The Donald & The Damage Done

“Realpolitik is the art of the possible—but it often ignores the cost of the probable.” — Anonymous diplomat, paraphrasing Bismarck’s legacy in a modern context

Executive Summary

History rarely gives advance notice that it is laying down a marker.

Empires do not typically hold press conferences when they change the rules.

And Superpowers do not typically send warnings before they weaponize the system they built.

And yet — America is telling the world exactly what is coming.

This is not the chaos of decline. This is not the flailing of a fading empire.

This is the world’s dominant power consolidating its control — unapologetically, aggressively, and with the full weight of its economic engine behind it.

And the playbook is not subtle.

The Trump Administration has thrown out the ivory tower frameworks of globalization, free trade, and rules-based cooperation — and replaced them with something far older, simpler, and more ruthless:

Realpolitik and Statecraft backed by Financial Warfare.

Tariffs are not policy details — they are pressure points. Supply chains are not economic abstractions — they are leverage.

And foreign governments and multinational CEOs are not partners — they are counterparties in a zero-sum contest for control.

Access to the American market — the largest, wealthiest, and most consumption-driven in human history — is no longer free.

It will come with a price.

But power moves like this do not come without consequences. Global capital is shifting.

Markets are trembling.

Foreign holders of U.S. assets — lulled for decades by predictability and privilege — are discovering that what the U.S. giveth, the U.S. can taketh away.

This is not about trade policy. And it is not about tariffs.

It is about power — who has it, who does not, and what happens when the world’s largest economy decides to stop pretending otherwise.

If you want to understand what comes next — the risks, the ruptures, the extraordinary unintended consequences — you will need to keep reading.

Because the damage that has already been done?

That is just the beginning…

The United States – The Shock

Amid the rising chorus of condemnation directed at President Trump’s hardline tariff policy, it seems almost forgotten that he was elected with a majority in both houses on an explicitly “America First” platform — one that very clearly featured the aggressive use of tariffs as a central policy tool.

In many ways, today’s backlash evokes a classic scene from the iconic film Casablanca.

In one of its most memorable moments, Captain Renault feigns outrage as a pretext to shut down Rick’s Café.

With a tone of mock sincerity, he famously declares, “I’m shocked — shocked! — to find that gambling is going on in here!”

Mere seconds later, a croupier casually hands him his own winnings.

The scene brilliantly encapsulates Renault’s hypocrisy, as well as the film’s broader themes of moral ambiguity during times of conflict — all underscored with a hint of dark humor.

Much the same dynamic is playing out today.

After several decades of what Trump’s election campaign characterized as the deliberate and systematic hollowing out of America — and in particular, the erosion of the American working class — his message was unequivocal:

“No more.”

At the top of Trump’s list of culprits is China.

From the outset, the incoming administration has sought to reassert American leverage by reversing what it sees as decades of lopsided concessions granted to major trading partners.

Europe, too, finds itself in Trump’s crosshairs.

And while many — both domestically and abroad — have responded with outrage, Trump’s answer has remained consistent: he is simply doing what he was elected to do.

But in light of some of the backlash, particularly from those from the same side of the aisle, one has to ask:

Is the pushback we are witnessing not simply a form of buyer’s remorse?

None of Trump’s advisers, at any rate, can credibly claim to be surprised by the President’s resoluteness.

He has been unambiguous and unwavering in his stated mission to upend the current global order — a mission he has pursued with relentless focus.

Inside the United States, those with the most to lose are the CEOs of multinational corporations whose earnings have become increasingly dependent on foreign markets.

