What if the money in your wallet isn’t what you think it is?

What if it’s not just a tool for buying coffee or paying rent, but a carefully crafted instrument of power, designed to shape your life in ways you barely notice?

These questions aren’t just philosophical musings…they’re at the heart of a debate that could redefine our financial future.

As markets soar to dizzying heights and central banks flex their muscles, the nature of money and its role in our world is more critical than ever.

Let’s dive into the murky waters of currency, power, and control, and explore why the answers might surprise you.

What Is Money, Really?

At its core, money seems simple: it’s what you use to buy groceries, pay bills, or splurge on a new gadget.

But peel back the layers, and you’ll find a concept that’s anything but straightforward.

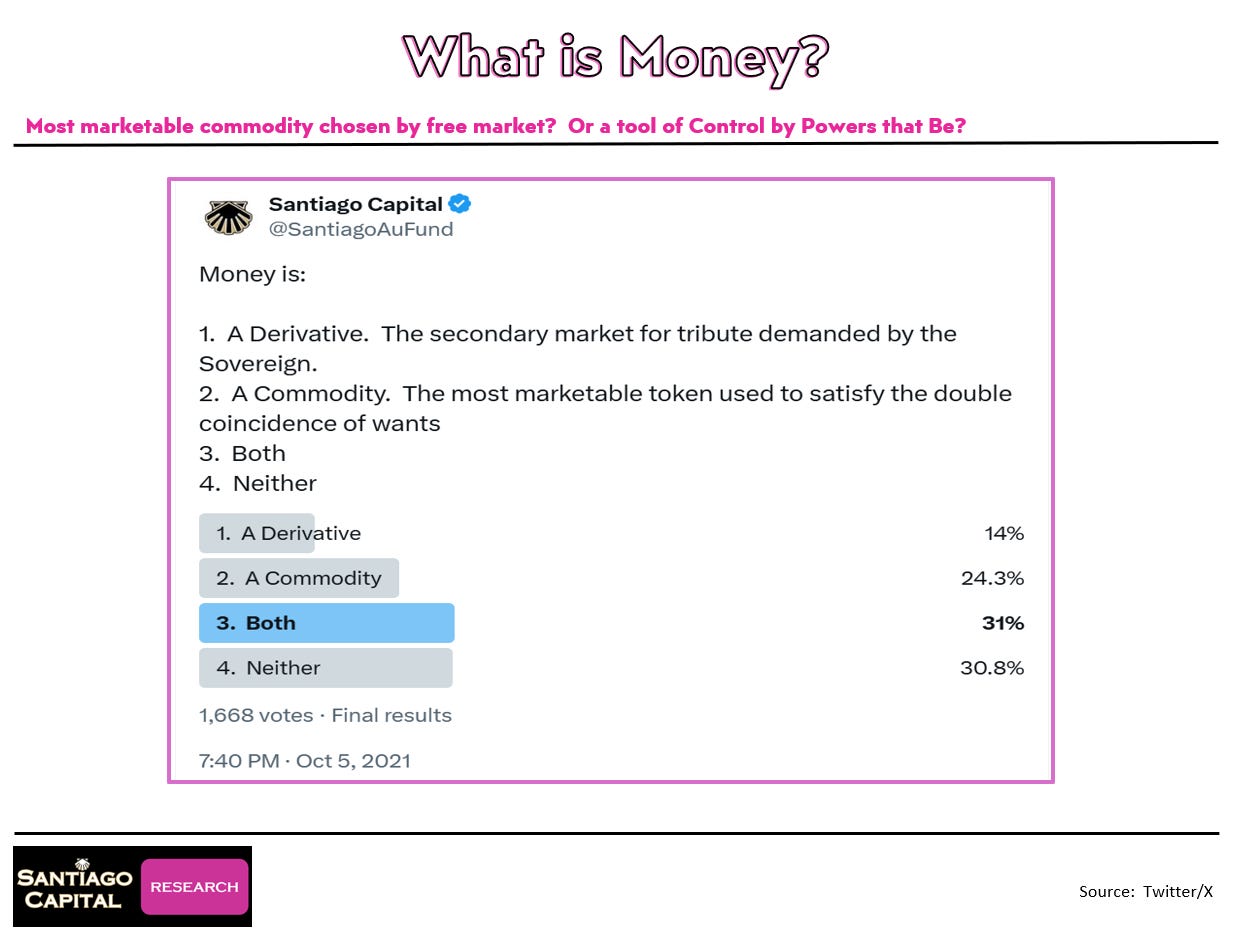

Some argue money is the most marketable commodity, chosen by the free market to facilitate trade…like gold or Bitcoin, valued because people agree it’s valuable.

