Are Central Banks Ditching Treasuries for a Shiny New Future?

Imagine waking up to a world where the bedrock of global finance is quietly crumbling…not with a bang, but with the subtle gleam of gold bars stacking higher in vaults around the world.

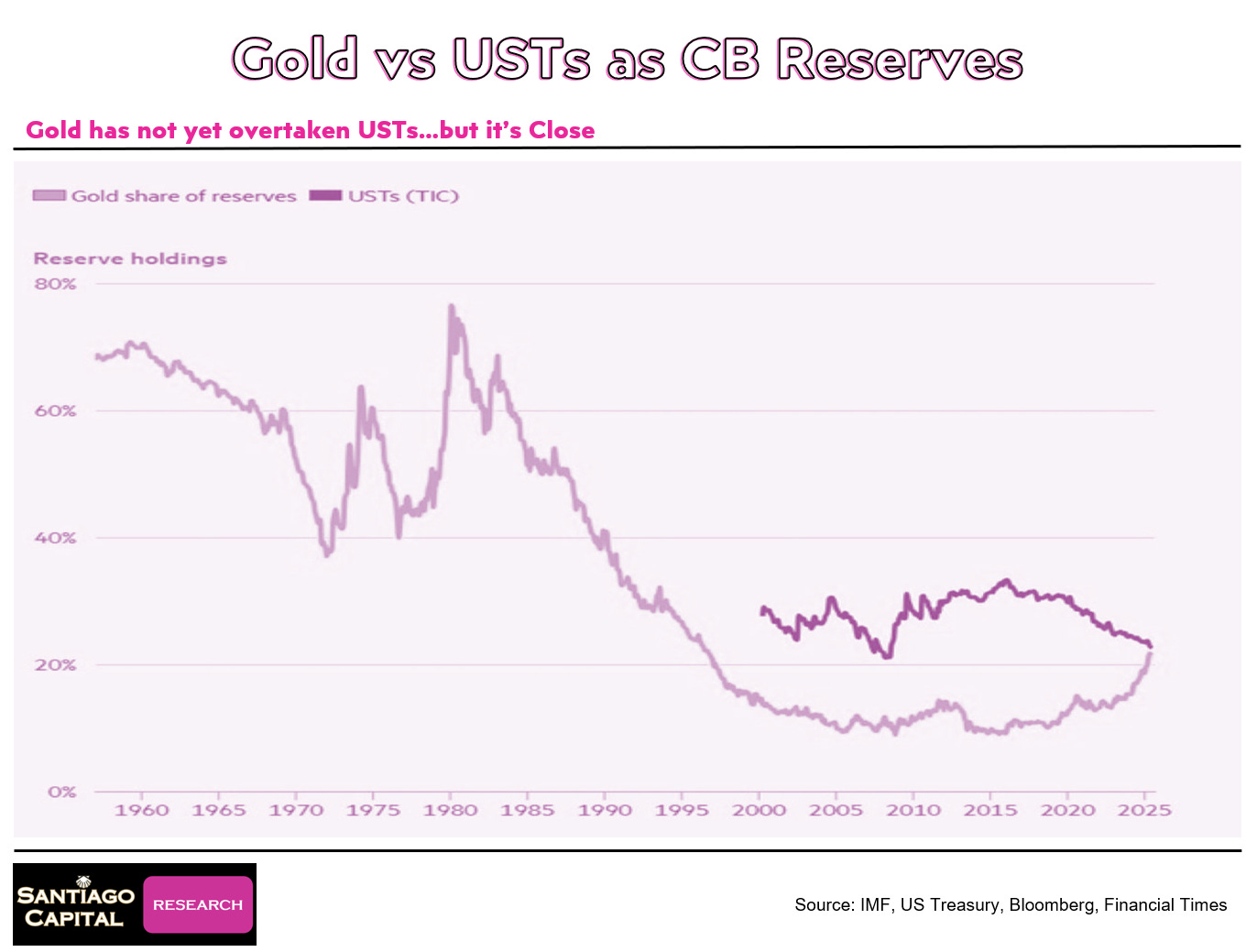

Over the past decade, central banks have been making a pivotal pivot: ramping up their gold holdings while dialing back on US Treasuries.

