In the dynamic world of financial markets, investors are constantly seeking strategies to achieve consistent returns while minimizing catastrophic losses.

Drawing inspiration from the metaphor of a magic trick, as depicted in the film The Prestige, this article explores the principles of successful investing, emphasizing the balance between capitalizing on long-term market growth and avoiding short-term drawdowns.

By synthesizing key insights, we outline a disciplined approach to wealth-building that prioritizes opportunity and risk management.

The Power of Compounding: The Bedrock of Wealth

Central to successful investing is the concept of compound interest, often described as the most powerful force in the world.

A simple comparison of single-year returns versus compounded returns illustrates how consistent growth, even at modest rates, can lead to exponential gains over time.

This upward trajectory, often visualized as a curve accelerating "up and to the right," is driven by three key factors:

Human Innovation: Technological advancements and productivity gains enhance asset values over time.

Population Growth: An expanding global population increases demand for assets, driving prices higher.

Fiat Currency Depreciation: The gradual erosion of fiat currency purchasing power incentivizes investment in appreciating assets.

To harness compounding, investors must actively participate in the market. Holding cash or low-yield instruments risks wealth erosion due to inflation.

However, participation alone is not enough; the real challenge lies in navigating the volatility that can disrupt long-term growth.

But compounding only works when it isn’t interrupted.

Just like a magician needs time and silence to build suspense before the final reveal, investors need uninterrupted momentum.

And the one force that can shatter that upward trajectory in an instant? A sharp drawdown. That’s where we turn next.

The Threat of Drawdowns: A Barrier to Compounding

While asset prices tend to rise over the long term, short-term drawdowns can severely disrupt the compounding process.

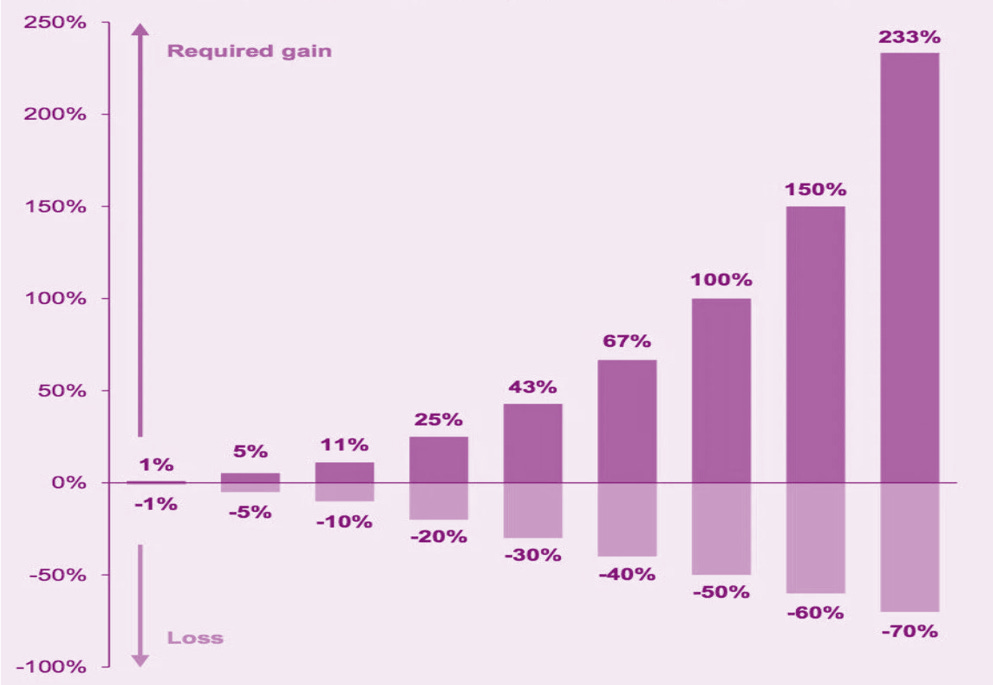

The mathematics of losses are stark: a 10% decline requires an 11% gain to recover, a 30% drop demands a 43% return, and a 60% loss necessitates a 150% rebound.

These figures highlight the disproportionate impact of drawdowns on a portfolio’s ability to compound effectively.

Such drawdowns often stem from the structure of the debt-based monetary system, where credit expansion fuels asset price growth but can lead to sharp, deflationary contractions when credit tightens.

Triggers like wars, natural disasters, pandemics, corporate earnings misses, or market panic can exacerbate these downturns, often amplified by systemic leverage.

Avoiding these drawdowns is the "magic trick" of investing, as it preserves capital and sustains the compounding trajectory.

The difference between a millionaire and a retiree starting over at 62 often comes down to one thing: how well they dodged the big ones.

These drawdowns aren’t random…they’re deeply connected to credit cycles, leverage, and human emotion.

And while you can’t predict the trigger, you can prepare. One famous portfolio has quietly done just that for half a century…

The Permanent Portfolio: A Model of Resilience

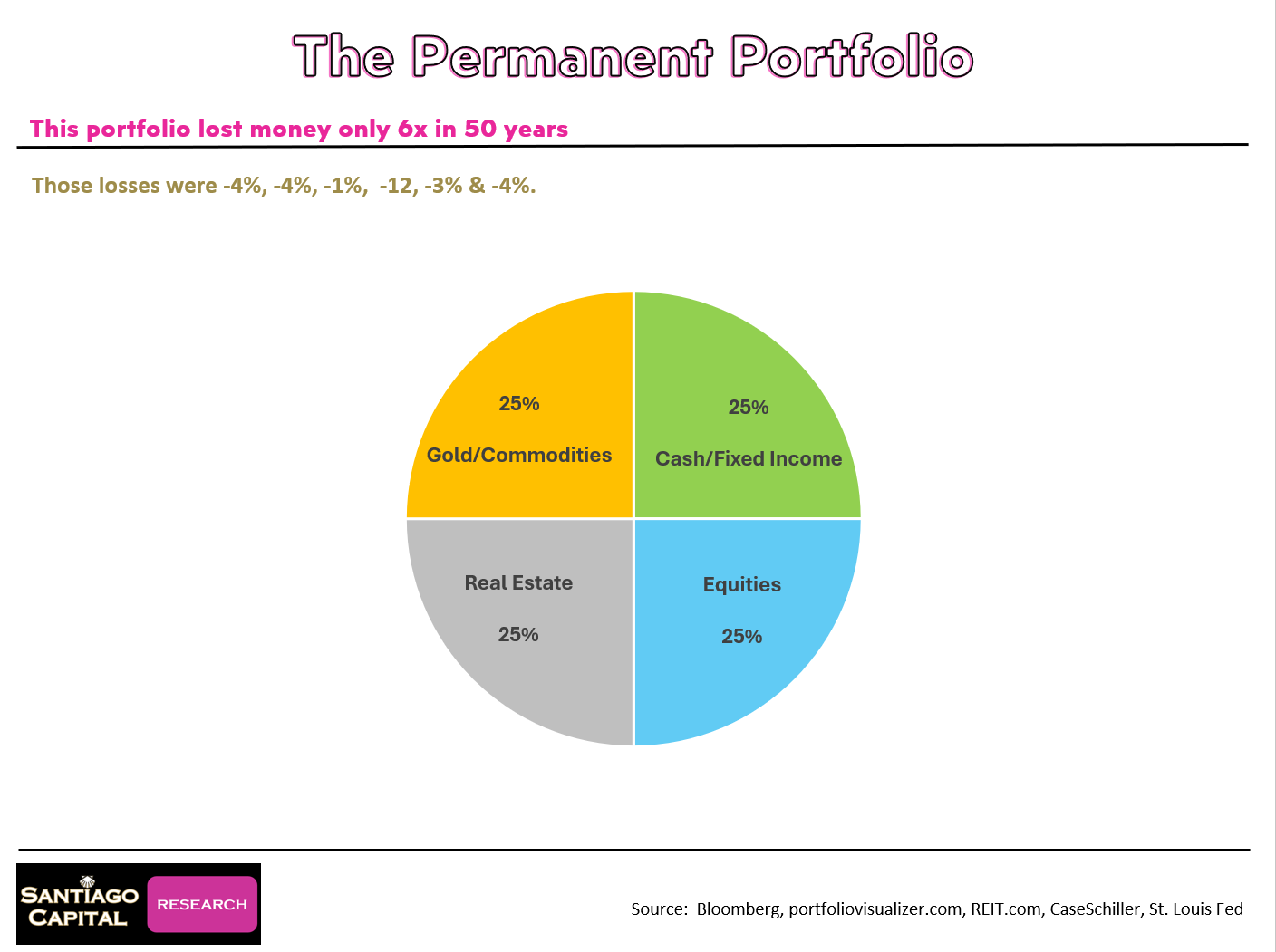

A practical example of minimizing drawdowns is the Permanent Portfolio, a diversified strategy allocating 25% each to cash or fixed income, equities, real estate, and gold or commodities.

Over a 50-year period, this portfolio achieved an average annual return of nearly 9%, with only six losing years, the worst being a 12% decline during the 2008 Global Financial Crisis.

Other losing years saw manageable declines of 1%, 3%, and 4%, allowing swift recoveries.

The Permanent Portfolio’s strength lies in its adaptability across economic cycles, performing well in inflationary and deflationary environments, as well as during booms and busts.

By diversifying across low-correlation asset classes, it cushions the impact of market shocks.

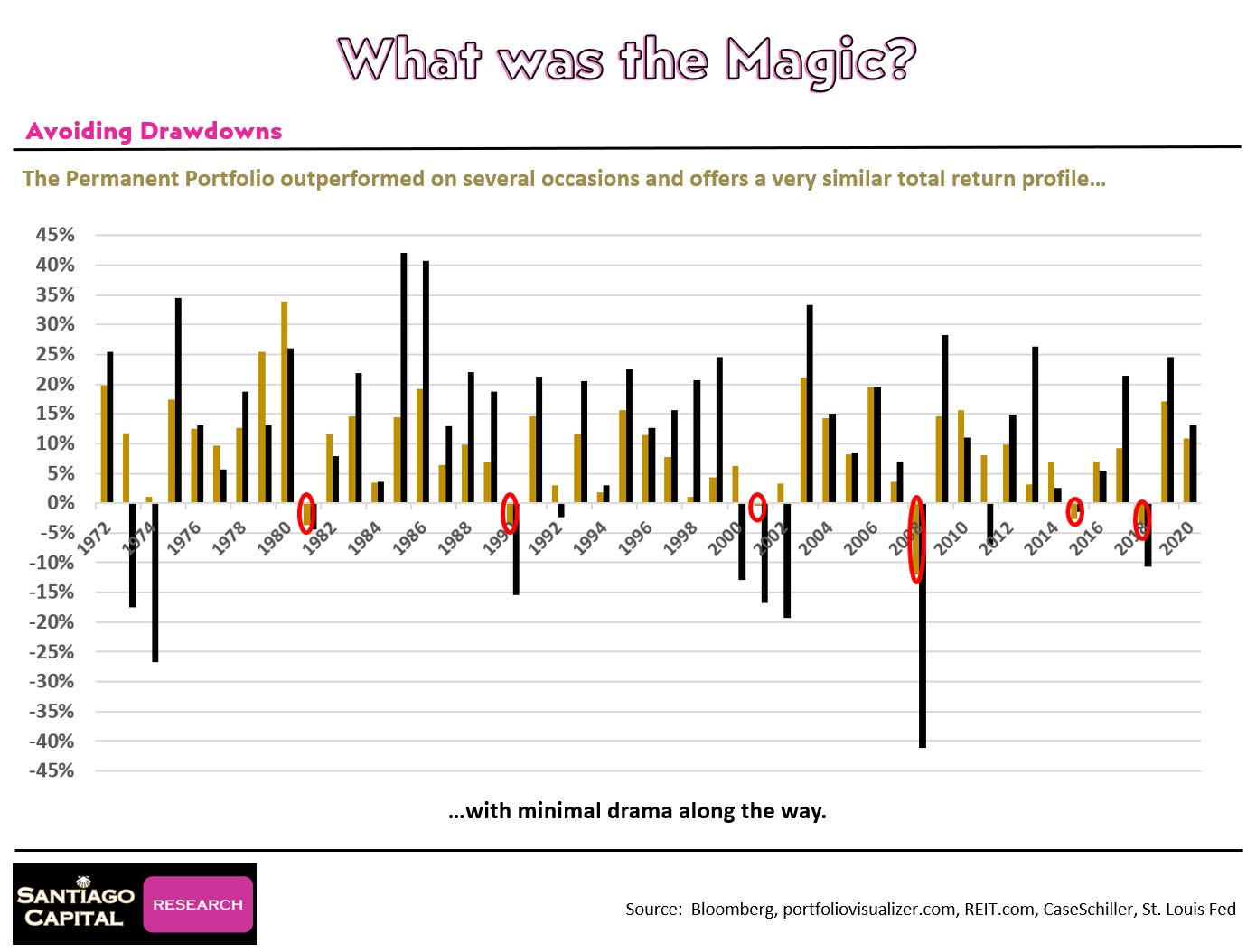

Some investors may consider this approach conservative, particularly those comfortable with higher volatility for potentially greater returns.

A comparison with a 60/40 equity portfolio (60% U.S. stocks, 40% international stocks) shows the latter achieved slightly higher returns, driven by the late 1990s dot-com boom.

However, it endured severe drawdowns of 25%, 35%, and 45% in certain years, creating a volatile experience.

The Permanent Portfolio, by contrast, offers stability, allowing investors to rest easy while still benefiting from long-term growth.

Its ability to sidestep significant drawdowns enables uninterrupted compounding, producing a curve that embodies exponential growth.

While Wall Street chased unicorns, the Permanent Portfolio just kept compounding.

It’s not sexy. It won’t win headlines. But it’s a strategy that avoided the traps that wrecked others…allowing for steady gains through chaos.

Still, even the best static allocation can fall short without active, informed risk management. That’s where the mosaic comes in.

Crafting a Risk-Management Mosaic

Achieving consistent returns requires more than diversification; it demands proactive risk management.

A suite of technical and sentiment-based tools, when combined into a "mosaic," provides clarity on market conditions and risks.

These tools include:

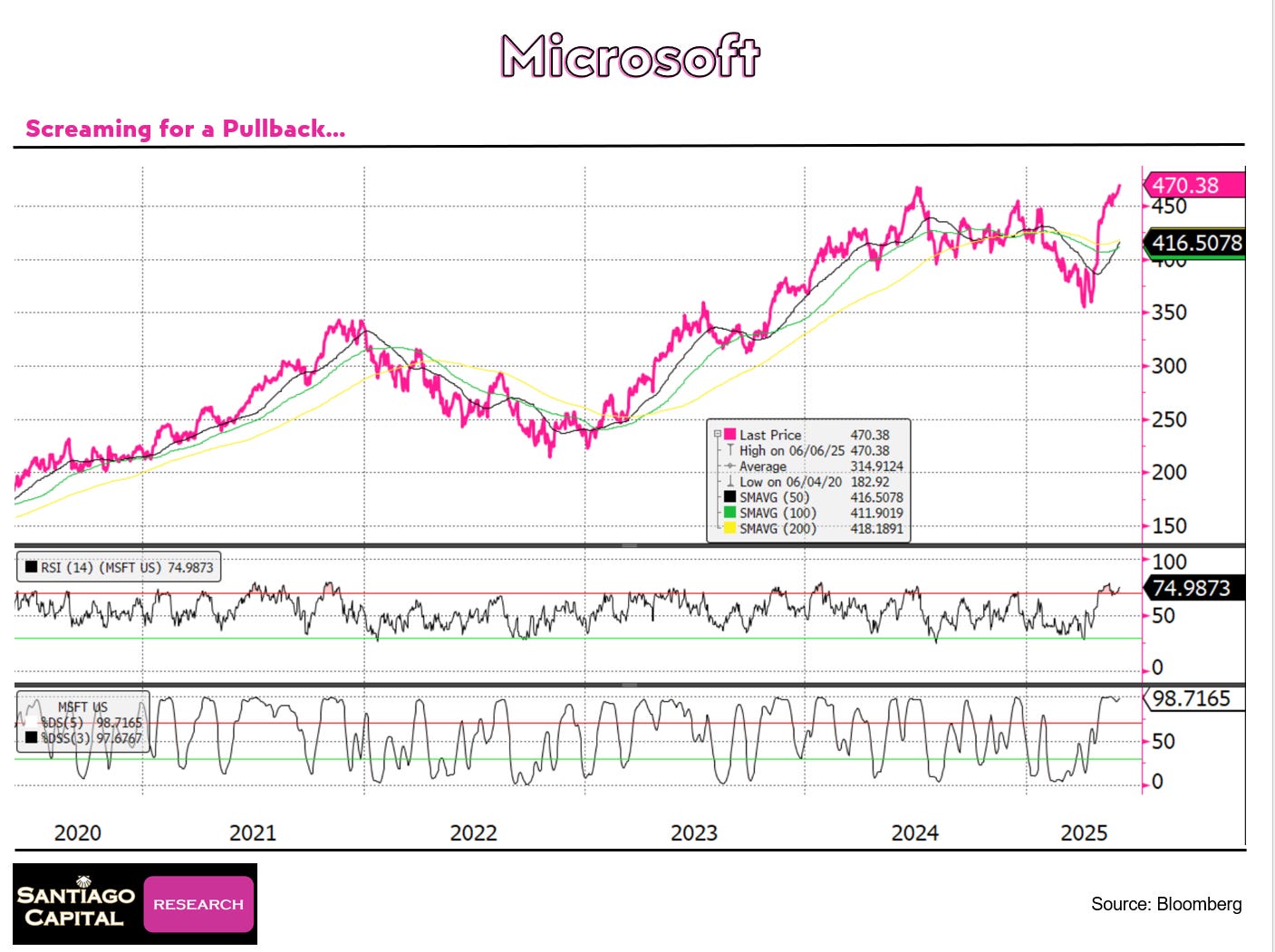

Relative Strength Index (RSI): Identifies overbought or oversold conditions by measuring momentum. For instance, the NASDAQ, Microsoft, and Taiwan Semiconductor are nearing overbought levels, signaling potential pullbacks.

Stochastics: Indicates when an asset’s price is at an extreme relative to its recent range. Stochastics for the NASDAQ, Microsoft, and Taiwan Semiconductor are at or near their peaks, suggesting reversals.

Sentiment Analysis: Measures market optimism or pessimism. Readings for the S&P 500, gold, and silver in the 80s (on a 0-100 scale) indicate over-enthusiasm and potential corrections.

Put/Call Ratio: Reflects the balance of bullish versus bearish options trading. A lower ratio suggests growing bullishness, which can precede corrections.

VIX (Volatility Index): The market’s "fear gauge" at 16, near yearly lows, indicates complacency and an opportunity to buy inexpensive hedges.

DeMark Analysis: A technical tool identifying market exhaustion and reversals. Over 20% of 200 tracked stocks, including the NASDAQ, Dow, Taiwan Semiconductor, Microsoft, and silver, currently show a "DeMark 13 sell" signal, a rare bearish indicator.

Individually, these tools are imperfect, but together, they form a powerful framework for anticipating market shifts and avoiding drawdowns.

One chart doesn’t tell the whole story…but ten of them might.

The key to front-running risk isn’t relying on any one signal. It’s knowing when the entire dashboard lights up red.

Right now, the indicators are flashing…and not just for tech stocks. Let’s walk through what that mosaic is telling us right now.

Strategic Application: Timing the Market

Current market conditions provide a case study in applying this mosaic. A roadmap anticipating a potential drawdown before year-end, informed by 2022’s market dynamics, is supported by several factors:

DeMark Signals: The rare occurrence of over 20% of tracked stocks, including major indices and stocks like Microsoft and Taiwan Semiconductor, registering DeMark 13 sell signals suggests broad market vulnerability.

Economic Catalysts: Upcoming economic data releases, including CPI, PPI, Michigan Sentiment, and inflation expectations, could trigger volatility. Corporate events like Oracle’s earnings, Apple’s Worldwide Developers Conference, Adobe’s earnings, and a 30-year Treasury bond auction may further influence markets, particularly the tech-heavy NASDAQ, which is on a DeMark 13 sell signal.

Sentiment and Positioning: A VIX at 16 signals low volatility and affordable hedges, while a declining put/call ratio reflects bullish positioning. Sentiment readings in the 80s for equities, gold, and silver suggest overstretched markets.

Technical Indicators: Overbought RSI and stochastics for the NASDAQ, Microsoft, and Taiwan Semiconductor reinforce the likelihood of a pullback.

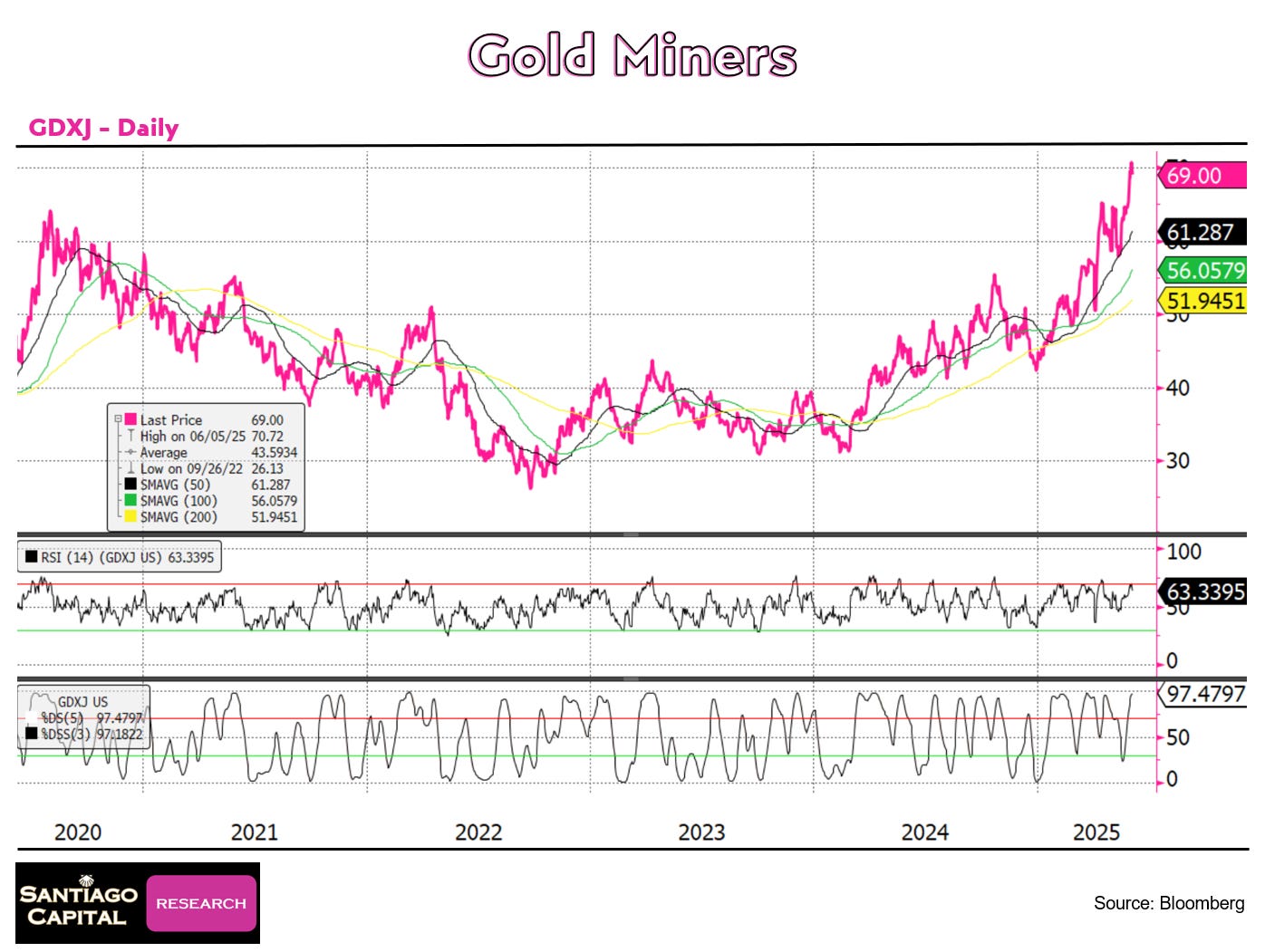

In response, strategic hedges, such as put options on Microsoft, gold miners (GDX and GDXJ), and other assets, are deployed to protect against declines.

These hedges leverage options’ inherent leverage to capitalize on rapid market moves, with profits taken quickly to secure capital and let gains run.

You don’t need a crystal ball…you need a framework.

When Microsoft, Taiwan Semi, and the NASDAQ all flash a DeMark 13 sell signal at the same time, something big is potentially brewing.

Add in overbought RSI, frothy sentiment, and a complacent VIX? The stage is set. Here’s how smart investors are protecting themselves…while still staying in the game.

Hedging Gold: A Tactical Approach

A notable strategy involves hedging gold exposure.

While holding significant gold positions, put options on gold miners (up 35-40% year-to-date) are used to protect gains.

High sentiment (86 for silver, low 80s for gold) and overbought conditions in gold miners, coupled with their higher volatility, make them an effective hedge.

A 10-20% pullback in gold miners, consistent with historical patterns, would protect the broader gold position without requiring its sale.

You don’t sell your winners…you insure them.

Gold is up big. So are the miners.

But if history is any guide, the next move could be a painful pullback.

That’s why seasoned investors aren’t dumping their holdings…they’re hedging them.

And gold isn’t the only sector that needs defense right now.

The Philosophy of Risk Management: Avoiding Disaster

