A Macro Pilgrim's Ledger - The Santiago Way (8/25/25)

A new weekly report that helps you see the whole picture...connecting equities, bonds, credit, and commodities into one coherent narrative so nothing slips through the cracks.

“Walking the path of global markets, one step at a time.”

We’ve titled this new report “A Macro Pilgrim’s Ledger – The Santiago Way.”

The name draws inspiration from the Camino de Santiago — the ancient pilgrimage across northern Spain known simply as “The Way.”

For centuries, travelers have walked the Camino not because it is easy, but because it is difficult. It is a test of endurance, perspective, and faith. In many ways, the goal is the journey itself.

In much the same way, global macro investing is its own pilgrimage — a demanding path that requires discipline, patience, and clarity amid a world of uncertainty.

A pilgrim’s ledger is not a list of transactions but a record of the road: the challenges to overcome, the milestones reached, and the waypoints ahead.

This ongoing Weekly Report will be our account of the road already traveled and a guide to the road still to come.

The Week That Was

Markets pressed higher across U.S. equities, with the Dow and S&P both reaching fresh records. The rally was broad, extending to small caps as the Russell 2000 played catch-up, though momentum indicators suggested many indices are entering overbought territory.

Internationally, Europe and Japan also moved higher, while China saw outsized gains that pushed the Shanghai Composite into extreme overbought conditions. The global equity picture remains tilted to the upside, but with signals stretched, the stage is set for consolidation.

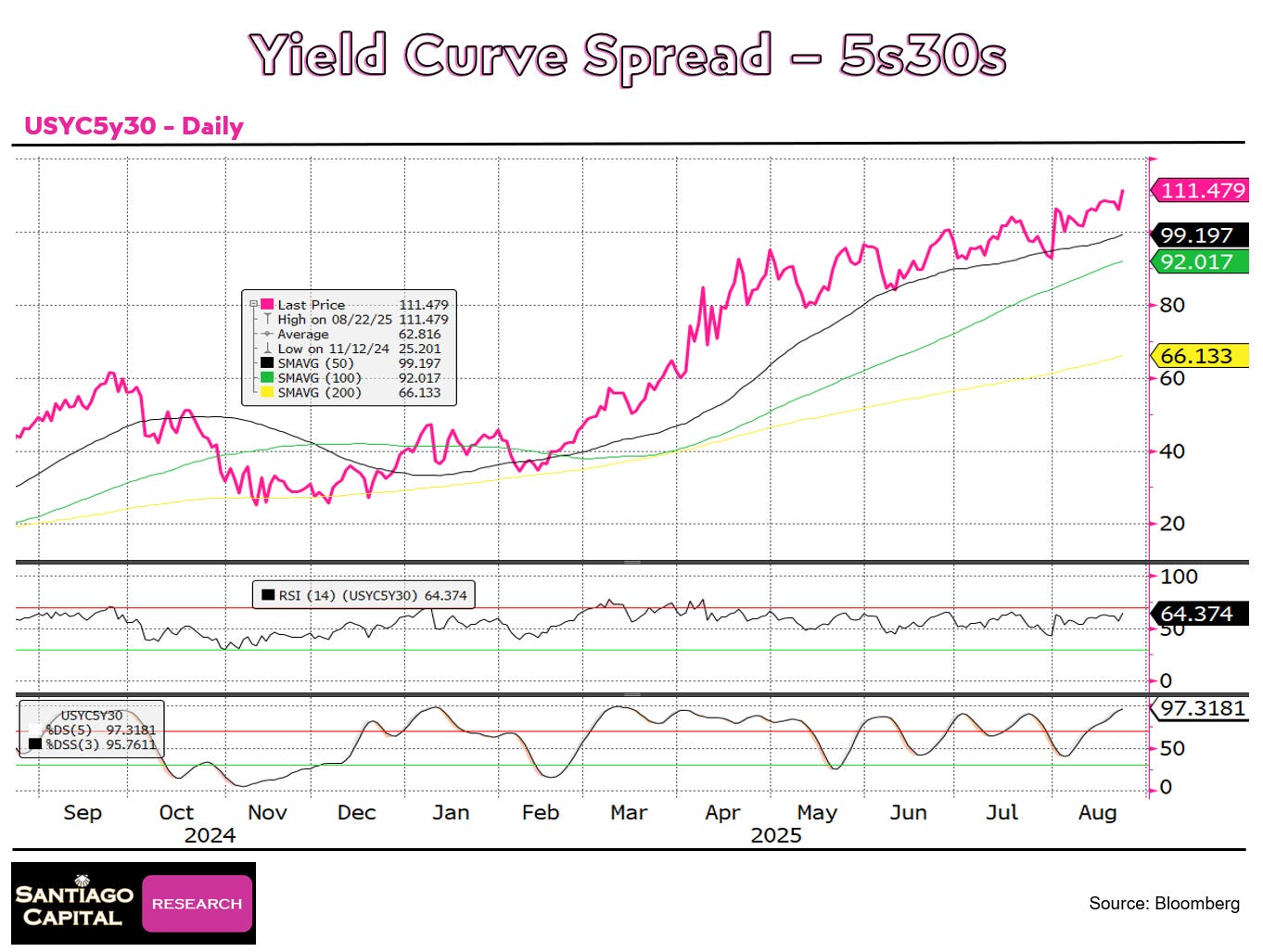

In fixed income, the front end of the U.S. curve continued to ease, with 2-year yields slipping into oversold territory while the long end stayed firm. The net result was a powerful steepening, with both the 2s10s and 5s30s spreads moving to levels not seen in months. Technicals show the steepening trend remains strong, but stretched momentum warns the move may be overextended.

