Macro Jordan Rules

When the error isn't in the Math...but rather in the Denial

“With Jordan, you needed a new plan. The old rules didn’t apply.”

— Isiah Thomas, Hall of Fame Point Guard, Detroit Pistons

The first mistake NBA teams made was treating him like everyone else.

They studied the film. They set their rotations. They stuck their best defender on him and tried not to foul. They played the averages.

In other words, they played the game as they always had.

And they got torched.

Because Michael Jordan wasn’t just better…he was something else entirely.

The usual strategies didn’t work. The normal math didn’t apply. If you walked onto the court thinking he was just another star, you weren’t just unprepared. You were already dead.

The Detroit Pistons were the first to admit it.

They didn’t pretend. They didn’t underestimate. They looked at the problem and said the quiet part out loud:

This is not normal.

And from that admission, they built a plan. Not a fair one. Not a pretty one. But a plan rooted in a simple truth: you cannot approach an anomaly with standard thinking.

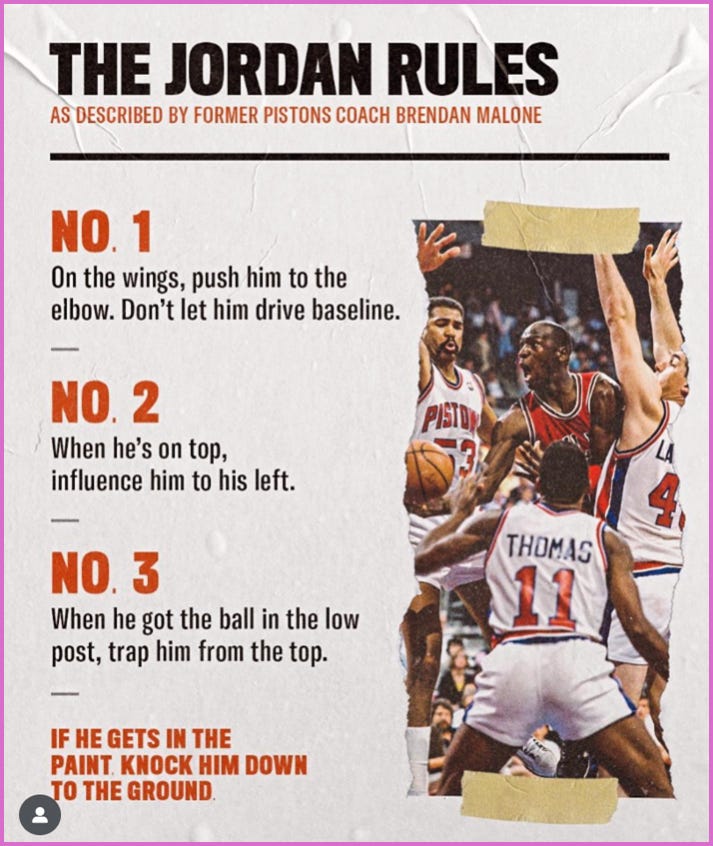

They called it The Jordan Rules.

It wasn’t just a strategy. It was an acknowledgment…a concession that traditional defenses were obsolete. Hit him when he drives. Double him before he touches the ball. Knock him down. Wear him out. Try anything.

Because until they accepted that the normal playbook wouldn’t work, they were not playing to win. They were just trying to survive.

And even once they acknowledged it, they only delayed the inevitable.

That’s the key no one wants to admit: the only way to begin understanding something this dominant is to first acknowledge it’s different.

Deny that, and you’ve already lost.

Treat the anomaly like it’s average, and you will never see the next punch coming.

But this isn’t just about basketball.

It’s about anytime you misread your most dangerous competitor…and build your entire game plan on a lie. The danger isn’t just facing someone great. The danger is treating them like everyone else.

That’s the fatal error…assuming the game works for them the same way it works for all the others.

This same mistake is being made in global macro circles today.

Investors, analysts, and policymakers continue to apply standard frameworks to a player that rewrote the game long ago. They run their models. They tally the deficits. They count the debt.

And they keep missing the bigger truth: the United States doesn’t play by the same rules as everyone else…not because it refuses to, but because it doesn’t have to.

To understand why, we start at the source of that difference…the one thing no other country can replicate, and no spreadsheet can fully explain.

The Global Reserve Currency and the Power of Seigniorage

The first and most important rule is this: the United States issues the global reserve currency.

This fact underpins everything else.

Roughly 60% of global foreign exchange reserves are held in U.S. dollars. More than 80% of international trade is invoiced in dollars. Commodities from oil to wheat to copper are priced in dollars, regardless of where they’re produced or consumed.

In the global banking system, cross-border dollar liabilities…Eurodollars…outnumber the domestic U.S. monetary base by a factor of several times. Everyone needs dollars, even if they don’t need America.

This gives the U.S. extraordinary privileges.

It can run persistent trade deficits without facing immediate currency collapse. It can finance wars and bailouts by issuing debt that the rest of the world is eager to buy.

And most importantly, it can export inflation…or absorb deflation…by shifting dollar supply or interest rates, with cascading effects across the globe.

This is not a bug. It’s the defining feature of the modern monetary order. The U.S. prints the collateral. Everyone else posts it.

And with that power comes seigniorage: the ability to consume more than you produce, because your liabilities are the rest of the world’s liquidity.

This dynamic allows the U.S. to behave in ways that would destroy smaller economies.

So, trying to judge the U.S. by those smaller metrics misses the entire point. The dollar is the benchmark. Everything else trades around it.