The stock market has been on a tear, climbing relentlessly through the late spring and into summer of 2025.

Investors have ridden a wave of optimism, fueled by strong corporate earnings and a belief that the good times would keep rolling.

But in the final days of July, cracks appeared in the facade.

Markets stumbled, volatility spiked, and whispers of a long-overdue pullback grew louder.

Was this just a blip, or is something bigger brewing?

Let’s dive into the data, the drama, and the dynamics that could shape where Wall Street heads next.

A Market Stretched to Its Limits

For months, the stock market has defied gravity.

The S&P 500, Nasdaq, and Dow Jones Industrial Average powered through April, May, and June, shrugging off warnings of overvaluation.

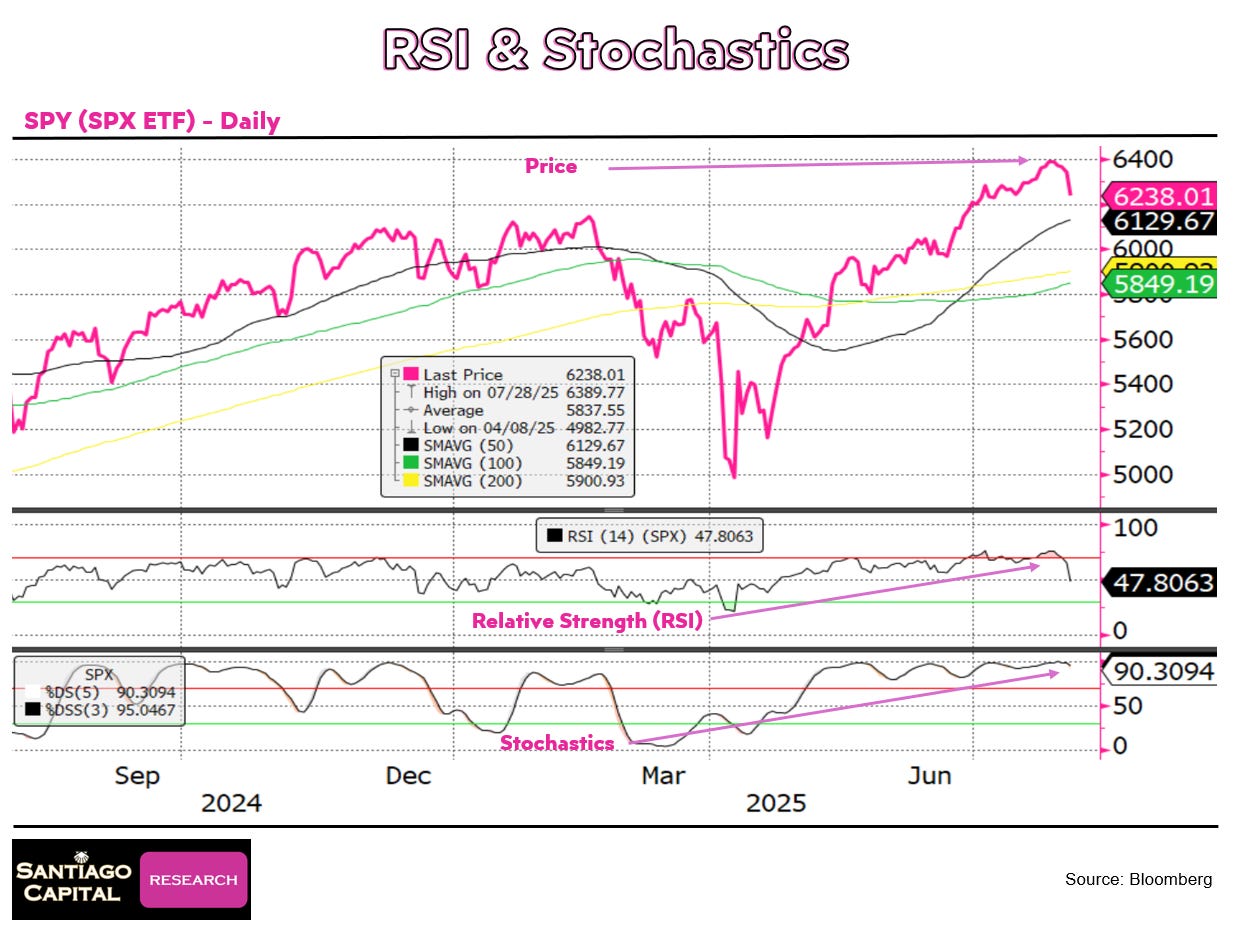

By mid-July, technical indicators were flashing red.

