When gold touches $4,400 before settling around $4,250, it’s not celebrating…it’s screaming.

The yellow metal doesn’t surge 50% in a year because everything is fine. It rises because something is profoundly wrong. Whether the fault lines run through politics, economics, geopolitics, or social structures doesn’t matter. What matters is that gold is raising its hand, demanding attention, insisting that all is not well.

And yet, this is precisely the moment when rational thinking becomes most difficult.

The very conditions that make gold surge also trigger emotional responses that cloud judgment. It’s rational to be irrational when the warning signs are this loud. But it’s also the exact moment when clear thinking becomes most critical.

So what does gold at $4,200 really mean? And more importantly, what should investors do about it?

The Wealth Preservation Framework

There’s a fundamental misunderstanding about gold’s purpose in a portfolio. It’s not a vehicle to get rich…it’s a tool to stay rich.

This distinction matters more than most investors realize. Those who have already built substantial wealth face a different challenge than those still accumulating it. The question shifts from “how do I grow this?” to “how do I protect this?” And that’s where gold’s true value emerges.

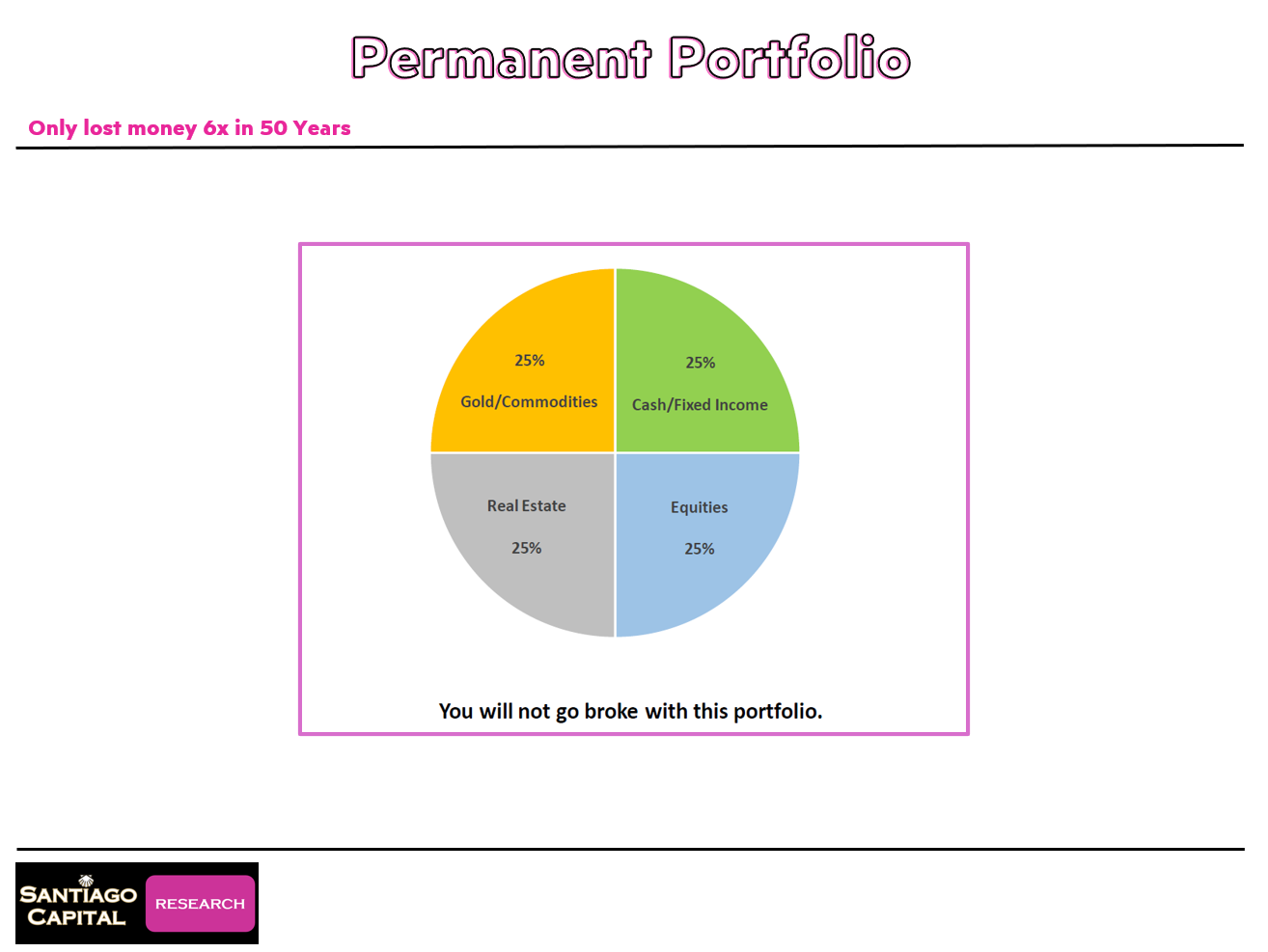

Consider the permanent portfolio framework: 25% stocks, 25% bonds, 25% cash, and 25% gold. It’s not designed to maximize returns.

It’s engineered to minimize catastrophic losses while still participating in upside.