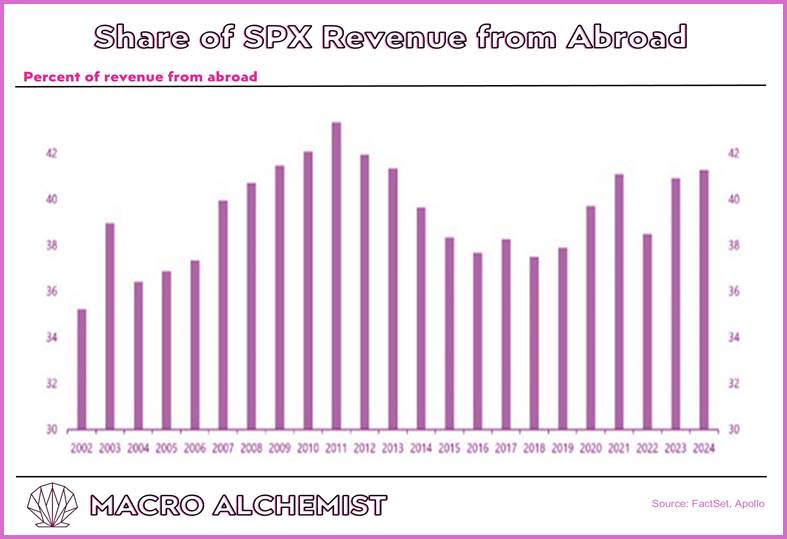

Today, more than 40% of the revenue generated by companies in the S&P 500 comes from outside the U.S. That is a substantial exposure, and one now being called into question.

At the same time, until the U.S. can fully transition into a more “re-shored” economy, the short-term burden of that transition will fall squarely on the American consumer.

The so-called “Liberation Day” tariffs are already driving up prices, which is likely to trigger a degree of retrenchment in household spending — particularly on non-essential goods.

This, in turn, places near-term pressure on U.S. economic growth.

But again, none of this should come as a surprise. These were predictable outcomes, well-telegraphed long before the November election.

Equally foreseeable was the prospect of retaliatory tariffs from a deeply aggrieved China — a country with far more at stake than most.

With the U.S. accounting for nearly 30% of all global consumption, China’s continued access to the American market is not just important — it is existential.

China – The Box

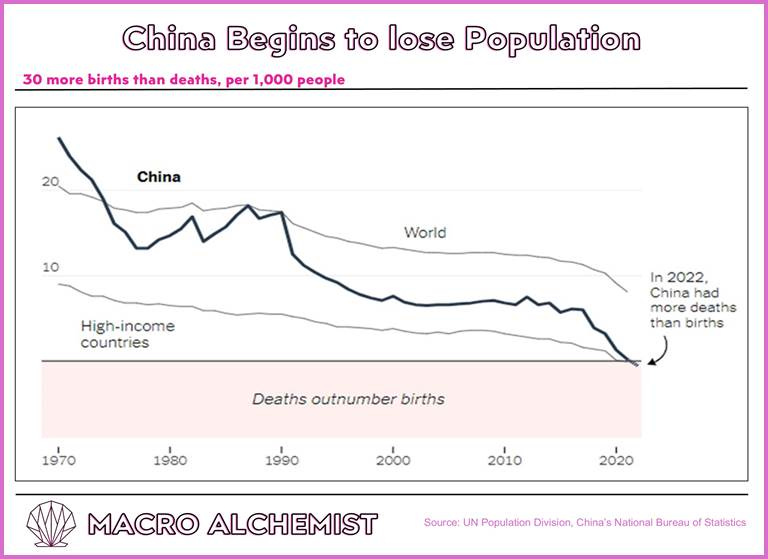

This situation would be significantly less problematic for China if it were capable of stimulating robust domestic consumption.

However, as we’ve previously written, China’s current economic model is fundamentally broken — and increasingly unsustainable. And no amount of “more of the same” stimulus will change that.

The country faces a rapidly declining population and a staggering oversupply of housing — with estimates pointing to around 90 million empty apartments.

There is little incentive to build more, especially when the bulk of household wealth in China is already tied up in real estate.

As we highlighted in our inaugural report, that wealth, in turn, is now eroding as the property sector undergoes a slow-motion crash reminiscent of Japan’s long stagnation.

China cannot build its way out of this malaise. More bridges, more roads, more ghost cities — these are not solutions. Instead, they are symptoms of a deeper dysfunction.

At every level of government, indebtedness is rising. The banking system is heavily leveraged. The manufacturing sector — long the engine of China’s growth — is facing excess capacity.

And now, with a wave of U.S. reshoring underway, that capacity is about to face new competition both within the United States and beyond its borders.

As such, China’s export machine is increasingly boxed in.

Not only is U.S. domestic manufacturing poised for expansion, but key economic zones such as Europe are beginning to erect their own defenses — implementing policies to prevent China from dumping excess goods at artificially low prices.

