Picture this: a world where the United States, long advertised as playing nice in the global sandbox, suddenly flips the script and starts building walls…not just physical ones, but economic fortresses made of tariffs.

For years, we've heard the doom-and-gloom chorus: tariffs are taxes in disguise, they'll spike prices, crush growth, and leave America isolated in a sea of resentment.

But what if that's only half the story?

What if these bold moves are quietly tipping the scales in America's favor, generating trillions in revenue, luring massive investments, and forcing rivals to the negotiating table?

Buckle up as we dive into the high-stakes drama of international trade, where the U.S. is rewriting the rules…and the results might surprise you.

Let's rewind the clock to just a year ago.

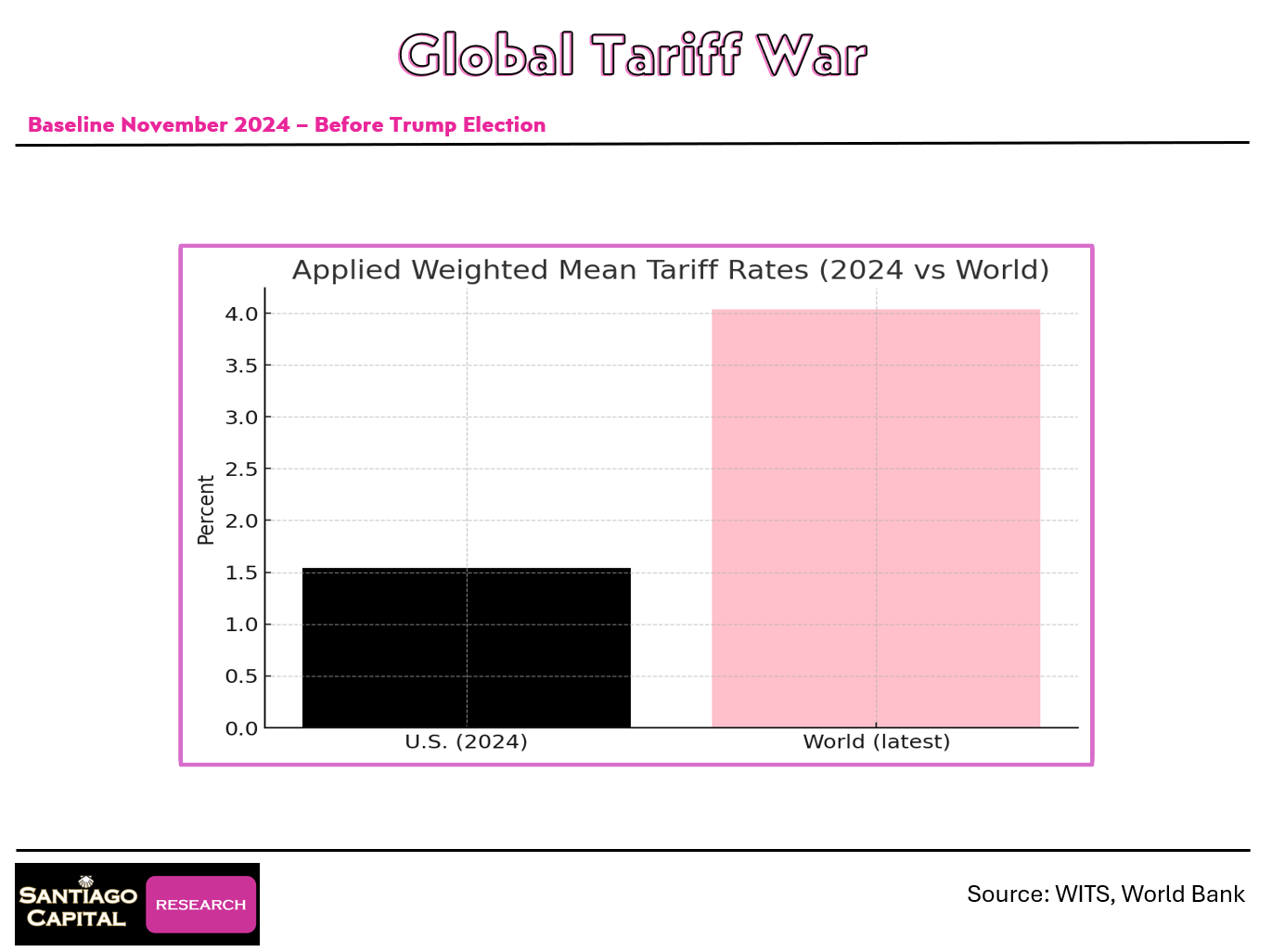

Back then, the average tariff slapped on goods entering the U.S. hovered around a meek 1%…a friendly handshake compared to the world's weighted mean of about 4%.

It was an era of open borders for commerce, rooted in post-World War II ideals that prioritized global harmony over national muscle.

But fast-forward to today, and that landscape looks unrecognizable.