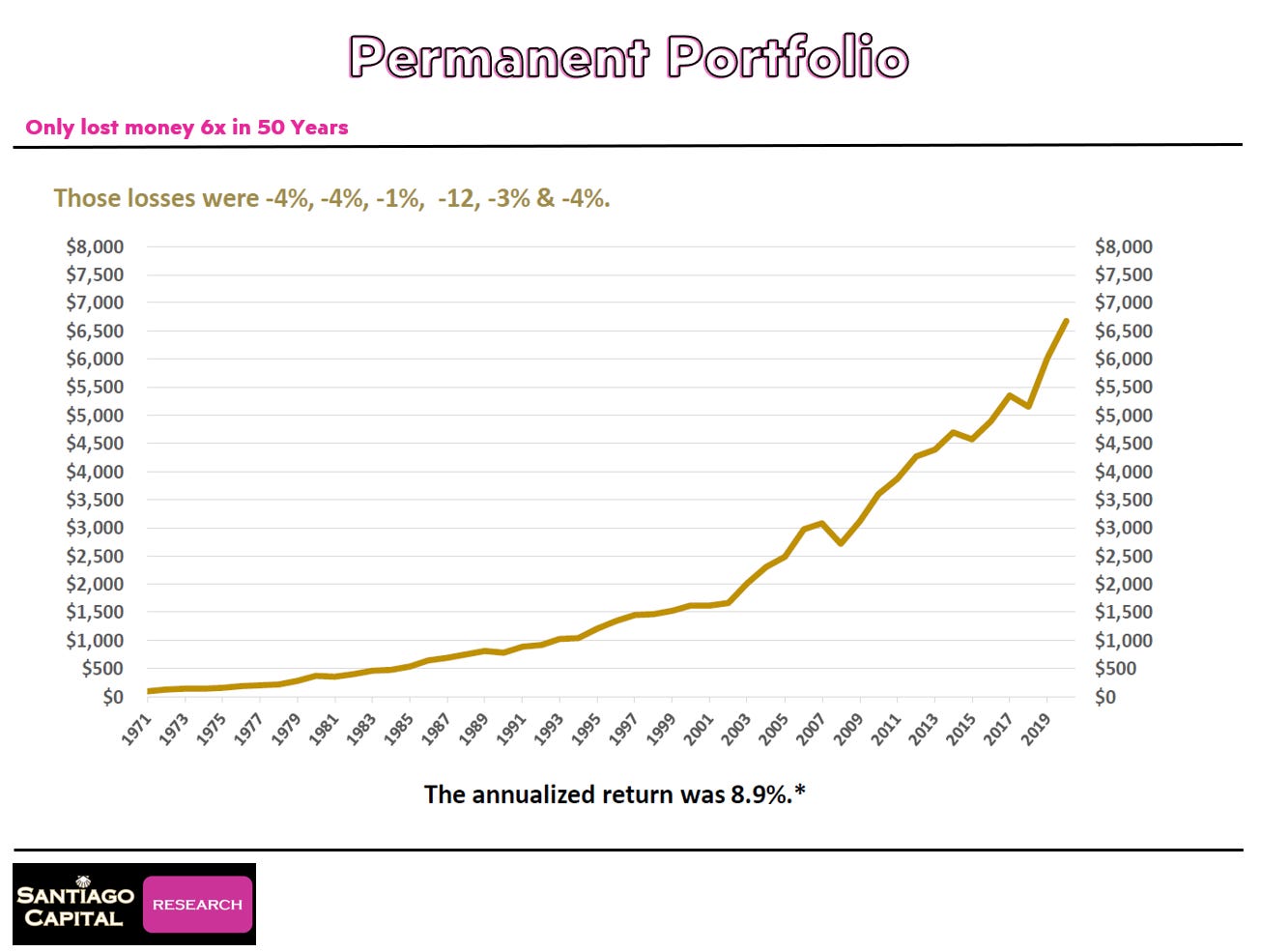

Over the past 50 years, this allocation has lost money only six times, with the worst drawdown being 12% during the 2008 global financial crisis. Most losses were 4% or less.

The annualized return? Around 9%…roughly 1% below a pure equity portfolio. But here’s what that 1% buys you: the ability to sleep at night.

The confidence that no single scenario…deflation, inflation, recession, or monetary collapse…will destroy your wealth.

Gold is the cornerstone of this defensive architecture.

But that leads to an uncomfortable question: If gold’s role is wealth preservation, what does a 50% surge in twelve months demand?