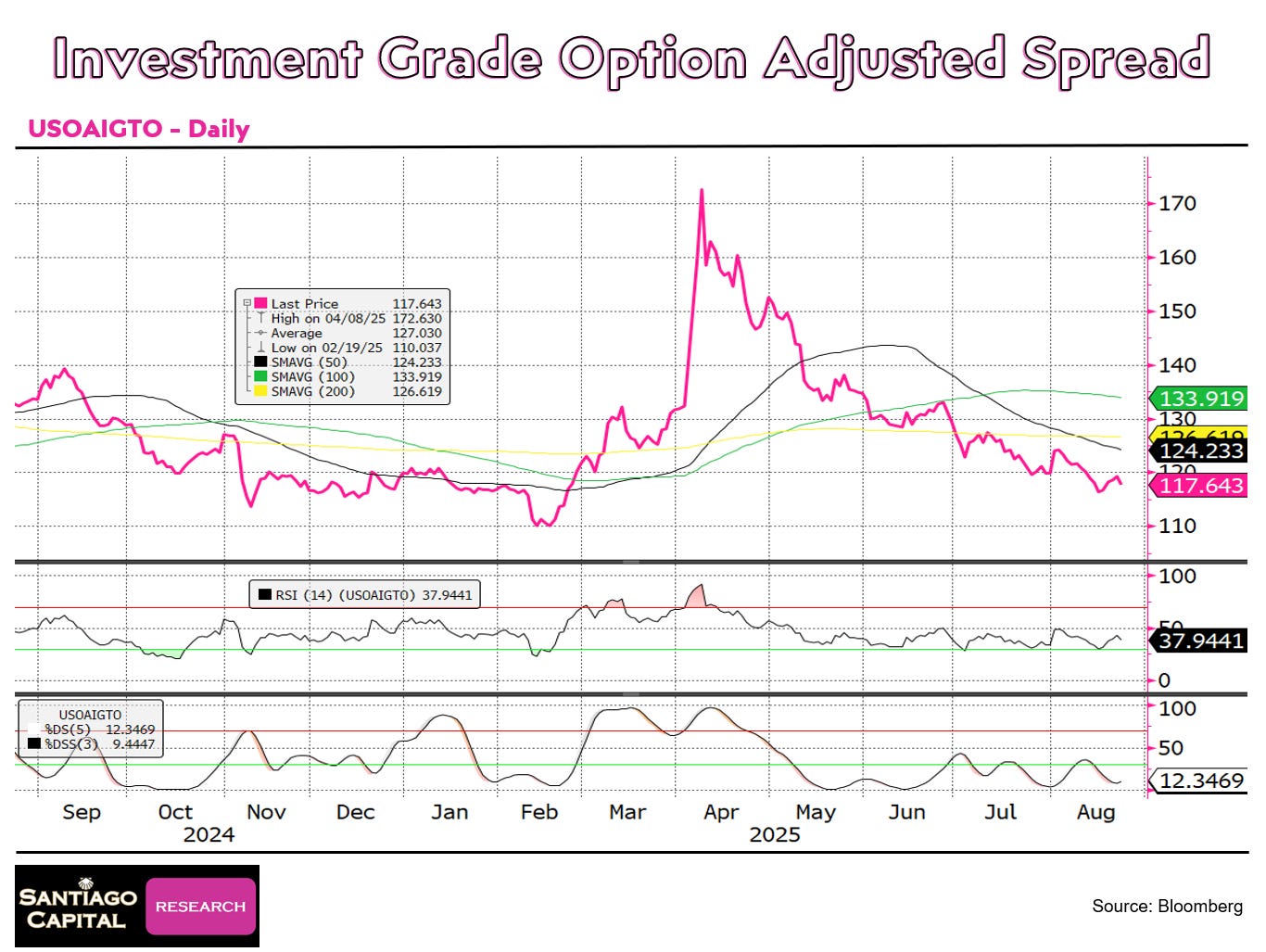

Credit spreads continued to grind tighter, with IG spreads at extreme lows and HY relatively steady. Technicals now show IG in oversold territory, reflecting compressed valuations and raising the risk of widening if risk sentiment turns.

