In the whirlwind world of global finance, headlines scream about seismic shifts that promise to upend everything we know.

This week, the buzz is all about developing nations ditching their U.S. dollar-denominated debt in favor of borrowing in Chinese yuan, supposedly at rock-bottom rates.

It's being touted as a masterstroke that slashes borrowing costs for cash-strapped countries while delivering a body blow to American financial dominance.

Picture it: emerging markets breathing easier, free from the dollar's iron grip, as the U.S. watches its influence evaporate overnight.

Sounds revolutionary, right?

But hold on—what if this isn't the death knell for the dollar, but just another chapter in a long-running saga of hype over substance?

The story making waves comes straight from major financial outlets, highlighting how countries like Kenya and Sri Lanka are negotiating to refinance their loans in yuan.

Proponents argue it's a savvy pivot: lower interest rates in China mean cheaper debt servicing, empowering borrowers and signaling a multipolar world where the yuan steps up as a viable alternative.

After all, why pay premium rates in dollars when you can snag a bargain in yuan?

It's painted as a win-win—borrowers save big, and the global south builds ties with a rising economic powerhouse.

Yet, as we peel back the layers, a nagging question emerges: If this swap is such a powerhouse move, why does it feel like we've heard this tune before?

Echoes of Past "Revolutions": When Game Changers Fizzle Out

Flash back just nine months, and the narrative was flipped on its head.

China itself issued bonds in U.S. dollars, and the move was hailed as a clever judo flip against American hegemony.

By borrowing in dollars at rates supposedly tighter than U.S. Treasuries, Beijing was seen as turning the tables, leveraging the dollar system to its advantage.

Fast-forward to today, and suddenly, escaping dollar debt is the real game changer.

It's enough to make your head spin—which side of the debt equation spells doom for the U.S.? If diving into dollar debt was a strategic coup back then, how can fleeing it now be the ultimate undoing?

Critics point out the inconsistencies in these breathless predictions.

For years, similar announcements have flooded the news: alliances forming alternative payment systems, nations stockpiling gold to bypass the dollar, or bilateral deals in local currencies.

Each time, it's declared the beginning of the end for U.S. financial supremacy.

Yet, here we stand, with the dollar still commanding the global stage. The latest twist?

This yuan swap isn't a bold offensive; it's a defensive scramble.

But what exactly is driving these countries to the negotiating table, and could it reveal more about the dollar's enduring strength than its supposed weakness?

The Hidden Pain Behind the Swap: Why Emerging Markets Are Desperate for Relief

Dig deeper, and the motivation becomes clear: dollars are getting harder to come by.

For emerging economies, a stronger dollar means their local currencies weaken, inflating the cost of repaying dollar-based loans. Add sky-high interest rates—often north of 10% for riskier borrowers—and you've got a recipe for financial strain.

Take Kenya, for instance: recent headlines paint a grim picture of millions grappling with a cost-of-living crisis where wages can't keep up.

The government is buried under staggering debt, forcing workers to bear the brunt through austerity measures.

In this context, swapping a $1 billion loan from China into yuan isn't a power play; it's a lifeline to avoid default.

Sri Lanka tells a similar tale. Plagued by economic turmoil, it's restructuring loans tied to infrastructure projects, converting them to yuan under pressure from lenders.

These aren't voluntary upgrades to a superior system—they're forced concessions in tough times.

And here's the irony: if the dollar were truly on the brink of collapse, as many doomsayers claim, why bail out of dollar debt at all?

A plummeting dollar would make repayments cheaper in local terms, handing borrowers a windfall.

Instead, these swaps suggest the opposite: faith in the dollar's resilience, making it too expensive to hold onto.

So, if desperation is the real driver, what does that say about China's low rates luring them in?

Unpacking China's Rate Advantage: Not as Rosy as It Seems

China's bond yields are indeed enviably low, hovering at levels that make U.S. rates look steep by comparison.

But is this a sign of unshakeable global confidence in the yuan? Far from it.

The secret sauce? Domestic dominance. Over 95% of China's debt is held by local investors—banks, the central bank, and institutions shielded from external volatility.

