"Build your own ark! The rain will come."

— Robert H. Schuller, Tough Times Never Last, But Tough People Do, 1983

It’s April 26, 2025, and Brent Johnson, host of Milkshakes, Markets, and Madness, is in a reflective mood.

And why not? After a bruising first quarter that saw the S&P 500 tumble 18%, gold spike and retreat, oil gyrate wildly, and the VIX rocketing past 50, Johnson has emerged once again as one of the voices urging calm and focus amid the chaos.

At the heart of Johnson’s analysis is the Dollar Milkshake Theory, a framework that continues to guide his perspective in today’s treacherous markets.

“This is a show where we talk about the financial markets, the madness surrounding those markets, and we do it all through the lens of the Dollar Milkshake Theory,” Johnson says.

It’s a theory rooted in cold, hard financial plumbing: Despite all the problems it is facing, the United States still has an incredible amount of advantages that the rest of the world just doesn’t have. And for better or worse, the world still needs U.S. Dollars to operate on the global stage. This has huge implications for capital flows, reserve assets, and safe harbors during the storm.

And 2025 is shaping up to be a textbook case of needing to understand these variables.

The Setup: Echoes of 2022

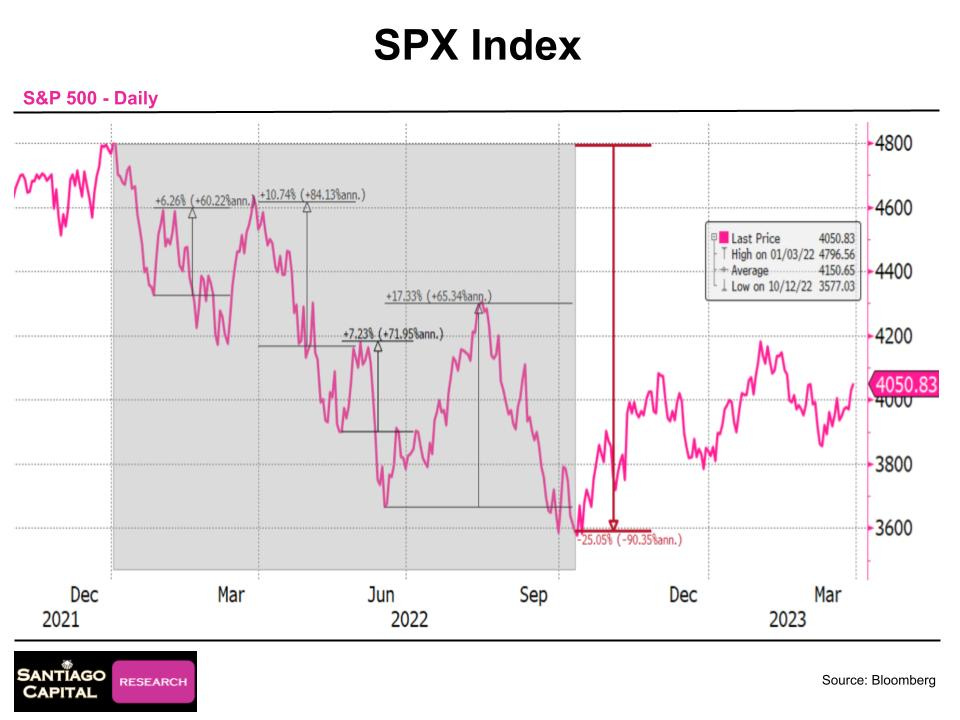

“2022 was kind of my analog for 2025,” Johnson notes.

He runs through the parallels: aggressive policy moves (then it was Fed hikes, now it’s tariffs), brutal drawdowns (25% peak-to-trough in 2022, a 15–17% slam in early 2025), and multiple vicious bear market rallies.

In 2022, countertrend bounces of 6%, 10%, and 17% peppered the landscape. So far this year, the S&P has clawed back 10% from its recent bottom.

The first week of April, what Johnson jokingly calls “post-Liberation Day,” was especially brutal.

Copper, oil, tech stocks, Asian markets, European indices…everything took a synchronized nosedive.

Gold was one of the few assets spared.

“Investors are just now realizing that Trump was serious, and as such, buying puts for the first time with the VIX at 50,” Johnson explains.

But it was too late. A violent repricing of insurance had already taken place as fear jumped off the charts and the VIX spiked over 50 in short order.

Not Out of the Woods

Today, markets are calmer. The S&P 500 has recovered much of its losses. Gold gave back some gains but remains well-bid. The VIX has retreated to below 25.

“I think there is more volatility to come,” Johnson warns.

The unresolved issues…U.S.-China decoupling, the tariff war’s next moves, and the slow-motion train wreck in Ukraine and Russia…are still lurking beneath the surface.

“I’m actually kind of cautiously optimistic for the second half, or at least the fourth quarter of this year. I think by the time we get into the late third quarter, fourth quarter, perhaps we’re going to have better visibility on where we’re headed,” he says.

But we are not there yet.

That timeline matches the 2022 analog, when markets didn’t bottom until October.

The Art of the Hedge

If there’s one theme Johnson hammers home, it’s the need for disciplined risk management. And that other than in extreme cases, portfolios should always have some kind of hedge.