The Overbought Question

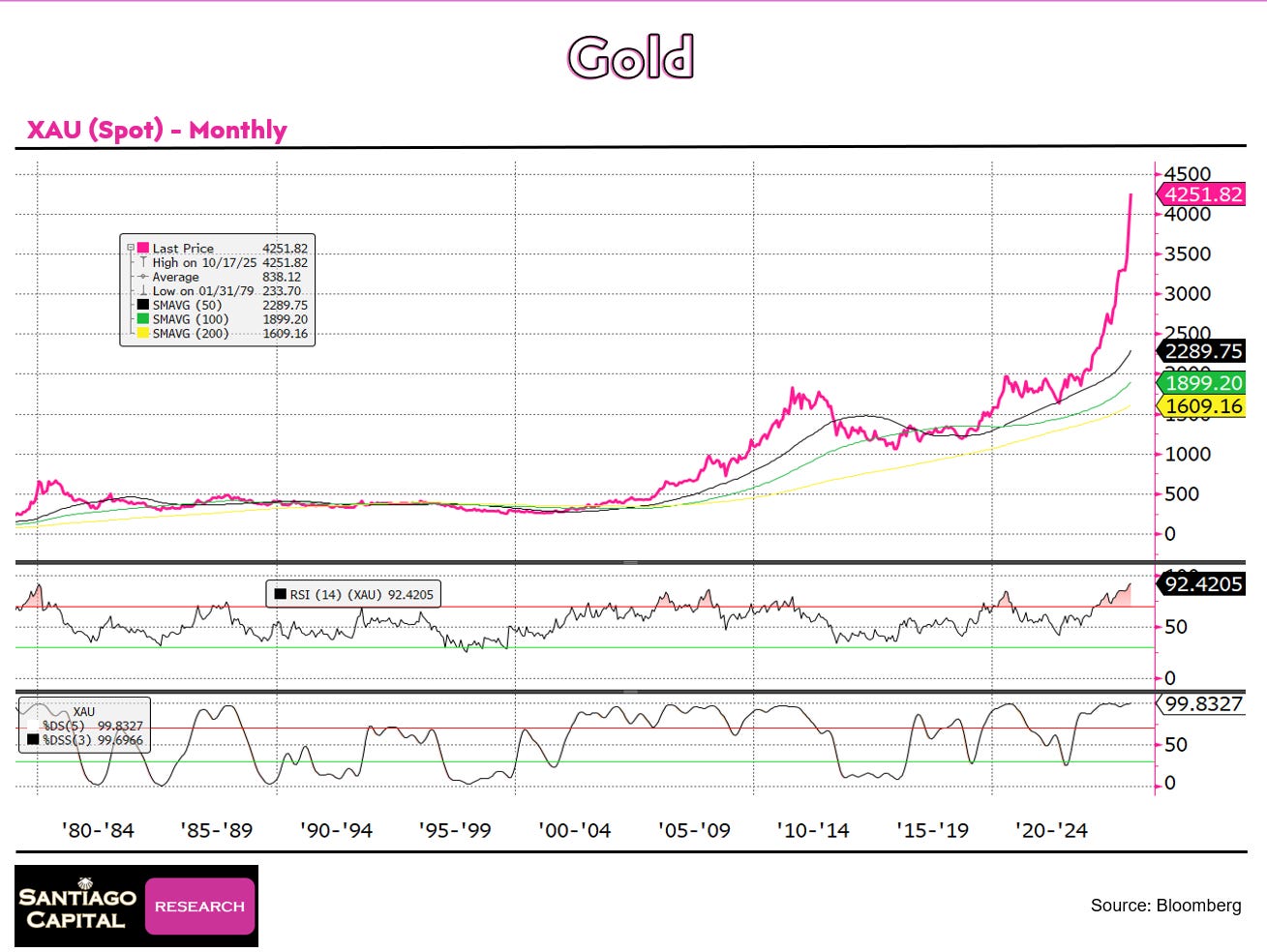

Gold is more overbought now than at almost any point in the past 45 years.

The technical indicators are screaming. Monthly stochastics and RSI readings show gold is more extended than in early 2021 post-COVID, more stretched than in 2009 after the financial crisis, and as overbought as 2013 before the multi-year bear market.

The only comparable moment? 1980, right before gold entered a two-decade decline.

This doesn’t mean gold is about to crash. But it does mean we’re at an extreme. And extremes, by definition, don’t last.

Yet here’s where the debate intensifies: Is this just another cyclical peak, or is this the beginning of the endgame?

Are we witnessing a temporary spike that will correct, or the early stages of a monetary system unraveling in real-time?

The answer determines everything. If this is a cyclical move, taking some profits and rebalancing makes sense. If this is the endgame, selling any gold could be the worst decision an investor ever makes. So which is it?

