The Return of Hard Power

Investing in National Defense

Executive Summary

It starts quietly.

A headline here, a policy shift there. Then, almost imperceptibly, the world changes its footing. What once passed for peace now looks more like intermission.

Factories hum again, not with consumer goods but with munitions. Budgets once devoted to welfare and green initiatives are being rewritten in the language of deterrence.

Something fundamental is stirring beneath the surface of global markets, and investors who sense it early will be the ones best positioned when the noise becomes undeniable.

Global defense spending is undergoing an escalation not witnessed since the height of the Cold War.

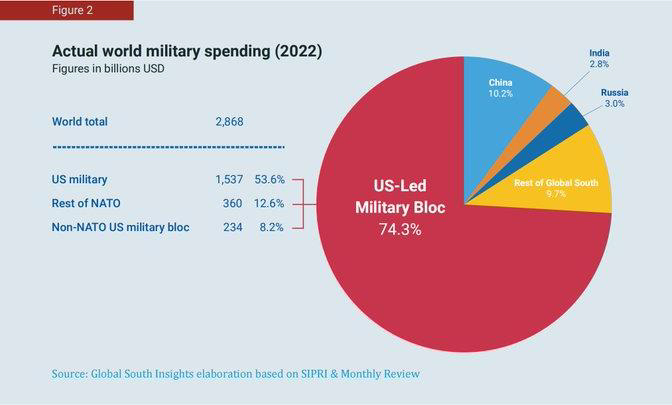

According to the Stockholm International Peace Research Institute (SIPRI), worldwide military expenditures surpassed $2.4 trillion in 2024, marking the ninth consecutive year of growth.

But this surge is not a fleeting response to a handful of conflicts. It is the outward expression of a deeper structural shift.

The post–Cold War era of globalization, efficiency, and interdependence has given way to one defined by rivalry, fragmentation, and national security.

Sovereignty now takes precedence over integration, and military modernization has become a long-term fixture of fiscal policy.

The implications are profound.

The defense sector sits at the crossroads of this new global reality, one that could define capital allocation for decades.

For investors, it offers a rare convergence of durability, visibility, and technological expansion.

Unlike most industries, where revenues wax and wane with consumer sentiment, defense contractors operate under multi-decade government commitments.

These programs encompass fighter jets, naval shipbuilding, and missile defense systems.

They secure revenue well beyond conventional corporate horizons, transforming defense into one of the few predictable constants in a volatile world.

Yet predictability is only the beginning.

The modern defense complex is rapidly evolving into a crucible of frontier innovation.

Artificial intelligence, autonomous systems, hypersonics, cyber defense, and space infrastructure are no longer speculative. They are operational priorities absorbing billions in annual funding.

The line separating military and civilian applications grows thinner each year.

This dual-use feedback loop allows defense demand to drive commercial adoption, creating a cycle of innovation that reshapes entire industries far from the battlefield.

Even the raw materials of modern deterrence have become instruments of strategy.

Rare earths, titanium, uranium, and semiconductors underpin every advanced weapons system, stealth aircraft, and secure communications network.

Yet control over these inputs lies largely with China and Taiwan, forcing Western nations to rebuild industrial capacity and supply resilience from the ground up.

In this reshoring wave, spanning critical mining ventures, rare-earth processing, and semiconductor fabrication, state-backed capital and private opportunity are beginning to align.

And perhaps most paradoxically, defense has proven anticorrelated with crisis.

While most sectors retreat in recessions, defense spending is often reinforced.

National security is politically untouchable, and history shows that downturns, conflicts, or global shocks tend to lift, not lower, military budgets.

That dynamic turns defense into both a hedge and a growth engine, offering steadiness when volatility strikes and upside when instability deepens.

Taken together, these currents are converging to make defense one of the defining investment megatrends of this century.

It fuses the stability of state-backed contracts with the velocity of technological innovation, the scarcity of strategic resources with the inevitability of geopolitical competition.

What follows is not a moral judgment but an observation of economic reality. The world is re-arming, and the flow of capital is following suit.

In the pages ahead, we trace the global defense supply chain, from upstream critical inputs to downstream AI-enabled systems, revealing where opportunity lies, where risk hides, and how this accelerating transformation may reshape not just portfolios but the balance of global power itself.