Picture this: the stock market soaring to dizzying heights, defying gravity like a rocket fueled by endless optimism.

Tech giants lead the charge, passive investors pile in, and headlines scream "bull market forever."

But beneath the surface, cracks are forming. Whispers of overvaluation, extreme positioning, and seasonal storms are growing louder.

Could this be the calm before a much-needed storm?

Let's peel back the layers and see why a correction might be lurking just around the corner.

The market's relentless climb has been nothing short of spectacular.

Since the lows of early 2023, indices like the S&P 500 and NASDAQ have powered ahead, driven by a handful of mega-cap names that seem unstoppable.

Yet, as prices push into uncharted territory, traditional metrics are flashing red. Take price-to-sales ratios…they've never been higher, eclipsing even the peaks of past bubbles.

This isn't just a quirky stat; it's a sign that investors are paying premium prices for every dollar of revenue companies generate.

On its own, it's intriguing, but when stacked with other signals, it starts to feel like a house of cards.

Speaking of valuations, price-to-book ratios are at their loftiest in 25 years.

Companies' market values are ballooning far beyond their tangible assets, suggesting euphoria rather than fundamentals.

But is this sustainable, or are we witnessing the classic setup for a reality check?

Hold that thought…we'll circle back to how concentration in a few stocks amplifies the risk.

What Happens When Credit Markets Play It Too Safe?

Shift gears to the credit world, where things look eerily calm. High-yield credit spreads…the premium companies pay over safe Treasuries…are at near 30-year lows.

Tight spreads scream "no risk here!" Everyone assumes smooth sailing, with lenders happily funding even riskier bets at bargain rates.

In a healthy market, this might signal confidence, but history shows it's often the prelude to trouble.

When fear creeps in, spreads widen fast, choking off liquidity and hammering stocks.

Imagine a party where no one's worried about the fire exit…until smoke appears.

That's the vibe in credit markets right now. No alarm bells ringing, but combined with sky-high valuations, it's another flag waving furiously.

And if credit tightens, who gets hit hardest?

The over-leveraged tech darlings that have propelled this rally, of course. But what if the real danger lies in how lopsided the market has become?

Let's explore that next.

