impossible to ignore. But why now, and what exactly is tipping the scales?

The Perfect Storm of Euphoria: Valuations, Credit, and Hype

Let's rewind through history's wildest market rides to spot the patterns repeating today.

Imagine the frenzy of the 1600s tulip mania, where bulbs fetched fortunes, or the 1700s South Sea Bubble that promised riches from distant trades.

Fast-forward to the roaring 1920s leading to the infamous 1929 crash, the dot-com delirium of the late 1990s, the 2008 housing meltdown, and even the 2020-2021 SPAC and meme stock madness.

What ties these episodes together?

Three explosive ingredients: inflated valuations that defy gravity, abundant credit flowing like an open bar, and a intoxicating narrative of unstoppable progress.

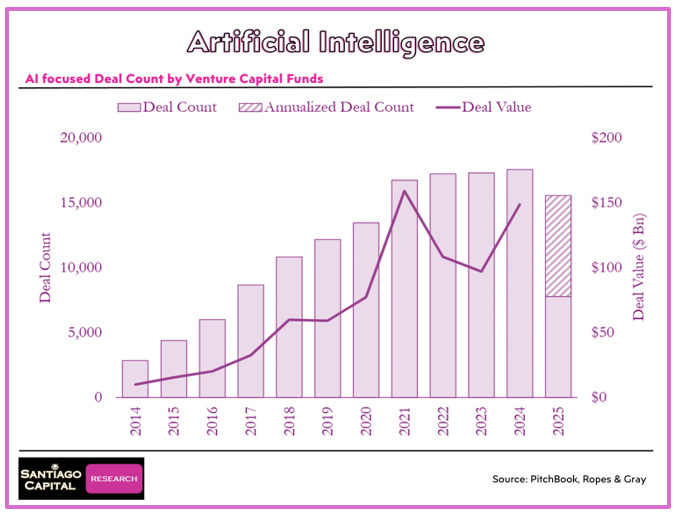

Today, these elements are bubbling over, supercharged by the AI revolution.

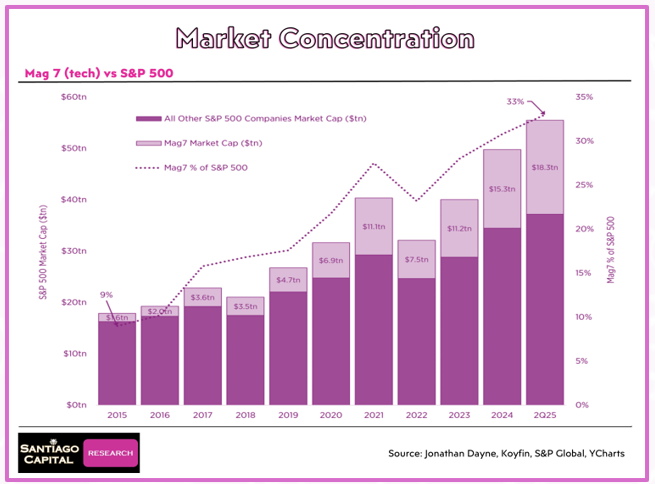

Large-cap tech stocks, the darlings of the market, have driven most of this year's gains, riding the wave of AI excitement. Valuations? They're stretched to extremes.

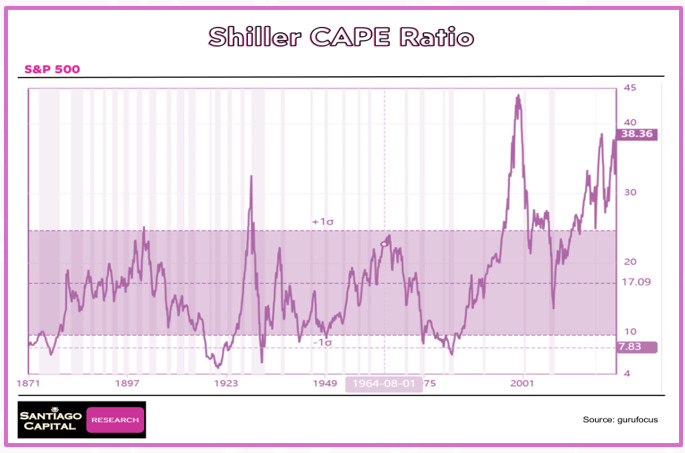

The Shiller CAPE ratio, a key measure of stock prices relative to earnings, is hovering at levels not seen in two decades…though not the absolute peak, it's a red flag waving furiously.

Take recent tech earnings surprises; some companies are posting numbers that seem too good to be true, pushing their stocks into the stratosphere. But valuations aren't perfect timers; they're more like a distant thunder warning of a storm.

Then there's the credit bonanza.