It’s a romantic idea, one that evokes images of ancient traders swapping goods until a universal medium emerged organically, free from control.

But is that the whole story? History suggests otherwise.

While bartering happened, it wasn’t the dominant system many imagine.

Instead, money often emerged as a tool of the powerful…a way to collect tribute, enforce taxes, or maintain control over sprawling empires.

Think of ancient kings demanding grain, labor or even paper money, not because it was “marketable” on its own, but because it was their decree.

Today, governments and central banks issue currency, backed not by gold but by their authority.

Money, in this view, is less about freedom and more about control…a system designed to keep the wheels of power turning.

So, which is it? A liberating tool of trade or a leash held by those in charge?

The truth might lie in a messy middle, but one thing’s clear: money’s role is evolving, and the stakes are higher than ever.

What happens when the system we’ve trusted for decades starts to crack?

The Power Game

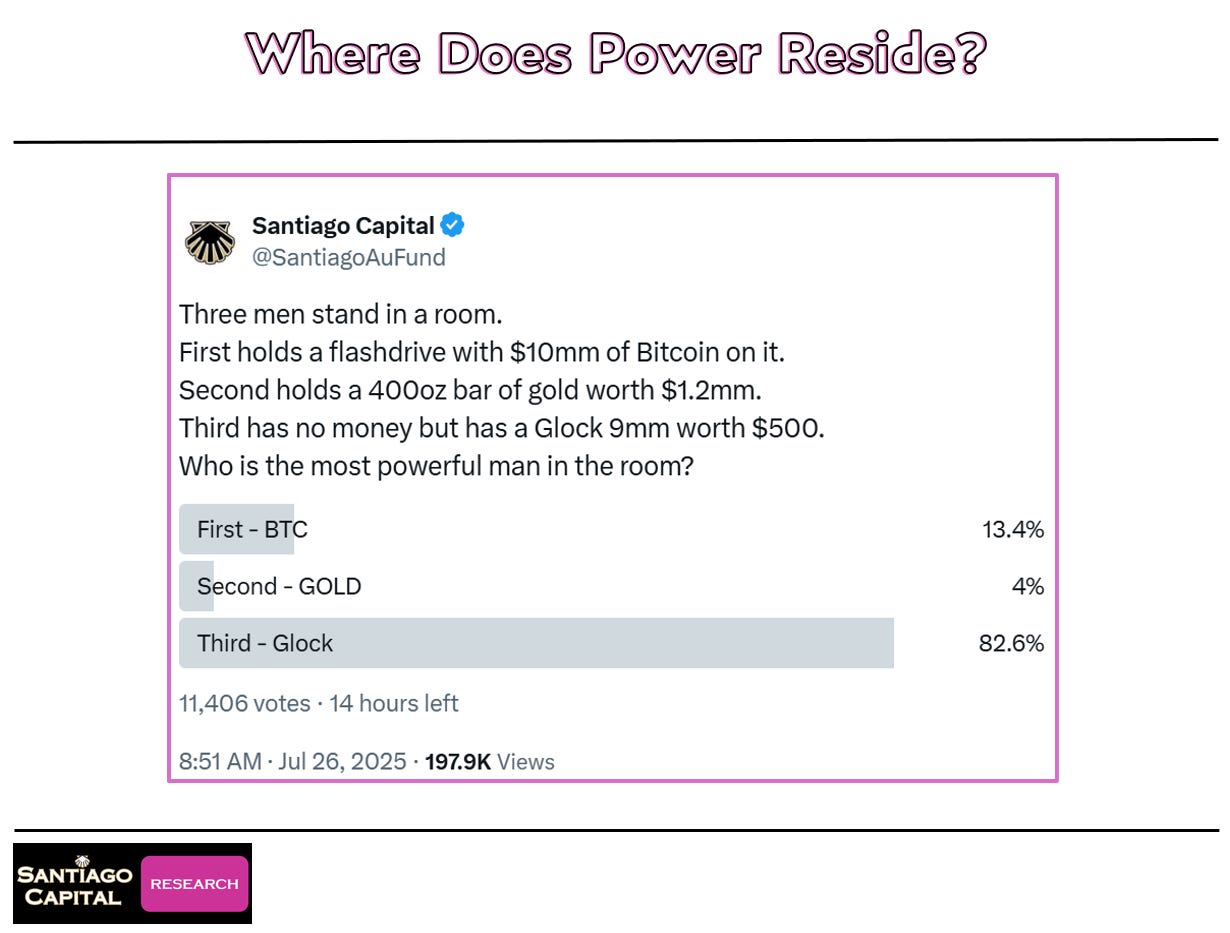

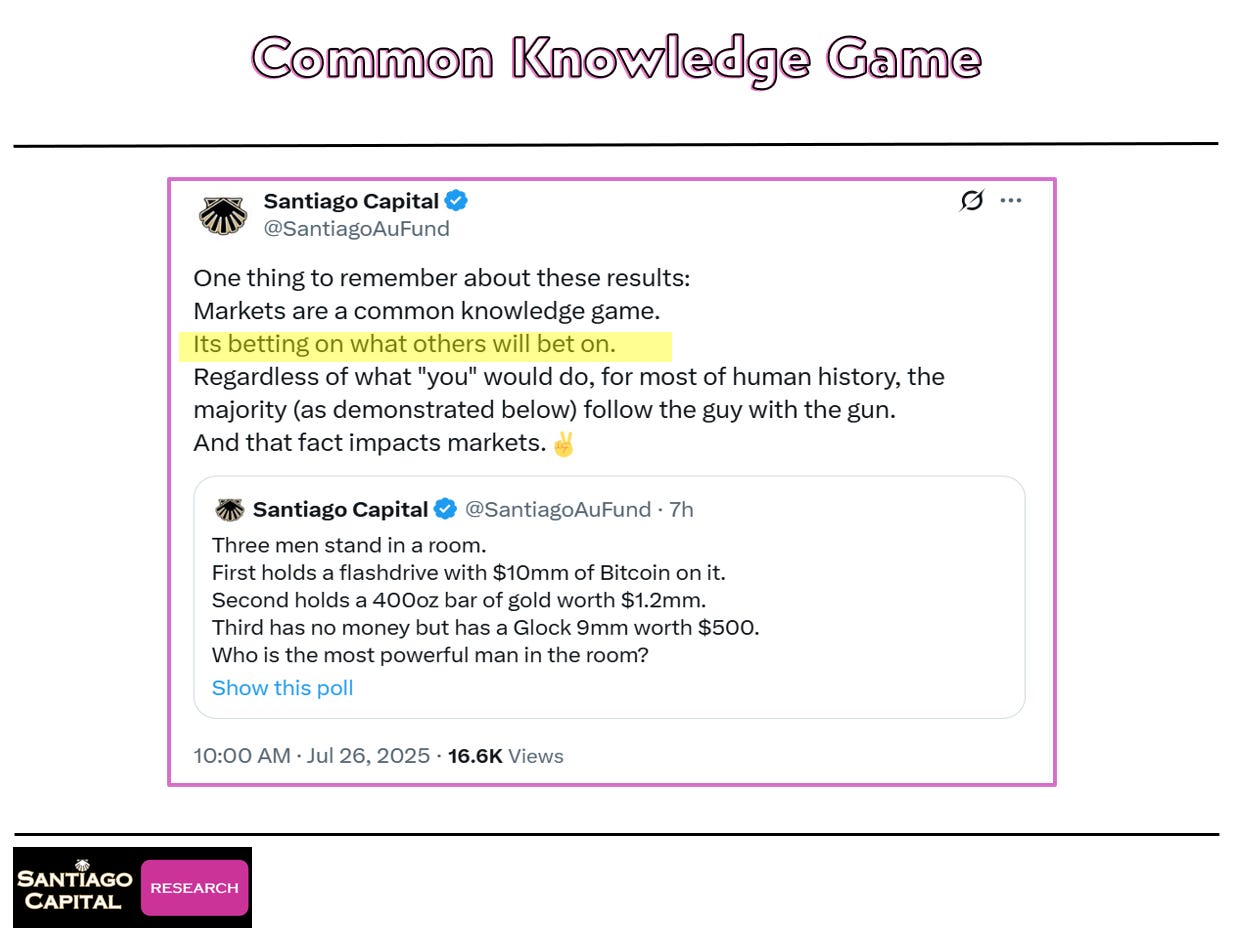

Imagine a room with three people: one holds a flash drive with $10 million in Bitcoin, another clutches a 400-ounce gold bar worth $1.3 million, and the third wields a gun.