What the Data Actually Shows

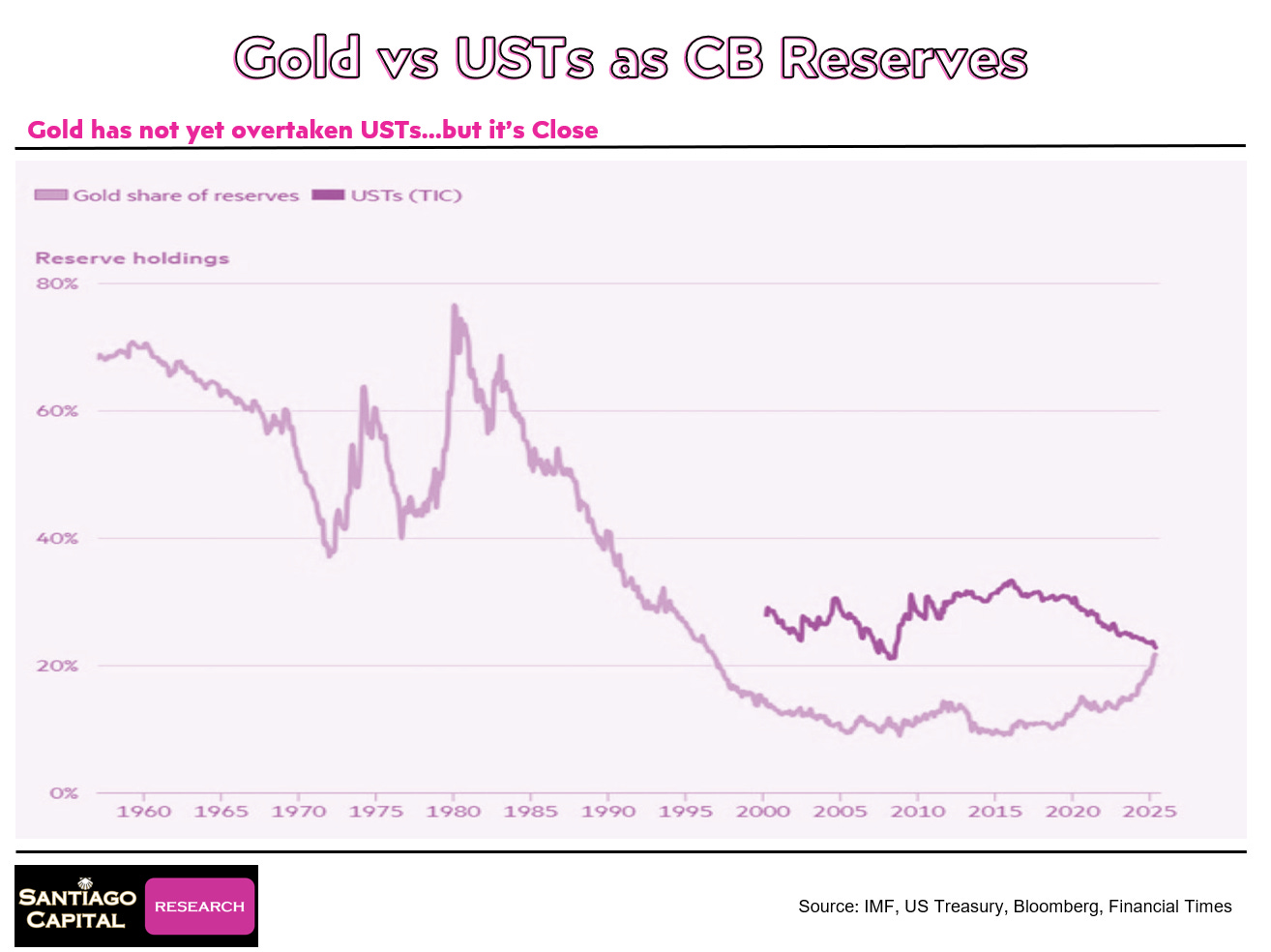

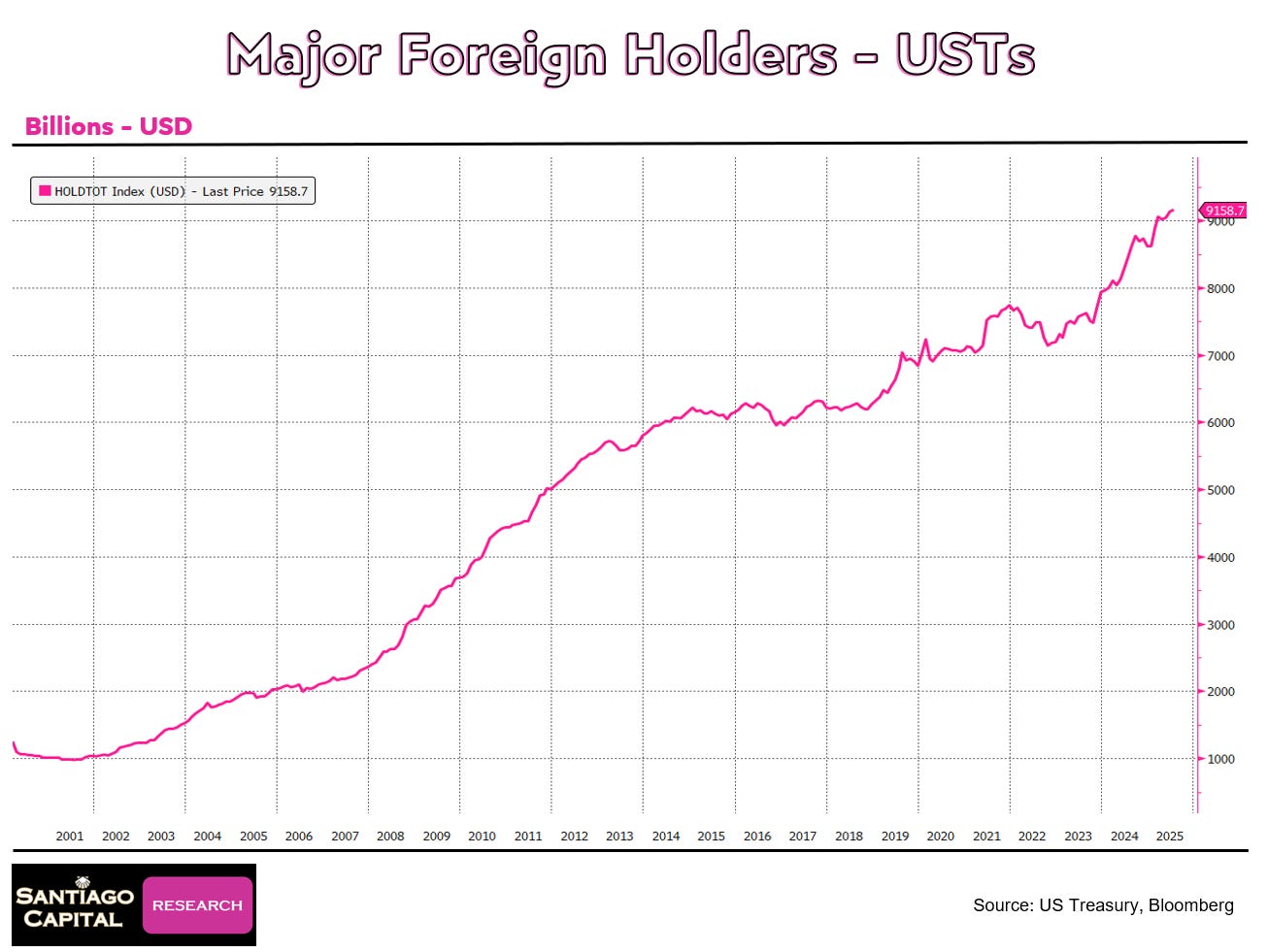

The narrative around gold’s rise is compelling: central banks are dumping U.S.

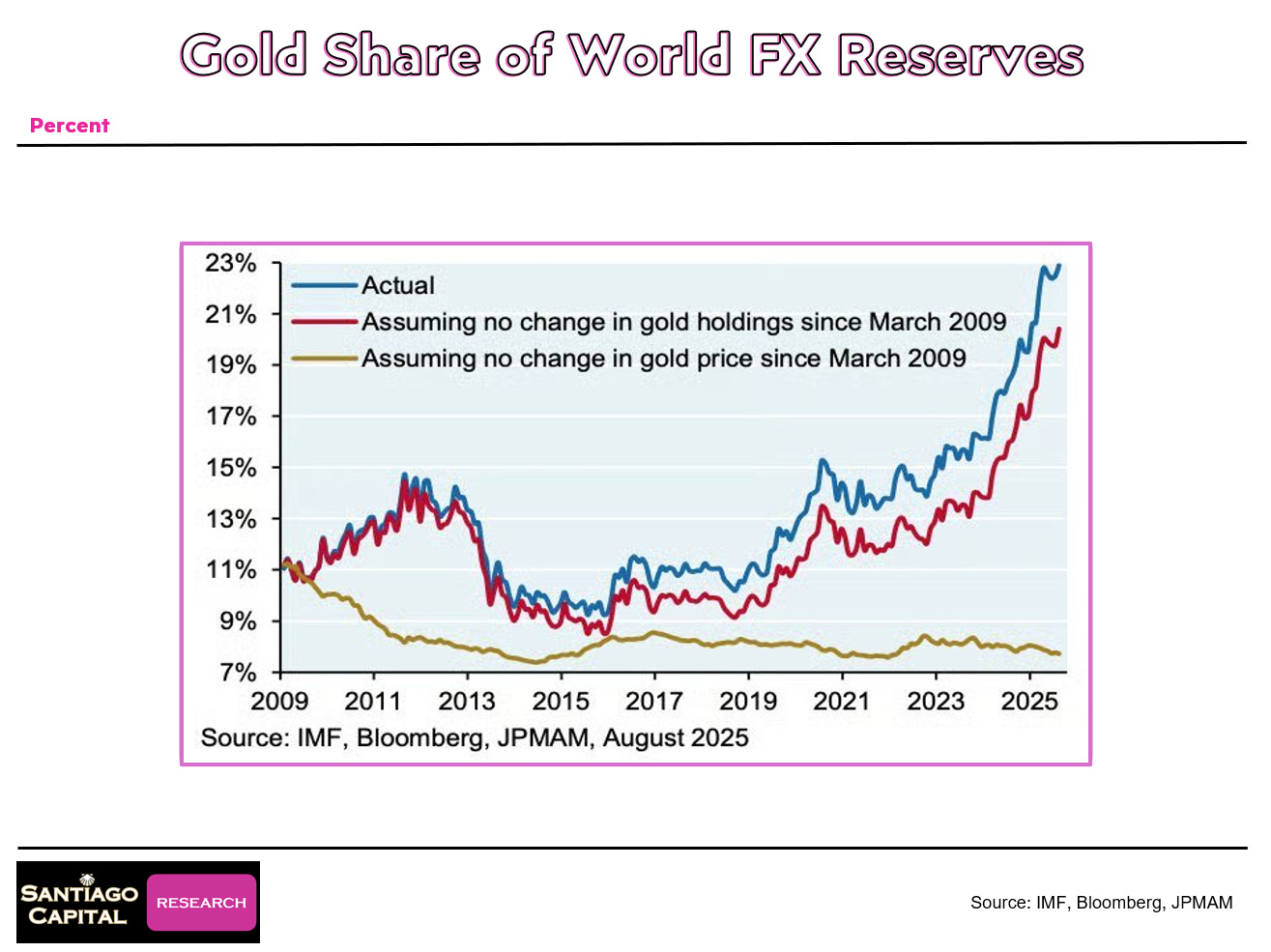

Treasuries and loading up on gold, signaling a loss of faith in dollar-based assets. The charts seem to confirm it…gold as a percentage of reserves is rising while Treasury holdings are falling.

But dig deeper, and the story gets more nuanced.

Foreign holders of U.S. Treasuries are at an all-time high in absolute terms.

Yes, gold as a percentage of reserves is rising, but much of that is driven by price appreciation, not massive new buying.

In fact, if you strip out price changes and look only at physical ounces held by central banks, gold reserves have actually fallen since 2009.

Here’s the remarkable part: The surge to $4,200 happened without central banks going on a buying spree.