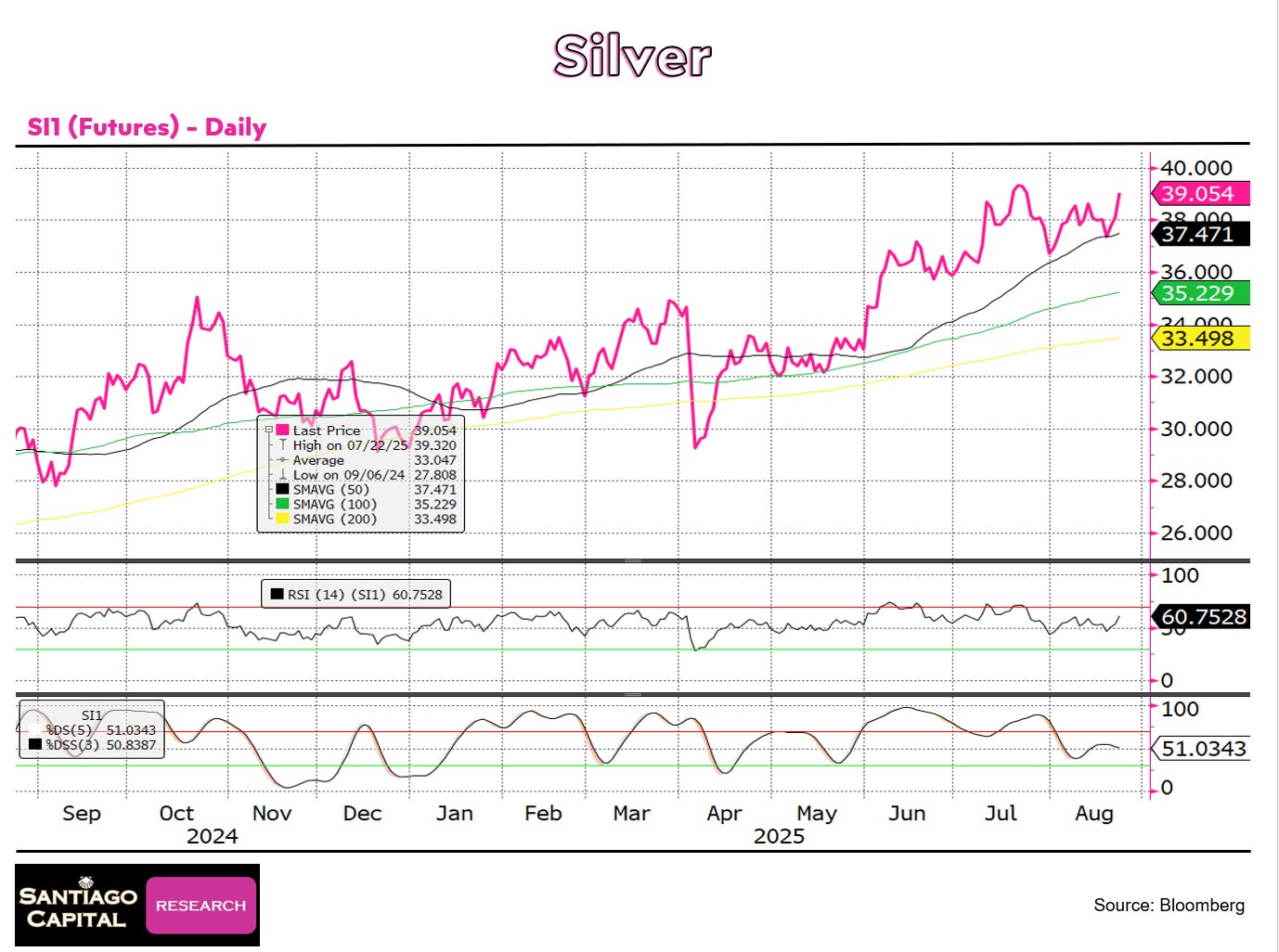

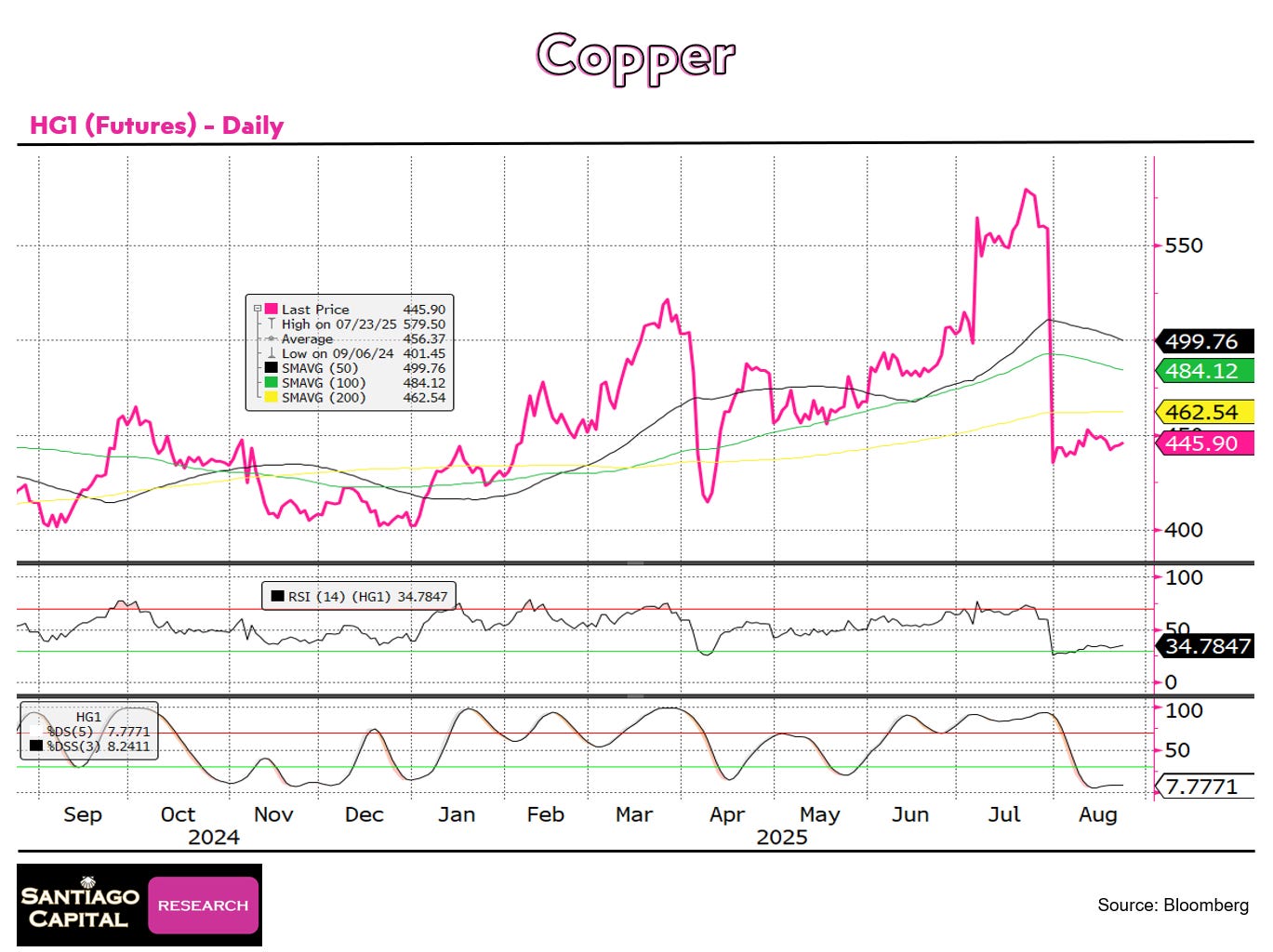

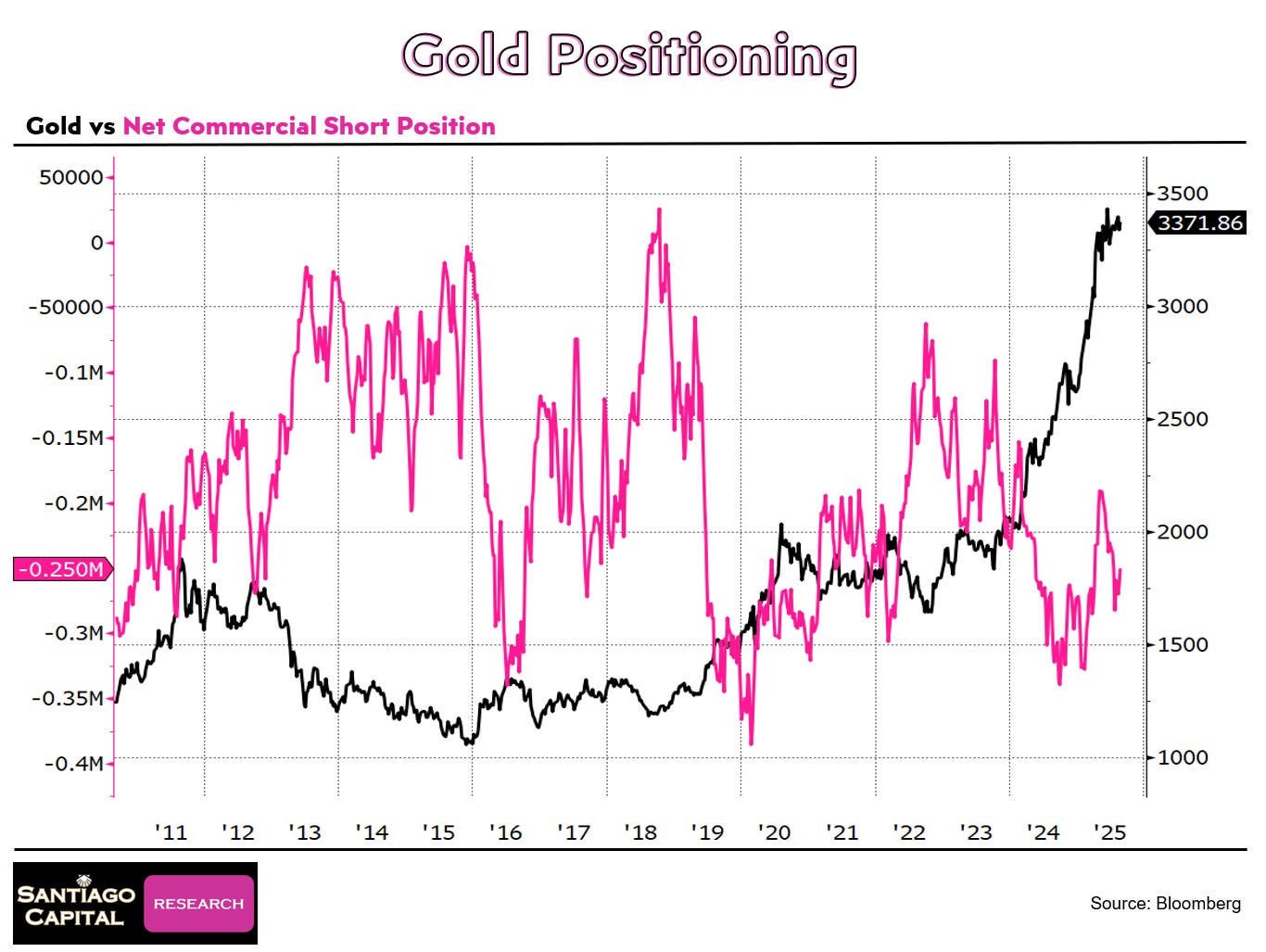

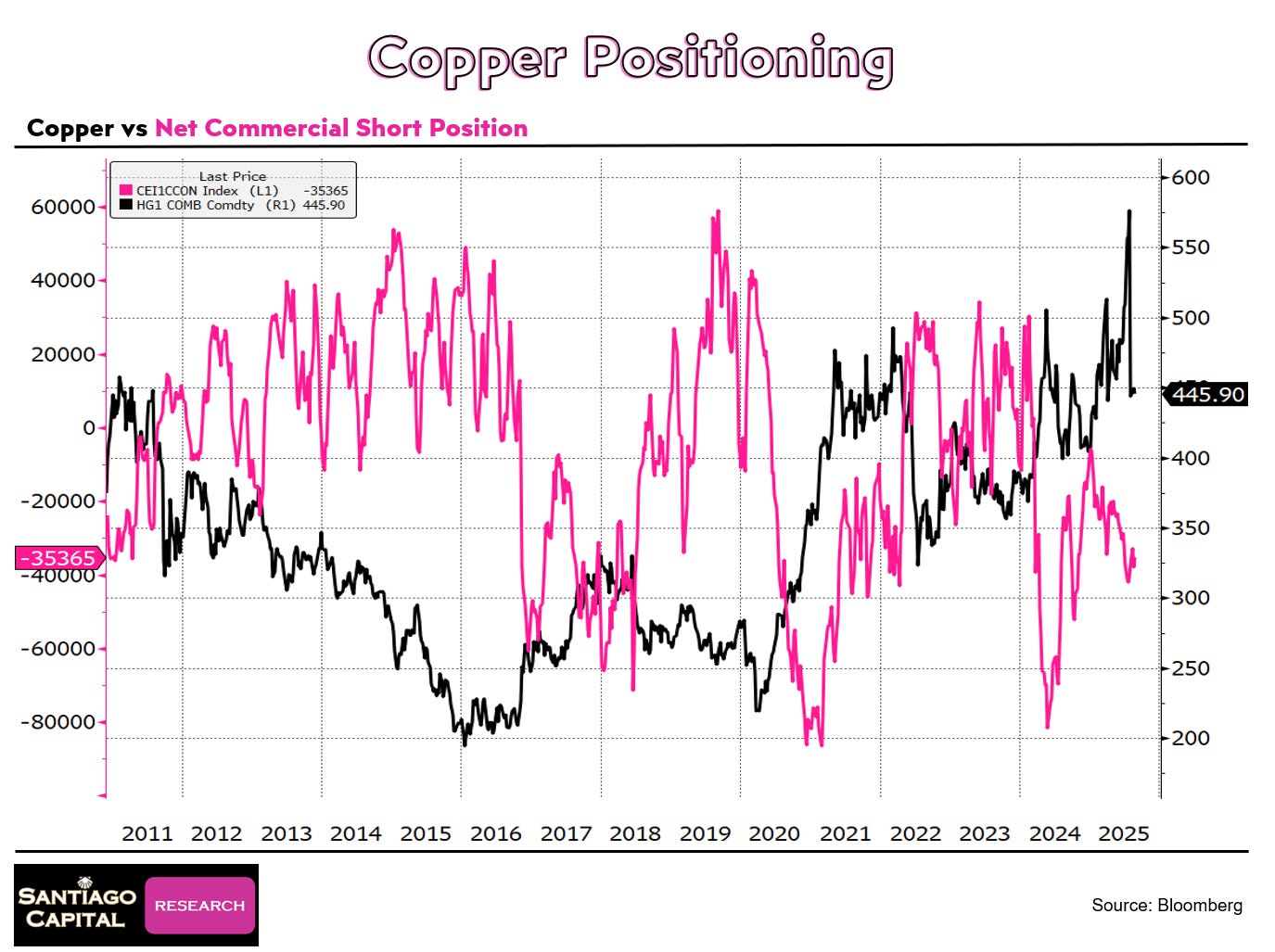

Commodities were mixed: crude oil and natural gas broke down further into oversold conditions, copper fell below support, while gold rose modestly on the week. Silver also edged higher, while agricultural markets like wheat and corn stayed weak and oversold. Positioning data reinforced these dynamics, with copper shorts elevated and gold shorts building modestly.

Macro / Policy

The story of last week was Jackson Hole.

For decades, the Fed has anchored its framework to a dual mandate of price stability and maximum employment. At this year’s symposium, they revealed a meaningful shift: inflation targeting will no longer dominate the model. Instead, financial stability, credit conditions, and the global feedback loop from U.S. policy will share the stage.