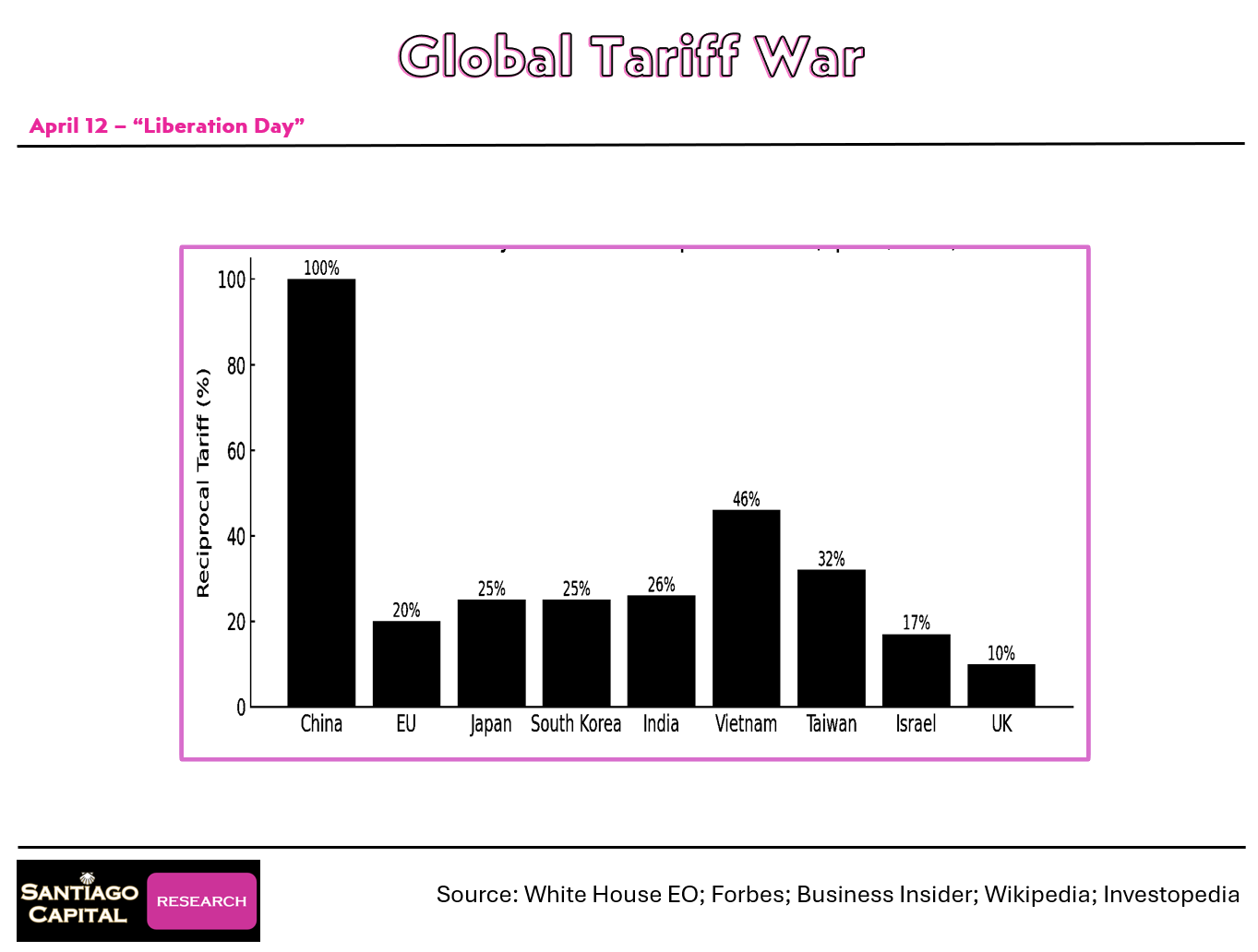

A baseline 10% tariff now applies universally, with country-specific hikes that make eyes water: think 20% on the EU, 25% on Japan and South Korea, a whopping 40% on Vietnam, and 30% on Taiwan.

Even allies like the UK face 10%.

These aren't pie-in-the-sky threats; they're now locked-in realities that sent markets tumbling earlier this year amid the uncertainty.

Why the shockwaves? Because this isn't just about slapping fees on imports…it's a seismic shift in how America wields its economic clout.

Markets tanked at the end of Q1 into early Q2 as the announcements rolled out, only to rebound spectacularly in the second half of Q2 and into Q3 when negotiations kicked in.

But now, with tariffs firing on all cylinders, the real effects are just starting to ripple through. Prices skyrocketing?

