U.S. - China Enmeshment

Implications of an Accelerated Decoupling

Executive Summary

Two countries. Two systems. One entanglement so complete that any attempt to pull the threads apart now threatens to unmake the fabric itself.

It started with a promise: open markets, cheap goods, mutual gain. What followed was something far more complex. Factories crossed borders. Capital changed flags.

Strategic industries rewired themselves across oceans. And for years, the model worked—until it didn’t.

What happens when dependence begins to feel like exposure?

Trade volumes remain immense. Financial flows continue uninterrupted. But the seams are showing.

Policies once aimed at cooperation now serve as bulwarks.

Sectors once considered safe are suddenly labeled critical. Supply chains built for efficiency are now treated as liabilities.

Resilience has become a euphemism.

Decoupling, a mandate. And still, the flows persist.

What do you do when the very systems that powered global prosperity now pose national risk?

The tariffs were a warning. So were the restrictions. And the countermeasures. And the rhetoric.

But none of those measures halted the machine—they only revealed how hard it is to stop.

Manufacturing ties. Strategic commodities. Rare earths. Chips. Pharmaceuticals. Energy. Each thread is tangled with another. Each move has its mirror.

Even finance, long the quiet enabler of integration, is no longer neutral. Treasury portfolios are scrutinized. Capital raises are political events. Cross-border listings carry invisible flags. Liquidity may be global, but allegiance is not.

And underneath it all, the digital frontier continues to harden. Technology that once moved freely is now met with controls, conditions, and classification.

Collaboration is giving way to containment. Semiconductors. AI. Quantum. The pipes are still connected, but the water is being filtered.

Meanwhile, a second front opens—geopolitical, rhetorical, and real.

Alliances strain under economic contradiction. Nations caught between systems recalibrate their strategies. Some hedge. Some posture. Some quietly prepare for a future no one will admit publicly but everyone can now imagine.

We've written about this before—about the dependencies, the warning signs, the quiet fractures. But this report isn’t a summary. This is where all of those signals begin to converge.

What follows isn’t escalation.

At this point, it’s just inertia.

Background

Since China’s accession to the World Trade Organization (WTO) in 2001, the economic relationship between the United States and China has grown exponentially, shaping not just bilateral trade but the global economy.