In practical terms, this is a recognition that monetary policy cannot operate in isolation when the U.S. yield curve is steepening at record speed, when global liquidity hinges on dollar availability, and when credit spreads are at their tightest levels in years.

Powell stopped short of declaring cuts, but the signal was clear — the old model is being retired. No longer is the singular focus on backward-looking inflation data enough to guide the most important central bank in the world.

The Fed now acknowledges that its own policies reverberate through a fragile global system. That admission alone was enough to ignite risk assets last week and accelerate the steepening of the U.S. curve.

Outside the U.S., the ECB and BOJ said little of substance, but in the shadow of Jackson Hole, their words mattered less. China’s interventions to stabilize growth — both liquidity injections and targeted fiscal support — kept domestic equities surging, but the real story was still the Fed.

When the anchor of the system changes its model, every other policy response will be measured against it.

Dow Jones (INDU – Daily)

Price at new highs and extended above all major moving averages.

RSI elevated and rising toward overbought.

Stochastics firmly overbought and flat.

Trend remains strong, but momentum stretched.

S&P 500 (SPX – Daily)

Price holding above all key moving averages.

RSI rising in the low 60s, showing steady strength.

Stochastics overbought and flat.

Uptrend intact, near-term upside limited by stretched momentum.

Nasdaq 100 (NDX – Daily)

Price easing off highs but well above moving averages.

RSI mid-50s and flat, showing neutral momentum.

Stochastics elevated but rolling over.

Momentum cooling despite strong structure.

Russell 2000 (RTY – Daily)

Price above all moving averages and pushing higher.

RSI near 67 and rising, close to overbought.

Stochastics in the high 70s and flat.

Trend strengthening, but signals stretched.

