If the system can’t handle a minor punch, what happens when it gets clocked with a haymaker?

This isn’t a story about what will happen. It’s a story about what could happen. And if you’re not paying attention, it could be a knockout blow to your portfolio.

The yuan…China’s currency and one of the most tightly managed instruments in global finance…is sitting in the crosshairs of a storm brewing for over a decade. Most market participants aren’t watching. That’s a mistake.

Because if the Chinese are forced to devalue their currency again, it won’t just be another August 2015. It could be much, much worse.

How to Break a Currency

Currencies aren’t just symbols on a trading screen. They are power levers, confidence meters, and time bombs wrapped in Excel charts.

For China, the yuan is all of the above.

At the core of this tale lies an age-old economic paradox: the Impossible Trinity. A country can choose any two of the following three things:

A fixed exchange rate.

Free capital movement.

Independent monetary policy.

China, like all illusionists, has spent the last 30 years trying to cheat the triad.

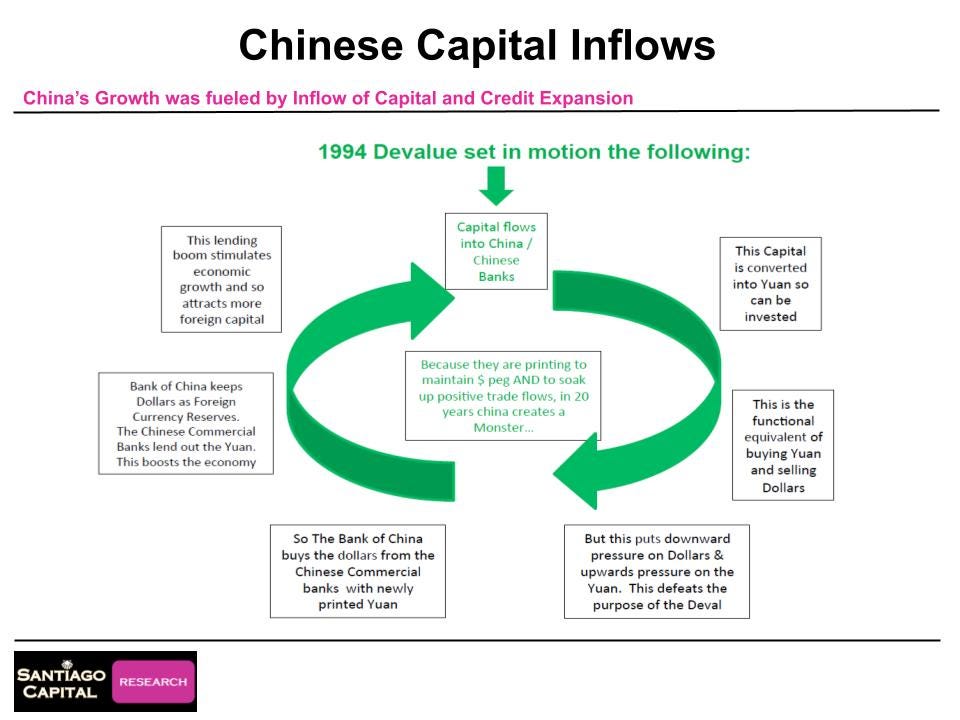

For years, Beijing kept the yuan artificially stable, pulling in foreign capital while tightly controlling monetary policy and the currency peg.

Investors, emboldened by the illusion of stability, poured money into China, which fueled a historic debt and infrastructure boom.

But the capital inflows that juiced growth in the 1990s and 2000s turned into slow leaks after the global financial crisis…and by 2015, the yuan peg nearly broke.

Here’s how the magic trick worked: foreign investors would convert dollars to yuan, flooding Chinese banks with foreign currency.

To prevent the yuan from strengthening…which would make exports less competitive…the People’s Bank of China (PBOC) would take those dollars, print new yuan, and give the new Yuan to the Chinese banks.

This fueled an enormous credit boom. And for a time, it worked brilliantly.

As long as the inflows kept coming, Beijing could fund growth without letting the yuan float freely or sacrificing monetary control.

But as every magician knows, illusions only last as long as the audience believes in them.

The Mini Deval Heard ‘Round the World

In August 2015, China surprised markets with a sudden mini devaluation of the yuan.

It cost them $700 billion in foreign currency reserves to defend the peg…and they still had to let it slide.

The global reaction? A synchronized selloff. Risk assets dropped 5-20% in a matter of days. And that was from a starting point of relative calm.

Today, the global picture looks anything but calm.

What triggered it? Capital outflows. Investors grew nervous about China’s slowing growth, and capital started leaving.

Once the flow reverses, defending the currency becomes incredibly expensive. Every outflow means dollars exit the system.

And since Chinese banks can’t print dollars, they go to the PBOC, which hands them over in exchange for yuan. This reduces reserves and stokes further panic.

In 2015, China still had a strong narrative. It was the global growth engine. It had a rising middle class. It was building Belt and Road. But even then, $1 trillion in reserves vanished in 18 months.