They’ve been purchasing gold at the margin, certainly, but the price movement far exceeds the volume of their purchases. The red line showing where gold would be with no new central bank buying since 2009 is only slightly below the blue line showing actual holdings.

What does this mean? Gold’s rise is not primarily about central bank accumulation…it’s about repricing. It’s about the market recognizing that something has fundamentally shifted. And if central banks really started buying in size, the price wouldn’t be $4,400. It would be multiples higher.

This should be terrifying and exciting in equal measure.

The Empire That Won’t Fall

One of the more popular narratives in gold circles is that the metal will somehow dethrone the United States, bringing down the American empire as the world returns to a gold-backed monetary system.

There’s just one problem with this theory: The United States holds more gold than any other nation. By a lot.

Yes, Fort Knox hasn’t been audited in decades. Yes, skeptics question whether the gold is really there.

But here’s the uncomfortable question those skeptics rarely address: When was the last time China audited its gold reserves? Or Russia?

Why do critics automatically accept every other country’s reported holdings while questioning only America’s?

If anything, the U.S. likely holds more gold than officially reported. So does China.

But the broader point stands: In a world that returns to gold-based monetary systems, the United States wouldn’t be weakened…it would be positioned as a dominant player.

Gold doesn’t threaten American power. If the monetary system shifts toward gold, America will be right there at the table, using its reserves as leverage just like everyone else. The idea that gold somehow undermines U.S. hegemony doesn’t survive scrutiny.

But this raises a different question: If gold isn’t about toppling empires, what is driving its historic surge?

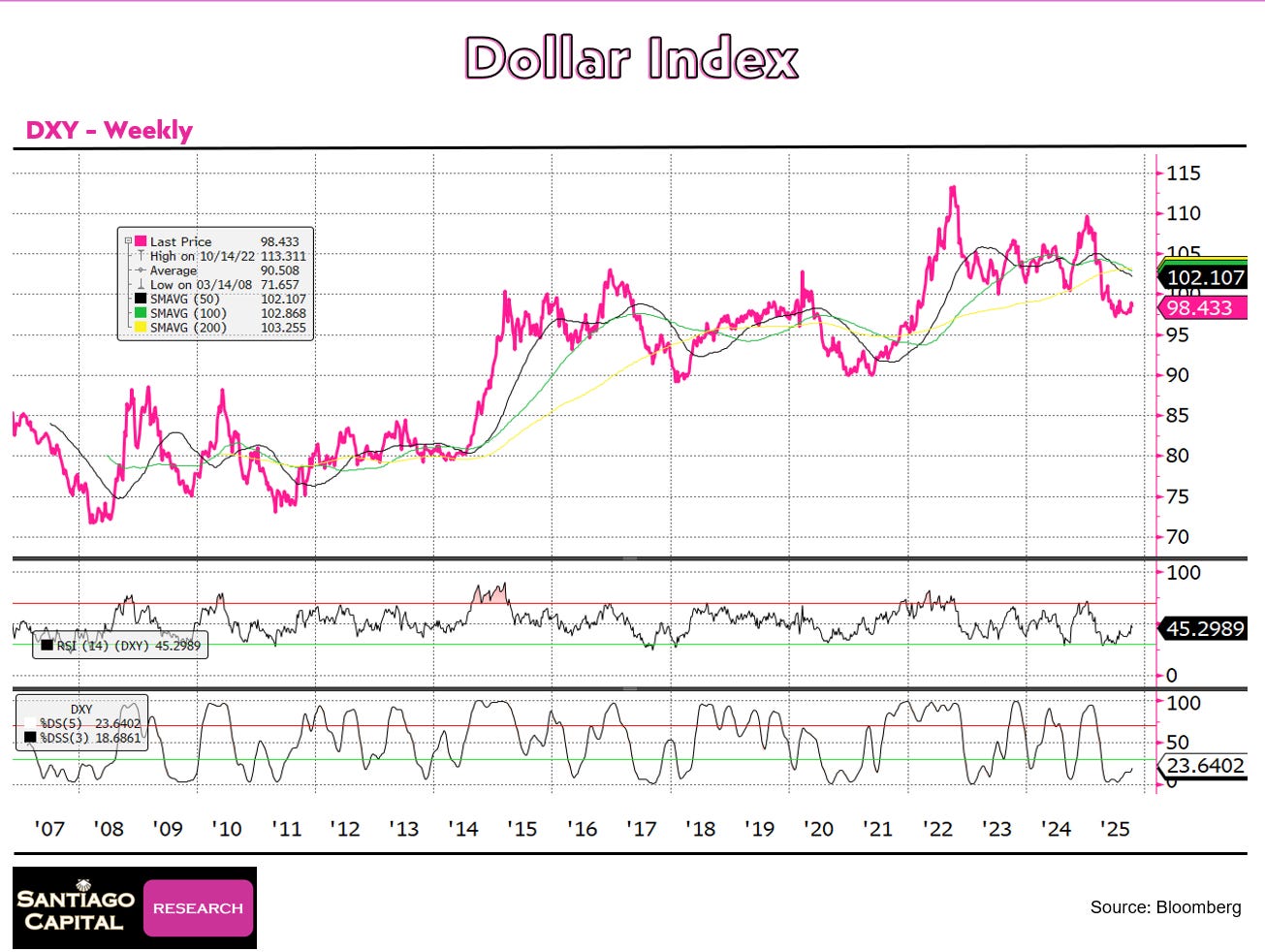

The Dollar Paradox

Here’s where conventional wisdom gets it wrong: A strong dollar isn’t bearish for gold. It’s the opposite.