“When insurance is that cheap, it’s just prudent to buy it, and if it expires worthless, you know what? That’s just the cost of doing business while having some of your backside protected,” he says, recalling the euphoria of January when market participants were calm and the Vix was around 15.

Johnson pulls out a recent case study:

January 23, 2025: SPY trading at 610. The VIX around 15. A June 30, 600-strike put…just 1% out-of-the-money…cost $16, or about 2.5% to protect the portfolio value.

Mid-February: That same put drifted lower, to about $13.

April 8: SPY plunges to 497. The put rockets to $108…a stunning 7x gain.

“Anytime the VIX is below 20, to me, that’s starting to get pretty low. And if it gets into 15 or lower, to me, that starts to get extreme,” Johnson says.

Had an investor allocated 2.5% to puts back in January, they would have dramatically cushioned the 18% drawdown that hit by early April.

Instead of seeing their $100,000 portfolio shrink to $80,000, it would have slipped only modestly to $97,500.

“Did it 100% perfectly protect your portfolio? No, but pretty darn close, right? And while everybody else that was all in on the S&P 500 is sitting at 80,000, your portfolio is at 97,500,” Johnson says bluntly.

Hedging before the storm hits can make all the difference…but how do you know when the clouds are real and not just passing shadows?

You don’t.

There are no guarantees when it come to financial markets. But you can use positioning, relative strength, and sentiment to move the odds into your favor.

We discussed these in detail in a previous post, Anatomy of a Trade.

The Trap of Chasing Fear

Contrast those we planned ahead with those who tried to hedge after the market had already cracked.

April 8: A June 30, 492-strike put (still about 1% out-of-the-money) cost $30… nearly 6% of a portfolio for just two and a half months of coverage.

Short-term puts: An April 25 expiration put cost $20, or 4% of the portfolio, for less than three weeks of protection.

“6% for two months, that means to protect a whole year, you’d have to…it would be 36%. I mean, that’s, that’s very, very expensive,” Johnson says.

He likens it to “gladiators saluting the Emperor before their demise.”

“If you didn’t already have those hedges on and you’re trying to put them on post-Liberation Day when everybody else is trying to do the same thing and everybody else is freaking out, the cost to buy insurance here is much higher,” he says.

By April 8, when investors scrambled to pay through the nose for downside protection, it was too late. The only thing left to come was the ritual sacrifice.

Timing the VIX

Much of Johnson's strategy revolves around the VIX, the market's fear gauge.

“The VIX measures forward-looking volatility based on short-dated S&P options,” he explains. “But it’s not the kind of thing you want to be trading directly.”

Instead, Johnson often uses SPY puts to hedge.

Over the past 20 years, VIX spikes above 50 have been fleeting.

Central banks, he points out, simply cannot tolerate sustained market dysfunction.

“Those spikes are the time where you want to start taking it off. Those spikes are not the time that you want to start putting them on,” he says.

True to form, he sold the bulk of his puts during the April 8 spike, locking in massive gains. He’s rolled down a few, maintaining partial hedges, but mostly took profits.

Now? With the VIX back near 25, he’s cautiously nibbling again, buying protection in anticipation of the next wave down.

“If we get the VIX back below 20, or even in the range of 20, we will very likely start adding more protection to the downside,” Johnson says.

A Playbook for 2025

Johnson’s playbook draws heavily from the lessons of 2022:

Multiple legs lower: 2022 wasn't a straight-line crash. Markets fell, bounced, fell harder, bounced again.

Policy uncertainty: Back then, it was Fed rate hikes. Today, it's tariffs and geopolitical realignment.

Pockets of opportunity: Those who stayed patient and tactical…adding protection when cheap, taking it off during spikes…fared far better than the crowd.

“Markets don’t move in a straight line, even when they’re volatile and even when, overall, directionally, there is a trend. There are oftentimes… going to be countertrend rallies along the way,” Johnson says.

Ultimately, he believes clarity will emerge by late Q3 or Q4, as the market digests the full impact of Trump’s trade agenda and the global chessboard reshuffles.

“I am more than happy to burn a little bit of premium in insurance in order so that I can sleep at night and so that I can keep my wits when everybody else is freaking out,” he says.

Insurance Isn't Free… But Ignorance Is Expensive

One point Johnson drives home: hedging costs money. But not hedging can cost far more.

“If the market goes up 15% that year and I spent 1 or 2% on insurance, and as such, I’m up 13 or 14 rather than 15. That’s fine, because when it does pay off, you more than make up for that portfolio drag,” he argues.

Spending 1–2% of a portfolio annually on puts when volatility is low is a small price to pay, he argues, for the right to stay solvent and opportunistic when the panic comes.

Stay Disciplined, Stay Liquid

As the conversation winds down, Johnson shares one final observation.

“Hope this has been valuable. You know, buy insurance when you can, not when you have to,” he concludes.

He sees plenty of turbulence ahead…but also plenty of opportunity for those willing to think ahead, stay flexible, and respect the realities of market psychology.

The storm is far from over. But for those with an open mind and a disciplined process, there is a way through it. And the opportunity to even profit from it…is becoming clearer by the day.

Stay tuned. The next squall might just be the one that rewards the disciplined few who remembered to pack an umbrella…before the skies turned black.

⭕️ America isn’t retreating…it’s rearming. Financial warfare has replaced free trade, and the global order is already shifting. But what shocks lie just ahead?