Buffett, Japan, & Middlemen

Why is Buffett hoarding cash yet betting big on Japan’s middlemen? Discover the strategy driving his latest moves.

Executive Summary

In our recent paper titled Trump, Tariffs, & Trade Wars, we discussed the importance of protecting a portfolio against a regime of increasing tariffs and capital controls.

One such strategy involved the idea of investing with middlemen, with an example of investing in India, the idea being that probably no other region is playing both sides of the current ideological divide better than them.

This prompted further reflection of Berkshire Hathaway’s recent investments in Japan, predominantly with merchant companies, or middlemen.

Japanese merchant companies play a significant global role. This then further led us to reflect that the idea of investing in middlemen is a common thread of Berkshire’s over many years. So, while Berkshire has been visibly divesting many of its investments such as Bank of America and Apple, one of the few areas it has been investing in is Japanese middlemen.

This is of keen interest to us.

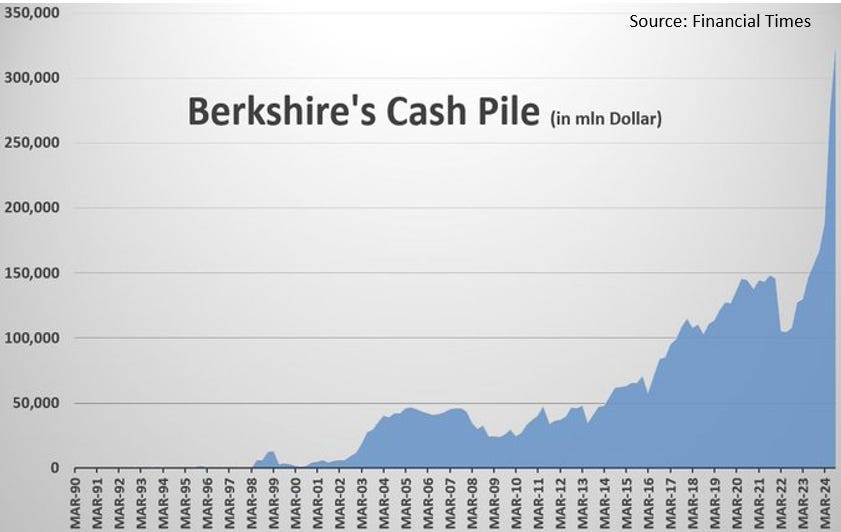

While considerable attention has been given in recent times to the increasing amount of cash reserves that are piling up on Berkshire Hathaway’s (BRK) balance sheet, that this is occurring against a record-breaking stock market backdrop makes it even more intriguing.

In relative terms, BRK has never held this much cash:

BRK has a history of hoarding cash during elevated market valuations, most notably during the Dot Com boom of the late 1990s, as well as leading into the Great Financial Crisis of 2008.

In the aftermath of the GFC, Buffett became an investor of last resort in multiple cases. To paraphrase Buffett, he said he always looked forward to Sunday night phone calls, as they usually led to vast profits. And now, in absolute terms, BRK’s current cash holding vastly exceeds previous record levels:

Bearish investors like to point towards this cash pile alongside Buffett’s strong track record of “being fearful when others are greedy” (and vice versa).

However, in recent years BRK has been investing in a hitherto unloved section of the global economy, which is Japan. Even more interestingly, BRK has been investing in Japanese merchant businesses, or middlemen called sogo shosha - its venerable trading houses - signaling a vote of confidence in their business models and the Japanese economy.

These trading houses, including Itochu Corporation, Mitsubishi Corporation, Mitsui & Co., Sumitomo Corporation, and Marubeni Corporation, are multi-faceted conglomerates with diversified operations spanning industries such as energy, metals, food, infrastructure, logistics, and finance.

Why have these trading houses attracted the interest of BRK?