Stress Fractures

From ghost cities in China to frozen markets in the West...real estate’s biggest story isn’t about collapse...it’s about a system that looks solid until you try to move through it.

"I can't help but think of the greatest of all things, gravity." Sir Isaac Newton

You can ignore gravity for a while.

Until you can’t.

Across cities and continents, towers rise, rents soar, and listings vanish…all while the average buyer can’t afford a front door.

Something doesn’t add up.

Everyone feels it, but few can articulate it. And those who can? Most are too invested to say it out loud.

It’s been called the safest asset in the world. The one thing that never goes to zero. A fortress of bricks and equity. But what if that fortress has no foundation?

What if safety has been confused with silence…the kind of silence you hear before an avalanche breaks loose?

For the last decade, cheap money has built more than homes.

It’s built assumptions.

Beliefs.

Narratives.

It’s shaped elections, distorted economies, and rewritten the meaning of ownership.

Real estate hasn’t just become a store of wealth…it’s become a store of denial.

Entire generations now believe property is a one-way bet. That governments will always intervene. That land is scarce, demand is infinite, and prices only move in one direction…up.

But faith, like leverage, is only stable until it isn’t. And somewhere, beneath the floorboards of this global housing boom, something is starting to shift.

The pressure is global. The players are everywhere. But the signals?

They’re oddly quiet.

Banks aren’t sounding alarms. Politicians speak in half-truths. Investors toe the line. All while cracks widen in plain sight…not just in spreadsheets, but in the streets.

And yet, the biggest question remains unasked.

What happens when the most inflated financial asset in the world… is the one we’re still living in?

Let’s begin.

Introduction + The Bubble You Live In

If real estate feels expensive, that’s because it is.

If it feels confusing, that’s because it is.

But if it still feels safe? That’s where the story gets interesting.

We’re not here to ring alarm bells or declare the end of the world. We’re here to ask better questions. And when it comes to the global housing market, one question looms larger than most:

What happens when the biggest financial bubble in history isn’t just in your backyard… but is your backyard?

Back in June of last year, we stitched together a global mosaic of what was really happening beneath the surface of real estate…and published our findings in Who Gets the House?.

What we uncovered was fascinating. And yes, a little unnerving.

But this isn’t a crash story. It’s a reveal story. A peek behind the curtain. And what’s behind it might surprise you.

Let’s unwrap the bubble.

The Bubble You Live In

It is widely believed to be the safest asset in the world. A hedge against inflation. A retirement plan with a roof.

But thanks to more than a decade of near-zero interest rates, real estate became something else entirely: a financial plaything.