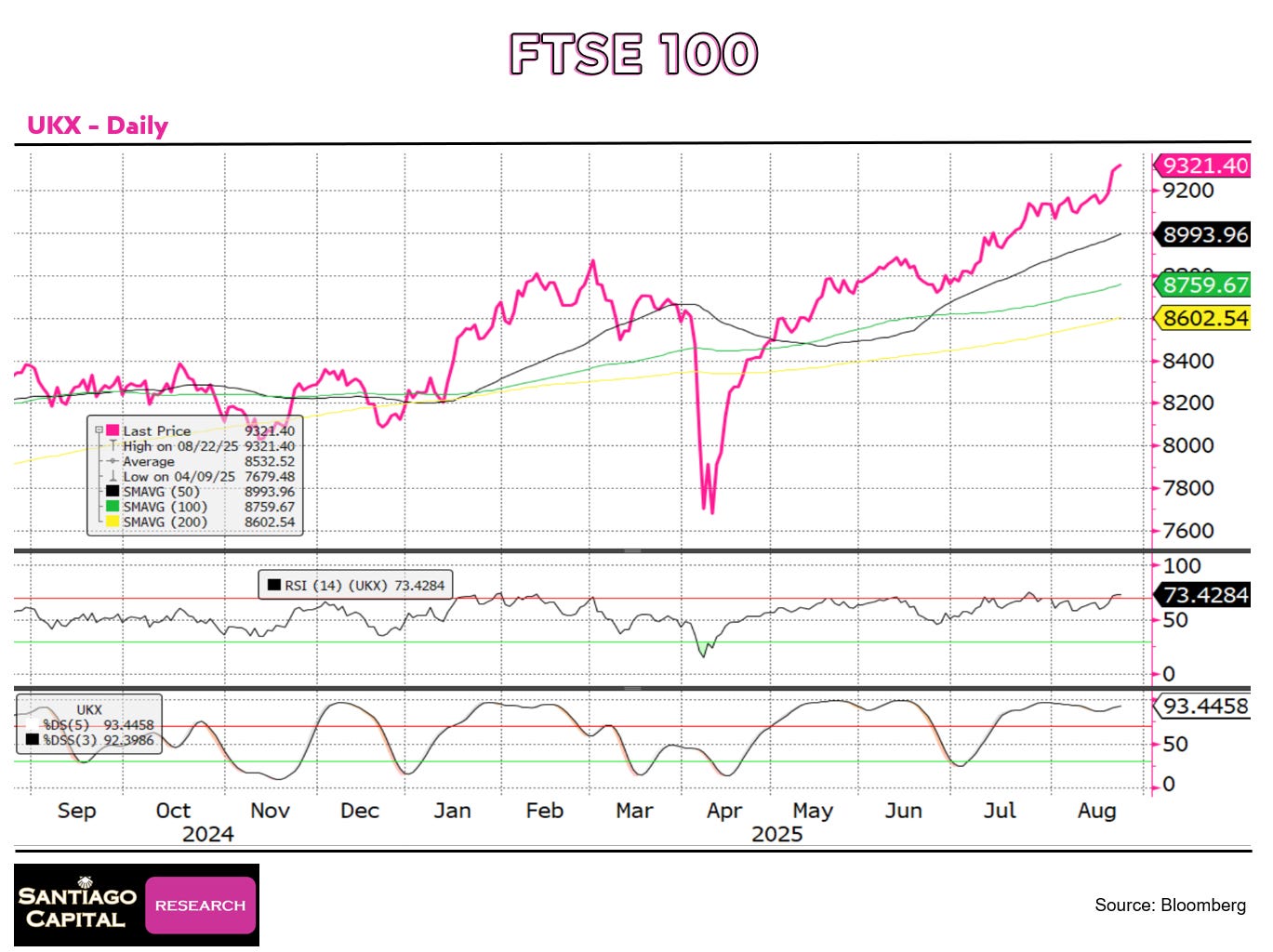

FTSE 100 (UKX – Daily)

Price breaking out to new highs above all moving averages.

RSI overbought above 70 and rising.

Stochastics extreme overbought and flat.

Trend strong, momentum stretched.

DAX (Germany – Daily)

Price consolidating above all moving averages.

RSI neutral mid-50s and flat.

Stochastics extreme overbought above 90.

Trend supported, but momentum overextended.

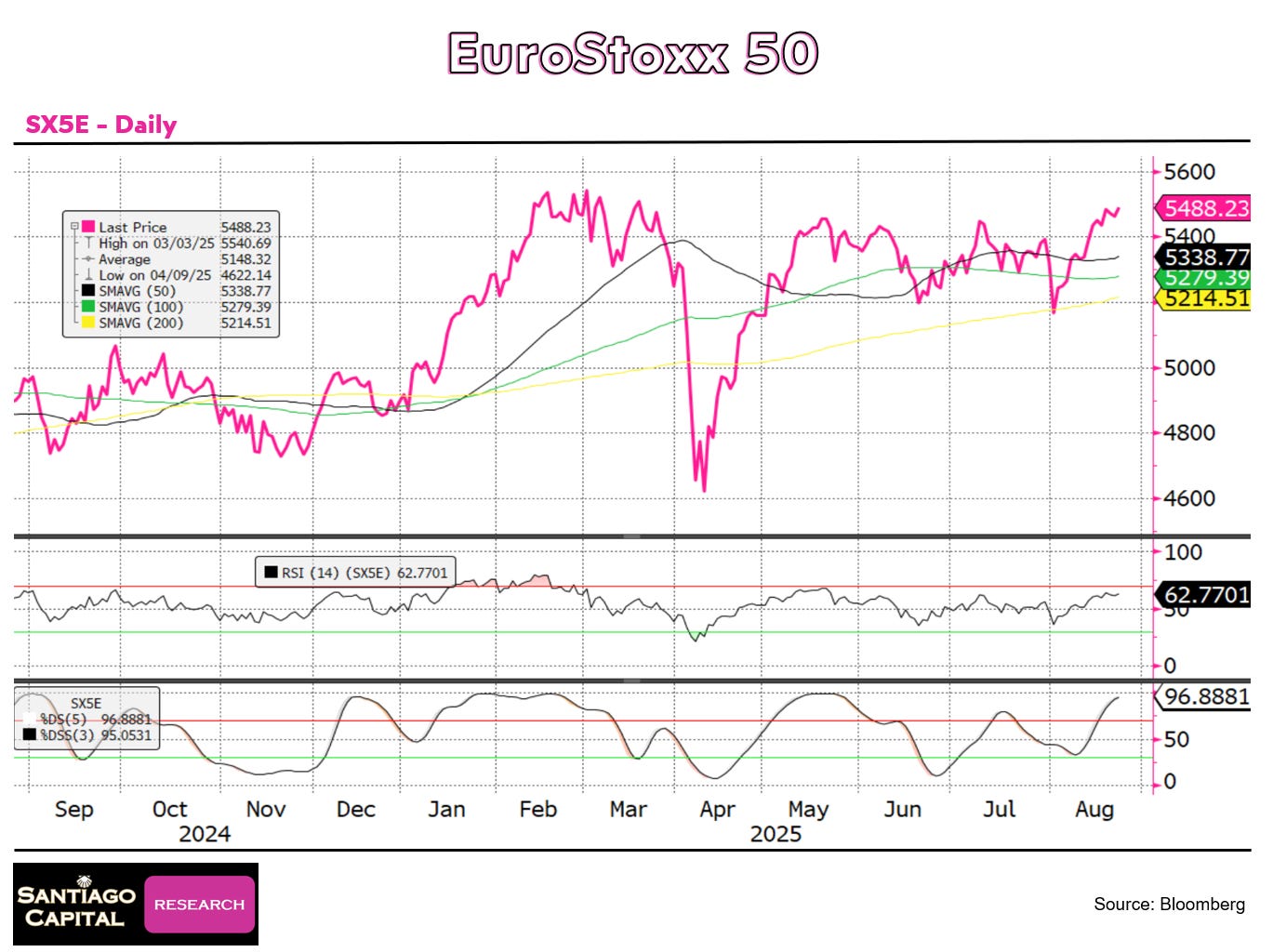

EuroStoxx 50 (SX5E – Daily)

Price trending higher above all moving averages.

RSI in the low 60s and rising modestly.

Stochastics extreme overbought and flat.

Structure intact, momentum stretched.