Investing, like a magic trick, is fraught with risks, where a single misstep can lead to significant losses.

Drawing from The Prestige, where a mistake sparks cascading consequences, the importance of avoiding errors is clear.

Diversification, technical and sentiment indicators, and strategic hedges tilt the odds in favor of success.

The focus is not on predicting crashes but preparing for plausible scenarios.

An asset-heavy portfolio ensures participation in market upswings, but drawdown avoidance…especially for older investors or those nearing retirement…ensures resilience.

Earlier success in 2025, profiting from a downturn and outperforming indices without fully chasing the rally, demonstrates the efficacy of this approach.

The best investors aren’t always the boldest. They’re the ones still standing.

In the end, managing risk isn’t about being scared…it’s about being smart.

The magic lies in surviving long enough to see the full power of compounding unfold.

And in a market this hot, knowing when to hedge could be the ultimate trick.

The Prestige of Financial Success

In investing, the prestige is long-term wealth achieved through disciplined risk management and compounding.

By embracing diversification, leveraging a mosaic of indicators, and deploying strategic hedges, investors can navigate volatility with confidence.

As markets face economic data, corporate earnings, and technical signals, the true magic lies in preserving capital through proactive risk management, positioning investors to stand on the stage of financial success, ready to accept their prestige.

In the final act of a magic show, the audience gasps…not because they didn’t see it coming, but because they couldn’t believe it worked.

That’s what successful investing feels like: slow, steady risk management that suddenly looks like genius when the dust settles.

The prestige isn’t the trade that tripled…it’s the portfolio that didn’t blow up.

If you want more strategies like this…real-time insights, hedge playbooks, sentiment dashboards, and technical triggers…join the thousands of like-minded investors on the Santiago Capital Research substack.

We don’t chase hype. We break it down, flag the risks, and help you build wealth without losing sleep.

Subscribe to Santiago Capital Research to stay ahead of the next big move.