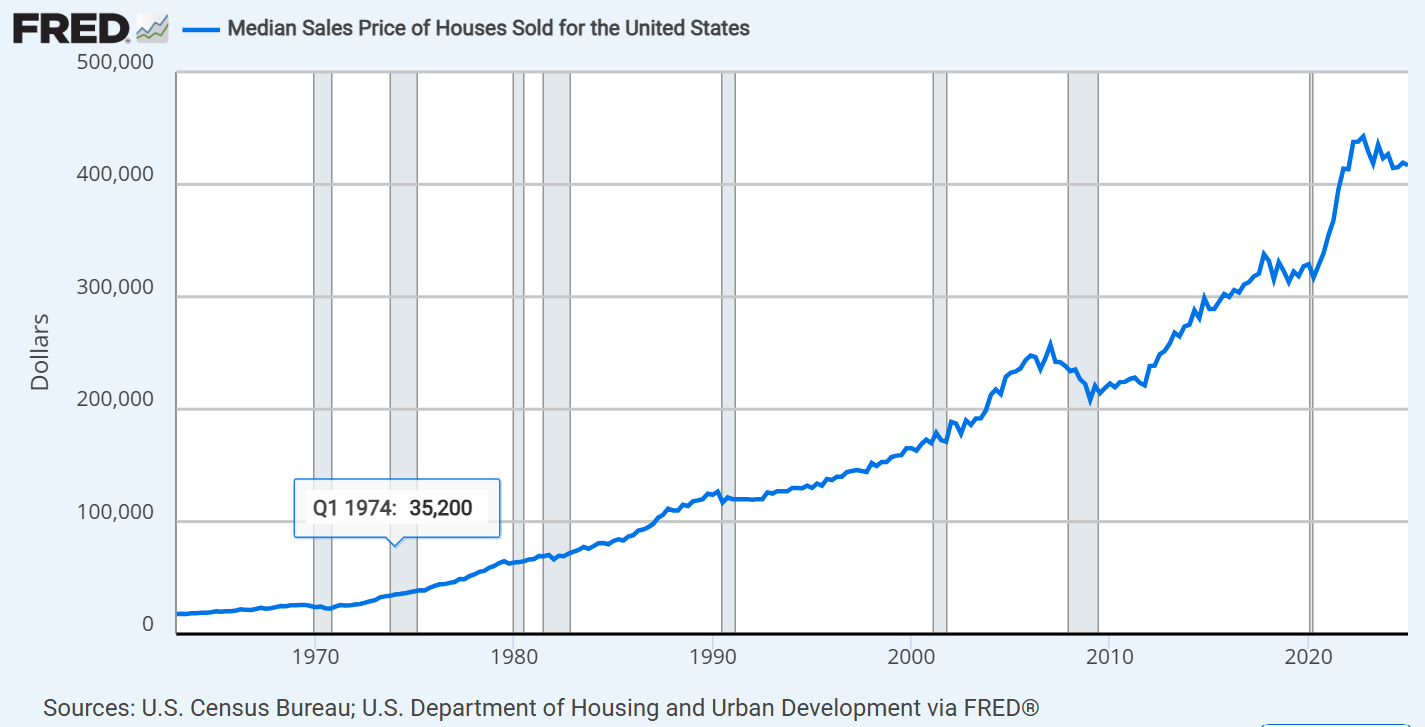

In the U.S., median home prices recently hit $412,300…up 5.2% year-over-year…even as affordability cratered and first-time buyers got priced out.

But this isn’t just a U.S. story. This is a global credit phenomenon dressed up as a housing boom.

The main character in this financial fantasy? Cheap money.

From California to Shenzhen, central banks printed, rates plummeted, and suddenly everyone was a real estate investor.

In China, housing became a cultural obsession.

In Vancouver and Sydney, foreign demand became a force of nature.

Across the West, artificially low rates pushed private investors into bidding wars with schoolteachers.

And now?

That air-hiss sound you hear might be the start of a global decompression.

And here's where it gets interesting: on its own, U.S. real estate might appear insulated. Lending standards are tighter. Borrowers are more qualified. Most homeowners only have to service an ultra-low mortgage rate.

But as we outlined in Who Gets the House?, real estate risk doesn't exist in isolation.

It's entangled.

We traced how China's real estate explosion created a ripple effect that swept across borders…inflating prices, distorting demand, and channeling foreign capital into markets like Canada, Australia, and the U.S.

When those sources of capital reverse… when external cracks widen…the risk doesn’t stay overseas. It comes home.

The bubble you live in might be bigger than you think. And more fragile than it looks.

China: The $50 Trillion Domino

If you want to understand the house of cards, start with the country that built a few million too many of them.

At its peak, China’s real estate sector was valued at over $50 trillion…twice the size of the entire U.S. economy.

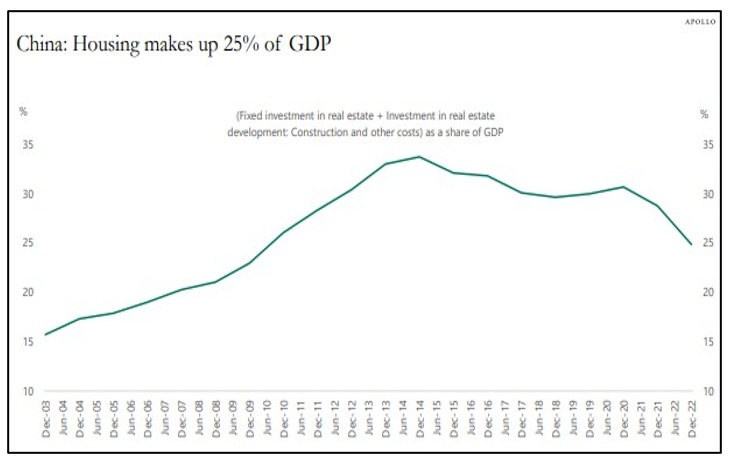

Fueled by debt and urbanization, property development swelled to nearly 35% of China’s GDP. Developers became deities. Ghost cities sprouted like mushrooms.

The construction frenzy devoured cement, copper, and steel by the megaton…and for a while, no one questioned the logic.