A chart making the rounds in financial circles paints a stark picture…gold’s share of reserves climbing steadily, while Treasuries’ portion plummets.

It’s the kind of visual that sparks heated debates in trading rooms and online forums alike.

But here’s the kicker: Is this really the death knell for the US dollar’s grip on the world, or just the opening act in a much bigger economic drama?

Let’s peel back the layers.

For years, US Treasuries have been the go-to safe haven for central banks, forming a massive chunk of their balance sheets.

They’re not just pieces of paper; they’re the lubricant keeping the global financial machine humming.

Yet, data shows a clear trend: foreign central banks are buying fewer Treasuries relative to the past, even as the total outstanding amount creeps higher.

Gold, on the other hand, is surging in popularity.

Its allure isn’t new…it’s been a store of value for millennia…but this acceleration feels different.

Emerging markets, particularly in Asia and Europe, are leading the charge, snapping up the yellow metal as if preparing for a storm.

Why the rush? Currencies in many countries are under pressure, eroding trust in local fiat.

When your money starts feeling like it’s melting away, gold looks pretty solid.

Take China, for instance: Citizens aren’t hoarding gold because they’re worried about distant US policies; it’s their own yuan’s wobbles and real estate crash that send them scrambling.

This foreign buying spree kicked into high gear around 2022, when the dollar was flexing its muscles and other currencies were taking a beating.

Gold prices have more than doubled since discussions about this shift began gaining traction about six or seven years ago, outpacing even the dollar’s gains against many peers.

But hold on…what if this gold rush isn’t undermining the dollar at all, but actually playing right into a long-predicted financial reckoning?