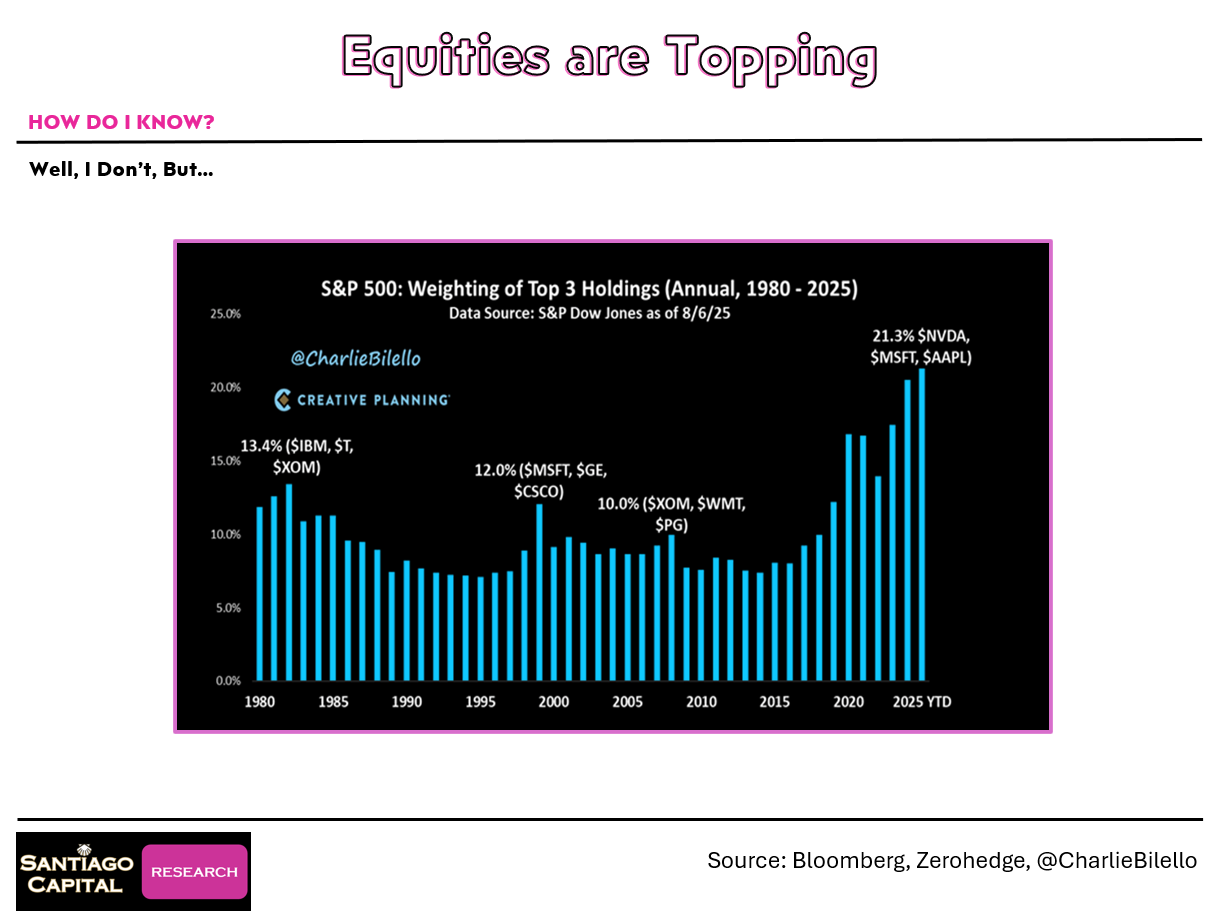

Is the Market's Power Concentrated in Too Few Hands?

Zoom in on the tech sector, the undisputed king of this bull run.

The S&P 500's performance is increasingly dominated by a select few…think the Magnificent Seven or even narrower, with names like Nvidia pulling disproportionate weight.

Concentration metrics are at extremes, with the top 10 stocks accounting for an outsized chunk of gains. This isn't diversification; it's a high-stakes bet on a handful of winners.

Visualize the market as a Jenga tower: pull out those key blocks, and the whole thing wobbles.

Tech's influence shows up in charts where the broader index masks weakness elsewhere.

The Dow lags, unable to hit new highs, while the NASDAQ barely squeaks through, propped up by passive flows into ETFs.

But here's the kicker: momentum is fading.

Stocks trading on hype rather than profits are trouncing the fundamentally sound ones. Momentum works until it doesn't…remember, it cuts both ways, like stairs up and an elevator down.

This lopsided setup raises a burning question: What if the trend-followers, those momentum chasers, all head for the exits at once?

Dive deeper into positioning data, and you'll see why that's a real possibility.

Are Investors All Betting the Same Way…and What If They're Wrong?

Positioning tells a tale of uniformity. Systematic equity strategies are at 89% exposure…not an all-time high, but a stark reversal from the caution of just six months ago.

Commodity trading advisors (CTAs), those trend-followers who amplify moves, are dialed up to 95% long.

By design, they're followers, not leaders, meaning the herd is fully committed. Everyone's mega-long, with little room for new buyers.

Add in the put-call ratio: it's not screaming fear. Options traders aren't loading up on protection; they're complacent, betting on more upside.

The VIX, Wall Street's fear gauge, lounges at 15…a level that's historically low and rarely sustainable. Sure, it can dip lower, but when it spikes, it does so violently, catching the unprepared off guard.

Preparation is key; reacting after the fact is like trying to board a speeding train.

But timing matters. Why now?

Seasonal patterns offer clues, but could they align with a perfect storm of catalysts?

Let's unpack the calendar and see if history is rhyming.

Why Does Fall Feel Like Crunch Time for Markets?

History has a funny habit of repeating in the markets, especially around seasons.