Who has the most power? The answer seems obvious…the gun wins. Wealth, whether in digital coins or glittering metal, pales against raw force.

This isn’t just a thought experiment; it’s a reflection of history.

For centuries, those with the swords, armies, or guns have set the rules, including what counts as money.

This dynamic raises a thorny question: if power defines money, what happens when the powerful don’t like the money you choose?

Take Bitcoin’s experiment in El Salvador, where it was briefly adopted as legal tender.

Even there, the government set strict rules on its use, proving that “free market” money still bends to authority.

The free market might choose a currency, but the state often decides how…or if…it’s used.

Why does this matter? Because the interplay of money and power shapes everything from your taxes to your investments.

If money is a tool of control, those in charge have little incentive to let it slip from their grasp.

Could a truly free currency ever emerge in a world where power calls the shots?

The Central Bank’s Hidden Agenda

Enter the central bank, the shadowy institution at the heart of modern finance.

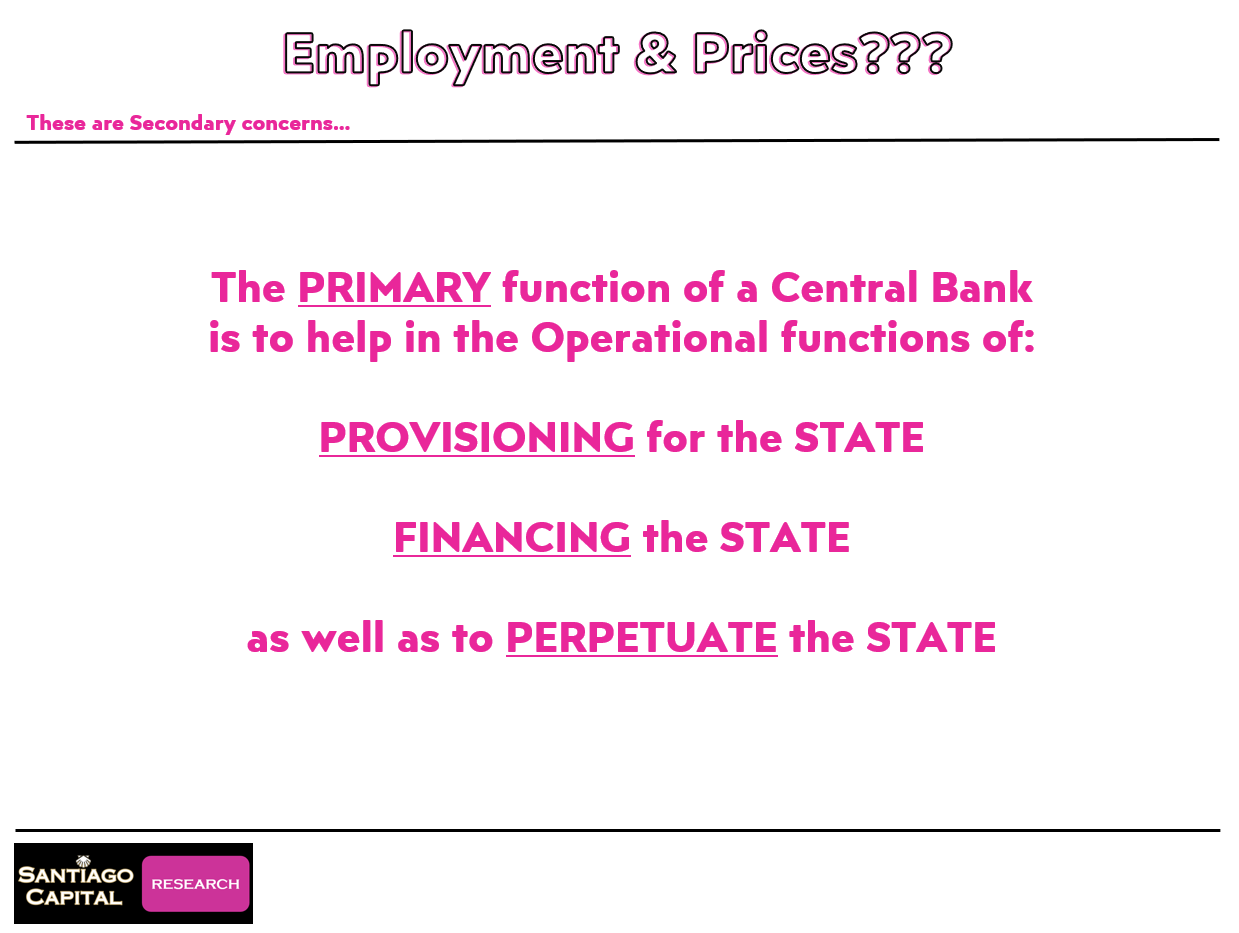

The Federal Reserve, for example, claims its mission is to ensure “maximum employment” and “stable prices.”

Sounds noble, right?

But what if that’s just a feel-good story to keep us nodding along?

The real role of central banks, some argue, is to prop up the state…ensuring its survival by financing its needs and bailing out its failures.

Consider this: when financial systems teeter, central banks step in as the “lender of last resort,” pumping money into banks, corporations, or even governments to keep the machine running. Why?

Because a collapsing system threatens the state’s authority.

The Fed’s actions during the 2008 financial crisis, funneling trillions to Wall Street while Main Street struggled, suggest priorities that don’t quite match the public script.

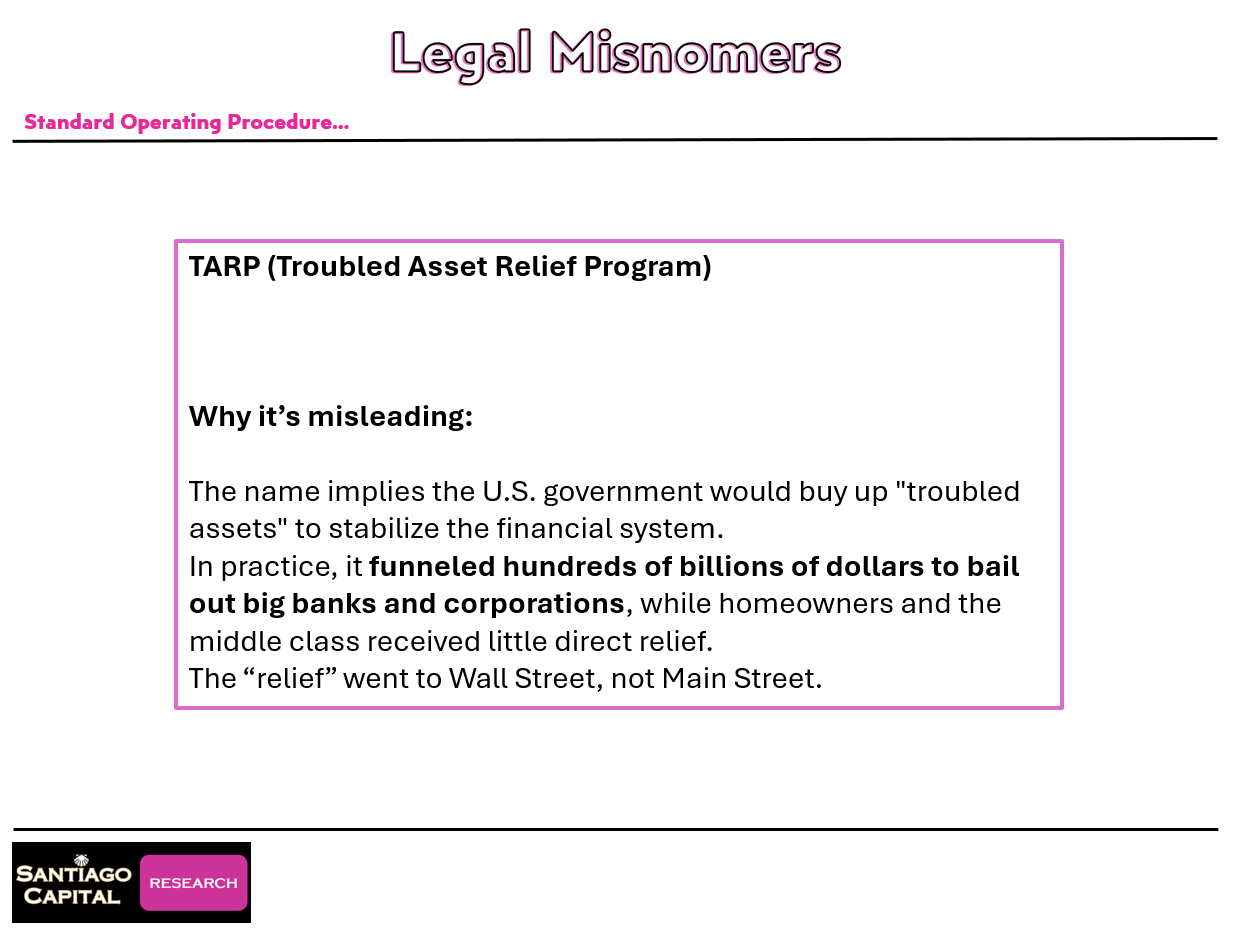

Programs like TARP (Troubled Asset Relief Program) weren’t about saving “troubled” assets…they were about saving the system that keeps the powerful in power.

This tension is playing out today.

Recent clashes between political leaders and the Fed highlight a growing battle over who controls the money supply.

If the state and the central bank are at odds, whose side are they really on? And what does that mean for the dollars in your bank account?

The Illusion of Freedom

Here’s a provocative thought: what if the freedom you feel when earning a paycheck or buying a new car is part of the design?

Money creates the illusion of choice…you work, you earn, you spend, you climb the ladder.

But at the end of the day, you’re paying taxes, feeding the system that keeps the state humming.

It’s like a farm where the animals think they’re free because they get to roam the field, but they’re still delivering milk, eggs, or meat to the farmer.

This isn’t to say you’re a prisoner. But are your “truly” free?

In many systems, you have real autonomy…more than in the feudal days when serfs toiled for scraps. But taxes, regulations, and monetary policies remind us that freedom comes with strings.

The state needs your productivity, and money is the tool that ensures you keep contributing. Is this cynical? Maybe.

But consider: why do we pay income taxes when the Fed can print trillions at will?

The answer lies in control…taxes aren’t just about revenue; they’re about keeping you in the system.

What would happen if you opted out? Could you ditch fiat currency for gold or crypto and live free of the state’s grip?

