Imagine waking up to news that the US Treasury just handed over $20 billion in a currency swap to a nation notorious for economic rollercoasters.

Is this a generous lifeline to a struggling ally, or a shrewd acquisition of prime real estate in the global power game?

As tensions simmer across the world, this deal isn’t just about dollars…it’s about dominance. But let’s dive deeper into what makes this swap more than meets the eye.

Argentina’s Endless Economic Tango

For decades, Argentina has danced on the edge of prosperity and peril, a land brimming with promise yet plagued by fiscal follies.

Picture a country with vast farmlands feeding the world, underground treasures of oil and gas, and enough lithium to power the electric vehicle revolution.

Yet, despite these riches, it’s grappled with sky-high debt…over 85% of its GDP, much of it in foreign currencies it can’t simply print away. When exchange rates turn hostile, the result? Hyperinflation nightmares that force desperate money-printing sprees.

Recent reforms under a bold leadership have slashed inflation and lured back foreign investors, but hurdles remain. A midterm election setback sparked doubts about policy continuity, triggering capital flight and a peso plunge.

Enter the US Treasury’s intervention: a $20 billion swap line that exchanges dollars for pesos, stabilizing the currency and signaling global confidence.

Bond spreads tightened, the peso’s freefall halted, and capital outflows eased. It’s a temporary fix, but one that buys time for deeper changes.

But why pour billions into a nation that’s been “the country of the future” for generations without ever arriving? What if this isn’t charity, but a calculated chess move in a high-stakes board spanning continents?

The Hidden Treasures: Why Argentina Matters More Than You Think

Zoom out, and Argentina isn’t just another Latin American economy…it’s a geopolitical jackpot.

As the third-largest player in the region with a GDP around $600 billion, it’s an agricultural titan exporting grains and meats that could rival global giants.

Its shale gas reserves rank among the world’s largest, offering energy independence vibes in an era of volatile oil prices.

Throw in massive lithium deposits…key for batteries in everything from smartphones to EVs…and you’ve got a resource powerhouse. Don’t forget renewable potential in wind and solar, plus abundant fresh water, which could become the new oil in a thirsty future.

Geographically, it’s a linchpin at South America’s tip, controlling vital sea routes around the continent.

Ships navigating from the Atlantic to the Pacific hug its waters, and it guards gateways to Antarctica. In a world rethinking supply chains, access here means leverage over trade corridors and resources.

The US isn’t betting on pesos for fun…it’s eyeing a strategic foothold that could secure energy, minerals, and influence for decades.

If resources and location are the bait, is the US hook-line-and-sinker committed to turning Argentina into its backyard fortress? And what does this mean for rivals lurking in the shadows?

Bailout or Buyout? Decoding the Dollar Deal

At its core, the swap is straightforward: Argentina pledges pesos, gets dollars in return, and must repay later…though history suggests these arrangements often roll over indefinitely.

Handled through the Treasury’s Exchange Stabilization Fund rather than the Federal Reserve, it bypasses typical central bank channels, giving the US tighter control.

The Treasury even bought pesos outright to prop up the currency, preserving Argentina’s dollar reserves for IMF payments and other debts.

Critics cry foul, calling it a bailout for a mismanaged economy. Farmers back home grumble: Why fund Argentine soybeans being sold to China when US exports suffer from trade wars?

Fair point…China’s pivot away from American grains hurts rural pockets, but expect compensatory aid to flow stateside soon.

Yet, frame it as a buyout, and the math shifts. For $20 billion…a drop in the bucket compared to Argentina’s trillion-dollar resource valuations…the US gains priority access to deals, investments, and alliances.

It’s like snagging front-row seats to the world’s next big commodity boom.

But strings attached? Absolutely. This isn’t altruism…it’s hegemony in action.

The deal underscores America’s “putting itself first” by bolstering a key ally, ensuring stability in the south amid global uncertainties.

So, if it’s a buyout, who’s getting squeezed out…and how does this reshape the Western Hemisphere’s power map?

Kicking Out the Competition: China’s Fading Footprint

Enter the dragon: China has been attempting inroads to Argentina with loans, military overtures, and overfishing in its waters.

A massive base in the south? Plans were afoot until this swap shifted allegiances.

By aligning with the US, Argentina neuters Beijing’s advances, echoing a broader push to expel Chinese influence from the Americas.

It’s no secret: Even as the US retrenches globally, it’s fortifying its home turf against Eastern encroachments.

This fits a pattern of subtle (and not-so-subtle) diplomacy.

First, polite partnerships…then, financial incentives like swaps or IMF aid…if needed, tougher tactics follow. Call it the playbook for maintaining dominance since World War II. China tried its Belt and Road version but with less punch.

Here, the US isn’t just lending…it’s claiming dibs on resources while weakening a rival. If the dollar’s “worthless,” as naysayers claim, why not trade 20 billion for leverage over assets worth exponentially more?