Throw in a deflationary spiral from a bursting real estate bubble, tax incentives for buying government bonds, and mandates for banks to load up, and you've got artificially suppressed yields.

The People's Bank of China has even dabbled in quantitative easing-like measures this year, further driving rates down.

Contrast that with the dollar's ecosystem: a vast, liquid market where global players flock for safety and returns. Emerging markets aren't rushing to yuan because it's superior; they're eyeing short-term relief from dollar scarcity.

But there's a catch—hedging currency risks could erase those interest savings, and without yuan revenues, these countries still need to convert scarce dollars to service the new debt.

It's like adding an extra step to an already complicated dance, reminiscent of past experiments like Russia demanding ruble payments for gas, which ultimately looped back to euros.

If these swaps are more patchwork than paradigm shift, how might this ripple into broader markets, especially with storm clouds gathering?

From Debt Dramas to Market Mayhem: Are Stocks on the Brink of a Shake-Up?

Shifting gears from global debt intrigue to Wall Street's pulse, the stage is set for turbulence.

Major indices have been riding high, but cracks are showing.

The Dow Jones, after a stellar year, has stalled, trading sideways for weeks.

Momentum indicators like stochastics are rolling over, and relative strength is waning.

A dip to the 50-day moving average seems plausible, potentially escalating to a 5% or more pullback by month's end—maybe even testing the 200-day average for a deeper correction.