Relative Strength Index (RSI) and stochastics for major indices like the S&P 500 and Nasdaq hit extreme levels…97 or 98 on the stochastics scale, a rare signal of overbought conditions.

Sentiment was euphoric, with investors piling into stocks, particularly in tech and semiconductors, which drove the lion’s share of gains.

But markets don’t move in straight lines forever. By late July, the rally showed signs of exhaustion.

The S&P 500, which had been in overbought territory, rolled over in the final days of the month.

The Nasdaq, a tech-heavy index, followed suit, shedding gains after hitting all-time highs.

The Dow, while slightly more resilient, also closed July flat, erasing earlier monthly gains. What caused this sudden shift?

Could a handful of economic reports and political fireworks have derailed the bullish momentum?

The Fed’s Hawkish Surprise

The Federal Reserve’s July meeting was a pivotal moment.

Investors were hoping for signals of imminent rate cuts, especially as inflation appeared to be cooling.

Instead, Fed Chair Jerome Powell threw cold water on those expectations.

The Fed voted to keep rates steady at 4.25% to 4.5%, but the real shock came from within: for the first time in three decades, two FOMC members dissented, advocating for a rate cut.

This rare discord hinted at internal tensions, amplified by a public feud between Powell and President Donald Trump, who has been vocal about wanting lower rates to juice the economy.

Powell, wary of being labeled a pushover like his 1970s predecessor Arthur Burns, stood firm.

In his press conference, he emphasized that inflation wasn’t yet tamed and that rate cuts weren’t guaranteed for September.

His hawkish tone caught markets off guard, triggering a sell-off as traders recalibrated their expectations. But was Powell’s caution warranted, or is he risking a policy misstep?

The answer lies in the data that followed.

A Mixed Bag of Economic Signals

Thursday’s economic releases added fuel to the fire.

The Personal Consumption Expenditures (PCE) Price Index, the Fed’s preferred inflation gauge, came in flat month-over-month, but the year-over-year figure ticked slightly higher than expected.

Core PCE, which excludes volatile food and energy prices, also rose, signaling persistent inflationary pressures.

This bolstered Powell’s case for holding rates steady, but it spooked investors who had bet on a dovish pivot.

Then came Friday’s bombshell: the non-farm payrolls report. Economists expected a slowdown, but the numbers were dismal.

Job growth was far weaker than anticipated, and revisions to prior months were brutal.

June’s job count, initially reported at 147,000, was slashed to a mere 14,000…a staggering downward revision.

Hourly earnings, however, crept higher, hinting at wage-driven inflation.

The mixed signals left markets in a bind: weak job growth could push the Fed toward cuts, but rising wages suggested inflation wasn’t fully under control.

How would investors react to this tug-of-war between growth and inflation fears?

Trump’s Labor Department Drama

Adding to the chaos, President Trump made headlines by firing the head of the Bureau of Labor Statistics (BLS), accusing them of manipulating jobs data.

The move was controversial, to say the least.

On one hand, the massive revision to June’s jobs numbers raised legitimate questions about the BLS’s accuracy. A miss of that magnitude is rare and can erode trust in official statistics.

On the other hand, Trump’s intervention sparked concerns about political meddling in economic data…a dangerous precedent that could undermine confidence in future reports.

The firing sent shockwaves through markets, amplifying uncertainty. Investors began questioning whether other economic indicators could be skewed by political pressure.

Yet, the weak jobs data also fueled speculation that the Fed might soften its stance, as Powell had hinted that a deteriorating labor market could prompt action.

So, was Trump’s outburst a reckless overreach, or a justified response to bureaucratic incompetence? The truth likely lies in a gray area, but its impact on market sentiment was undeniable.

Tariffs: The Wild Card

If economic data and Fed drama weren’t enough, the specter of tariffs loomed large.

