Money isn't Everything

Money isn't Everything...But the lack of it is...Here's the uncomfortable truth facing European Institutions...

Every so often, the world quietly approaches a line it cannot afford to cross.

It’s the kind of situation no one wants to discuss…because everyone already suspects the unwanted reality.

Not because it’s ambiguous. But because it’s scary. Because saying it out loud risks unraveling a fragile truth that global finance depends on to survive.

Europe likes to think of itself as sovereign.

Self-directed. Independent.

But beneath the polished language of technocrats…behind every ECB policy release, every fiscal coordination call, every currency swap..lurks a reality too uncomfortable to admit:

The continent still runs on something they don’t have and can’t create.

Not sometimes. Not theoretically. But structurally. Quietly. Relentlessly.

This dependence is not new. But for decades, it has been politely ignored.

The choreography was simple: Someone else provides the oxygen, Europe breathes, and no one talks about the level in the tank.

Liquidity flows, markets hum, and the illusion of independence holds. Everyone plays their part.

But what happens if one of the players decides to opt out?

That’s the scenario being modeled now…not in public, not in speeches, but behind closed doors, inside confidential risk committees, and deep within the plumbing of Europe’s financial system.

Quietly. Carefully. Urgently.

Because behind the outward calm, policymakers in Brussels, Frankfurt, and Paris are gaming out a future they can’t afford to get wrong. A future where funding is withheld, backstops are rescinded, and lifelines are no longer guaranteed.

No to emergency liquidity.

No to overnight rollover extensions.

No to the unsaid promises that kept Europe’s banks solvent in 2008, 2011, and 2020.

This isn’t a crisis. Not yet.

It’s a drill. A rehearsal. A tightening of assumptions as global trust thins and global seigniorage once again becomes geopolitical leverage.

Most observers haven’t noticed.

They’re watching yield curves, parsing central bank pressers, or fixated on the latest moves in tech stocks.

They aren’t looking at liquidity corridors.

They aren’t asking what would happen if Europe’s funding access became weaponized…whether by strategy or by accident.

But some people are asking. And those people are writing new contingency plans.

The reason being that if this liquidity is ever withheld…accidentally, tactically, or even deliberately, Europe doesn’t just face a monetary problem. It faces an existential test.

And it may not pass.

Because in moments like that, survival doesn’t go to the biggest. Or the best capitalized. Or the most prepared on paper.

It goes to the one with the shortest distance to the oxygen tank.

Europe’s Dollar Dependence: The Quiet Crisis No One Wants to Test

On May 14, 2025, news broke that some of the European Union’s largest banks are modeling unprecedented scenarios: a world in which the U.S. Federal Reserve no longer provides dollar liquidity.

The scenario may seem implausible at first glance…after all, the Fed has functioned as the global lender of last resort in every major financial crisis since at least 2008.

But in today’s politicized environment, where dollar liquidity is increasingly seen as a geopolitical weapon, the possibility has become significant enough to warrant serious contingency planning.

This development was reported by Reuters, highlighting that European Central Bank (ECB) supervisors are urging eurozone banks to reassess their reliance on U.S. dollar funding.

The concern stems from potential political tensions under the Trump administration that could disrupt access to the Federal Reserve's dollar swap lines.

A substantial portion of euro zone banks funding is denominated in U.S. dollars, largely borrowed through short-term U.S. markets, leaving them vulnerable in times of financial stress.

While the Fed has not signaled any change in its commitment to these facilities, recent geopolitical uncertainties have prompted European regulators to press banks to identify and reduce dollar funding gaps, and in some cases, to revise business models to lessen dollar exposure.

Most still see the Fed as an impartial referee. But if the dollar becomes a partisan instrument of foreign policy, the world’s plumbing doesn’t just clog…it bursts.

And Europe? It’s directly downstream.

Why It’s an Issue: The Eurodollar System’s Fragile Foundations

The global financial system runs on dollars.

Not just inside U.S. borders, but across the planet.

This is the Eurodollar system…a vast, opaque, dollar-based funding network operating outside the jurisdiction of the U.S., but entirely dependent on it.

European banks, particularly in France, Germany, and the Netherlands, rely heavily on short-term U.S. dollar funding markets to finance long-term assets.

According to recent ECB data, up to 17% of eurozone bank liabilities are denominated in U.S. dollars, with a disproportionate share concentrated in cross-border and wholesale funding channels like repo, FX swaps, and commercial paper.

This figure is detailed in the ECB's November 2024 Financial Stability Review, which notes that 23% of euro area banks' funding is denominated in foreign currency.

The short-term wholesale nature of U.S. dollar funding can expose banks to liquidity stress, as this funding has often dried up in times of heightened market volatility.

This system functions smoothly when dollars are abundant.

But when dollar liquidity tightens…due to market stress or policy decisions…European institutions can face acute funding shortages, especially if their dollar liabilities cannot be rolled over.

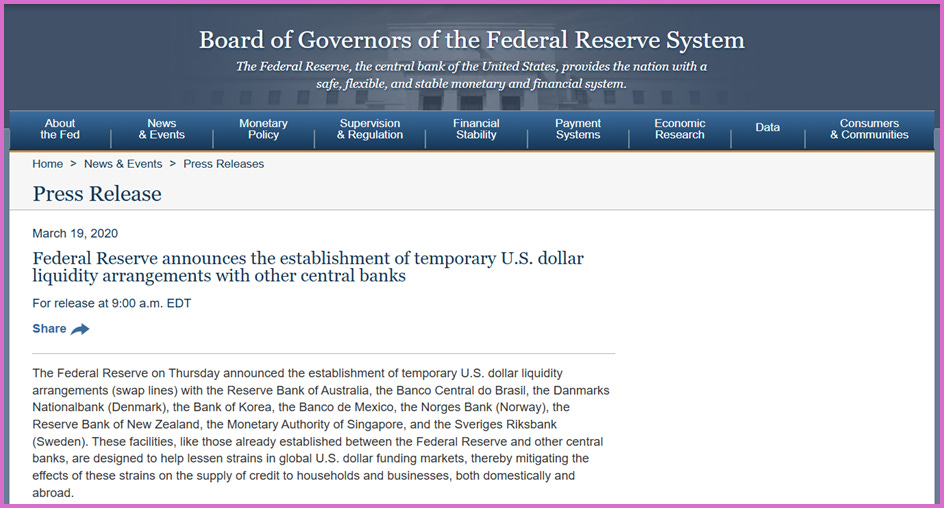

This is exactly what happened during the 2008 Crisis, 2011 Crisis, and again in March 2020, prompting the Federal Reserve to establish or expand dollar swap lines with foreign central banks like the ECB, SNB, and BoJ.

But today’s context is different.

The fear is not just market dysfunction…but political decoupling.

A system this brittle only works when everyone pretends it isn’t. But cracks are forming. And once the illusion breaks, it’s not balance sheets that matter…it’s access.