Into this environment steps President Trump, who has undeniably widened the aperture of economic confrontation well beyond what his predecessor envisioned.

The trade war has intensified, and Trump’s stated objectives are part of a far longer-term strategy — one that will extend well past the horizon of a second term.

With mid-term elections looming at the end of next year, the urgency to act is amplified.

History suggests he could very well lose his absolute majority, which raises the stakes for near-term implementation.

In this context, it is unreasonable to assume that any of these outcomes — economic retaliation, political backlash, geopolitical tension — would come as a surprise to the President or his advisers.

The “America First” agenda has always been public, deliberate, and unapologetically confrontational.

To advance it without anticipating resistance or condemnation would be out of character for an administration that prides itself on preparation.

And despite popular opinion, Trump and his team are not naive.

Divide & Conquer

The premise is a simple one: If you want access to American markets, you will either pay more — or reshore your operations in America and create jobs for Americans.

If you do not, you will bear part of the tax burden that has long been shouldered by the American worker, displaced by decades of offshoring.

This message has not gone unheard.

According to Treasury Secretary Bessent, seventy countries have already expressed a willingness to renegotiate trade agreements with the United States under this new framework.

And as a sign of this shift taking root, Hyundai recently announced plans to build a $5 billion steel plant in Louisiana — a clear win for the reshoring narrative.

But to the surprise of absolutely no one — least of all President Trump — China was not among the seventy countries willing to enter into these discussions.

Efforts by President Biden to escalate the trade conflict with China were largely ineffective.

Rather than triggering a meaningful decoupling, Biden-era tariffs encouraged the creation of “arm’s length” workarounds — supply chain detours through countries like Canada, Mexico, and Vietnam.

These countries became intermediaries, allowing Chinese goods to find their way into the U.S. market while technically avoiding direct violation of the tariffs.

Trump’s incoming team was more prepared for such evasive tactics.

Unlike prior administrations, they anticipated that many countries would attempt to serve two masters — maintaining their relationships with both the U.S. and China.

To counter this, Trump’s strategy includes blunt-force tools designed to eliminate ambiguity.

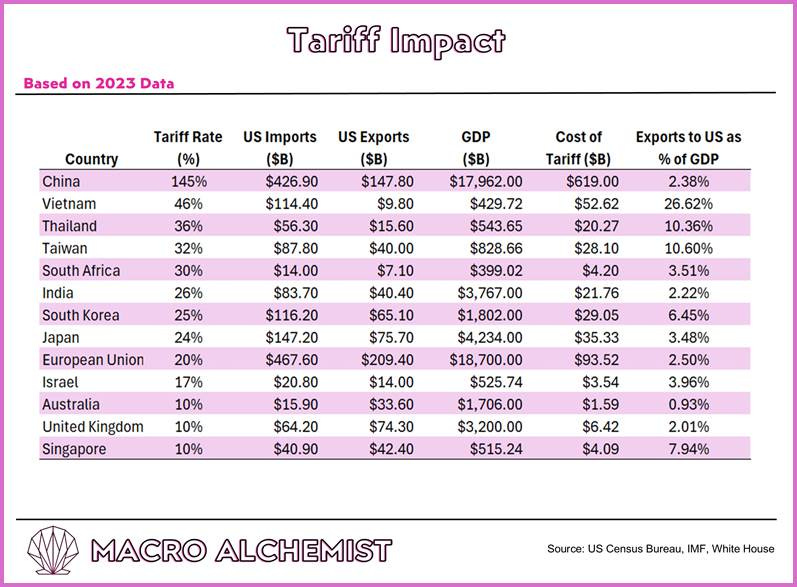

For example, the imposition of a 46% tariff on Vietnam forces a moment of reckoning.

With over 25% of Vietnam’s GDP tied to exports to the U.S., the country was compelled to reconsider its balancing act.

As a result, within hours of the reciprocal tariff announcement, Vietnam did just that.

This is the power of bilateralism.

Under multilateral agreements, the U.S. sacrifices leverage in favor of collective negotiation — often at the cost of speed and clarity.

In contrast, bilateral agreements allow the U.S. to deal directly with each country, stripping away cover and forcing clear choices.

In this model, a country like Vietnam must choose a side.