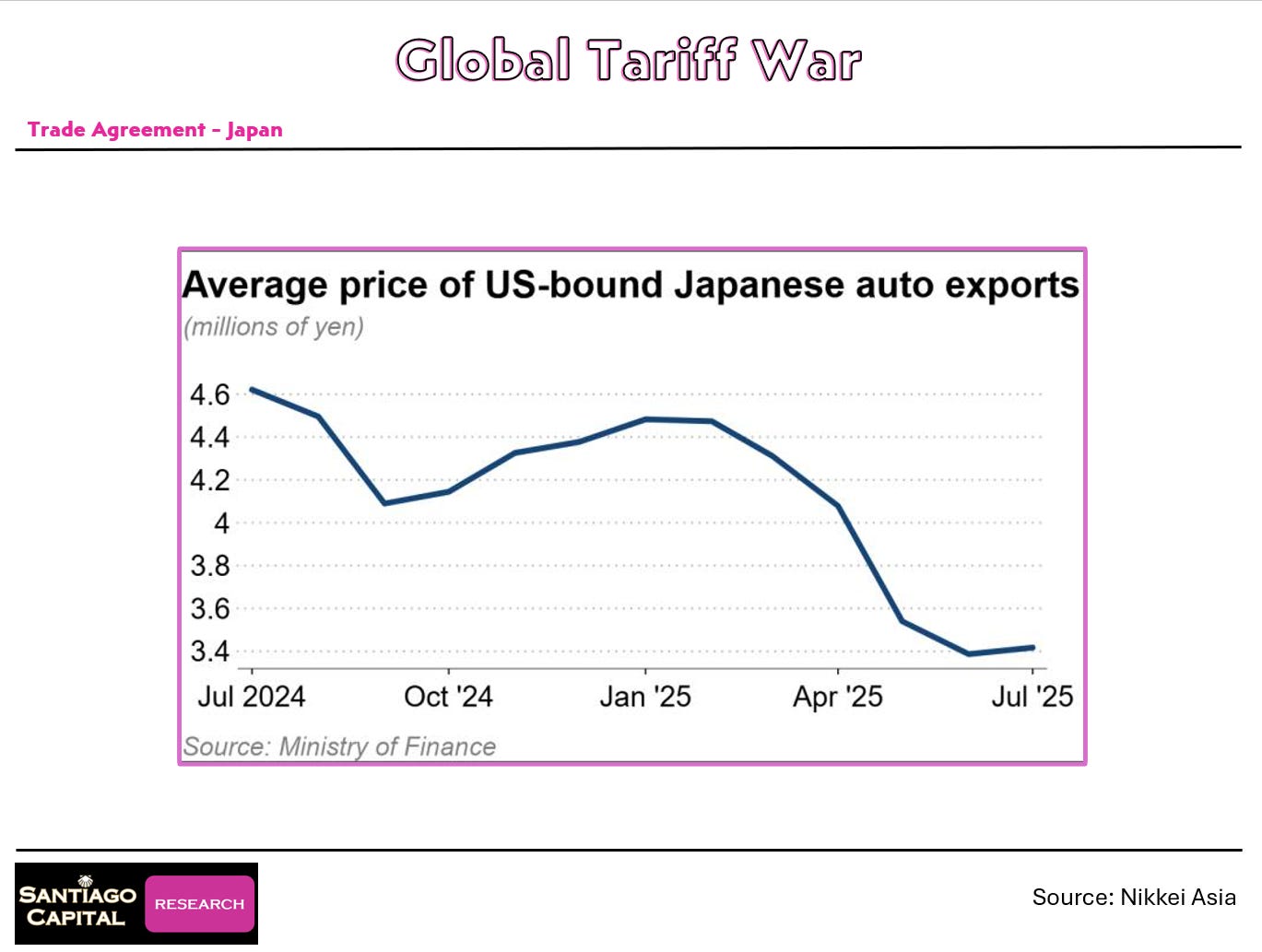

Not yet…importers, especially automakers, have been absorbing the hits so far, keeping consumer costs in check.

One recent headline hints that Japanese car giants might start passing on some pain, but the data shows prices dipping overall. Intriguing, right?

But here's the burning question: If these tariffs were supposed to backfire spectacularly, why do the early deals look like U.S. victories? And could this be the secret sauce fueling a manufacturing renaissance at home?

Take Japan, for starters…a nation synonymous with automotive dominance. A year ago, tariffs on Japanese goods trickled in at under 2%. Today?

They're cruising at 15%, even on cars, that sacred cow of trade talks no one dared touch before.

Skeptics predicted catastrophe: soaring vehicle prices, supply chain chaos, a humiliating retreat.

Instead, the numbers paint a picture of American leverage in action. Japanese firms are eating the costs, and U.S. consumers haven't felt the sting…yet. If this is a loss for the U.S., it's a peculiar one.

The same story unfolds across the Pacific Rim.

South Korea? Tariffs jumped from negligible to 25%. Taiwan? 30%.

These aren't concessions; they're conquests, achieved through a mix of baseline pressures and one-on-one haggling that delayed full implementation until mid-year.