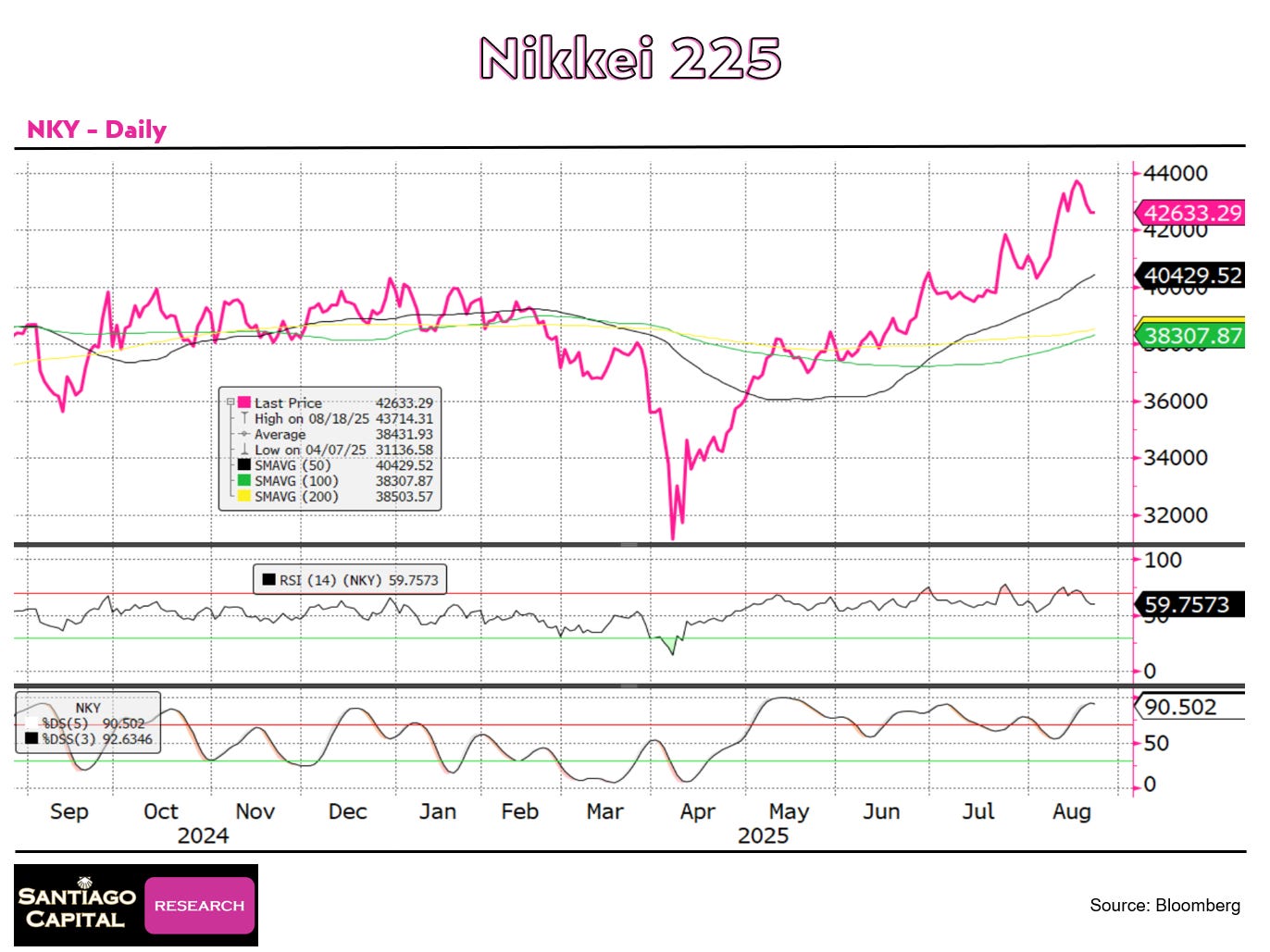

Nikkei 225 (NKY – Daily)

Price above all moving averages after recent highs.

RSI in the high 50s and rising.

Stochastics overbought above 90 and flat.

Trend remains positive, momentum extended.

Hang Seng (HSI – Daily)

Price holding above all moving averages.

RSI in the high 50s and flat.

Stochastics mid-60s and rising modestly.

Trend intact with moderate momentum.