And make no mistake: this trade war is all about choosing sides.

President Trump & Treasury Secretary Bessent have each said as much.

Everything else — every strained alliance, every tariff on a third-party country, every disrupted supply chain — is collateral damage.

And in the eyes of the Trump administration, that collateral damage is not only acceptable...it is strategically necessary.

The Fallout

It is reasonable to conclude that the market turmoil triggered by “Liberation Day” was anything but unforeseen.

Unlike prior administrations, there has so far been little attempt to stem the steep selloff in U.S. equities.

This calculated inaction is not the result of oversight or inexperience — it is strategic.

It reflects an Administration that is prepared to endure near-term volatility in pursuit of a broader, long-term reshaping of the global order — one in which America occupies a more dominant, less encumbered role.

Integral to this outlook is Treasury Secretary Scott Bessent, a seasoned market veteran who is no stranger to financial cycles or capital market dynamics.

To think he did not anticipate the potential shock to asset prices would be…silly.

In public remarks, Bessent downplayed the market reaction, framing it as “a Mag 7 problem, not a MAGA problem” — a subtle but pointed dismissal of the idea that this correction reflects any weakness in the administration’s strategy.

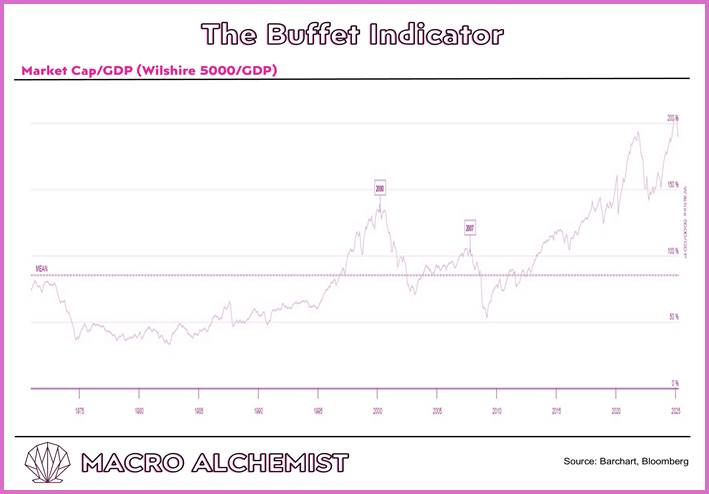

The administration has also been open in its belief that it inherited an overvalued stock market.

The Buffett Indicator — a measure of total U.S. market capitalization to GDP — had reached historically extreme levels, well above long-term averages.

In the Administration’s view, some degree of correction was not only inevitable but necessary. And in that context, the current pullback is less a crisis than a recalibration.

But that does not mean that there has not been, and there will not be more, consequences.

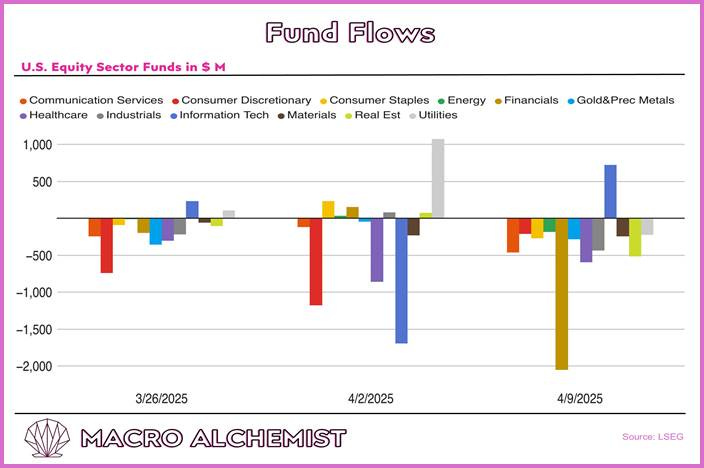

Much commentary has centered around the amount of outflows from US equity markets.

