In a week where stock markets lurched and political debates raged, the concept of "gaps"…both literal and metaphorical…dominated financial discourse.

The Gap Inc., a retail giant, saw its stock plummet 20% overnight after a disappointing earnings report, a stark reminder of the unpredictable chasms that can open in the market.

This event, coupled with a surprising judicial ruling against proposed tariffs, has left investors and analysts grappling with uncertainty.

Why do these gaps matter, and what do they reveal about the state of our markets and governance?

Let’s dive into the chaos and clarity of this week’s financial landscape.

The Gap That Shook the Market

This week, The Gap Inc. became the poster child for market volatility when its stock gapped down 20% overnight following a lackluster earnings release.

The irony wasn’t lost on analysts: a company named "Gap" experiencing a textbook gap in its stock price.

This sudden drop, triggered by disappointing financials, underscored a broader truth about today’s markets…gaps, or sudden price movements, are becoming a hallmark of an environment where headlines can shift fortunes overnight.

The Gap’s plunge wasn’t an isolated incident.

Just weeks ago, Nike’s stock fell 10% overnight after its own earnings miss, compounded by trade-related concerns.

Hewlett Packard followed suit, with a 20% drop post-earnings.

These events highlight a market where rapid, and unexpected shifts are increasingly common.

But what causes these gaps, and how can investors navigate them?

The answer lies in understanding the interplay of market dynamics, policy decisions, and human psychology.

As we explore these market gaps, a larger question looms: how does a recent judicial ruling against tariffs fit into this volatile picture, and what does it mean for the balance of power in America?

Judicial Pushback: A Check on Executive Power

On Wednesday night, as Nvidia’s earnings sent futures soaring, a lesser-known but equally significant event unfolded.

The U.S. Court of International Trade ruled against tariffs proposed by the Trump administration, declaring that the executive branch overstepped its authority.

This decision sparked polarized reactions: supporters of the administration decried it as judicial overreach, while opponents celebrated it as a necessary check on power.

Stephen Miller, a key figure in the Trump administration, called it “judicial tyranny,” but the reality is more nuanced.

The ruling exemplifies the separation of powers at work.

The court’s decision, now subject to appeal, demonstrates that no single branch of government holds absolute control.

This push-and-pull, where the judiciary checks the executive, is precisely what the Founding Fathers intended when they designed the U.S. government.

They didn’t aim for harmony but for competition, ensuring that ambition in one branch would be countered by the others.

As we previously wrote, “The Founding Fathers did not attempt to create angels; they created a battlefield. They understood that power naturally seeks to expand, so instead of suppressing it, they ensured it would always have a competitor.”

This week’s ruling is a testament to the Republic’s resilience.

Tyranny, by definition, would mean a final, unappealable decision.

Instead, the ability to appeal and the subsequent overturning of the ruling by another court show a system functioning as designed.

But how does this judicial drama connect to the market’s wild swings?

If the courts are checking executive power, what does this mean for policies like tariffs that directly impact markets? And how do investors prepare for the gaps these policies can create?

The Market’s Wild Ride: Gaps Beyond Stocks

The Gap’s 20% drop is just one example of the gaps plaguing markets. Currencies, too, are not immune.

The Turkish Lira, for instance, has been steadily losing value but experienced sudden, dramatic gaps overnight.

Even the Taiwan Dollar, considered more stable, strengthened 10% against the U.S. dollar in just two days…an extraordinary move for any currency.

Commodities like copper also saw a 20% drop over a few days last month, catching investors off guard.

These gaps aren’t just numbers on a chart; they reflect a market environment where rapid shifts are driven by policy announcements, geopolitical tensions, and unexpected earnings.

The current U.S. administration’s penchant for headline-grabbing statements…often via social media…amplifies this volatility.

As one market commentator put it, “You go to bed one night, and by morning, the world could be different. Investors need to be ready for the unthinkable.”

This unpredictability demands a strategy of preparedness.

Rather than going “all in” on a single asset, seasoned investors maintain hedges…cash reserves, T-bills, equity puts, or tail-risk strategies…to cushion against sudden drops.

The lesson is clear: in a market where gaps can appear out of nowhere, the key is to “mind the gap” by anticipating what could go wrong.

If markets are this volatile, how do historical examples of misplaced certainty…such as the natural gas frenzy of 2022…inform today’s strategies?