Margin debt in brokerage accounts is at record highs, meaning investors are borrowing big to bet bigger. But that's just the tip of the iceberg.

Sneakier forms of leverage, like zero-day and one-day expiration options, are embedding themselves in the market's DNA, amplifying moves without showing up in traditional metrics.

It's like invisible rocket fuel…great on the way up, disastrous if things reverse. And liquidity?

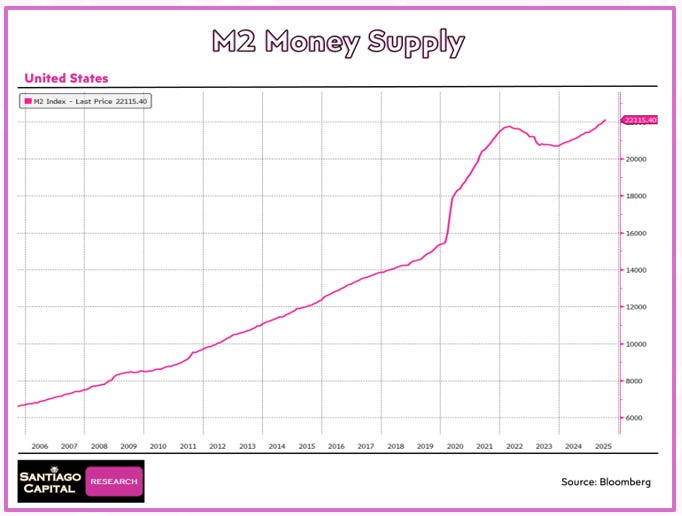

M2 money supply, reflecting credit expansion through bank loans, is ballooning, flooding the system with cash that's chasing fewer and fewer sensible opportunities.

Euphoria is everywhere: Magazine covers trumpet the next big thing, TV pundits gush over AI's world-changing potential, and casual conversations buzz with stock tips. It's the classic setup where greed overtakes fear.

Accounting tricks and outright fraud have marred past bubbles…fudged numbers to hype growth…and while no one's pointing fingers yet, concerns are mounting that similar shenanigans could be at play in today's tech darlings.

History screams that when these forces align, corrections follow.

But if these patterns are so predictable, why do they keep catching us off guard? And what if a modern twist is making this setup even more volatile?

The Hidden Danger: Leverage and the Illusion of Innovation

Leverage isn't just a tool; it's a double-edged sword that slices deeper on the downside.

In past manias, borrowed money magnified gains until reality bit, forcing fire sales that spiraled markets lower.

Today, it's on steroids.

Beyond margin debt, leveraged ETFs…some offering 2x or 3x exposure…and those ultra-short-term options are turning the market into a high-stakes casino.

One wrong move, and positions unwind faster than you can say "margin call."

Now, layer on the AI narrative.

Trillions are being poured into AI infrastructure, with projections so astronomical they border on fantasy.

One estimate suggests that to fulfill Nvidia's build-out ambitions over the next 5-10 years, it could require a quarter of the entire M2 money supply.

Pause and let that sink in: 25% of all circulating credit funneled into a handful of chips and data centers. Is this feasible without starving other sectors or inflating a massive bubble?

The hype promises AI will revolutionize everything…boost productivity, reshape jobs, even necessitate universal basic income. And sure, AI could be transformative, but history shows the first wave of excitement often crashes, wiping out overzealous players.

The survivors? Prudent firms that weather the storm and capitalize later.

Separating genuine innovation from speculative frenzy is key. Being bullish on AI's future doesn't mean ignoring valuations that scream "overheated."

Behavioral cues are telling: Irrational exuberance abounds, with investors chasing narratives over numbers.

Liquidity cycles drive this…easy money inflates assets until it dries up, triggering the inevitable deflate.

Yet, amid these familiar risks, a new wildcard has entered the arena, one that could accelerate a downturn like never before. What if the market's very structure has evolved into a machine that amplifies chaos?

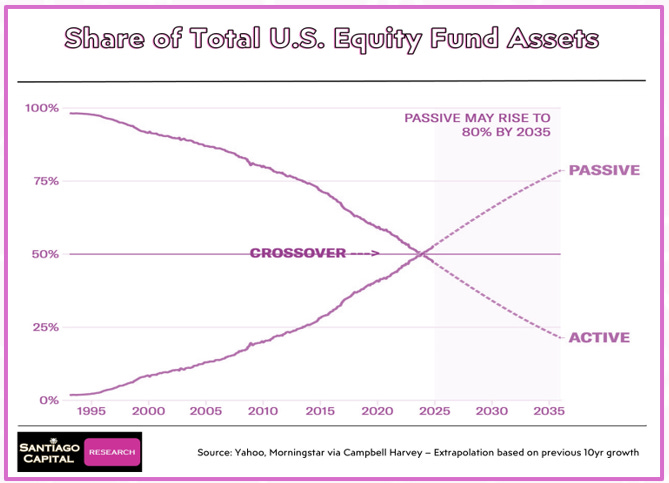

The Game-Changer: Passive Investing's Silent Revolution

Enter passive management, the algorithmic behemoth reshaping how money flows.