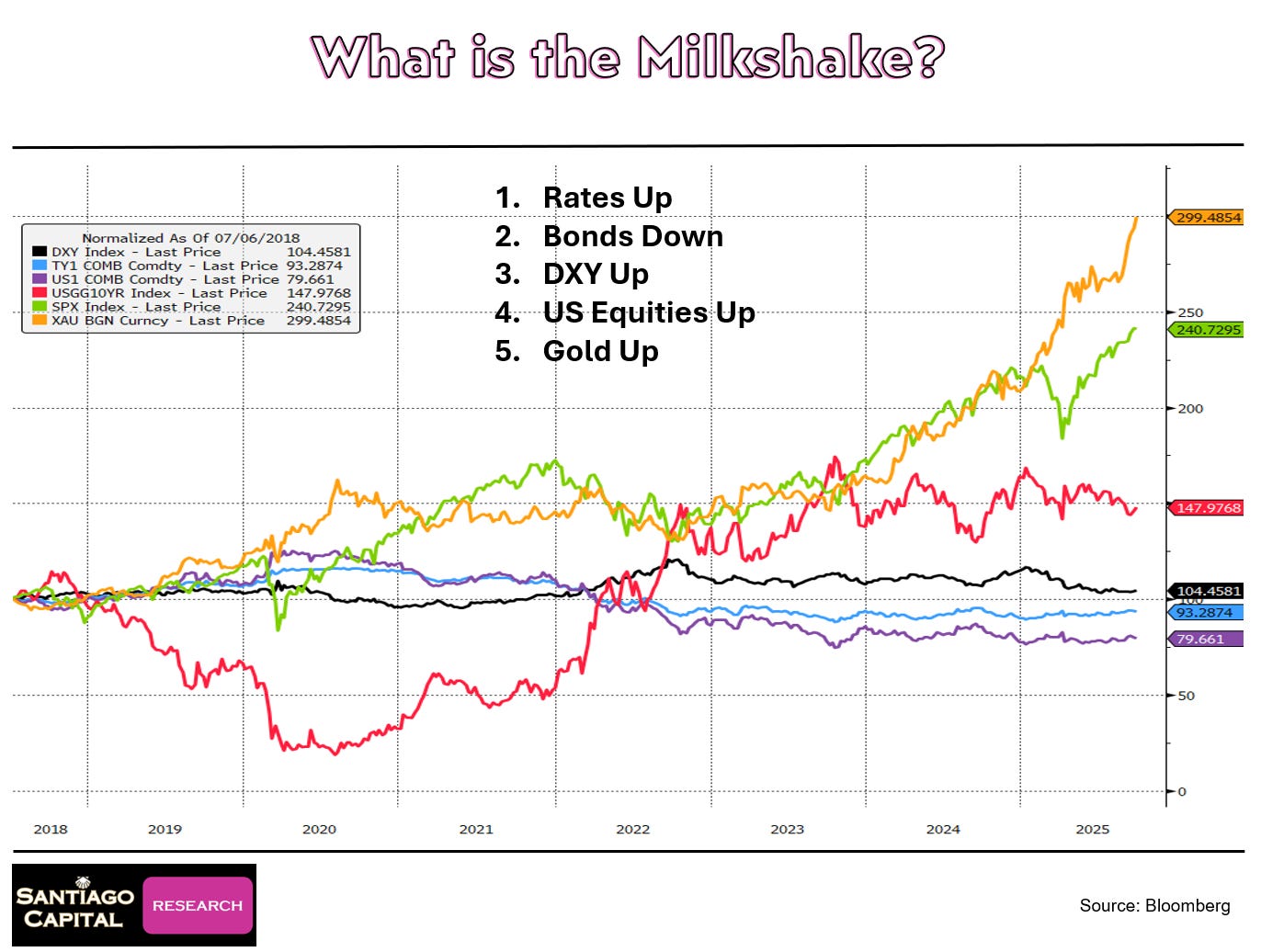

Picture this: A scenario where rising interest rates, falling bond values, a stronger dollar, booming US stocks, and soaring gold all happen in tandem.

It sounds counterintuitive, like mixing oil and water, but let’s explore how these pieces might fit together in a puzzle that’s been assembling since 2018.

The Sovereign Debt Squeeze: Could Rising Rates Be the Real Game-Changer?

Flash back to predictions from half a decade ago: Analysts foresaw a brewing sovereign debt crisis, where governments worldwide would struggle under mountains of borrowing.

Rates would climb after decades of decline, bonds would tank, and the dollar would soar as investors sought safety.

US equities? They’d defy gravity, climbing higher amid the chaos.

And gold? It would shine brighter than ever, not in spite of the dollar’s strength, but because of it.

Fast-forward to today, and many of those elements are unfolding…albeit without the full-blown crisis materializing yet.

We skirted the edge in 2020 during the pandemic’s dollar spike and again in 2022’s turmoil, but the system held.

Still, rates have risen, Treasuries have dipped, the dollar has strengthened overall, US stocks have rocketed, and gold has delivered impressive gains.

The twist? This isn’t a smooth, linear story.

Markets zigzag, with bonds rallying briefly during early COVID fears before resuming their slide.

Here’s where it gets intriguing: A sovereign debt crisis isn’t just about one country imploding…it’s a global chain reaction.

If US Treasuries lose favor and their prices drop (pushing yields up), it’s not only America’s problem.

Global finance prices everything off US rates. Corporate borrowing costs spike worldwide, squeezing businesses from Tokyo to Toronto.

In 2022, when the Fed hiked rates and the dollar surged, we saw the fallout: The British pound collapsed, Japan’s yen hit crisis levels, and emerging markets like Sri Lanka, Pakistan, and Egypt teetered on default. Why?

Trillions in dollar-denominated debt sit outside the US, owed by entities that can’t print greenbacks. A stronger dollar jacks up their repayment burdens, turning manageable loans into nooses.

Now, imagine central banks worldwide facing losses on their existing Treasury holdings. Their reserves shrink, forcing tighter policies or asset sales…exacerbating a credit crunch.

Economies hooked on dollar liquidity suffer most, as higher yields and a beefier buck tighten the screws on global credit.

It’s a vicious cycle: Treasuries fall, rates rise, dollars vanish in defaults, and the world scrambles for alternatives.

But what if this scramble doesn’t dethrone the dollar overnight, but instead entrenches it temporarily while exposing cracks in the system?

De-Dollarization’s Double Edge: Is the Dollar’s Rise Its Own Undoing?