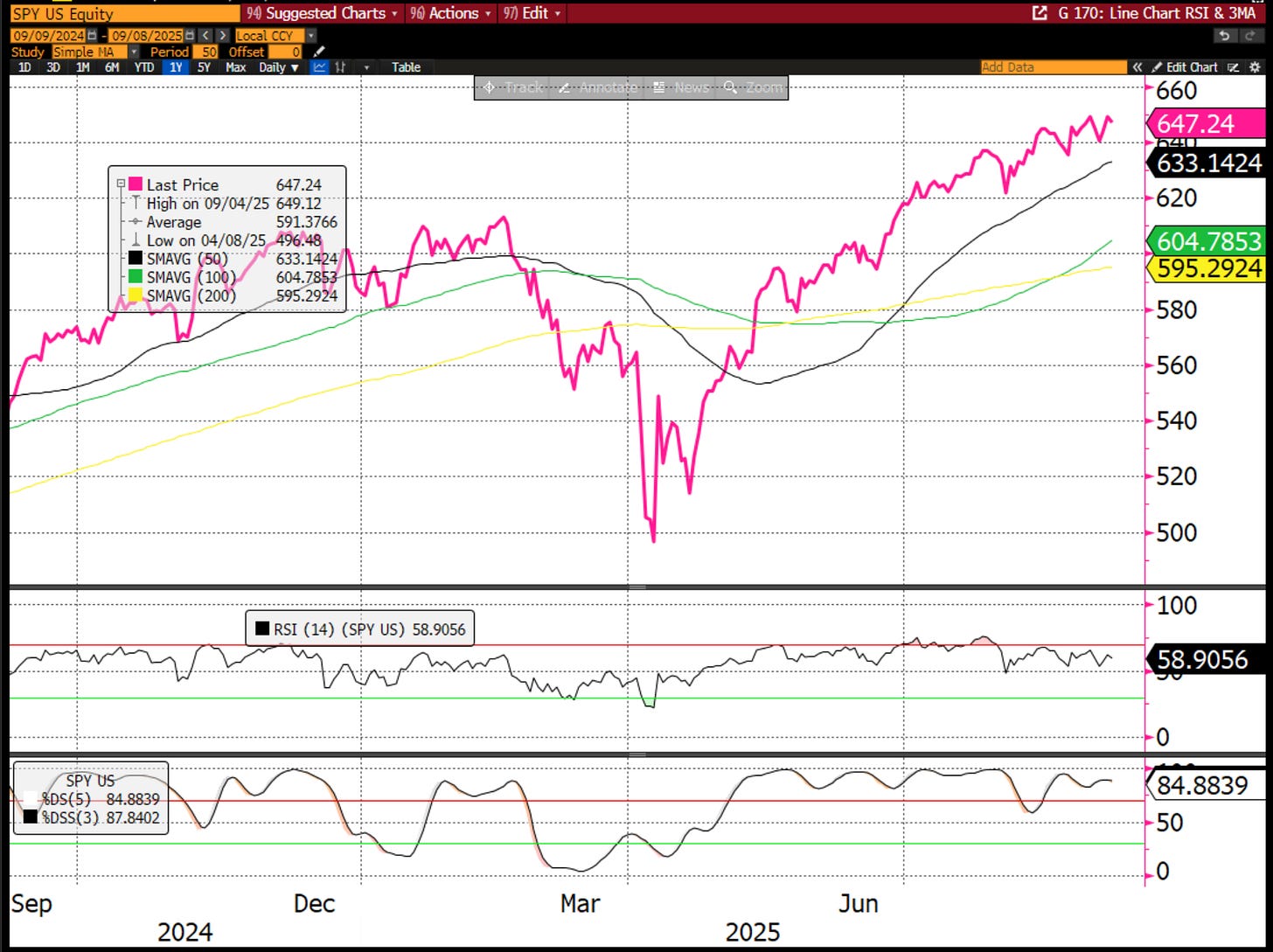

The S&P 500 echoes this unease. Sideways action masks underlying weakness: relative strength broke down six weeks ago, and stochastics are teetering.

Don't be surprised if it retreats to the 200-day moving average, shedding value in the process.

And the Nasdaq?

Its momentum has evaporated since late July, with prices clinging on despite overbought conditions easing.

A 9-10% drop to the 200-day average wouldn't be outlandish, especially as big-cap tech darlings falter.

Speaking of tech giants, Microsoft is flashing warning signs. It closed below its 50-day moving average recently, a key level that could signal further declines.

Momentum has collapsed, and a slide to the 100-day or even 200-day average—potentially down to 450—looms. Nvidia follows suit, breaking its 50-day average with exhausted momentum.

These heavyweights drive indices via passive investing; their breakdowns could drag everything down. It's like a bike stalling mid-hill—restarting upward momentum is tough, and gravity might pull harder.

Even beyond the U.S., the vibe is cautious. Germany's DAX, after a blockbuster run, has breached its 50- and 100-day averages, with momentum gone and relative strength fading. Taiwan's index mirrors this, poised for a test of its 200-day average.

Financials aren't immune—Goldman Sachs could tumble back to the mid-600s amid similar breakdowns. JP Morgan could face a similar fate.

