Musical Chairs...Managing Monetary Madness

“In a highly leveraged system, stability breeds instability.” — Hyman Minsky

Musical Chairs.

You’ve played the game before.

The music blares, the crowd circles, tension builds with every passing second.

Then…silence. A scramble. Elbows fly. Panic erupts.

Someone is always left standing, stunned, wondering how they did not see it coming.

Now imagine that game is playing out on a global scale.

Except this time, the stakes aren’t bruised egos or playground bragging rights…they’re the stability of the entire financial system.

The rules are unwritten, the players are everywhere, and most of them don’t even know this is the game they are playing.

And even those that do understand the game often vastly underestimate the ratio of players to chairs.

But make no mistake, the music will not play forever. When it stops…and it always does…you will want to understand why the scramble began in the first place, who is fighting for the chairs, who holds power, and what it means for every dollar-based promise in the world.

To understand the stakes of that scramble, we must begin by looking at the systems monetary mechanics not as a web of abstract charts or economic obligations, but as something far more familiar.

A children's game, yes…but one whose rules have been written in silence, whose players have multiplied by the trillions, and whose consequences, when the music stops, are nothing short of biblical.

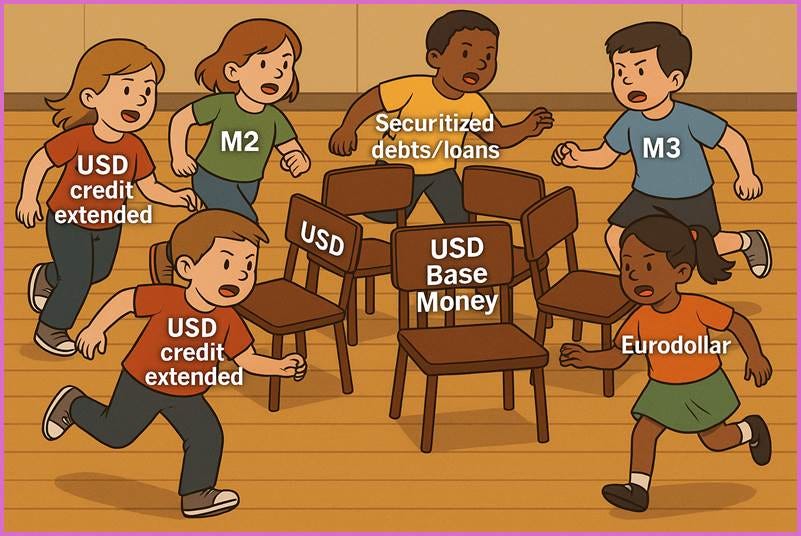

Think of the entire global monetary system like a game of Musical Chairs.

Because that is exactly what it is.

In this metaphor, USD Base Money…which consists of bank reserves held at the Federal Reserve, and the physical cash and coins in circulation…is represented by the chairs.

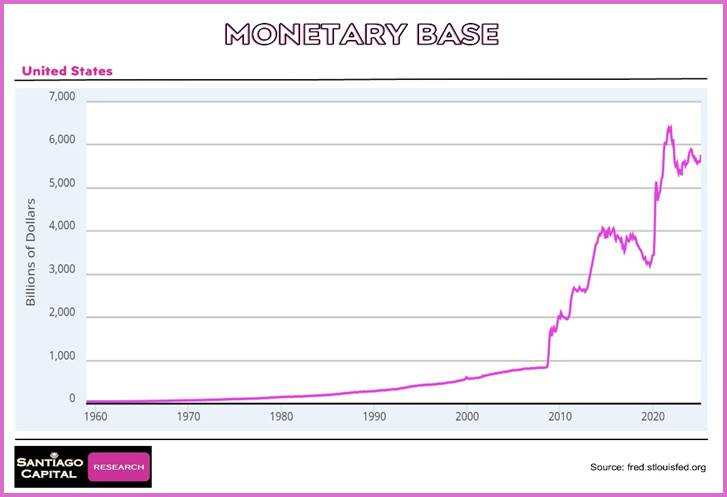

These chairs, currently amounting to approximately $6Trillion, are the bedrock, the only legal, foundational form of the U.S. dollar.

Everything else in the financial system that is commonly labeled as "money”…

…whether it is M2, M3, certificates of deposit, securitized debt obligations, collateralized loan obligations, bank-issued credit, or even Eurodollar liabilities…should be thought of not as chairs, but as the people circling the chairs.

These are not base money. They are merely claims upon it. They dance around as long as the music is playing.

The entire system, global and domestic alike, works smoothly while the music continues to play…i.e., while credit flows, while trust endures, while liquidity remains abundant.

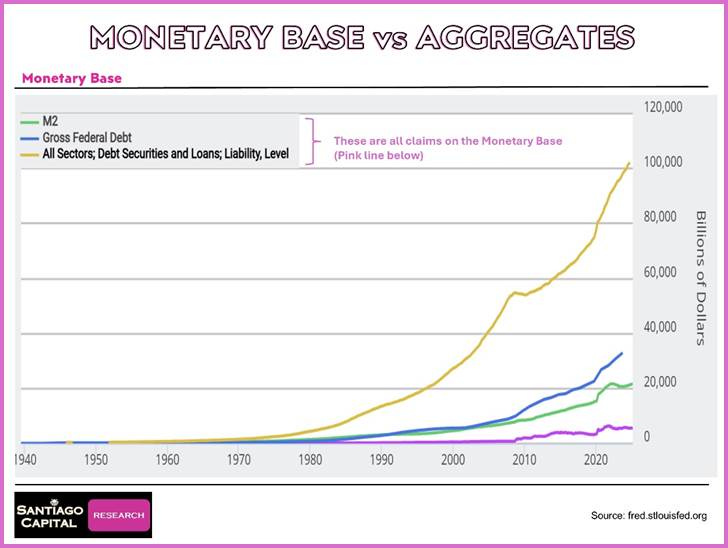

But herein lies the critical dynamic: these monetary aggregates…while often labeled as money supply…are also expressions of money demand. And this demand absolutely swamps the actual supply.

That is the first and perhaps most overlooked truth of the system.

They are promises, debt instruments, and accounting entries that exist only because the underlying base money allows them to.

Because in our debt based monetary system, all money is loaned into existence using the monetary base as the collateral off of which to extend credit.

So, when the music stops, meaning credit ceases to expand or begins to contract, or when liquidity evaporates suddenly, all those circling figures…the vast monetary aggregates….reveal themselves as claims on base money.

And suddenly, just as in the childhood game, everyone scrambles for the chairs.

This scramble exposes the reality of the immense leverage in the system.

While credit and financial expansion might give the illusion of increasing supply, they do not increase the number of chairs.

In fact, every new participant that joins the game increases demand for those same limited chairs.

Extending credit, issuing new loans, or securitizing assets does not increase the quantity of reserves or cash. It only creates more people circling the same chairs, all expecting there will be a seat when needed.

So, the more credit is extended, the greater the number of people in the game…and the more leveraged the system becomes relative to its base.

When that music stops, when velocity slows or reverses, the entire structure flips.

Demand for those limited chairs explodes. Participants realize that they are not holding base money but merely IOUs to it. They rush to redeem, to secure safety, to sit down.

But just as in the game, there are fewer chairs than people.

Far fewer.

This mismatch creates stress, panic, and price dislocations.

The value of each chair…each unit of base money…soars, because in that moment, it becomes the only thing that matters. No one wants the promise of liquidity…they want liquidity itself.

In other words, it’s a bank run.

If the music doesn’t restart quickly…if liquidity remains frozen or impaired…there is only one way to prevent a system-wide collapse.

The Federal Reserve or the U.S. Treasury must step in and add chairs to the game.

That is, they must inject base money…reserves, cash, or some combination thereof… to recapitalize the system and relieve the panic. Because without new chairs, without the creation of new base money, the scramble only intensifies.

People begin to fight over the chairs. Credit contracts even further. Trust erodes. The VIX spikes. Risk assets plummet. Markets collapse.

And this brings us to the most important structural facts of the entire global monetary system: only two institutions on Earth can create those chairs.

Only the U.S. Federal Reserve and the U.S. Treasury have the authority and capacity to create USD base money.

The Fed can do it by creating bank reserves via open market operations and the Treasury can do it by authorizing the minting of new currency and coins.

What we’ve just described…the base money, the leverage, the scramble, and the centrality of the Fed and the Treasury…constitutes the U.S. domestic monetary system.

But it is only half the story.

And the second half of the story is what gives the U.S. such overwhelming monetary leverage over the rest of the world.

Because while only two players, both U.S. entities, can create new chairs, every other entity in the world is a participant, either willingly or unwillingly, in the game.

The reason for this is that there exists a second system, vast and mostly invisible, that operates outside of the formal U.S. banking structure. It is also denominated in U.S. dollars, but it exists entirely offshore.

This is the Eurodollar market.

The Eurodollar market…named not because of any connection to the euro currency or even specifically to Europe…refers to dollar-denominated liabilities and credit instruments held outside the legal jurisdiction of the United States.

It includes loans, deposits, and derivatives issued by institutions outside the United States that are not governed by U.S. banking laws but still use dollars. And it is immense.

Over the decades, this offshore dollar market has grown massively, to the point where it is larger than the formal U.S. dollar system in size.

Corporations, governments, hedge funds, and banks across the globe rely on this system for financing, liquidity, and trade settlement.

And yet, the Eurodollar system operates with a dangerous constraint: it cannot create base money.

The only chairs that even exist in the Eurodollar market are a portion of the physical currency and coins currently in existence, and that are geographically sitting outside the U.S. borders.

In other words, almost the entire Eurodollar market is nothing more than claims on chairs inside the U.S. borders.

This means that the Eurodollar market is not just highly leveraged…it means it IS leverage.

Every dollar in the Eurodollar system is ultimately a claim on a chair that doesn’t exist and cannot be manufactured by any of the system’s participants.

The entire structure is built on the hope that the music never stops, or that when it does, someone back in the U.S. will provide a seat, often via Central Bank swap lines.

The Eurodollar system isn’t just a sideshow…it’s the shadow stage on which much of global finance dances.

But how exactly does it tie back to U.S. domestic policy? And what happens when both systems tighten at once?