Trump’s trade policies, a hallmark of his administration, took center stage as new tariffs kicked in on August 1.

Earlier in 2025, markets had rallied on hopes that Trump’s tariff threats were mere posturing…a negotiating tactic dubbed “Taco Tuesday” by skeptics.

But those hopes were dashed as tariffs became reality, targeting major trading partners like China, Japan, and the EU.

Average tariff rates in the U.S. jumped from 2% to around 18%, according to the Yale Budget Lab, threatening higher goods prices and reduced consumer spending.

The tariff rollout coincided with the market’s late-July stumble, raising fears of a broader economic fallout.

Higher tariffs could stoke inflation, disrupt supply chains, and dampen corporate earnings…particularly for companies reliant on global trade.

Yet, some argue tariffs could bolster domestic manufacturing over time.

Will the short-term pain outweigh the long-term gain, or is the market overreacting to a policy that’s now a fact of life?

Volatility Wakes Up

As markets grappled with these headwinds, volatility roared back.

The VIX, Wall Street’s “fear gauge,” spiked on Thursday and Friday, posting its biggest moves since April. After months of eerie calm, the sudden jolt signaled a shift in investor psychology.

Gold, a traditional safe haven, rallied sharply on Friday after a week of declines, reflecting renewed uncertainty.

Silver followed a similar pattern, pulling back from its $40 test but rebounding late in the week.

Even the U.S. dollar, which had rallied post-Fed meeting, took a hit as Treasury yields fell, with the 10-year note dropping from 4.5% at the start of the year to 4.2%.

Semiconductors, a key driver of 2025’s rally, also faltered. The sector, which had been in overbought territory, saw sharp selling, mirroring the broader Nasdaq’s decline.