And this is without question the case:

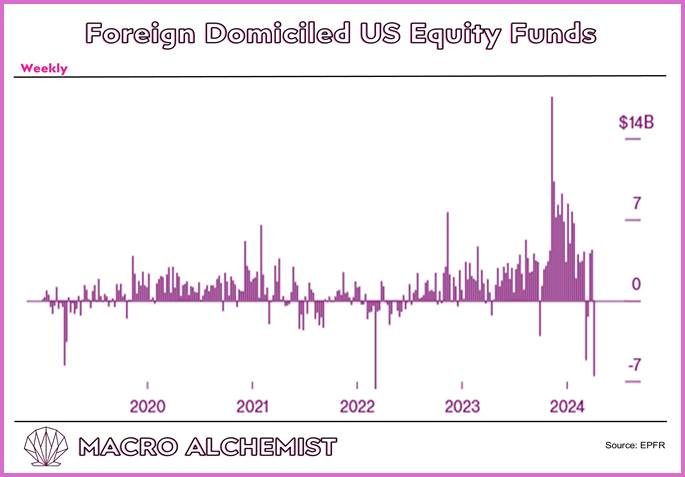

Outflows are also occurring in non-US domiciled US equity funds:

However, these outflows must also be taken into context with the massive escalation in US exceptionalism as the key theme of the market strength of recent years.

At the start of this year, US stocks accounted for 50% of global market capitalization, an all-time high.

It is not unreasonable to expect a reversal just as Bessent clearly does.

Furthermore, foreign ownership of US stocks has never been this high, and the $20 trillion of current foreign ownership of US stocks has tripled over the past decade.

With Trump also expecting allies to spend more on defense, we can expect a reset in this unprecedented inflow to US stocks, largely into the Mag 7.

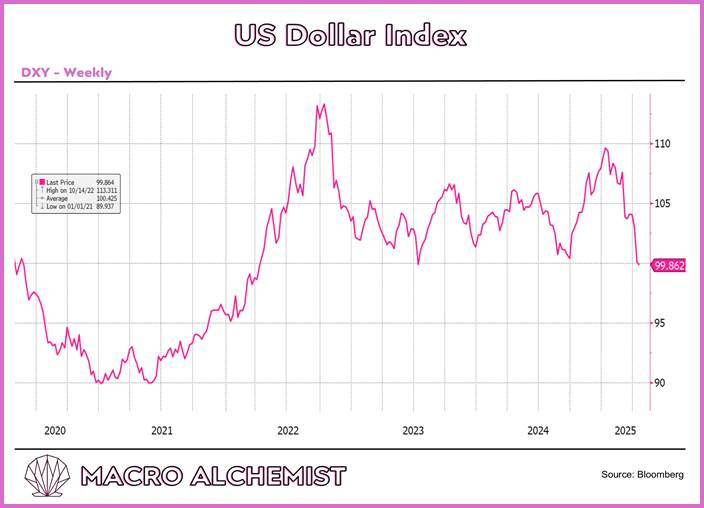

As foreigners liquidate positions and repatriate their capital, short-term weakness in the USD is not a surprising outcome of this reset.

But if the downturn were to continue, and markets were to transition from recalibration to crisis, we would expect this chart to reverse.

The Three T’s - Tariffs, Trade, and Taxes

At the core of the America First platform lies a foundational idea:

The United States must fundamentally change its revenue model.

In this emerging framework, those who refuse to reshore operations to the U.S. — and instead, choose to continue exporting into the American market — will be required to shoulder a portion of the tax burden that has long fallen on American workers.

Tariffs, in this context, are not just about trade — they are about redistribution.

They are about ensuring that the cost of maintaining the American system is no longer borne solely by its domestic labor force.

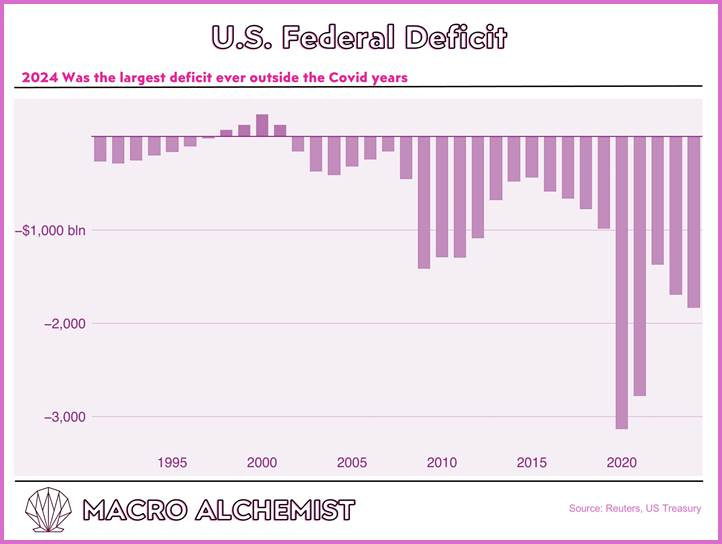

This comes at a time when the U.S. deficit has played an outsized role in driving GDP growth in recent years.