Unlike active investors who ponder decisions, passive funds follow indexes blindly, pouring cash into top stocks regardless of fundamentals.

This has concentrated wealth into a tiny elite…the Magnificent Seven or so…making the broader market fragile. If these giants stumble, the dominoes fall hard.

Passive's scale is staggering: Trillions track benchmarks, creating self-reinforcing loops.

Uptrends accelerate as inflows buy more of what's rising; downturns snowball as outflows force sales.

No human pause, just code executing relentlessly.

Experts warn this setup turns mild dips into cascades, especially with market concentration at extremes not seen since the dot-com era.

Add geopolitical tensions, tariff hikes, and central bank moves, and the powder keg is lit.

September and October historically bring volatility, with VIX fear gauges slumbering below 15…a complacency signal. End-of-quarter rebalancing could exacerbate swings, as funds adjust en masse.

But what about the immediate triggers? Could the Federal Reserve's next move be the spark that ignites it all?

Catalysts on the Horizon: Fed Decisions and Market Realities

All eyes are on the Fed's upcoming meeting, where rate cuts are baked in.

But markets might be primed for a "sell the news" reaction…expectations so dovish that anything short of fireworks disappoints.

With stocks at peaks, how much upside is left? A dovish surprise could propel higher, but risks tilt toward downside if reality under-delivers.

Beyond the Fed, data releases, global central bank actions, and economic indicators loom. Yields have dipped from yearly highs, hinting at caution…perhaps anticipating cuts or sniffing out trouble.

Credit spreads like CDX are at lows, signaling no perceived risk, but perfection pricing leaves little room for error.

Charts paint a uniform picture: S&P 500, Dow, Nasdaq, Russell 2000…all at or near highs, with overbought indicators like RSI and stochastics flashing warnings.

Globally, it's similar: UK's FTSE momentum rolling over, Germany's DAX testing supports, Japan's Nikkei stretched thin. Even emerging markets like Brazil and China show fatigue.

Tech titans? Nvidia dipped below its 50-day moving average before rebounding, but momentum wanes. Microsoft tests resistance from below. Financials like JPMorgan hover at peaks but could falter in Q4.

Commodities offer contrast: Oil range-bound, natural gas slumping, while gold and silver hit records…strong but overdue for pullbacks.

Currencies? Dollar at yearly lows, euro and pound firm but vulnerable. Crypto like Bitcoin and Ethereum rally but face resistance.

Positioning data shows shorts in gold and silver holding steady, not aggressively betting against rises. Yet, with everything extended, a breather seems inevitable.

So, if a correction is brewing, how can savvy investors shield themselves without panicking?

Preparing for the Pullback: Diversification and Smart Alternatives

Corrections aren't doomsday; they're resets.

Valuation discipline means monitoring excesses without knee-jerk sales. Awareness of leverage's pitfalls encourages trimming borrowed bets.

Embracing innovation? Fine, but temper with realism…AI's promise doesn't justify any price.

Diversification reigns supreme. Adding assets like gold historically boosts returns while cutting risk, per studies showing portfolios with 10-20% gold yielding higher Sharpe ratios. But why stop at static holdings?

Innovative platforms now let gold earn yields by leasing to businesses needing metal financing…insured, productive, and bridging bullion's safety with stocks' upside.

It's a middle-ground on the risk spectrum: Not as inert as vaulted bars, not as volatile as miners.

Allocating a portion here could enhance overall performance, turning a non-yielding asset into one that pays.

In weekly market summaries, patterns emerge: Economic data mixed, policy shifts subtle, but overextension universal. No Great Depression redux, just a healthy purge after a euphoric run.

But what if this correction spirals deeper, thanks to passive's grip? Or evolves into opportunity for the prepared?

Navigating the Unknown: Lessons from History's Echoes

History teaches that bubbles burst, but survivors thrive by heeding signs early.

We're not at the precipice of 1929 or 2008, yet parallels demand vigilance. Passive's role could make this dip sharper, quicker… a "crescendo" unfolding in weeks.

Investors: Audit portfolios, consider hedges, embrace alternatives like yielding gold. The market's climbed far; a step back might refresh. Stay informed via detailed reports…executive summaries distilling weekly chaos, charts unveiling trends.

Ultimately, prudence pays. As catalysts converge, preparation trumps prediction. Will this be the reset that tempers AI mania, or just a blip? Only time tells, but ignoring the setup invites regret.