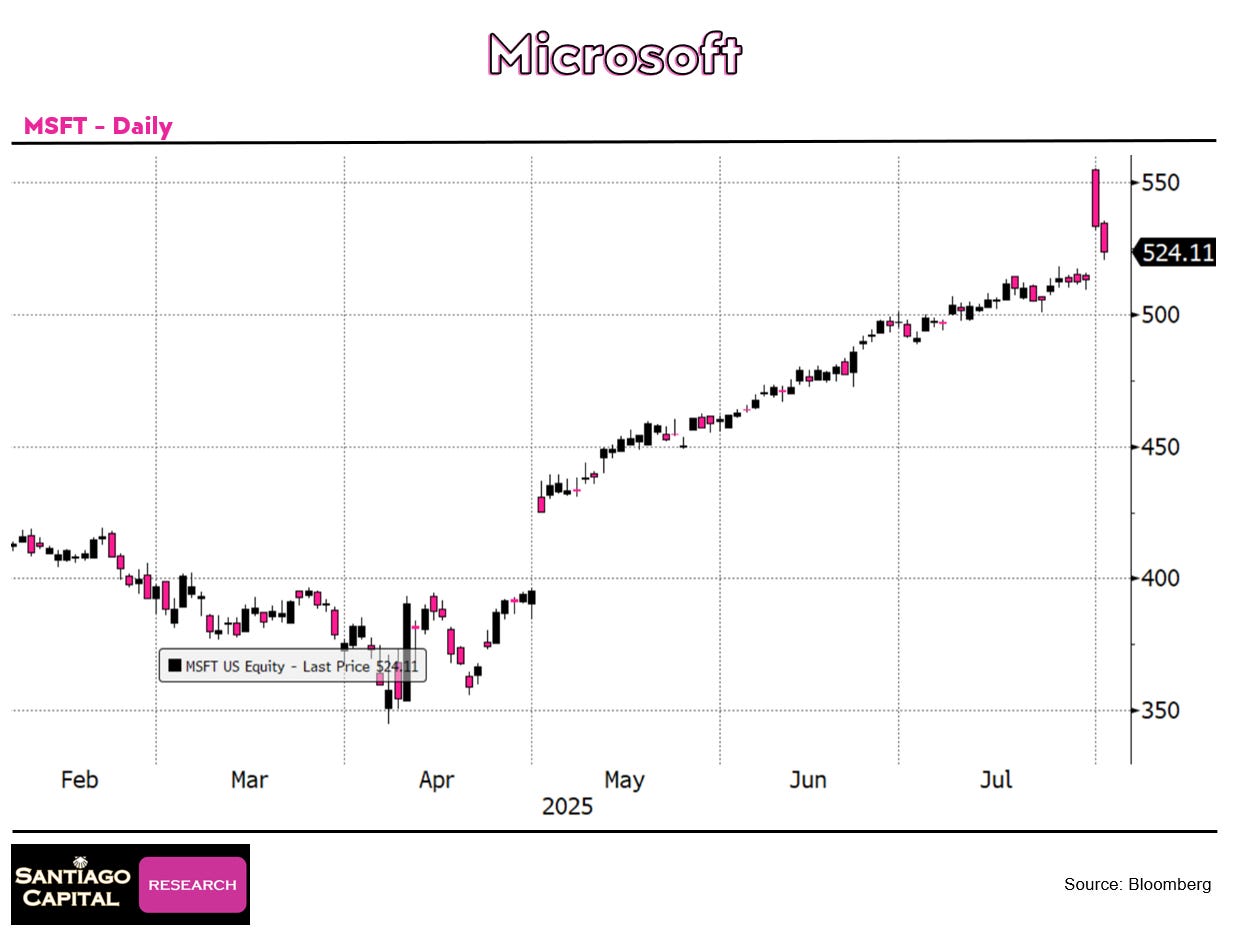

Tech giants like Microsoft, despite smashing earnings expectations, couldn’t sustain their post-earnings pop, with shares sliding by Friday’s close.

Was this the start of a broader tech correction, or just a healthy breather after a parabolic run?

Technical Warning Signs

From a technical perspective, the market’s late-July swoon wasn’t surprising.

The S&P 500 and Nasdaq had been trading at extreme overbought levels, with RSI and stochastics screaming caution. Candlestick charts revealed ominous patterns: massive gap-ups followed by swift reversals.

Microsoft’s chart, for instance, showed a relentless climb from May to July, only to gap higher post-earnings and then crater.

The semiconductor index mirrored this, breaking below key trendlines.

Even financials, like JPMorgan, saw sharp pullbacks after weeks of overbought conditions.

These technical breaks suggest the rally’s momentum is fading.

If the S&P 500 fails to reclaim its trendline soon, a deeper sell-off could materialize, potentially testing support at 4,500…a 15% drop from current levels, according to some analysts.

But could dip-buyers step in to save the day, as they have so often in 2025?

The Week Ahead: Make or Break

The coming weeks will be critical. Markets face a gauntlet of catalysts: ongoing tariff fallout, upcoming economic data like the consumer price index, and the Fed’s next moves.

If stocks can rebound quickly and hold above key trendlines, the rally might regain steam. But if selling pressure persists, a more significant correction could unfold, especially given the overstretched sentiment and positioning.

Investors aren’t defenseless, though. Hedges like gold, bonds, or equity-linked structured notes could cushion the blow.

But the bigger question looms: is this a temporary pause, or the start of a deeper unwind?

Navigating the Uncertainty

The market’s late-July stumble isn’t a death knell, but it’s a wake-up call.

The combination of a hawkish Fed, weak jobs data, Trump’s tariff push, and technical exhaustion has created a perfect storm of uncertainty.

Add in geopolitical noise…like Trump’s decision to move nuclear submarines closer to Russia…and the stage is set for more volatility.

Yet, opportunities abound in chaos. A pullback could reset valuations, offering buying opportunities for patient investors.

The key is discipline: avoiding panic selling, diversifying portfolios, and staying alert to policy shifts.

Will the bulls regain control, or are we on the cusp of a sharper correction?

Only time will tell, but one thing’s clear: the market’s relentless climb has hit a speed bump, and the road ahead looks bumpier than ever.

To stay ahead, you need more than surface-level headlines.

Our research service dives deep into these dynamics, offering insights you won’t find in mainstream reports. From market signals to the hidden mechanics of money and power, we provide the tools to navigate this complex world.

Click the button below to join our community of paid subscribers and unlock exclusive analysis that could safeguard your financial future.

Don’t just watch the matrix….understand it, and make it work for you.