As a result, any effort to impose fiscal discipline — whether through DOGE-led spending cuts or broader efforts at restraint — carries a very real risk of inducing a recession.

Fired government employees do not seamlessly transition into private sector roles, especially in a weakening economic environment where recent data has shown increasing softness.

The tax cuts that are intended to be funded by tariff revenues will not provide sufficient short-term relief in the face of a deficit-driven downturn.

Meanwhile, savings rates are rising in response to prevailing uncertainty, which only adds fuel to the inflationary fire.

Consumers are pulling back, yet prices remain sticky, creating a precarious feedback loop.

If President Trump were to bow to growing criticism of his approach, the consequences would be immediate and politically costly.

He would risk failure on three fronts — and just 90 days into his term.

First, by compromising the tariff framework.

Second, by failing to meaningfully reduce the deficit.

And third, by being unable to deliver the tax cuts he promised on the campaign trail.

This is the world we now inhabit — not necessarily the one everyone wants, but certainly the one that was chosen.

Trump was elected on a wave of dissatisfaction with the status quo. No one who voted for him should have expected an orderly or frictionless transition.

There will be costs, big ones, for both the U.S. and its geopolitical rivals.

The administration is betting that the long-term benefits will outweigh those costs.

Corporate leaders with the most to lose — particularly those whose earnings are heavily reliant on overseas operations — understand that they cannot simply flip a switch and reshore those earnings overnight.

Any serious attempt to do so would require massive capital expenditure and long lead times.

For these companies, the stakes are enormous.

For Trump, turning back from the America First platform so early into his presidency would amount to more than just a tactical retreat — it would be a strategic capitulation.

In many ways, it could leave him politically more vulnerable than even his adversaries abroad.

At this moment, he arguably has more to lose than Xi Jinping.

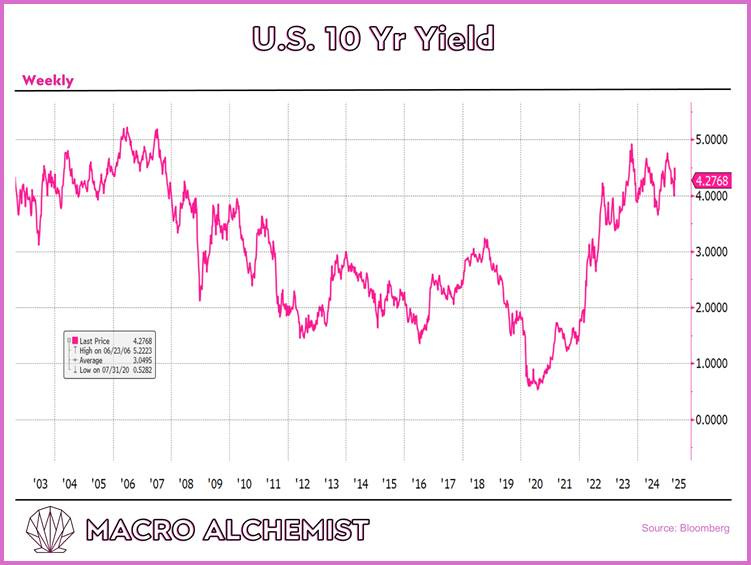

Amid this already volatile backdrop, the bond market has thrown an unexpected challenge at the administration.

A notable selloff in U.S. Treasuries has begun to materialize, and understanding the forces behind it requires some context.

Foreign ownership of U.S. stocks was at record highs, and the American Exceptionalism narrative — the idea that the U.S. is uniquely insulated from global risk — had driven valuations to unsustainable extremes.