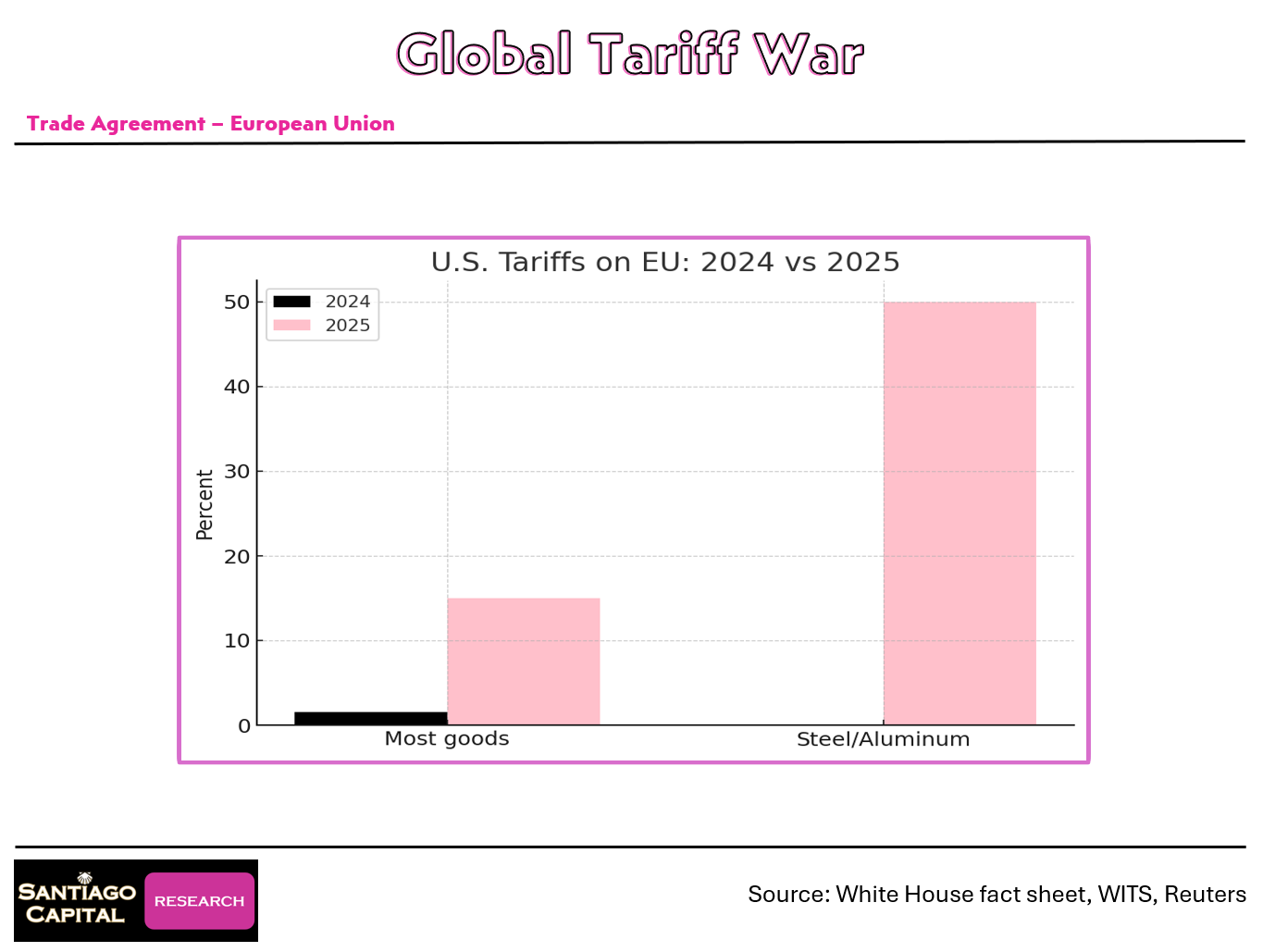

But what about Europe, that sophisticated bloc often portrayed as America's intellectual equal in diplomacy? The EU's tale is even juicier.

Pre-tariff era: around 1-2%.

Now, most goods face 15%, with steel and aluminum skyrocketing to 50%.

Imagine the scene: EU leaders, once defiant, trooping into high-level meetings and emerging with deals that favor U.S. interests.

Photos from those summits tell a thousand words…handshakes that scream concession, not triumph.

Critics might cry foul over "bully tactics," but the facts are stubborn: these hikes are double digits higher than anyone forecasted when the tariff drumbeat began.

And the UK? Fresh off its own geopolitical headaches, it saw tariffs climb from 2.5% to 10% overall, with autos hitting 25%.

No wonder markets rebounded once the dust settled…the uncertainty gave way to clarity, and that clarity tilts toward American gains.

Now, let's turn north to Canada, where the plot thickens with a dash of hockey bravado.

Enter a new prime minister, fresh from central banking glory, vowing to play "elbows up" against the U.S….a tough-talking promise to lead if America wouldn't.

Pre-election rhetoric was fiery: the old ties are dead; we'll stand tall.

Post-election?

A different tune.

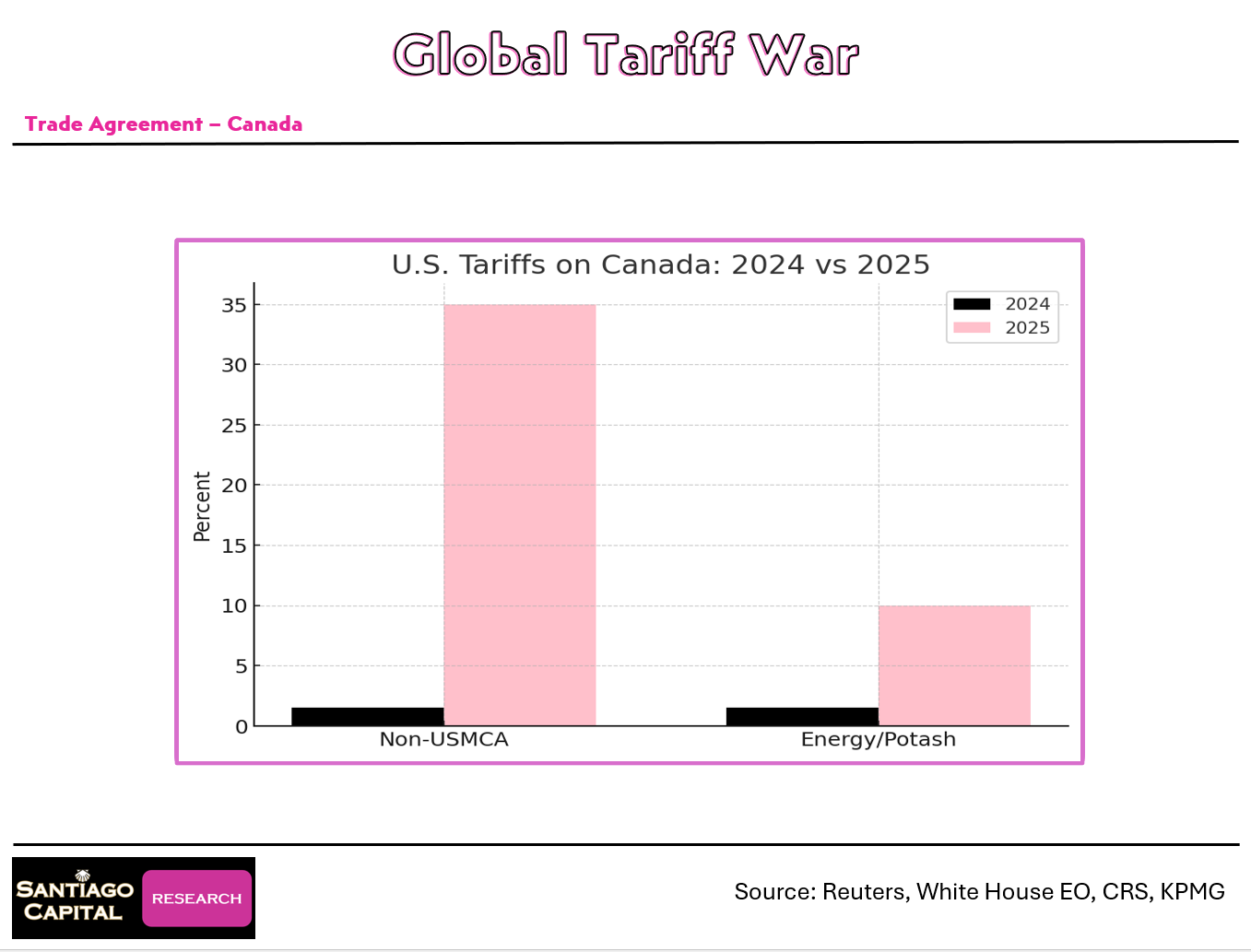

Tariffs on non-USMCA goods leaped to 35%, energy and potash to 10%. And those retaliatory tariffs Canada threatened? Quietly dropped.

Canadian media hasn't been kind, lambasting the deal as a bend-the-knee moment. If this is outsmarting the U.S., the strategy's well-hidden.

Across Asia…excluding the elephant in the room…the pattern repeats: dramatic hikes that rewrite trade flows.

Overall, the U.S. average tariff has ballooned from 1% to 16-17%.

But if these deals are so lopsided, why aren't rivals pushing back harder? And what hidden windfalls are they creating for America's coffers and factories?

Here's where it gets interesting: these tariffs aren't just barriers; they're revenue rockets.

Projections from neutral watchdogs like the Congressional Budget Office estimate they'll rake in over 3.3 trillion dollars over the next decade…funds that could slash deficits and fuel domestic priorities.

This isn't hypothetical; it's a fiscal lifeline that didn't exist last year.

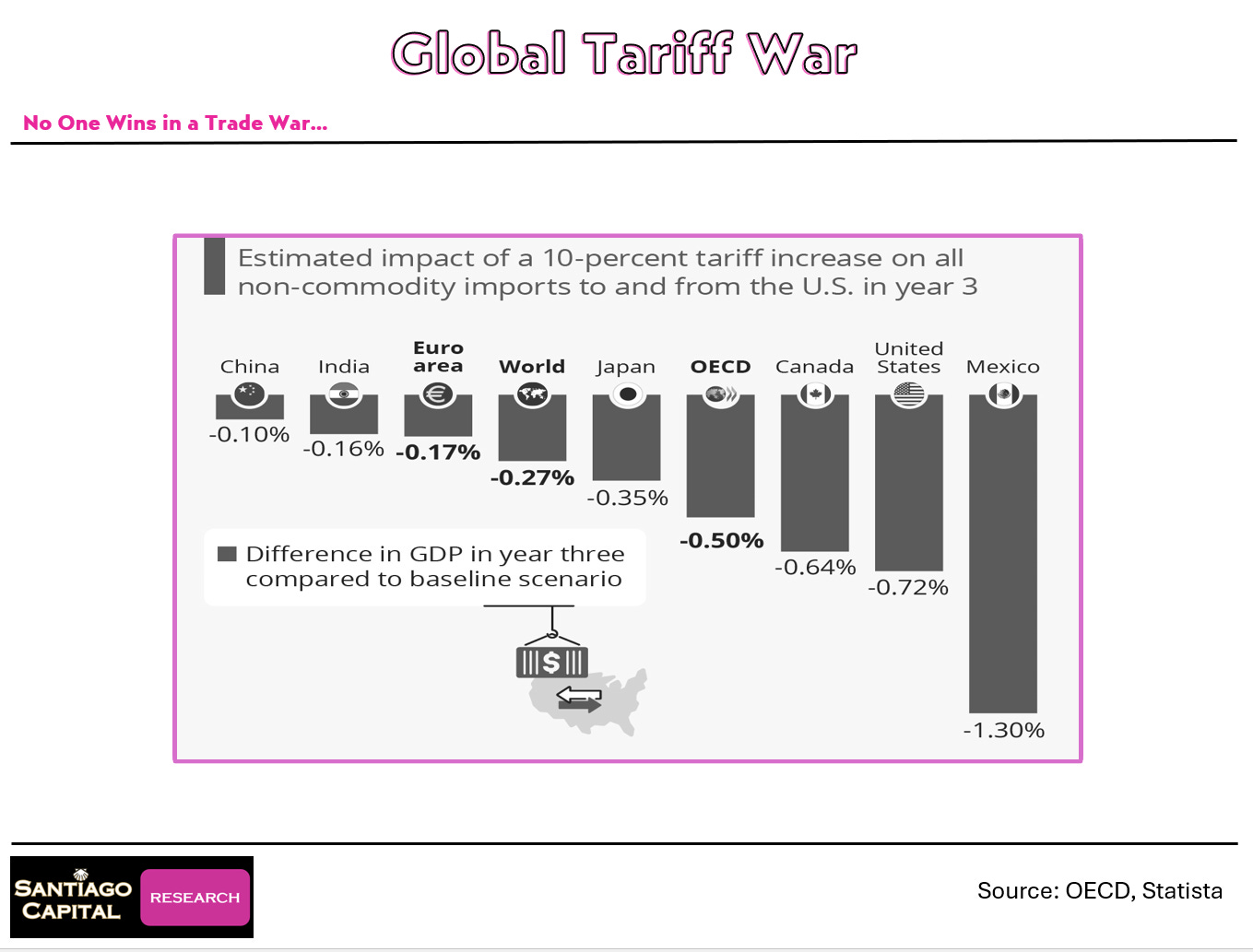

Detractors argue tariffs are taxes that hurt everyone, stifling efficiency and growth.

Fair point…but in a relative game, if everyone stumbles and the U.S. trips the least, hegemony holds.

Beyond cash, the real magic is in the magnets: foreign investments pouring in like never before.

The UAE pledges 1.4 trillion, Qatar a trillion, Japan another trillion, Saudi Arabia 600 billion to a trillion.

These aren't idle chit-chat; they're commitments tied directly to tariff pressures, aimed at building U.S. infrastructure and tech.

And the manufacturing boom? It's no mirage. Announcements flood in: TSMC expanding chip plants in Arizona, Samsung in Texas, Toyota in North Carolina, Hyundai in Georgia, Honda in Ohio, Siemens back in the Carolinas.

U.S. firms are reshoring too…Intel doubling down in Arizona, Apple in North Carolina, GE in Kentucky.

This is the heart of the strategy: reversing decades of offshoring that hollowed out American industry.

Post-WWII rules, designed to favor the U.S., ended up enriching Wall Street at Main Street's expense.

Now, that's being dismantled…not for global good, but national security and sovereignty.

Jobs, supply chain resilience, less reliance on far-flung factories: it's a bid to fix inequality's roots, even if it ruffles feathers.

But with all this momentum, why the radio silence on the biggest prize? What if the entire global squeeze is just prelude to the ultimate showdown…with China?

Ah, China…the dragon in the room, where the trade war's true stakes lie.

While deals with Japan, Europe, and others are sealed, Beijing remains the outlier, negotiations dragging like a suspense thriller. Why?

Because this isn't peripheral; it's existential.

China supplies critical rare earths and pharmaceuticals to the U.S., vulnerabilities that sting.

But flip it: America feeds China food, energy, and dollar funding…lifelines in a symbiotic tango both sides are desperate to untangle.

The U.S. strategy?

Use deals elsewhere to isolate and pressure China, enlisting allies in a containment play.

Everything circles back here: talks with the UK? About China. India? China. Even domestic policies? You guessed it.

Skeptics insist no one wins trade wars…it's mutual destruction.

True, but overlook the power asymmetry.

America isn't a maker anymore? Nonsense…that consumer juggernaut is a superpower.

The world's biggest buyer dictates terms; sellers bend.

China aims to ascend, but the U.S. holds cards: global finance dominance, military might, alliances.

This is no spreadsheet skirmish; it's a Game of Thrones saga, where power trumps economics. Alliances shatter, thrones topple, and the iron fist rules.

Watch that epic over economic tomes, and the world snaps into focus: nations vie for the crown, not just profits.

But is this sustainable? Hegemons don't retire gracefully.

History whispers of "hegemonic wars"…bloody transitions when challengers rise.

The U.S., post-WWII boss, won't yield without a fight.

In 250 years of existence, America's been at war for 230; since 1945, 73 out of 80 years.

Being top dog means constant battles…advantages galore, but a blackened soul, like clutching the One Ring.

War fuels the state, challengers abound. Hope it stays economic, not kinetic, but tariffs are the opening salvo in defending the throne.

Markets? They're the wild card.

Tariffs drove the Q1 plunge, fueled the rebound, but effects loom.

Last week's Fed signals hint September rate cuts, sparking a Dow high, flat S&P, Nasdaq dip.

Divergences scream caution…a hard Q3 correction feels inevitable.

Even a cut might underwhelm; it's priced in. Tariffs embolden more boldness, not retreat. Unintended blowback? Sure. But data so far? U.S. advances.

So, has America lost the trade war?

Far from it…this revolution's just heating up, reshaping power, pockets, and the planet. But what if the biggest twists are yet to come? Stay tuned; the game's afoot.