Few outside China noticed at the time. But inside the machinery of global finance, the tremors were loud and clear. It wasn’t just China that shook…it was every investor exposed to risk assets, from Silicon Valley to São Paulo.

$60 Trillion of Leverage Can’t Be Wrong, Right?

From 2004 to 2014, China created $27 trillion of new loans…more than the United States did in its entire history up to that point.

From 2014 to today, they created another $30 trillion.

Total: $60 trillion in domestic credit.

Where did all that money go? Infrastructure, ghost cities, state-owned enterprises, and most importantly…real estate.

By 2014, real estate made up over 30% of Chinese GDP. That’s not a typo.

But every boom needs buyers. And China’s demographics began to turn.

Fewer young people. Slower household formation. Increased debt burdens. And suddenly, those condo towers stopped selling.

To make matters worse, the credit expansion didn’t just build assets…it built expectations.

Local governments became addicted to land sales.

Developers borrowed from everyone, everywhere, all at once.

And households poured their savings into real estate, often owning multiple empty apartments as a form of retirement planning.

In a banking system where some estimates place non-performing loans (NPLs) at 5% or more, that means $3 trillion of bad debt…officially. And that’s the conservative number.

Private estimates run much higher. Some say NPLs are north of 20%. But let’s stick with 5% for now. Even that is more than the entire GDP of India.

The Great Outflow Begins

When capital flows into China, the system expands. Growth is easy, leverage is cheap, and foreign investors cheer.

But when capital leaves? The cycle reverses.

Foreigners dump yuan, buy dollars, and wire funds home.

Chinese banks, short on dollars, turn to the PBOC for help. The central bank sells dollars to support the currency. Reserves fall. Confidence falls faster.

Sound familiar?

It should. Because it’s already happening again.

In the last two years, outflows from China have surged. Equities are underperforming. Foreign direct investment is in decline. And U.S.-China tensions are doing the rest.

Investors see the yuan weakening and grow even more reluctant to hold Chinese assets.

It becomes a self-fulfilling prophecy: weaker yuan leads to lower confidence leads to more outflows.

China is now a less attractive place to park money than at any point in the past 20 years. And that’s a big problem for a country still dependent on dollar-priced commodities like oil, gas, and food.

2015, Meet 2025

During the 2015 mini-deval, China was the darling of emerging markets. Growth was strong. Foreign investment was robust. And they still lost $1 trillion in reserves defending the yuan.

Today, growth is slowing. Real estate is imploding. Demographics are collapsing. Foreign capital is fleeing. And political tensions with the U.S. are escalating.

China’s FX reserves still sit at around $3.2 trillion. Roughly $2 trillion is in U.S. dollars. Their external debt in dollars? Around $1 trillion.

That leaves a buffer of $1 trillion in excess U.S. dollar reserves. Sounds like a lot…until you remember they spent $700 billion in a few months last time.

And if this time is worse?

What Happens If the Peg Breaks?

Let’s play this out:

Capital outflows continue or accelerate.

The PBOC burns through reserves trying to hold the yuan peg.

Investors lose faith in China's ability to defend the peg.

Devaluation becomes inevitable.

What then?

A 5% deval caused a global asset rout. A 10% or 20% deval?

That’s not a correction. That’s crisis.

Every fund exposed to Chinese assets, every institution relying on yuan stability, every commodity priced in dollars…they all get hit.

And if it coincides with U.S. restrictions on outbound capital to China, forced delistings, or mandates to repatriate funds?

You're not looking at a trade war anymore. You're looking at a monetary war.

And we’ve barely mentioned the dominoes. What happens to:

Emerging market currencies pegged to trade with China?

Global commodity exporters who rely on Chinese demand?

Central banks holding yuan as part of their reserves?

A sharp yuan devaluation could ripple outward like a financial tsunami.

Imagine the headlines: Chinese companies defaulting on offshore bonds. Emerging market ETFs in freefall. Commodity prices soaring as yuan-based contracts get repriced in panic.

Now add a geopolitical accelerant. If Trump escalates restrictions on U.S. capital flowing to China, or mandates repatriation of university endowments with Chinese exposure, the feedback loop goes nuclear.

The False Safety of Currency Reserves

Yes, China still has reserves. But consider this:

Their credit system is over-leveraged.

Their bad debts are enormous.

Their economy is slowing.

Their imports…especially energy and food…are mostly priced in dollars.

If China burns through its reserves trying to hold the peg and still loses, not only will confidence evaporate, but the implications for commodity prices, global trade, and risk assets could be catastrophic.

Remember: a devalued yuan makes imports more expensive, drives inflation higher, and can spiral into social unrest.

For a regime built on economic performance, that’s an existential risk.

So will China devalue?

We don’t know.

But can they afford not to?

What if they already are?

And what happens when the music stops and there’s no more reserves left to sell?

⭕️ From ghost cities in China to frozen markets in the West...real estate’s biggest story isn’t about collapse...it’s about a system that looks solid until you try to move through it.