As policy velocity accelerates in Washington, global investors are pausing, reassessing, and in some cases, repatriating capital.

This dynamic offers little comfort to a Treasury Secretary who must navigate issuance of $9 Trillion in debt over the coming year.

Not to mention high-yield spreads are widening. And funding costs are rising.

In this context, reducing the deficit becomes not just a matter of political will — but of fiscal survival.

If the high-yield market is, in fact, pricing in a growing probability of recession, then efforts to reduce the deficit will become exponentially harder.

This, perhaps, is what the bond market is trying to say — a warning embedded not in press releases, but in yield curves and credit spreads.

And it is likely why the rhetoric out of Washington has begun to soften ever so slightly.

Summary and Conclusions

Even if President Trump were to abandon his expansive and aggressive policy agenda, the costs would not simply disappear.

Inflationary pressures would remain — fueled by an unsustainable deficit — while the tech-based trade war with China would continue to reinforce the broader trend of deglobalization.

An inability to deliver promised tax cuts would further erode confidence, and the resulting uncertainty could lead to a more profound loss of faith in both policy direction and market stability.

In many ways, Trump now has the most to lose by retreating.

Having launched his term wielding an economic sledgehammer, a sudden reversal would not be seen as pragmatism — it would be viewed as weakness.

Politically, it would be disastrous.

The chaos that would emerge from a partial or full withdrawal would likely exceed even the current turbulence roiling global markets.

A walk-back from the hardline policies implemented thus far would almost certainly signal the onset of a lame-duck presidency — a weakened administration, unable to advance its objectives.

Yet even if the policies were dialed back, the effects already set in motion cannot be undone. The damage — at least in the short term — has already been done.

The pain, already underway, will continue.

In sum, the Trump administration’s objectives are ambitious, uncompromising, and deeply interwoven.

They include:

Reducing the deficit while simultaneously cutting taxes,

Increasing defense spending,

Leveling the global trade playing field,

Transforming the American revenue model,

Diminishing China’s economic leverage,

Pressuring Europe to bear more of its own defense burden,

Reclaiming a larger share of global production capacity, and

Imposing direct economic costs on any nation that resists this rebalancing.

There may be compromises along the way, negotiated adjustments or partial recalibrations.

But for now, the Trump agenda is moving at full speed, driven by the urgency of the upcoming mid-term elections.

The costs and consequences of this momentum are no longer hypothetical — they are now a structural part of the landscape.

The only remaining question is one of scale: just how significant will these costs be?

What we already know is that rising volatility is one of them. Declining market valuations are another.

Add to this supply chain disruptions, escalating inflationary pressures, and a rise in reciprocal tariffs accompanied by intensifying geopolitical tensions.

While the bond market may yet influence the shape and direction of what comes next, there is little doubt that investors and policymakers must brace for a period marked by elevated uncertainty, compressed valuations, a growing risk of both U.S. and global recession, and rising global defense expenditures — all of which will carry inflationary consequences.

Consumers, especially those heavily exposed to the equity markets and already facing leverage pressures, are unlikely to escape unscathed.

And beyond all this, there are still other tools — financial instruments, legal frameworks, institutional levers — that may soon be repurposed as mechanisms of economic weaponization.

But that, as they say, is a story for another day…

Great post. I reread it and didn’t find any big stones left unturned.

Hello there,

Huge Respect for your work!

New here. No huge reader base Yet.

But the work has waited long to be spoken.

Its truths have roots older than this platform.

My Sub-stack Purpose

To seed, build, and nurture timeless, intangible human capitals — such as resilience, trust, truth, evolution, fulfilment, quality, peace, patience, discipline, relationships and conviction — in order to elevate human judgment, deepen relationships, and restore sacred trusteeship and stewardship of long-term firm value across generations.

A refreshing take on our business world and capitalism.

A reflection on why today’s capital architectures—PE, VC, Hedge funds, SPAC, Alt funds, Rollups—mostly fail to build and nuture what time can trust.

“Built to Be Left.”

A quiet anatomy of extraction, abandonment, and the collapse of stewardship.

"Principal-Agent Risk is not a flaw in the system.

It is the system’s operating principle”

Experience first. Return if it speaks to you.

- The Silent Treasury

https://tinyurl.com/48m97w5e