History suggests most people won’t try.

The majority prefer the security of a system, even a flawed one, over the chaos of a “Wild West” free market. But if the system starts to break, will that preference hold?

A Broken System…or a Perfect Machine?

From most peoples perspective, the financial system often feels broken.

Skyrocketing debt, inflation eating away at savings, and wealth inequality paint a grim picture.

But from the state’s perspective, this might be a feature, not a bug.

A system that keeps you working, spending, and paying taxes is a system that sustains power.

Central banks, by controlling the money supply, ensure the state’s survival, even if it means bailing out the guilty and leaving the prudent to fend for themselves.

Take the 2009 Financial Stability Act, sold as a way to prevent another crisis.

In reality, it entrenched “too big to fail” banks, consolidating power among the very institutions that caused the mess.

Or consider the USA Freedom Act, marketed as a curb on NSA spying, but which quietly legitimized mass surveillance.

These aren’t accidents…they’re examples of “newspeak,” where the name of a policy masks its true intent.

So, is the system broken, or is it working exactly as designed?

If money and power are intertwined, changing one means challenging the other.

Could a new form of money…like Bitcoin or a gold-backed currency…upend the status quo, or will the state always find a way to bend it to its will?

A Storm Brewing?

While we ponder the nature of money, the markets are sending their own signals.

Right now, they’re in a euphoric mood.

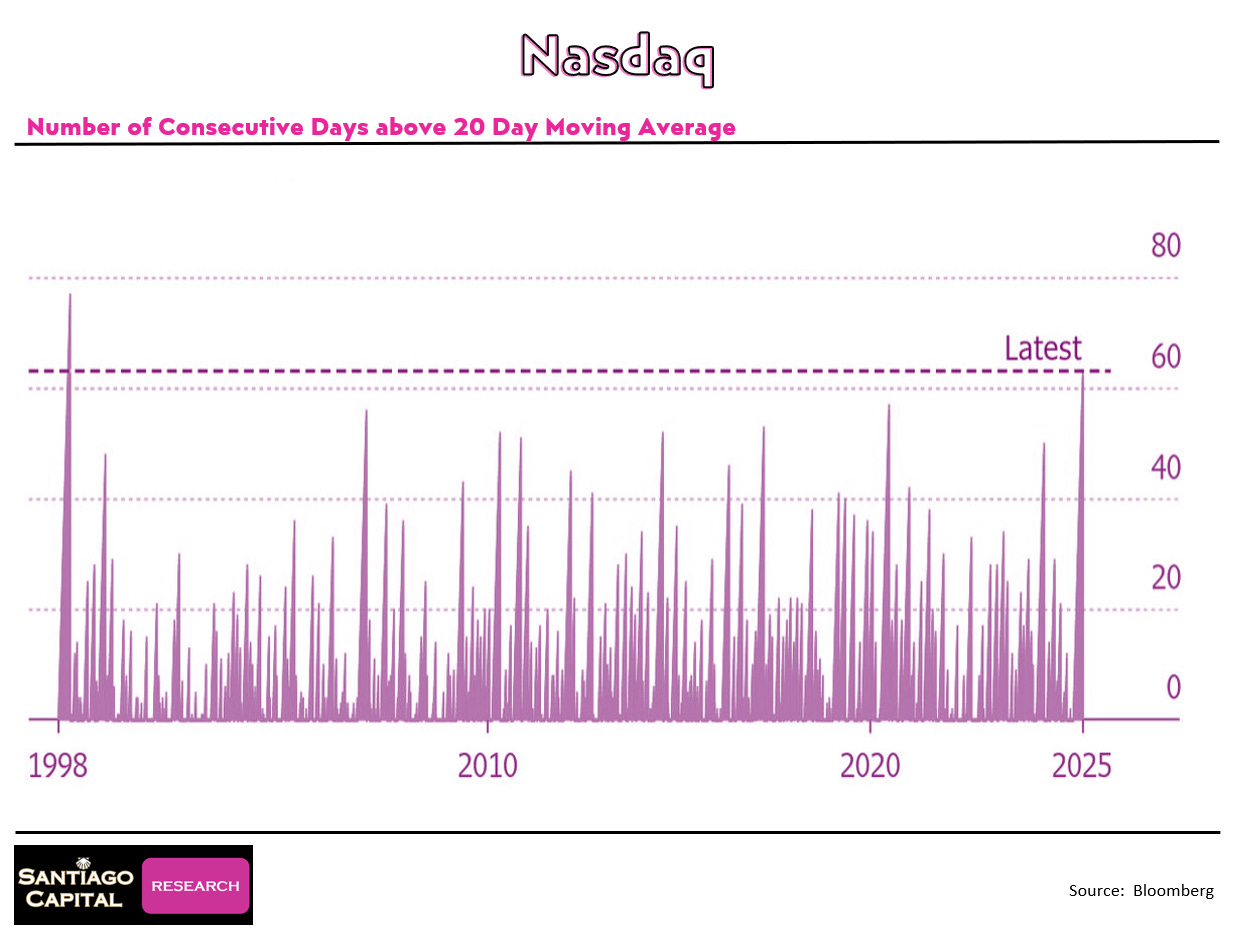

The NASDAQ is trading above its 20-day moving average for the longest stretch since the dot-com boom, and the S&P 500 is in overbought territory.

Volatility is at historic lows, with the VIX below 15, signaling zero fear among investors.

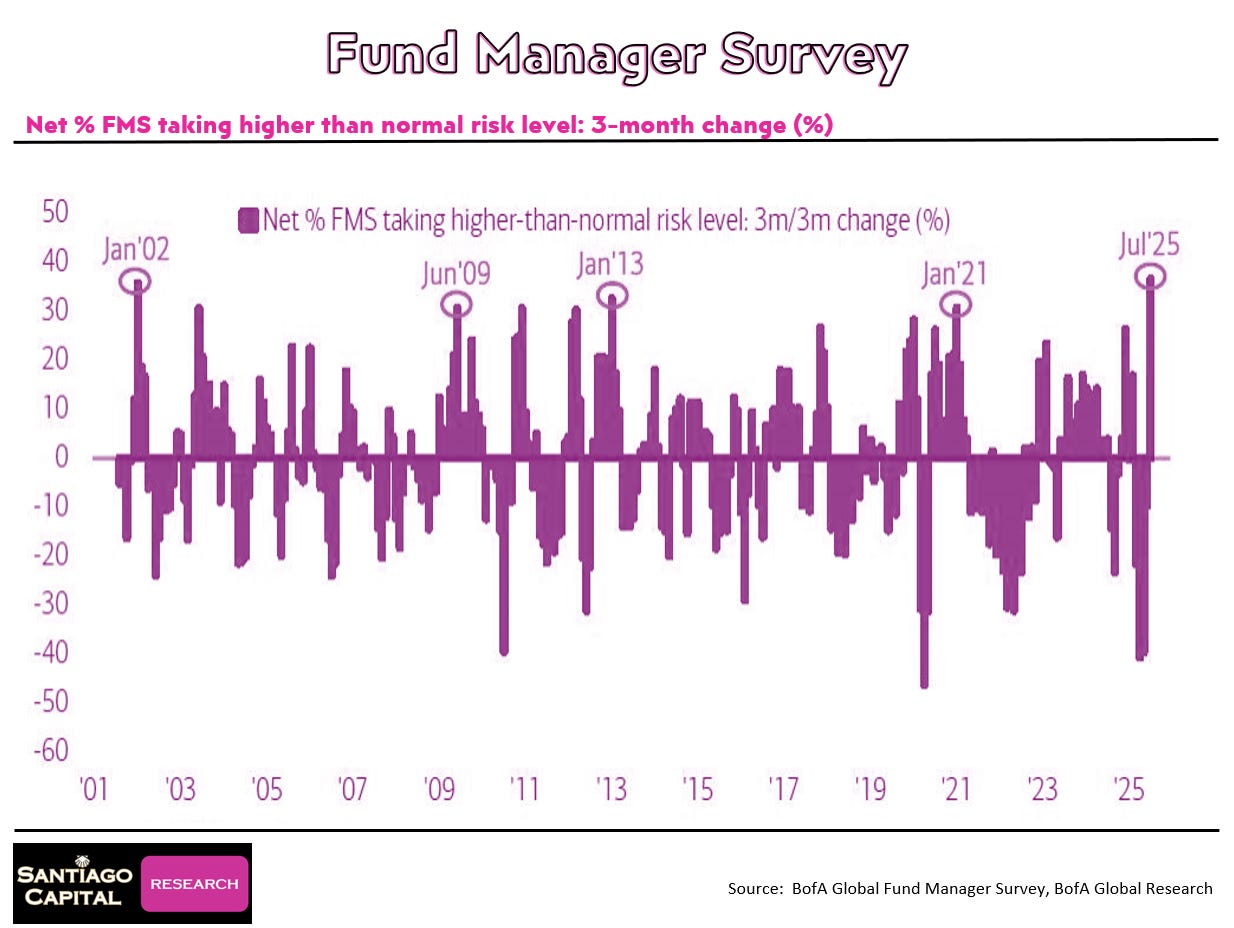

Fund managers are piling on risk, with exposure levels not seen in 25 years.

But here’s the catch: when everyone’s on one side of the boat, it doesn’t take much to tip it over.

Technical indicators like RSI and stochastics are flashing warning signs, suggesting a pullback could be imminent.

Gold, recently near all-time highs, has dipped, while silver’s overbought status hints at vulnerability. Even Bitcoin, soaring past $100,000, owes its rise to collective belief, not some inherent guarantee.

This setup isn’t a prediction of a 2008-style crash, but it’s a reminder: markets move on “common knowledge,” not just facts.

If enough people believe in gold, Bitcoin, or the stock market, prices climb…until they don’t. What could spark a reversal?

An unexpected event, a policy misstep, or simply a shift in sentiment could turn today’s euphoria into tomorrow’s panic.

Navigating the Matrix

So, where does this leave us? Money is more than a medium of exchange…it’s a battleground where power, control, and freedom collide.

Central banks, governments, and markets aren’t just managing currency; they’re shaping the rules of our lives.

Whether money is a free market commodity or a tool of the state depends on who’s holding the gun…and whether the rest of us go along.

The future is uncertain.

Will the current system hold, or will a new form of money rise?

Will central banks tighten their grip, or will decentralized currencies break their hold?

These questions aren’t just academic…they’ll determine how you save, invest, and live in the years ahead.

To stay ahead, you need more than surface-level headlines.

Our research service dives deep into these dynamics, offering insights you won’t find in mainstream reports. From market signals to the hidden mechanics of money and power, we provide the tools to navigate this complex world.

Click the button below to join our community of paid subscribers and unlock exclusive analysis that could safeguard your financial future.

Don’t just watch the matrix….understand it, and make it work for you.