The End of the Borderless Dream

Picture a world where borders were mere suggestions, and capital flowed like water across continents, turning CEOs into global dealmakers and investors into explorers chasing the next hot market.

For nearly half a century, this was the gospel of globalization: a flat, interconnected planet where supply chains hummed with Swiss-watch precision, and multinational empires reaped profits from predictability.

Wars felt like distant memories, and economic interdependence was the ultimate peacekeeper.

Investors built fortunes on this foundation, diversifying portfolios like chefs sampling global cuisines, confident the world’s flattening would lift all boats. But what happens when the seams of this seamless world begin to split?

The invisible threads that stitched our global economy are fraying.

Today, borders are snapping back into focus…not as quaint map lines, but as fortified ramparts guarding national treasures.

Welcome to de-globalization, a seismic shift that’s rewriting the rules for governments, corporations, and your 401(k).

This isn’t a blip; it’s the prelude to decades of disruption. Yet, amid the chaos, fortunes will be forged.

Who will emerge as the new kings of this fractured kingdom?

The Cracks in the Global Machine

For decades, globalization’s machinery ran smoothly: raw materials from one continent, assembly in another, finished goods rocketing to consumers with astonishing efficiency.

The secret sauce? Predictability.

Unknowns were engineered out, risks minimized, profits maximized. Supply chains spanned the globe like a symphony, and borders were opportunities, not obstacles.

But beneath the glossy veneer, cracks were forming…hairline fractures in a dam holding back a deluge.

What force could shatter this unshakable framework?

The escalating rivalry between the world’s economic superpower and its rising challenger exposed the truth: politics and profits can no longer be separated.

Those sprawling supply chains, once marvels of efficiency, became liabilities…vulnerable to disruption and manipulation.

A global health crisis acted as the wrecking ball, laying bare the fragility in brutal clarity.

Factories halted, ports clogged, and nations watched essential goods become geopolitical pawns. The lexicon of economics flipped overnight.

Efficiency and integration? Out.

Sovereignty, resilience, self-sufficiency? In.

Governments now shout these mantras, trading razor-thin margins for ironclad security, redundancy for optimization, control for openness.

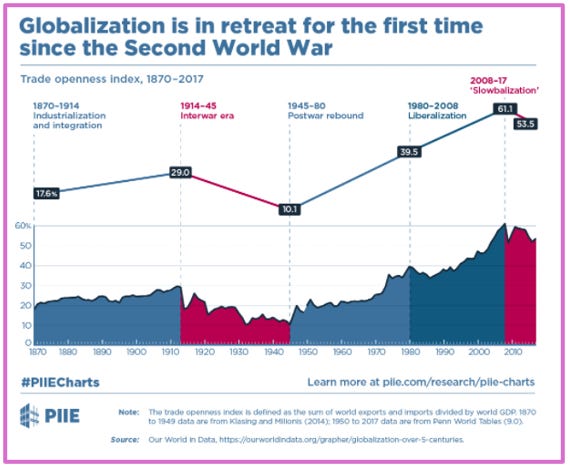

For the first time since World War II, globalization is in full retreat. But why is this happening now, and how deep will the impact cut?

The Perfect Storm of De-Globalization

The pandemic was the spark, illuminating vulnerabilities that simmered for years. Yet, it’s not the whole story. A cocktail of catalysts…geopolitical, economic, and human…has thrust this tectonic shift into overdrive.

At the heart of de-globalization lies a clash of titans, where the world’s dominant power and its rising challenger are locked in a struggle that echoes history’s most perilous rivalries.

Scholars have long warned of the Thucydides Trap, a concept rooted in ancient Greece, where a reigning power’s fear of a rising one breeds tension that often spirals toward conflict.

Today, this dynamic defines the escalating standoff between the United States and China, two giants whose ambitions threaten to fracture the global order.

As their competition intensifies, it’s not just markets or trade routes at stake…it’s the very framework of global cooperation. What sets this showdown in motion?

The incumbent superpower, its currency the “global lingua franca”, faces a manufacturing colossus with silk roads of influence threading Asia to Africa. Peaceful coexistence feels like a noble dream as tariffs, tech bans, and territorial spats ignite economic warfare. How will this duel reshape the global chessboard?

Downstream, the fragility of supply chains adds fuel. The crisis exposed the peril of outsourcing lifelines to a single node…often the very rival atop the geopolitical food chain.

For much of the world, one country was the factory floor for everything from chips to masks.

When lockdowns hit, shortages spiked, and inflation roared. Dependence became a chink in the armor, exploitable by adversaries.

Now, “friend-shoring” and “near-shoring” dominate, with nations like the U.S. subsidizing domestic factories or allies like Mexico and Vietnam.