With China on the back foot, is the US gearing up for something bigger…like a full-court press to control the entire hemisphere? What if military maneuvers are already in motion?

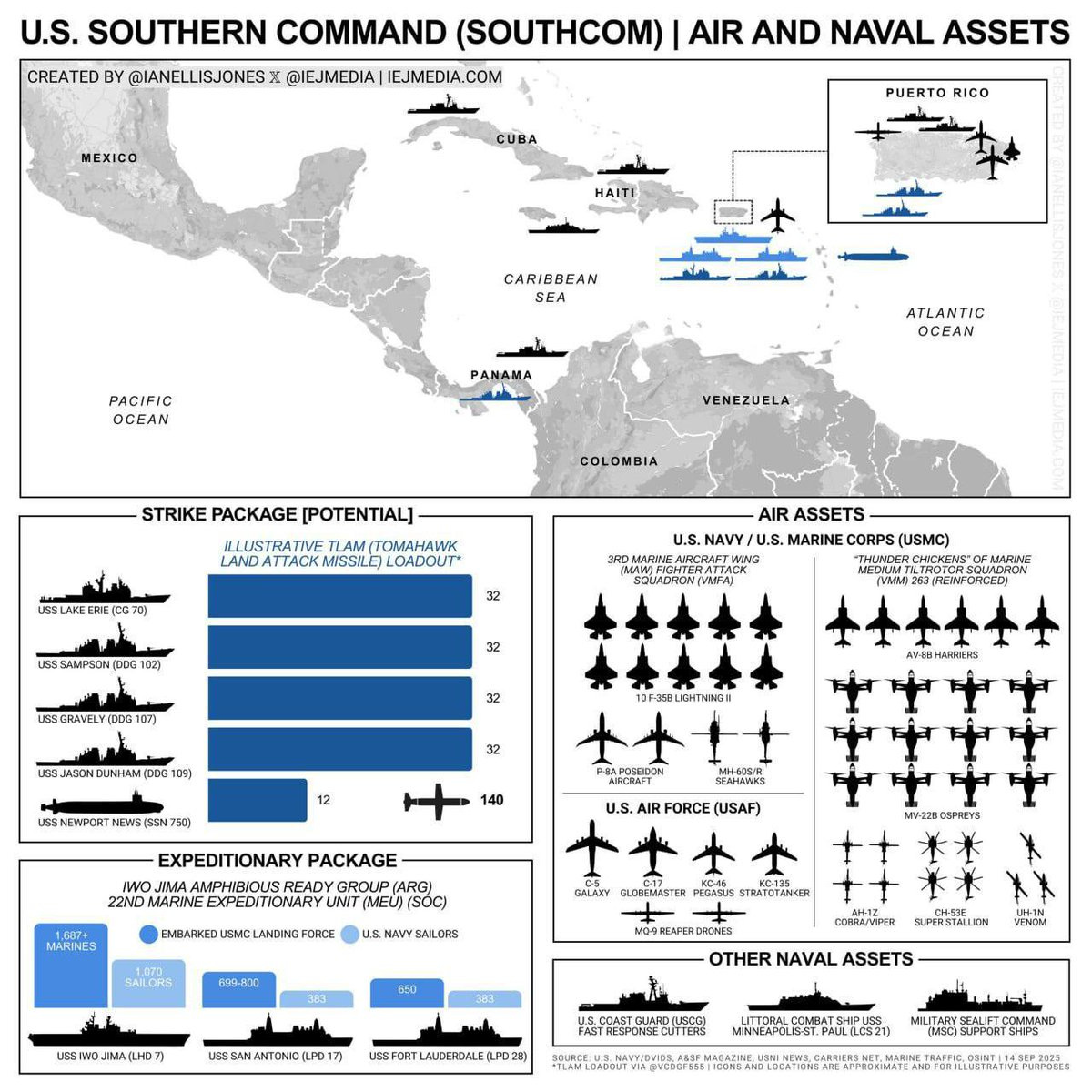

Fortress Americas: Military Moves and the Drug War Escalation

Whispers of buildup echo from Puerto Rico, where US forces have ramped up like never before…beach assaults, training runs, and intercepts of drug-laden boats from South America.

It’s the most significant Caribbean presence since the Cuban Missile Crisis. Why? Drugs, sure…fentanyl floods in from China via Mexico and cartels, poisoning communities and enriching enemies.

But it’s deeper: Weakening cartels starves China of illicit profits and asserts regional control.

Expect incursions beyond seas…into Venezuela’s oil fields, Colombia’s narco strongholds, even Mexico.

Partnerships with local leaders, like El Salvador’s anti-gang crusader, pave the way. Black ops, Delta Force, or mercenary alliances?

Details fuzzy, but intent clear: Secure supply lines, oust foreign meddlers, and build a “United States of the Americas.”

Echoing the century-old Monroe Doctrine, it’s about enclosing the hemisphere under US sway, from Greenland’s ice to Argentina’s tip.

Blowback inevitable…international outcry, unintended chaos…but the drive persists. If this is the blueprint, how does it connect to the global rift tearing economies apart? And what about the market meltdown signaling trouble ahead?

The World in Divorce: US-China Rivalry Heats Up

The globe’s splitting like a bad breakup, mutual and messy.

Post-COVID, supply chains fractured…Russia’s Ukraine moves accelerated the divide.

East vs. West: China, Russia, and the Global South on one side…US, Europe, Japan on the other.

Each retreats to spheres of influence, but rivalries rage.

The US pulls back globally yet doubles down hemispherically…Argentina’s swap is exhibit A, countering China’s everywhere push.

It’s always about China, even when it’s not.

Trade wars escalate: Beijing curbs critical mineral exports…the US slaps 100% tariffs come November.

Markets? Panicked. This isn’t fading…it’s intensifying, reshaping alliances and economies. As hemispheres harden, volatility becomes the norm…not the exception.

Speaking of which, have recent market shakes got you rethinking your portfolio? What if the safe havens aren’t what they seem?

Market Mayhem: Volatility Returns with a Vengeance

Friday’s frenzy was a wake-up call.

The VIX fear gauge spiked from 16.5 to 21, equities tanked…the Dow down 1-2%, S&P 500 retreating to its 50-day moving average, NASDAQ shedding 3.5%.

Passive investing amplified the drop: No human hesitation, just algorithmic sells cascading like dominoes.

Crypto crumbled too…Bitcoin plunged amid record liquidations, billions vaporized.

Far from a safe harbor, it’s a liquidity play: When global flows dry up, it dives.

Credit markets creak…high-yield spreads widened, options-adjusted indicators jumped, credit default swaps ticked higher. Under the hood, not so rosy.

The dollar? Sideways for months but breaking its downtrend. A surge could unleash more chaos, especially with risk-on bets dominant.

Gold, meanwhile, hit all-time highs before pulling back, closing above $4,000… a reminder that in turbulent times, tangible assets shine.

Diversifying within them…bullion for safety, yields for growth…could buffer portfolios efficiently.

As swaps stabilize south and tensions boil east, is this the dawn of a dollar-dominated era…or the prelude to greater madness?

Wrapping the Hemisphere in Stars and Stripes

In this $20 billion saga, facts paint a picture of ambition over aid. From Argentina’s resource riches to US strategic secures, it’s a tale of influence bought smartly.

Countering China, combating cartels, and corralling volatility…America’s playbook is bold, entertainingly audacious.

Yet questions linger: Will this buyout pay dividends, or spark unintended wars? As markets jitter and maps redraw, one thing’s clear…the game’s just heating up. What’s your next move in this global milkshake of power and profit?

The Defense Report That’s Turning Heads in Global Macro

Get access to the report institutional investors don’t want buried in the free feed!

Every so often, we open the gates just a little wider.

For the next few days, our free readers can take a rare step inside Santiago Capital’s inner circle…but only if you act before 11:59 PM EST on October 15th.

When you upgrade to our $399/year Santiago Capital Research tier, you’ll gain instant access to our newest Pro-level deep dive:

👉 “The Return of Hard Power: Investing in National Defense.”

This 36-page report dissects one of the most important macro shifts of our time…the end of the post-Cold War peace era and the emergence of a multi-decade defense super-cycle now reshaping capital markets.

Inside, you’ll discover:

How $2.7 trillion in global defense spending is creating new investment frontiers across minerals, semiconductors, and cyber defense.

Why defense has proven counter-cyclical, historically outperforming during crises and recessions.

The structural link between geopolitical fragmentation and industrial renewal, and what that means for long-term investors.

Normally, access to this level of research is reserved for our Pro members ($2,500/year)…professionals, fund managers, and serious allocators who rely on Santiago’s work to frame long-horizon strategy.

But until Wednesday October 15, 2025 at midnight you can read it now by upgrading to our $399/year Research tier.

That upgrade also unlocks:

✅ 5–6 full articles per month exploring the intersection of capital markets, geopolitics, and human behavior.

✅ The Macro Pilgrim’s Ledger…our weekly Sunday digest breaking down the week that was, the week ahead, and the data that matters most.

✅ Narrative-driven macro research that helps you think independently, cut through noise, and identify long-term opportunity before the crowd.

This is your chance to move beyond headlines…to start understanding why markets move, not just how.

⏳ Access to this Pro-level research closes permanently at 11:59 PM EST on October 15th.

After that, only PRO level members will continue receiving Santiago’s full macro deep dives.

Now is your chance to dive into a premium Santiago Capital Research premium report. But do so now before time runs out.

👉 Upgrade to $399/yr now to unlock full access.

👉 Join Santiago Capital Research ($399/year) and experience the research trusted by serious retail investors…at a fraction of the institutional price.