The dollar index sits at 98, well above the lows many predicted. Despite massive stimulus, quantitative easing, bailouts, and unprecedented monetary expansion, the dollar hasn’t collapsed. It hasn’t fallen into the 80s or 70s as so many forecasters insisted it would. It remains stubbornly resilient.

And that resilience is exactly what’s bullish for gold.

When the dollar strengthens against other fiat currencies, it wrecks the global system.

It creates stress in foreign debt markets, pressures emerging economies, and exposes the fragility of dollar-dependent financial structures.

The 2022 dollar surge did precisely this…causing chaos across global markets and forcing countries to question their reliance on dollar-based reserves.

That chaos is what makes gold relevant. When the system itself comes into question, gold doesn’t need a formal return to a gold standard.

It just needs to be there, offering an alternative, raising its hand and saying: “Look at me. I’m still here. I don’t break.”

The confiscation of Russian reserves in 2022 accelerated this dynamic. Countries watching that unfold realized that dollar reserves aren’t quite as safe as they thought…not if geopolitical winds shift.

Gold, by contrast, can’t be sanctioned away or frozen by foreign governments.

So the strong dollar doesn’t undermine gold. It validates it. The fact that gold is surging while the dollar remains elevated isn’t a contradiction…it’s confirmation that something deeper is shifting in the global monetary order.

But if that’s true, why isn’t this the endgame yet?

The Technical Reality Check

Gold is tracing a parabolic curve on the monthly charts. Nothing goes vertical forever. The question isn’t whether gold will pull back…it’s when and by how much.

Support levels sit around $4,000, with the 50-day moving average down near $3,680.

A pullback to test either level wouldn’t be bearish…it would be healthy. Parabolic moves that don’t correct tend to end badly. The more vertical the ascent, the harder the eventual fall.

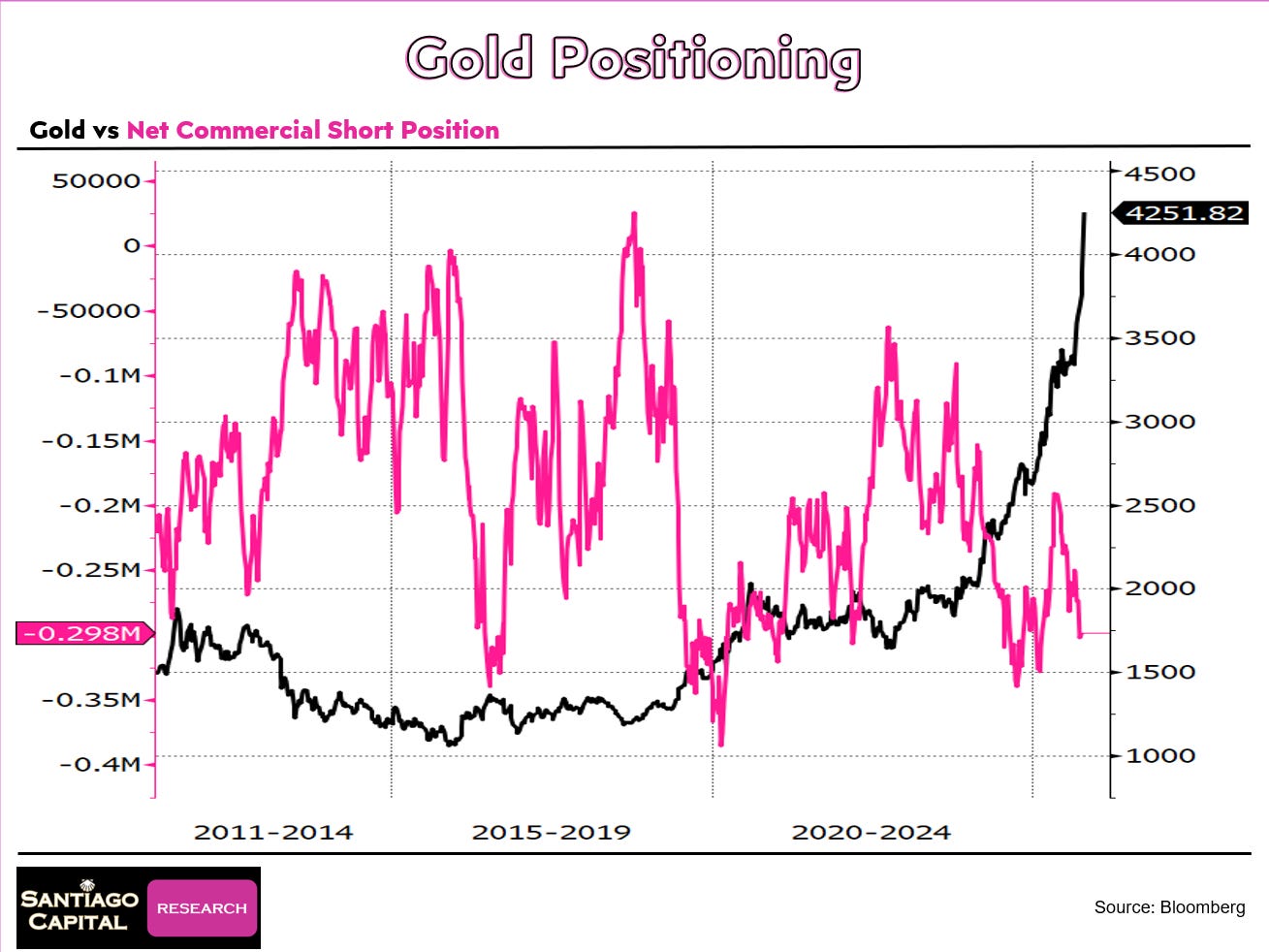

There’s also the mystery of the commercial short position. Typically, this is a reliable contrarian indicator: when commercials are heavily short, gold is near a top.