It’s costly…billions in incentives, years of catch-up…but the alternative is strategic strangulation.

Can nations afford to stay dependent in a world that’s picking sides?

Energy, Jobs, and the Weaponization of Wealth

The plot thickens with the green revolution’s thorny crown: the energy transition.

Moving from fossil fuels to renewables is daunting enough, but in a splintering world, it’s a high-wire act. Few nations are energy islands; even the mightiest juggle volatile imports and exports.

The U.S. and Russia boast relative self-reliance…oil fields and gas pipelines as moats…but no one’s impervious.

Rare earths for batteries, solar panels choked by tariffs: a bifurcated world turns shared markets into zero-sum scrambles.

Trillions flow into domestic grids, hydrogen hubs, and nuclear revamps, driven by survival as much as eco-zeal.

Europe, weaning off Russian gas, courts Qatari LNG while racing to build wind farms. What happens when the lights flicker in this high-stakes gamble?

Domestic politics fan the flames too.

Offshoring’s ghosts haunt ballot boxes, where lost factories birthed rust belts and wage wars.

Jobs and living standards vanished with cargo ships, fueling populist surges.

Leaders promising to “bring it home” turn economic nationalism into electoral gold, with tariffs and subsidies as their swords.

This isn’t fringe; it’s the new normal, as governments wield fiscal bazookas to lure industries onshore, from EV plants to steel mills.

Then there’s the dark art of weaponized economics. Finance, once neutral, is now gladiatorial.

The dollar’s dominion lets its issuer sanction foes with SWIFT bans and asset freezes, turning pixels into prison bars.

Retaliation follows: energy pipelines choked, commodity exports embargoed. Russia, commodity czar, flexes its levers, reminding Europe warmth comes at a price.

Trust evaporates; alternatives sprout…digital currencies, barter blocs, crypto as the rebel’s reserve. In a world where goods flow less freely, stockpiles become swords.

Who holds the sharper blade in this new economic arena?

The New Gold Rush: Where Fortunes Await

De-globalization isn’t just a storm…it’s a treasure hunt for sectors poised to thrive in silos over spheres. Which industries will crown the new titans?

Start with semiconductors and advanced tech.

Chip wars escalate as nations etch independence into silicon, with subsidies flooding fabs in Arizona and Taiwan. Valuations are frothy, ripe for corrections, but the long arc bends toward dominance…AI, quantum, 6G demand insatiable supply.

Defense and aerospace are ironclad bets.

As cooperation fades, fortification rises. Budgets balloon…NATO’s spending pledges are floors, not ceilings.

Drones, missiles, cyber shields: the military-industrial complex roars, rewarding investors who back the builders of barricades.

Energy security seals the triad.

The transition demands diversification: domestic oil booms alongside solar sprawls, uranium hunts fueling mini-nukes.

The U.S., with shale and rare earth quests, edges ahead; others scramble for lithium and cobalt, turning mining stocks into modern gold rushes.

Critical minerals and commodities…copper for grids, nickel for batteries…are no longer footnotes but front-page futures, with prices poised for parabolic pops.

Healthcare and biotech get a high-tech infusion.

AI revolutionizes drug discovery and delivery, blending biology with bits in a profitable fusion. Traditional white-coats yield to code-wielding wizards, redefining care’s frontier.

The colossus? Infrastructure…the backbone bending the boom.

Reshoring demands ports, rails, power lines, data centers, scaled to elephantine proportions.

Trillions, printed fresh from central banks, will inflate assets while bridging gaps.

Think bridges to chips, highways to hydrogen. But how will markets react when the bill comes due?

The Market’s Ticking Time Bomb

Markets, drunk on easy money and AI euphoria, are primed for a reckoning.

The dollar index, a global jitter barometer, hugs 15-year support after a post-pandemic peak and sideways shuffle.

Pundits predict Fed rate cuts will unleash freefall, but history disagrees: four years ago, it breached similar lines, lingered, then soared to 30-year highs.

Recent cuts sparked a “sell the news” rebound, with the buck barely a dime shy of April lows.

Sentiment’s sour, positions anti-dollar, volatility at five-year lows…autumn’s VIX spikes loom. Could a contrarian reversal catch the crowd off-guard?

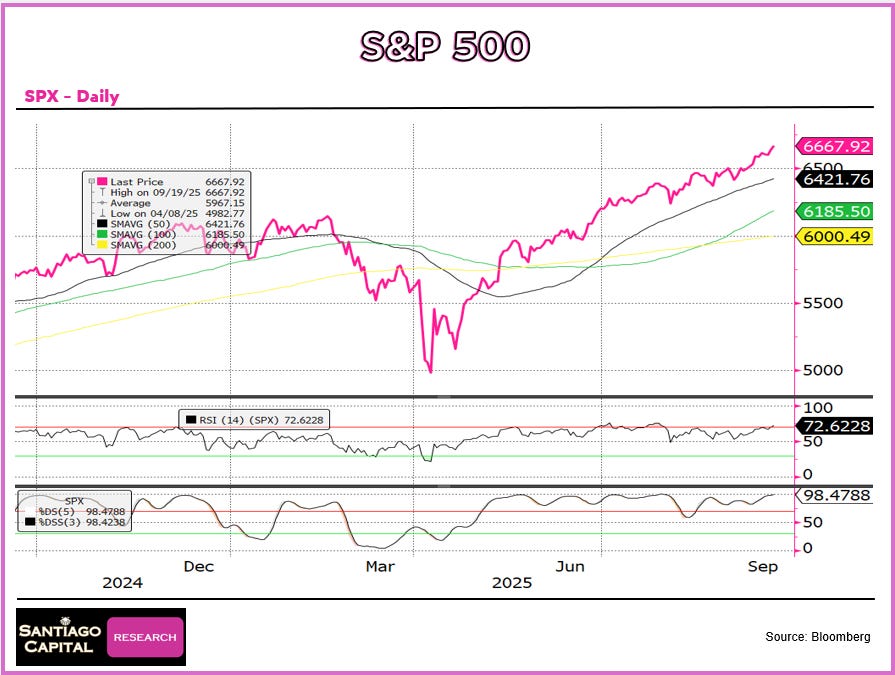

Equities scream caution.

The S&P 500’s sprint from October lows pins stochastics at 99, relative strength overbought.

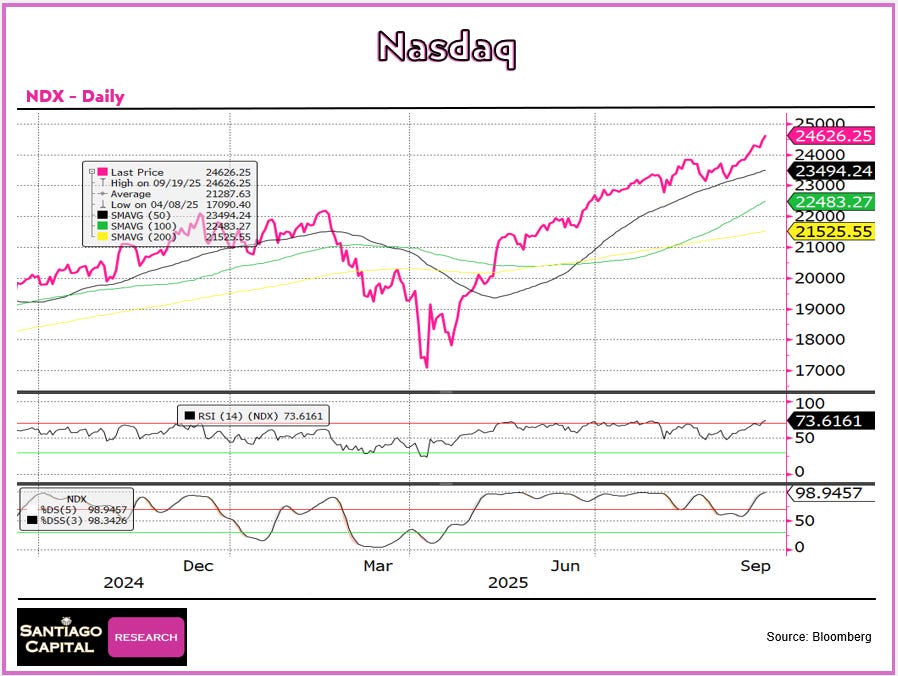

The Nasdaq’s worse: maxed stochastics, RSI in the red.

Google? A parabolic poster child…five-year most overbought.

Meteoric rises don’t start here; they stall. Newbies piling in court disaster; veterans eye pullbacks.

A correction by September’s end feels overdue…economic data, a potential government shutdown, or Sino-Russian shadows could catalyze.

If October dawns calm, the script’s shredded. But conviction demands adaptability.

What’s your next move in this grand game of global chess?

Seizing the Seams of Tomorrow

In this de-globalized dawn, the old playbook will no longer work.

Portfolios must pivot: fortify with defense, fuel with energy, innovate with tech.

Governments will print, nations will hoard, markets will meander…then mutate.

The question isn’t if you’ll adapt; it’s how swiftly. The bold don’t just survive…they seize the seams, stitching new empires from the threads of tomorrow. Where will you place your bet in this fractured future?

Have you read these reports yet? 👇🏻