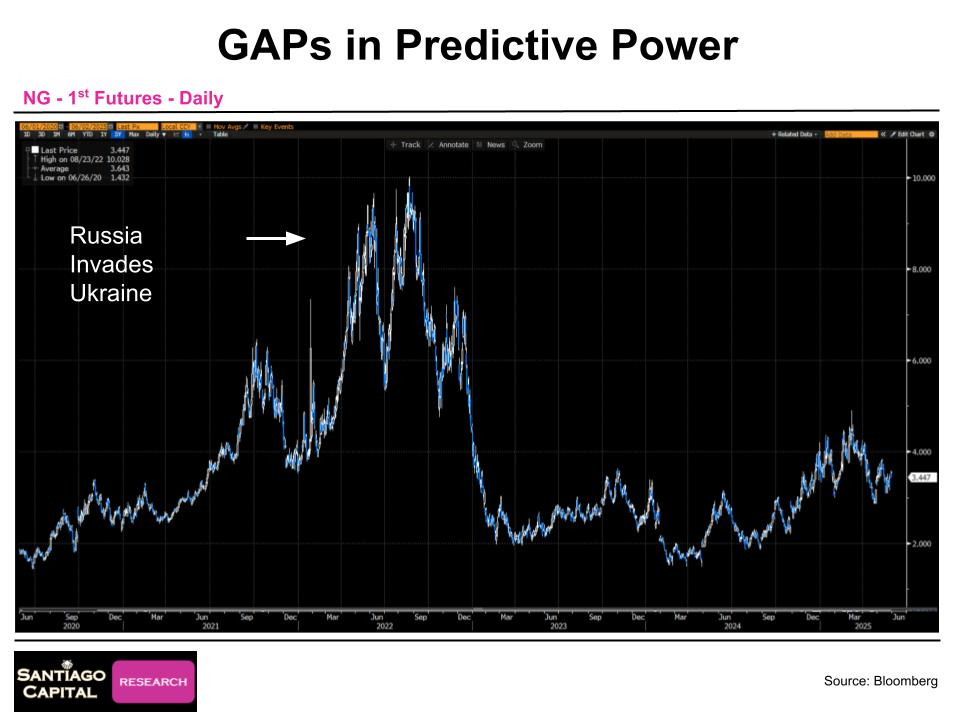

The Natural Gas Fiasco

Three years ago, when Russia invaded Ukraine, the consensus was unanimous: energy prices would skyrocket.

Natural gas was predicted to hit $25, and oil was expected to soar to $200.

The logic seemed airtight…sanctions on Russia would choke supply, driving prices to the moon. Yet, the opposite happened.

Natural gas prices collapsed, and oil, despite a brief spike, fell significantly.

By June 2025, oil is trading at $60, down more than 30% from the $95 level where the Biden administration sold from the Strategic Petroleum Reserve (SPR) in 2022.

The SPR decision, heavily criticized at the time, proved prescient.

Critics argued it would deplete reserves and send oil prices soaring, but the data tells a different story.

The move put downward pressure on prices, stabilizing the economy during a turbulent period.

This wasn’t a stroke of genius but a calculated use of a tool designed for such crises.

The natural gas and oil saga underscores a critical point: even the most confident predictions can fail.

Investors who loaded up on energy in 2022 without hedges or diversification were “massacred” as prices tanked. The lesson?

Conviction can be helpful. Certainty is a trap.

By maintaining an open mind and preparing for unexpected outcomes, investors can avoid the pitfalls of overconfidence.

How do these gaps in knowledge and prediction shape expectations for the rest of 2025, and what specific market gaps should investors watch?

Gaps to Watch in 2025

As we move into June 2025, some analysts are eyeing potential market gaps, particularly in major indices like the S&P 500 and NASDAQ.

Technical analysis suggests that recent gaps…price jumps where a stock or index opens significantly higher or lower than its previous close…often “fill” over time.

For instance, the S&P 500 has two notable gaps: one 5% below current levels and another 10-15% lower.

The NASDAQ exhibits similar gaps, suggesting a potential pullback in the near future.

Historical data supports the frequency of gap-filling, though it’s not a guaranteed outcome.

We believe that the S&P 500’s first gap may close in June, followed by a potential bounce and then deeper correction in the third quarter.

This forecast aligns with expectations that 2025 could mirror the market dynamics of 2022, when the S&P 500 declined 30% from January to September but experienced several significant rallies during that period.

As we have noted since last fall, 2025 might follow a similar trajectory to 2022.

That year saw large rallies, including one in the summer, before rolling over into Q3.

However, the rallies in 2022 were not as pronounced as the significant recovery seen in 2025 so far.

In my view investors may be overly bullish in the short term while being too bearish on the long-term outlook.

We anticipate increased volatility driven by new policies under the Trump administration, alongside heightened geopolitical tensions involving the United States, China, Russia, and Ukraine, which could lead to further downside in 2025.

Despite the potential for near-term challenges, we remain cautiously optimistic about the longer-term outlook, suggesting that navigating the current volatility could pave the way for opportunities later.

The substantial sell-off in March and April was a bit too excessive in too short of time period. But that’s what markets often wo when gaps in “certainty” of outcome show up.

This sell-off led to an overshoot to the downside, with technical indicators such as relative strength and stochastics reflecting extreme weakness.

A subsequent recovery pushed these indicators into overbought territory, with stochastics reaching levels as high as 99.

As such, we believe markets have now returned to being excessively complacent as we believe those same investors have some gaps in their understanding of the volatility that is still likely to come.

Recently, the market has shown signs of rolling over, prompting speculation that the adage “Sell in May and go away” might hold true this year.

Investors will need to watch closely as the year unfolds to see if these predictions materialize.

Markets, much like the Republic, thrive on checks and balances, but what happens when national priorities shift the ground beneath them?

As policies increasingly prioritize borders over balance sheets, the gaps in markets may widen further…driven by forces that defy economic logic.

To understand how this clash between national interest and global markets could reshape the financial landscape, explore our in-depth analysis in Borders Before Balance Sheets - When National Interest Overtakes Economic Interest.

Who will be the first to feel the impact of this new order?