The four-year election cycle shows we're entering a phase where stocks typically go sideways or down. September and October? Notoriously volatile.

Crises…from Black Monday to the 2008 meltdown…often brew in the fall. Why? Who knows…maybe it's back-to-school blues or post-summer realities…but data doesn't lie.

Annualized volatility spikes this time of year, and with the VIX already suppressed, any jolt could amplify swings.

We're not just talking abstract history; upcoming events pack a punch. Fed Chair's speech at Jackson Hole looms, followed by Labor Day and another Fed meeting.

Rate cuts? Economic data? Geopolitical flares? A half-dozen triggers wait in the wings, any one capable of halting the grind higher.

Intrigued yet? These seasonals aren't isolated…they compound with technical warnings. What if charts confirm the momentum stall?

Let's scrutinize the squiggles and see the divergences emerging.

Are Technical Cracks Signaling a Reversal?

Technical analysis isn't crystal-ball gazing, but it's spotting patterns.

Take the S&P 500: price flirts with new highs, but relative strength index (RSI) and stochastics show divergences.

Overbought in summer, a pullback eased pressures, but the bounce lacks conviction.

Momentum heads down while price tiptoes up…a classic bearish signal.

The NASDAQ tells a similar story.

It notched a fresh high, but only barely, thanks to those concentrated tech flows. The Dow? Stuck below peaks, highlighting breadth issues.

Semiconductors, crucial to the rally, rolled over too. Nvidia's influence is immense…almost systemically important, like a too-big-to-fail bank.

But its chart shows fading momentum; a downturn here could drag everything.

Think of it as biking up a steep hill: initial speed carries you far, but stop midway, and restarting is grueling.

The market's paused three-quarters up, momentum waning. Challenges abound to push higher.

Gaps in charts hint at potential drops: S&P could fill voids at 7-8%, then 11-12%, even 18%. NASDAQ eyes 10-19%, semis over 20%. Not apocalyptic, but healthy resets after years of gains.

So, is a 10-15% pullback on the horizon?

It's not a crash prophecy…far from 1929 or 2008 echoes…but a normal breather.

Patterns overlaying 2008 setups are uncanny, but context differs.

Exceptionalism bulls scream higher; doomsayers predict Armageddon. Reality?

Somewhere in between: a correction soon, perhaps by Q3's end, then a base for fresh highs. But why not chase upside now?

Risk-reward skews poorly.

Buying here feels like grabbing the last cookie from a crumbling jar.

Curious about shielding gains? What if cheap insurance could turn a dip into opportunity? Let's examine smart ways to navigate turbulence.

How Can You Armor Up Without Betting the Farm?