When they cover their shorts, that’s often the fuel for rallies. But because the U.S. government is shut down, the latest data isn’t available. The last update was three weeks ago, right as gold was accelerating.

The critical question: Are commercials now holding the biggest short position ever, suggesting an imminent correction? Or have they thrown in the towel, covered their shorts, and removed the resistance that usually caps gold rallies?

The answer will reveal a lot about whether this move has legs or whether it’s exhausting itself in a climactic blow-off. Until that data updates, we’re flying blind on a key indicator.

The Rebalancing Decision

If gold started the year at 25% of a portfolio and has now surged to 35%, what should an investor do?

This is where philosophy matters more than technique. If you view gold as a speculation…a way to get rich on monetary chaos…then you hold on and maybe even add more, willing to accept the volatility and risk.

If you view gold as a wealth preservation tool, as a strategic allocation meant to protect purchasing power over decades, then this is precisely the moment to rebalance.

Rebalancing doesn’t mean selling everything. It means trimming back to 25%, taking some profits, and perhaps hedging the position.

Not because gold is doomed, but because that’s what disciplined portfolio management demands when any asset becomes overweighted due to price appreciation.

The permanent portfolio works because it forces you to sell high and buy low. When gold runs 50%, you rebalance by selling some. When it crashes, you rebalance by buying more. The system removes emotion from the equation.

But here’s the tension: What if this isn’t a normal cycle? What if we really are in the early stages of monetary system breakdown? Then rebalancing could mean selling right before gold goes to $10,000 or $20,000.

But if you trim your allocation to 25%, and gold then doubles or triples…you are still participating on this upside in a large way. And as such, you have not “missed it”.

But this is the question every gold investor is facing right now. And nobody…regardless of what they claim…knows the perfect answer with certainty.

What Comes Next

Gold will tell us whether this is a cyclical peak or something more profound. If this is just another overbought extreme, gold will pull back, test the $4,000 level or lower, and then spend months or years consolidating before the next major move. That’s what happened in 1980, 2011, and 2013.

If we are moving into the endgame…if the monetary system really is coming apart…then gold won’t correct significantly. Or won’t correct for long. It will pause, consolidate briefly, and then resume its climb toward levels that seem impossible today.

The technical setup will reveal which scenario we’re in. A healthy correction that finds support at prior resistance levels and holds there would actually be bullish long-term. It would signal that gold is building a base for the next leg higher rather than exhausting itself in a blow-off top.

An inability to correct, or a correction followed by an immediate resumption of the parabolic climb, would suggest something more urgent is happening. That the market senses time is running out. That the monetary endgame is closer than most believe.

Either way, one thing is certain: Gold at $4,200 is a signal. It’s a fire alarm going off in a crowded building.

Whether the fire is contained in one room or spreading through the entire structure, the alarm demands attention.

The only question left is whether investors will listen…or whether they’ll keep dancing while the smoke thickens.

Because gold doesn’t care about human optimism or denial. It just keeps doing what it’s always done: reflecting reality, whether we’re ready to face it or not.

Subject: Don’t miss Wednesday’s drop: Upgrade now to unlock Brent’s stablecoin special.

The USD Stablecoin deep dive publishes Wednesday. Upgrade today to read it first.

If you’ve been sitting on the fence, this is the week to step over it.

On Wednesday (Oct 22) we publish a new Pro-level special presentation from Brent Johnson on US-dollar stablecoins…how code, ledgers, and policy will merge to reshape global money and power (and why that matters to your portfolio).

Why this matters:

See the next monetary rails before the crowd. Brent explains how USD stablecoins can fuse private innovation with state power…turning the US dollar into programmable infrastructure that scales across borders. Spot second-order effects in liquidity, settlement, and market access.

Anticipate policy and capital flows. Learn how “empire by code” could extend U.S. monetary reach and influence adoption in unstable currency regions…an edge for positioning, risk control, and timing.

Operate with a framework, not headlines. Understand the contest within fiats…and why the dollar’s digital form may accelerate, not diminish, its dominance.

Upgrade to read it Wednesday

Move up to Santiago Capital Research ($399/yr) and you’ll unlock:

5–6 premium articles each month on markets, geopolitics, and the madness of crowds.

The Macro Pilgrim’s Ledger (weekly Sunday brief with data, charts, and context).

Deep, narrative-driven research that helps you think independently and position early.

That’s $1.09/day for professional-grade insight…less than coffee, far more useful.

👉 Upgrade now to access Brent’s USD stablecoin report on Wednesday

This is a Pro-level report made available to $399/yr members for a limited time.

If you want first read…and first mover advantage…upgrade today so you’re in when it lands on Wednesday, Oct 22.

After two weeks, the report will move behind the Pro level paywall.