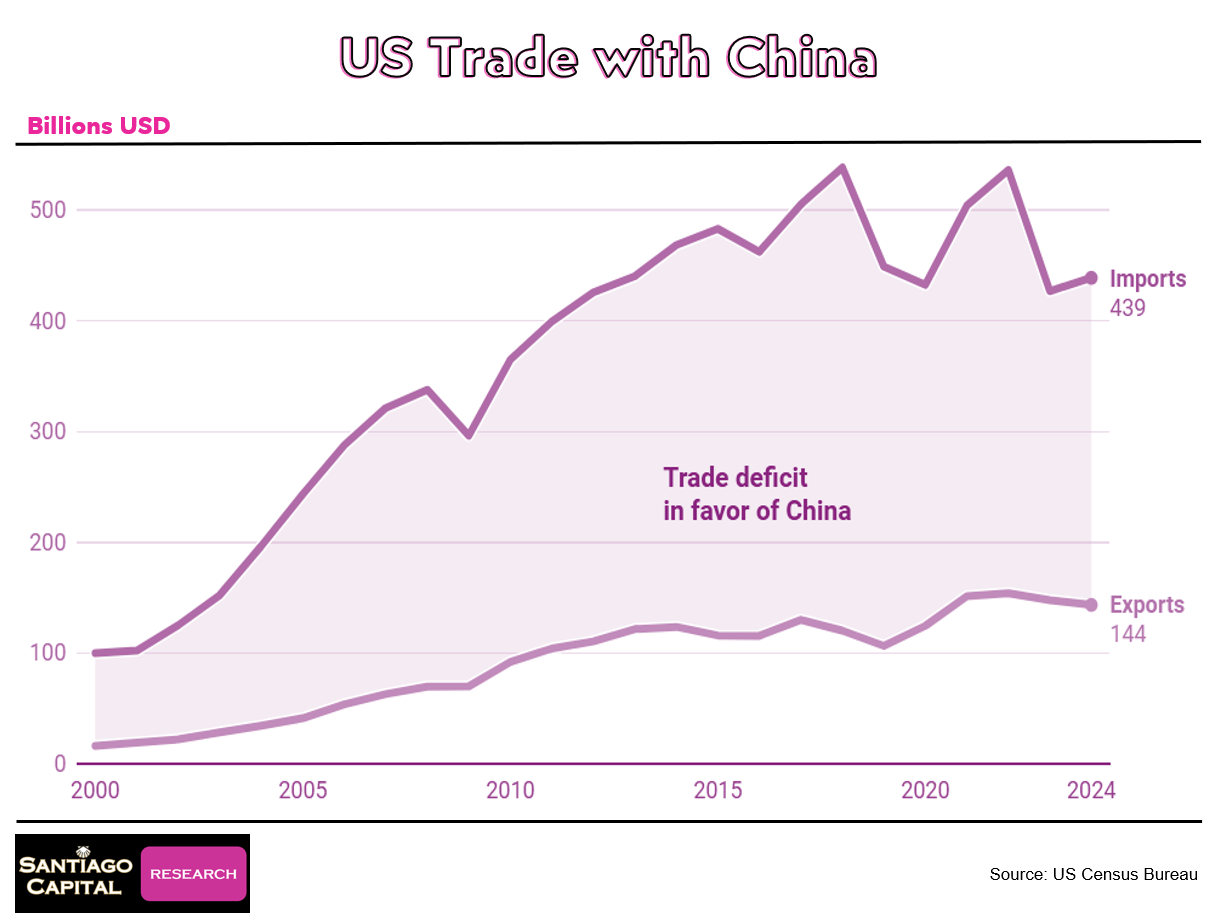

U.S.-China bilateral trade expanded from approximately $100 billion in 2001 to over $700 billion in 2025, with U.S. imports dominated by electronics, machinery, textiles, and toys, while exports include soybeans, aircraft, and semiconductors.

The trade deficit with China underscores the scale of this integration.

U.S. firms have deeply embedded themselves into Chinese supply chains, particularly in high-value sectors such as technology, automotive, and pharmaceuticals.

Apple, for instance, relies heavily on China’s manufacturing capabilities, while Walmart sources vast quantities of consumer goods from Chinese suppliers.

Even amid the imposition of tariffs and retaliatory measures during the trade war, bilateral trade volumes have remained historically high, demonstrating the deep resilience of economic ties despite rising political antagonism.

The fact that the relationship continues to function at a high level, even as national security rhetoric escalates, underscores the sheer weight of two decades of economic interdependence.

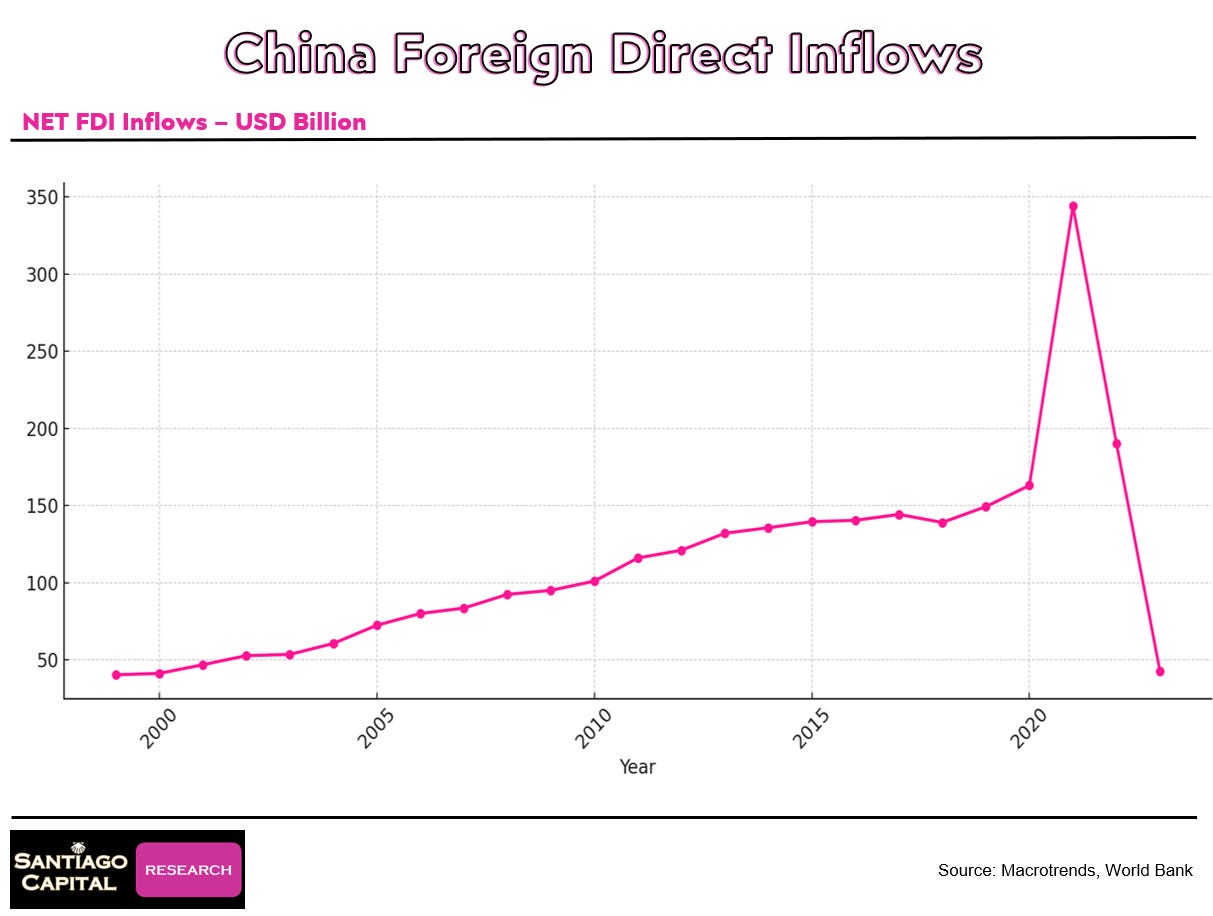

Chinese investments in U.S. real estate, technology startups, and energy have complemented U.S. FDI in China, which has grown from $6 billion in 2001 to around $120 billion by 2023, although geopolitical tensions and regulatory changes have since reversed investment flows.

Foreign direct investment into China is now negative—flowing out rather than in.

Financial interdependence has expanded alongside trade. China’s holdings of U.S. Treasury securities, peaking at over $1.3 trillion in 2013 and standing at $784 billion in 2025, have long supported U.S. fiscal stability while providing China with a safe asset base.

U.S. financial institutions and investors hold substantial stakes in Chinese firms. Over 200 Chinese companies have raised more than $100 billion through U.S. capital markets, creating a financial mesh that has yet to be meaningfully unwound.

U.S. financial institutions are increasingly active in China, reflecting gradual market liberalization.

However, tightening regulations, such as U.S. delisting threats and China’s domestic capital controls, have been compounded by increasing geopolitical tensions between the two.

The trade war has highlighted how deeply integrated supply chains are, with disruptions affecting industries and consumers on both sides.

Tariffs on Chinese goods have led to higher prices for U.S. consumers, inflationary pressures, and greater uncertainty for businesses.

Sectors such as technology and automotive have been particularly affected, with companies like Apple and Tesla facing supply chain disruptions and elevated costs.

Reshoring—or moving manufacturing back to the United States—is both time-consuming and expensive.

The pandemic underscored these risks, revealing that critical industries like pharmaceuticals, rare earth elements, and electronics depend heavily on Chinese production.

For President Trump, dependence on certain sectors has been framed as a strategic vulnerability he is determined to address.

However, U.S. efforts to shift supply chains or increase domestic production capacity remain complex, slow-moving, and costly—reflecting the depth of integration that has developed over the past two decades.

The technological dimension of U.S.-China enmeshment is now seeing deep and rising tensions.

China’s “Made in China 2025” strategy and U.S. policies such as the CHIPS Act highlight an escalating competition for technological dominance.

The case of TikTok exemplifies the complexities of digital interdependence, with concerns over data security juxtaposed against its popularity among U.S. consumers.

Winning the tech war in quantum computing, space exploration, and advanced robotics is the key aim of both nations, with a “winner take all” mentality on both sides.

Economic decoupling is only a part of a much larger agenda, and the U.S. is effectively weaponizing its economy and financial architecture to make life as difficult as possible for China in achieving technological superiority. America is hell-bent on thwarting such Chinese aspirations.

Moreover, U.S. financial markets remain broadly unprepared for the implications of a sharp realignment in trade and capital flows. After a hard selloff in April, markets have largely returned to their all-time highs.

But the inevitable disruption of financial ties—layered over physical supply chain breaks—could have cascading impacts on global liquidity, asset pricing, and risk transmission that remain underappreciated by investors.

Sociocultural ties are also in the cross hairs of the Trump Administration.

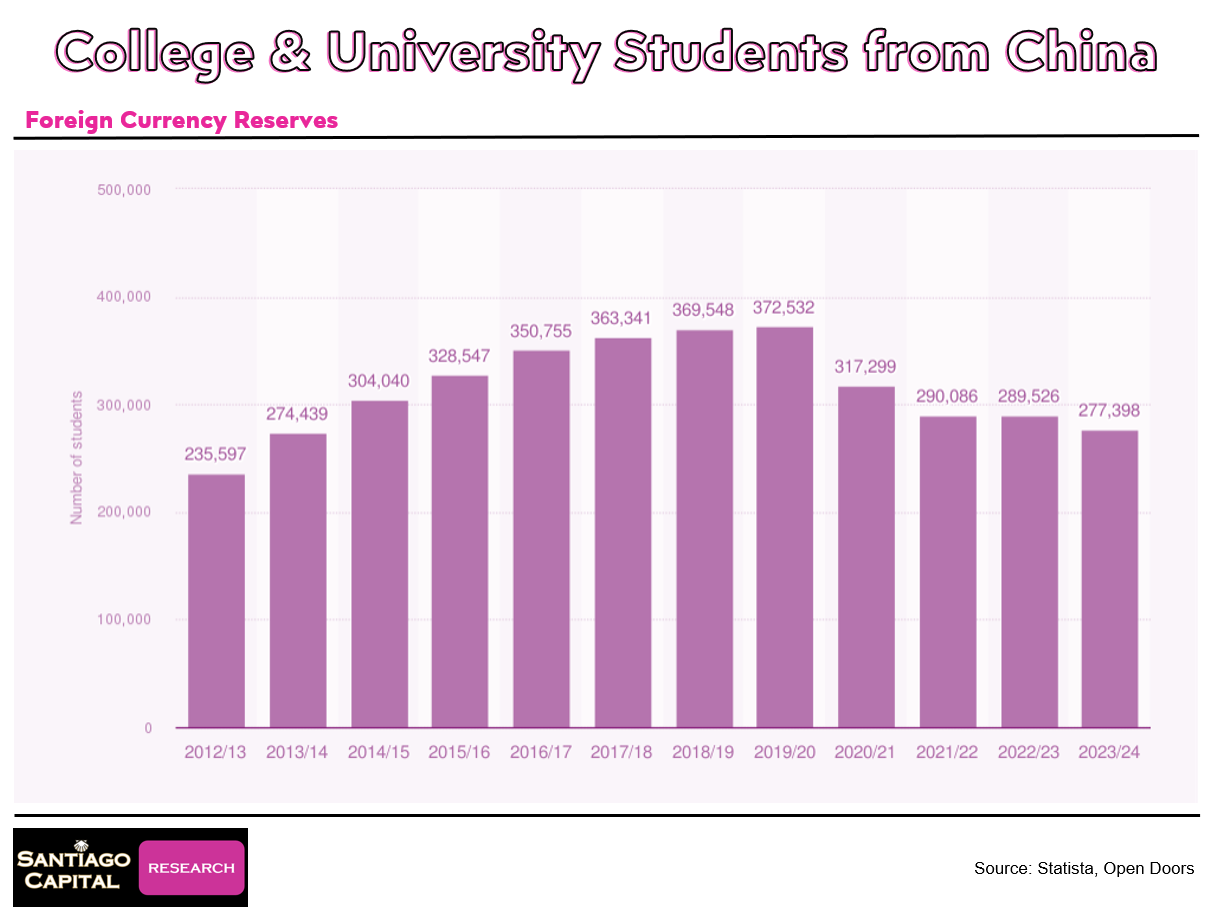

Chinese students in the U.S. peaked at 372,000 in 2019–2020, representing a third of international students.

Tourism and cultural exchanges, such as joint art exhibitions and academic collaborations, once deepened mutual understanding, but these are now in retreat.

Recent U.S. visa restrictions and policy shifts have led to notable declines in Chinese student enrollment and a broader chilling of academic collaboration.

Geopolitical and strategic competition has now intensified, and any pretense of civility between America and China has long disappeared into this new world of export controls, tariffs, military posturing, and cyber operations amidst growing mistrust.

U.S. initiatives such as the CHIPS Act, restrictions on advanced technologies, and the Inflation Reduction Act, coupled with China’s dual-circulation strategy, emphasize efforts to reduce dependency on each other in key sectors.

The U.S.-China trade war arising out of Covid demonstrated the fragility of supply chains dependent on an adversary and unfolding geopolitical tensions. The Belt and Road Initiative and the U.S. Indo-Pacific Strategy exemplify contrasting visions for global leadership.

Furthermore, military developments in the South China Sea and Taiwan Strait, as well as cybersecurity concerns, underscore strategic friction that the financial markets continue to ignore.

Technological collaborations that initially flourished have become overshadowed by disputes over intellectual property and national security concerns.

People-to-people exchanges, including the growth of Chinese students in U.S. universities and cultural exchanges, are reversing at the behest of the Trump administration.

The deglobalization trend of recent years is now being amplified by the unmasked hostility between the two nations.

The overall depth of enmeshment makes rapid and complete disengagement very challenging, although this objective is front and center for the Trump administration.