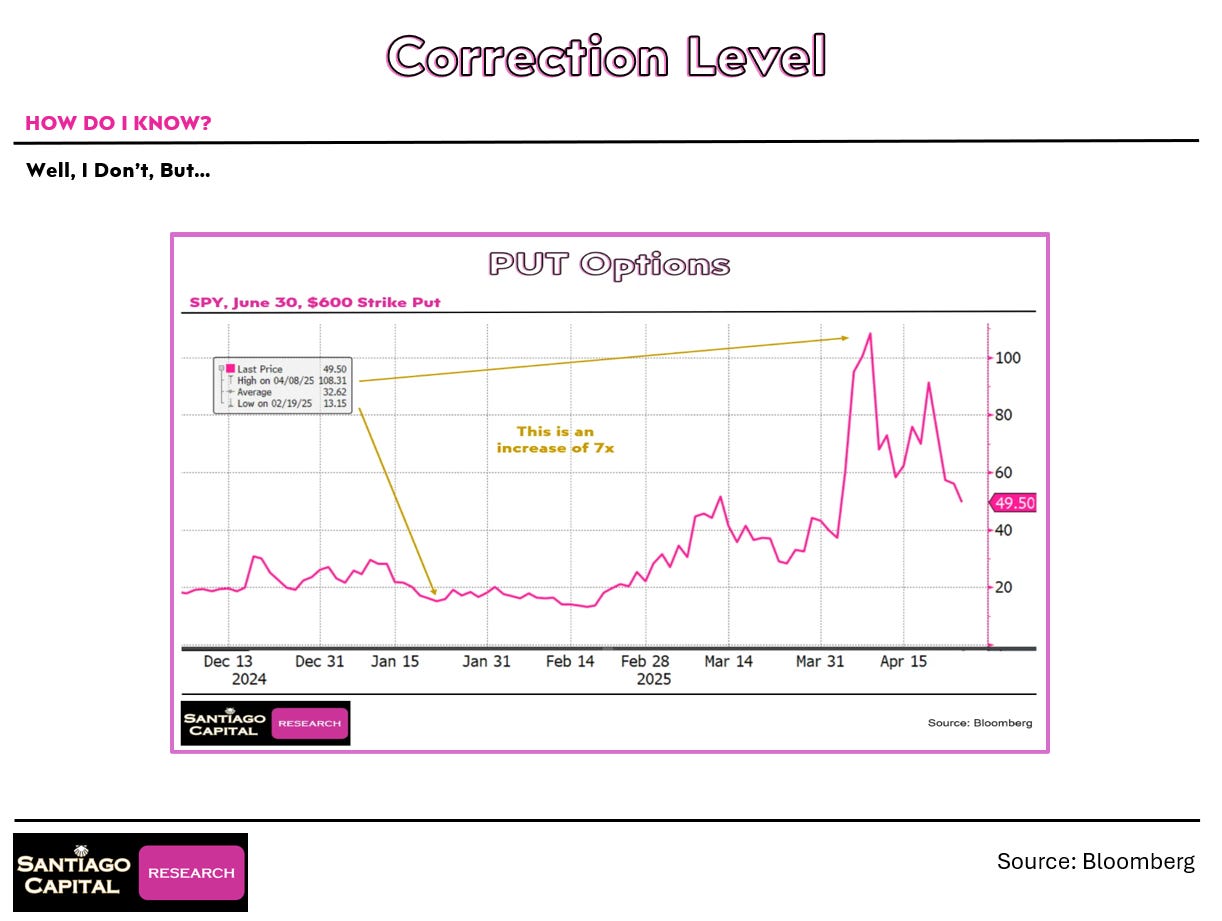

In frothy markets, protection is prudent, not paranoid. With VIX low, options like puts are bargains.

Imagine hedging a portfolio: a put slightly out-of-the-money through December costs about 2.5%…same as earlier this year when similar setups paid off handsomely.

In April's dip, that put rocketed from $17 to over $100, a 7x gain offsetting losses.

It's like buying home insurance during a drought…cheap when risks seem distant.

Time it right, say through September, and costs drop further.

Past setups in July last year and spring this year proved early but right. Worst case?

Insurance expires unused, a small premium for peace. Best case? It cushions the blow, letting you reposition smarter.

Concentration heightens fragility; a few names falter, and the tower teeters.

Yet, a pullback could fortify foundations, enabling sustainable climbs. Markets aren't crashing; they're correcting, purging excesses.

View it as a forest fire clearing deadwood for new growth.

What's Next: Catalysts or Calm?

As summer fades, the stage is set. Jackson Hole could drop rate hints, shaking complacency.

Post-Labor Day, Fed decisions loom amid election noise.

Geopolitics simmer, economics fluctuate…plenty to ignite volatility.

Will the correction materialize, or does the bull defy odds again?

Signs stack up: valuations stretched, positioning crowded, technicals diverging, seasonals ominous.

No guarantees, but ignoring them is folly. A 10-15% dip wouldn't shatter empires; it might refresh them.

The market's a thrilling ride…exhilarating ups, stomach-churning drops. Stay vigilant, hedge wisely, and turn potential pitfalls into profits.

After all, in finance, fortune favors the prepared.

What if this dip is your next big buy?

Only time…and the charts…will tell.

🔴 Upgrade to Paid and take advantage of the premium level content below: