The Geopolitical Chessboard Ignites: Are We Witnessing a New Empire Rise?

Imagin the world stage resembling a brutal episode of Game of Thrones, where alliances shatter, incursions spark overnight, and financial markets hang on every power move.

Just last week, the United States launched a swift military push into Venezuela, met with surprisingly minimal pushback so far. But that’s merely the opening salvo in a saga that’s far from over.

Geopolitics isn’t just background noise anymore...it’s the dominant force steering stocks, bonds, and your retirement fund.

We’ve been inching toward this reality for years, but now it’s here, raw and undeniable.

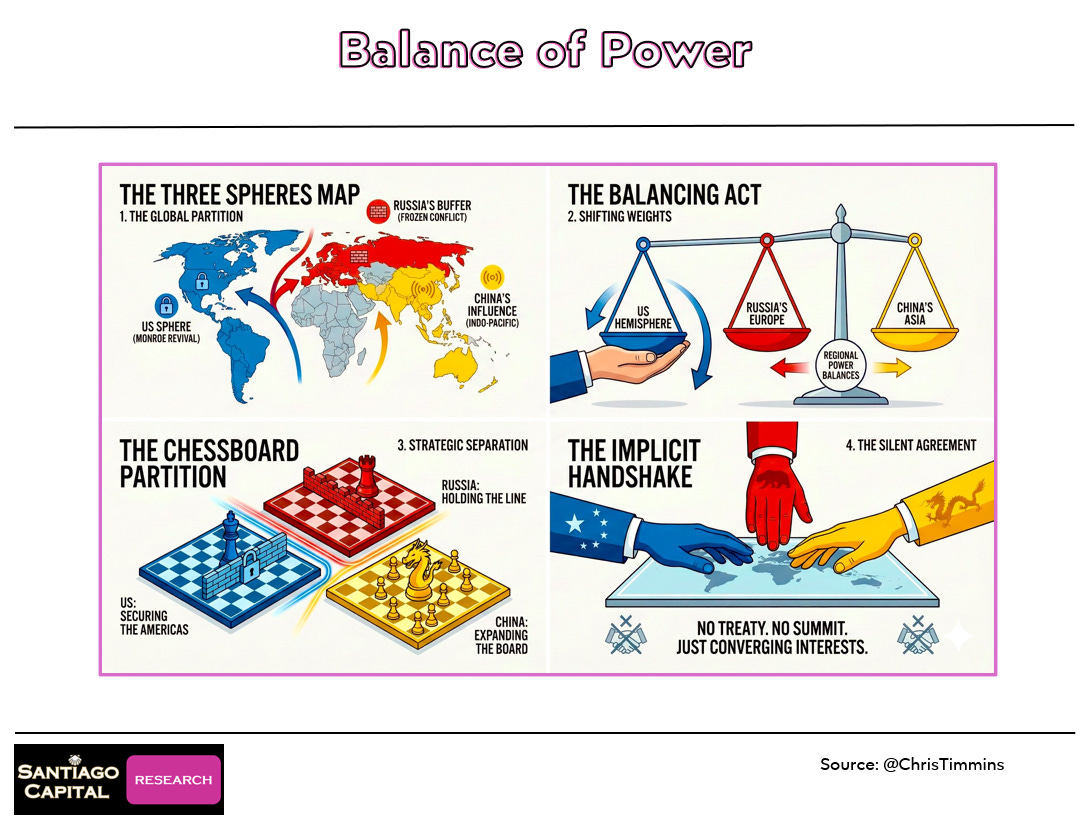

Debates rage about whether global power is fracturing into new spheres or if something more sinister is at play.

Some whisper of a pre-orchestrated carve-up: the US claiming the Western Hemisphere, Russia dominating Northern Europe and Asia, China swallowing Southeast Asia and even eyeing the Indian subcontinent.

It sounds plausible in a post-COVID de-globalization era, but is this really the script? Or is the US flexing muscles that never truly weakened, just hidden behind a polite facade?

What if the so-called shift isn’t a retreat but a ruthless recalibration? Buckle up as we strip away the illusions and reveal how this power play is rewriting the rules of finance.