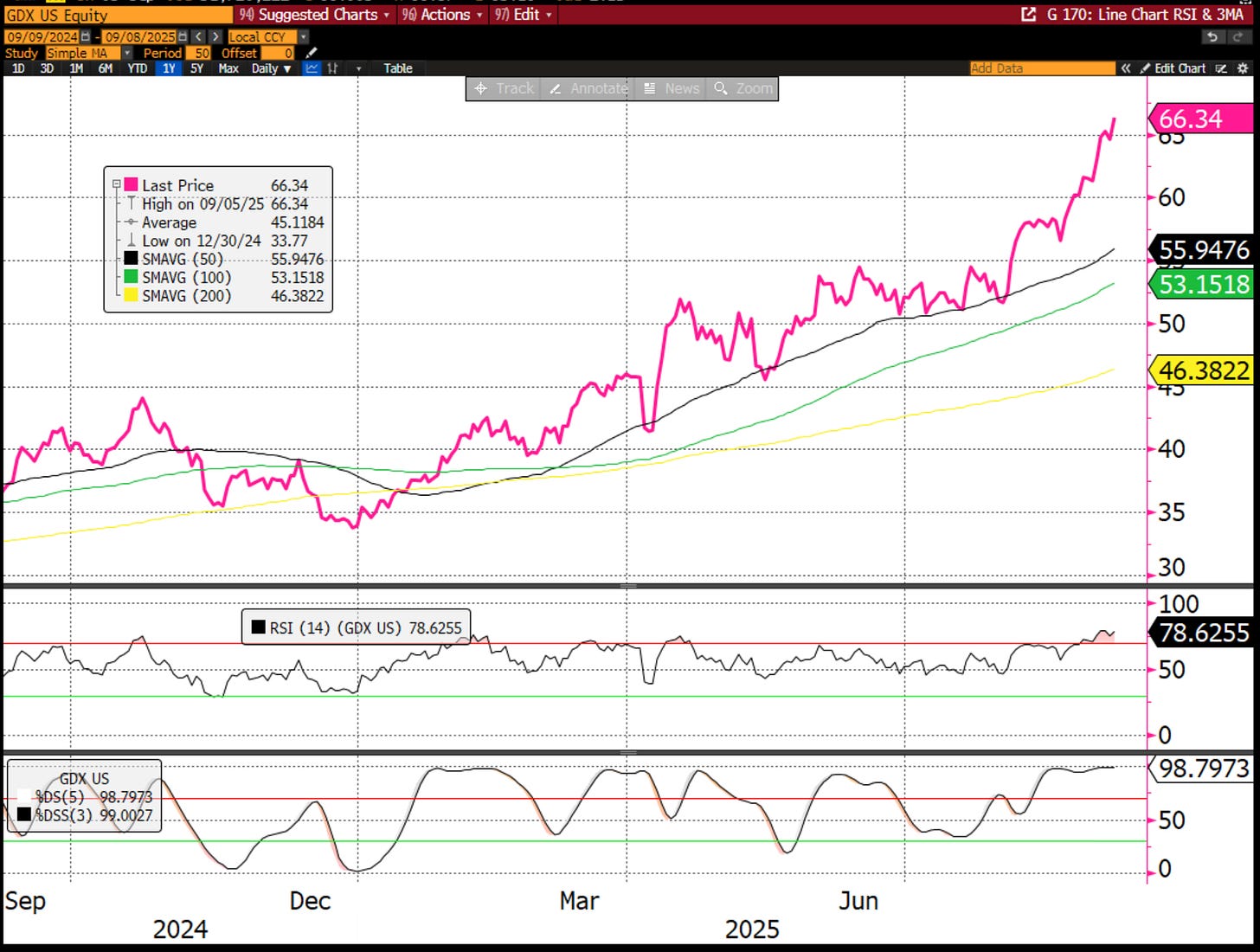

But what about havens like gold? Miners have minted profits this year, but with stochastics and relative strength maxed out, chasing here is risky.

Gold itself sits at all-time highs, overbought and vulnerable to a pullback.

A similar setup exist for the Gold miners (GDX). If you're eyeing entry, patience might pay— a 10-15% dip could sting newcomers. With all this brewing, could the Fed's next move be the spark that ignites—or extinguishes—the fire?

Fed Watch and the Week Ahead: Will Rate Cuts Save the Day or Seal the Fate?

As September unfolds, all eyes turn to the Federal Reserve's meeting mid-month.

Markets are betting on a rate cut, with euphoria potentially spiking on announcement day. But is it already baked in? Recent sideways trading suggests yes, and any post-cut rally might fizzle fast—perhaps within hours.

This week brings a data deluge: inflation figures, consumer sentiment, and more. Expect sideways-to-down action early, with late-week releases like CPI possibly hotter than anticipated, jolting markets lower.

Looking further, the week after could see initial gains into or on the Fed's decision, but by late September, downward pressure might resume.

Volatility, dormant at VIX levels around 15, often spikes this time of year.

Seasonality, combined with overextended markets, points to a non-boring month. If the Fed disappoints—or even if it delivers exactly what's expected—the "sell the news" dynamic could prevail.

In the end, these threads weave a tapestry of interconnected risks: debt swaps born of necessity, not revolution; markets primed for correction amid fading momentum; and policy moves that might not deliver the hoped-for boost.

The dollar's story isn't over—it's evolving in ways that defy the doomsayers.

But as uncertainties mount, one question lingers: In a world of hype and headlines, are we on the cusp of real change, or just another false alarm? Only time—and the markets—will tell.