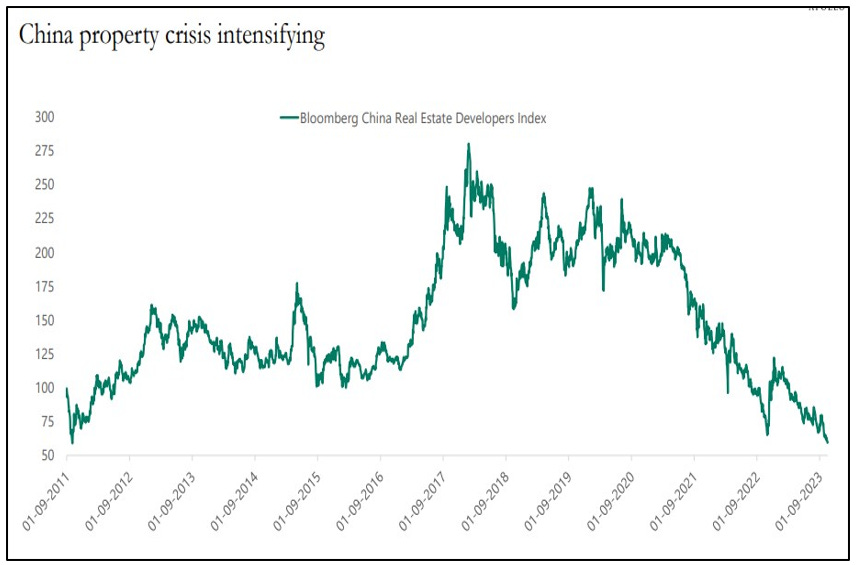

But by the early 2020s, the illusion cracked.

According to Bloomberg Economics, home prices in major Chinese cities have fallen back to 2011 levels.

Evergrande defaulted. Other developers followed. Millions of apartments sit vacant, unsold, and increasingly unviable.

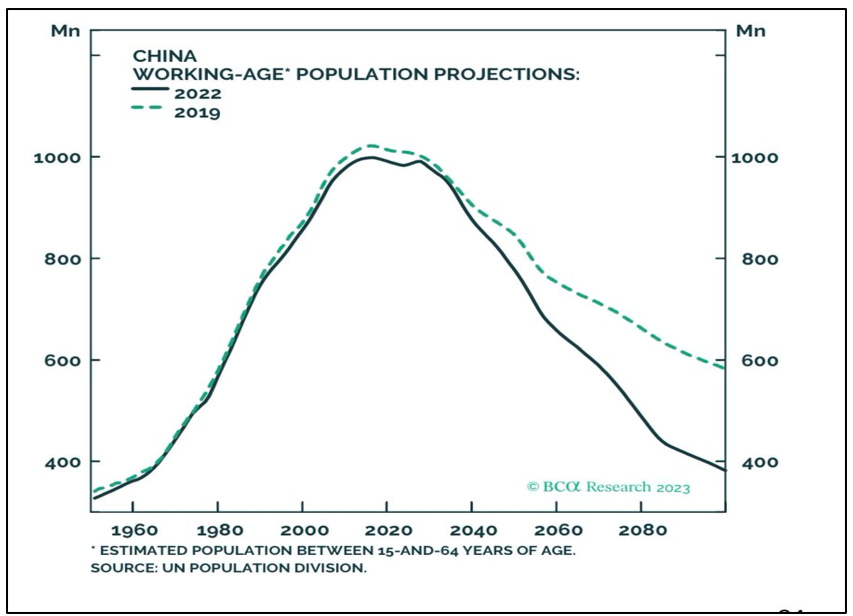

Beijing’s once-reliable growth engine…stimulate demand by building more…has slammed into a demographic wall.

China’s working-age population is shrinking. Youth unemployment is rising. The buyer of last resort is quietly vanishing.

And when the music stops, the money looks for the exits.

As we outlined in Who Gets the House?, the implications are not confined to China’s borders.

Chinese investors…once dominant players in global real estate…now face liquidity stress at home.

Those holding foreign assets may soon become desperate sellers abroad.

What was once outbound capital inflating global markets could soon become a forced unwind.

For years, China exported capital, confidence, and demand. Now it may begin exporting something else: volatility.

Volatility doesn’t knock…it slips through side doors, disguised as something else.

When foreign demand becomes foreign liquidation, the impact isn’t local. It’s systemic.

What looks like a housing slowdown in one country might just be the first domino.

And if that’s true… where does the chain reaction begin?