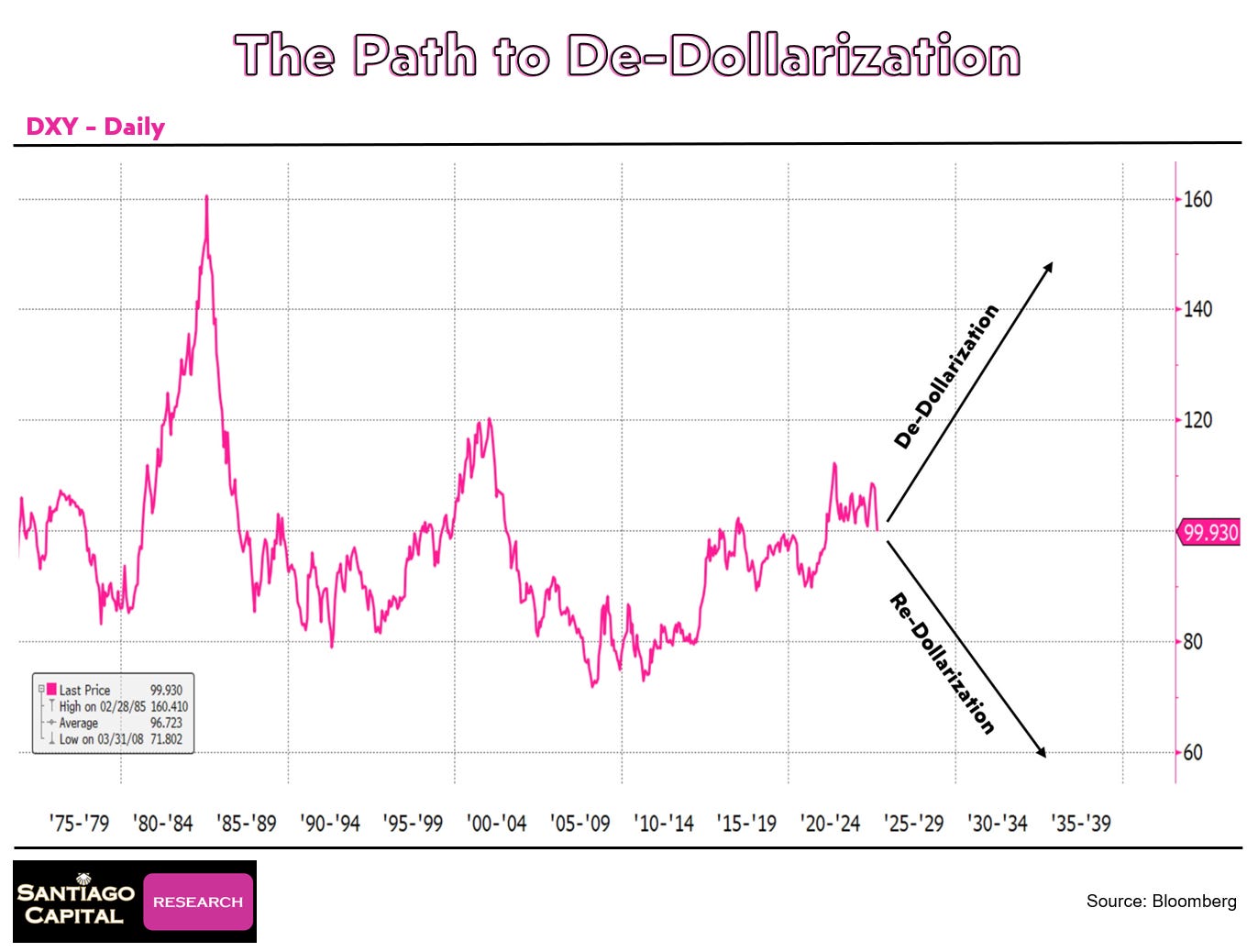

De-dollarization…the buzzword du jour…conjures images of a multipolar world where the greenback fades into irrelevance. But what if the path to that future runs through the dollar getting stronger, not weaker?

It seems paradoxical, but hear this out: When the dollar falls, new loans flood the system, creating future demand and kicking problems down the road. That’s re-dollarization in disguise, solidifying its reserve currency status.

Conversely, a rising dollar triggers defaults, evaporates liquidity, and forces nations to innovate…that’s true de-dollarization, paving the way for a reset.

The dollar isn’t the global reserve asset; it’s the currency.

Treasuries have played that asset role, but as they wane, gold steps up.

Yet, gold and the dollar aren’t eternal enemies…they can ascend together against weaker fiat peers.

Since these trends kicked off, gold has skyrocketed in dollar terms, but it’s even more impressive against foreign currencies that have depreciated faster. If all fiats are debasing, gold emerges as the neutral arbiter, its price signaling systemic stress.

For businesses and investors navigating real-world markets, dollar strength versus other currencies matters immensely. It impacts stocks, bonds, commodities…even if you’re a gold bug living off the grid, global trade flows hinge on these dynamics.

A falling dollar might buy time, but a rising one wrecks havoc, ultimately leading to the system’s overhaul.

And as gold’s role grows, who stands to benefit?

The US holds the world’s largest official gold reserves…far more than most competitors. Skeptics question audits, but if we’re doubting numbers, why trust any government’s tally?

History shows victors in conflicts often amass treasures; the US has been no stranger to global engagements.

But if gold becomes the new benchmark for success on the world stage, is America really at a disadvantage?

Far from it.

This shift could hurt the US in absolute terms…after all, losing reserve currency perks stings…but relatively speaking, others might falter first.

China may be buying gold hand over fist, but its economic woes and yuan instability drive that demand. Europe grapples with its own debts, and emerging markets are even more vulnerable.

In a relative game, the hegemon doesn’t topple easily.

What if this entire transition isn’t about winners and losers in a zero-sum battle, but a gradual reconfiguration where gold reasserts itself as money?

Traditional gold ownership splits into safe bullion (low risk, no yield) and volatile miners (high reward, high drama).

Now, innovative platforms bridge that gap, letting holders earn yields by treating gold as active money…lending it out in structured ways.

It’s not risk-free, but it reintroduces gold to modern finance without the extremes.

Curious how this could turbocharge the shift? Let’s connect it to broader market ripples.

Global Ripples and Market Mayhem: Will Equities Keep Defying Gravity?

As Treasuries wane and gold gleams, the spotlight turns to equities.

US stocks have been on a tear, climbing amid rising rates and dollar strength…aligning with those 2018 forecasts.

But nothing lasts forever.

Markets are stretched thin, with valuations screaming “overbought.”

A correction looms, especially with potential government shutdowns disrupting data releases like payrolls and inflation figures. If the Fed’s data-dependent, what happens when the data dries up? Bullish uncertainty or bearish panic?

Geopolitical tensions add fuel: Military buildups in regions like the Caribbean, escalations with Russia, and whispers of interventions in volatile spots like Venezuela.

These aren’t abstract risks…they could jolt markets, amplifying any debt-driven volatility.

Stablecoins, those digital dollar proxies, might accelerate trends, turbocharging liquidity in unexpected ways. Reports on their impact are forthcoming, but they could either stabilize or supercharge the game.

Yet, in this sovereign debt saga, US Treasuries remain dominant on central bank sheets despite the dip. Foreign holdings are at record highs in absolute terms…they’re still buying, just not proportionally.

If yields spike further, it cascades: Global borrowing costs soar, credit tightens, and weaker economies crack first. The US might be the last standing, not because it’s flawless, but because alternatives are scarcer.

So, as central banks stack gold and eye Treasuries warily, ask yourself: Is this the end of an era, or the messy birth of a new one?

Gold’s rise signals distrust in fiat, but the dollar’s resilience suggests the unwind will be protracted, not precipitous.

In this relative arena, sins abound everywhere…budget blowouts, debt piles, currency manipulations.

Focusing solely on US flaws misses the global picture: Everyone’s in the same leaky boat.

The chart that’s buzzing isn’t wrong…it’s vital. But it doesn’t spell instant doom for the dollar or triumph for rivals.

Instead, it hints at a progression where rates climb, bonds falter, dollars strengthen, equities wobble, and gold endures.

Will we hit that $5,000 gold mark amid pullbacks? Likely, as systemic strains mount.

The real question: When the reset hits, who rebuilds first? Keep watching…the golden shift is just getting started.

❤️ Thank you for being a paid subscriber. We wouldn’t be publishing our research without you.