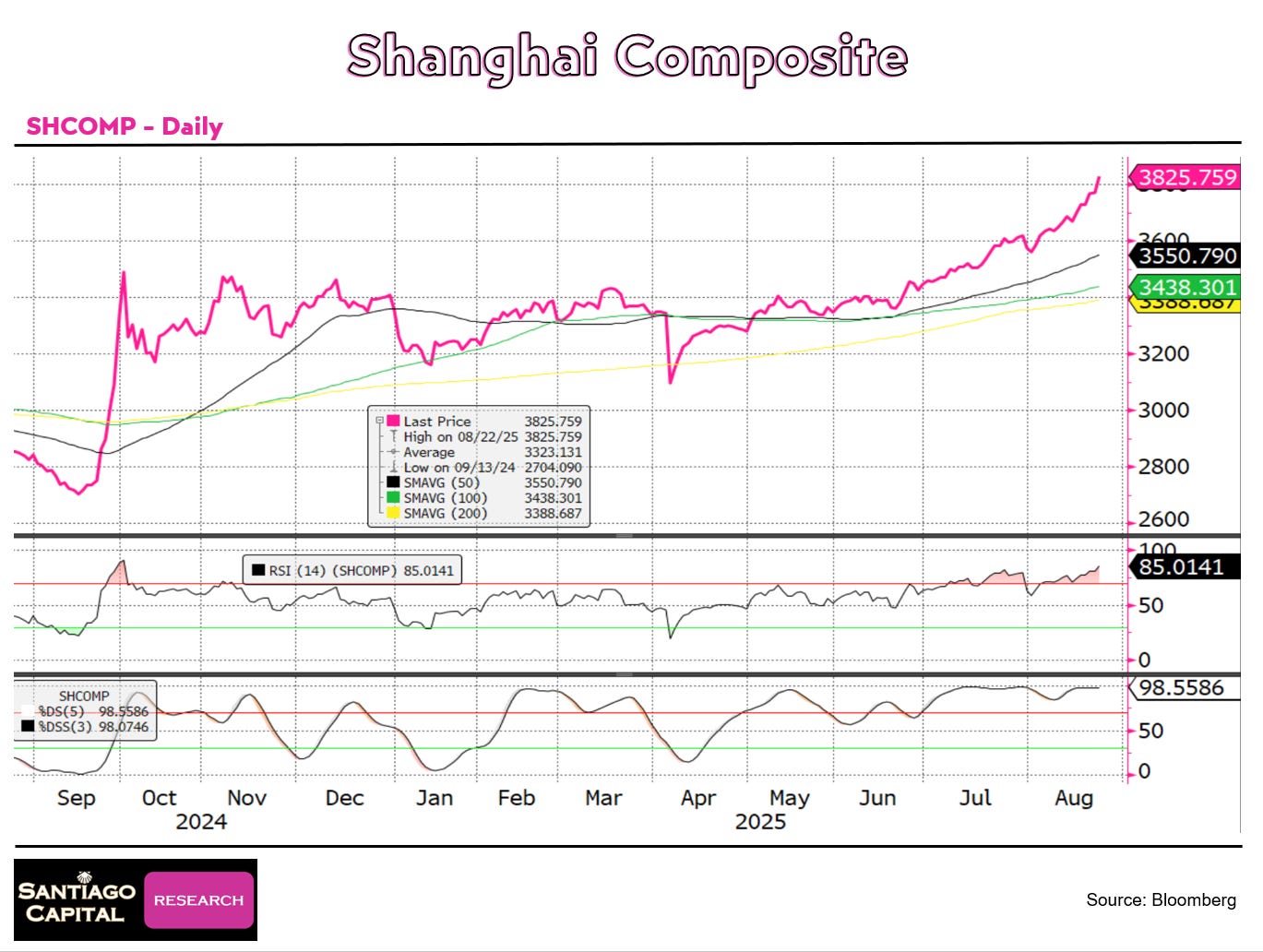

Shanghai Composite (SHCOMP – Daily)

Price surged well above moving averages.

RSI extreme overbought mid-80s and rising.

Stochastics maxed out near 100 and flat.

Trend powerful, momentum dangerously stretched.

Bovespa (IBOV – Daily)

Price consolidating above moving averages.

RSI upper 50s and rising.

Stochastics high 60s and rising.

Trend constructive with room to advance.

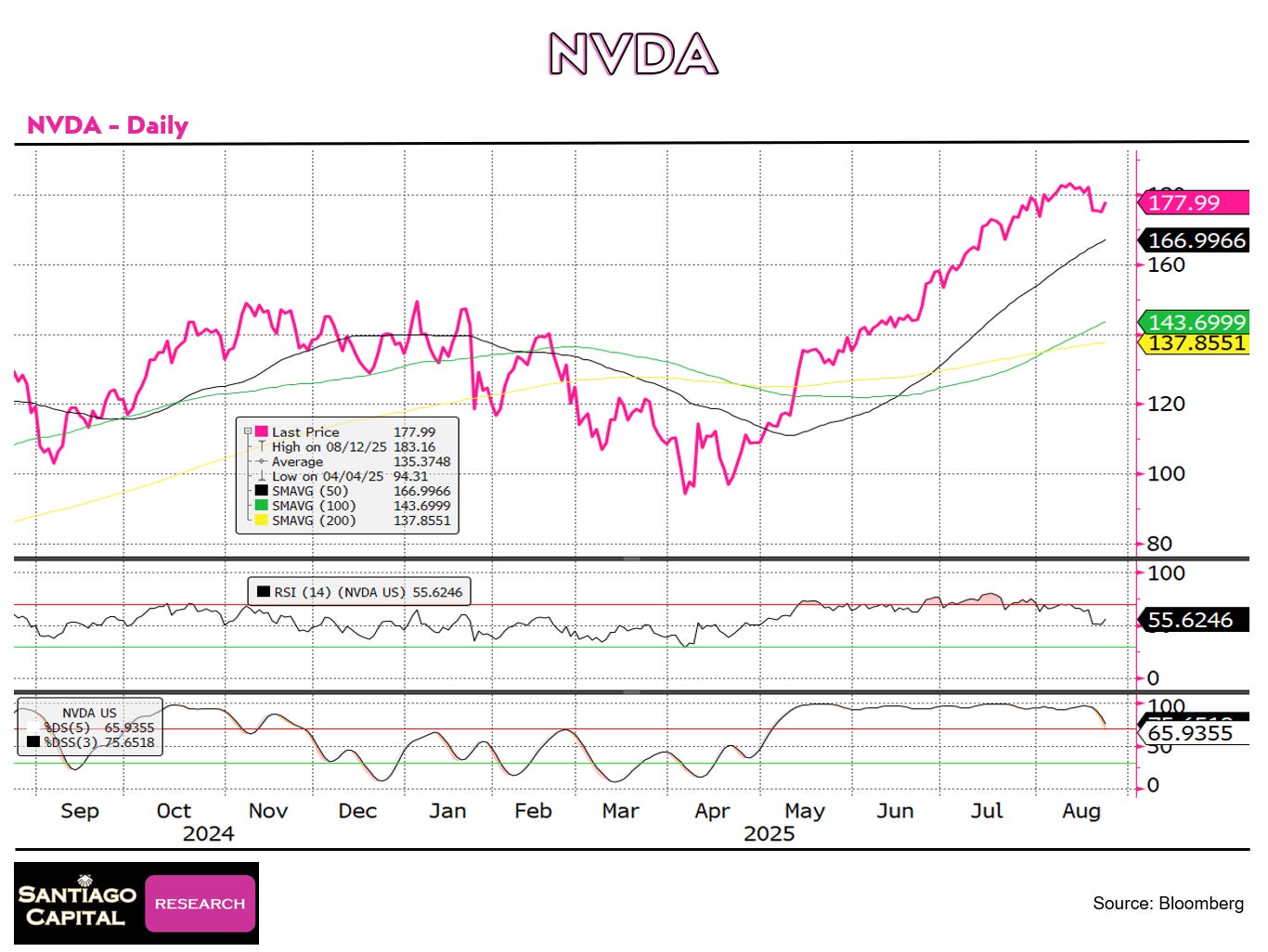

Nvidia (NVDA – Daily)

Price consolidating above moving averages.

RSI mid-50s and flat.

Stochastics mid-60s and rolling over.

Momentum cooling after strong run.

Microsoft (MSFT – Daily)

Price consolidating near 50DMA after peak.

RSI mid-40s and falling.

Stochastics low 30s and falling.

Momentum weak, short-term pressure remains.

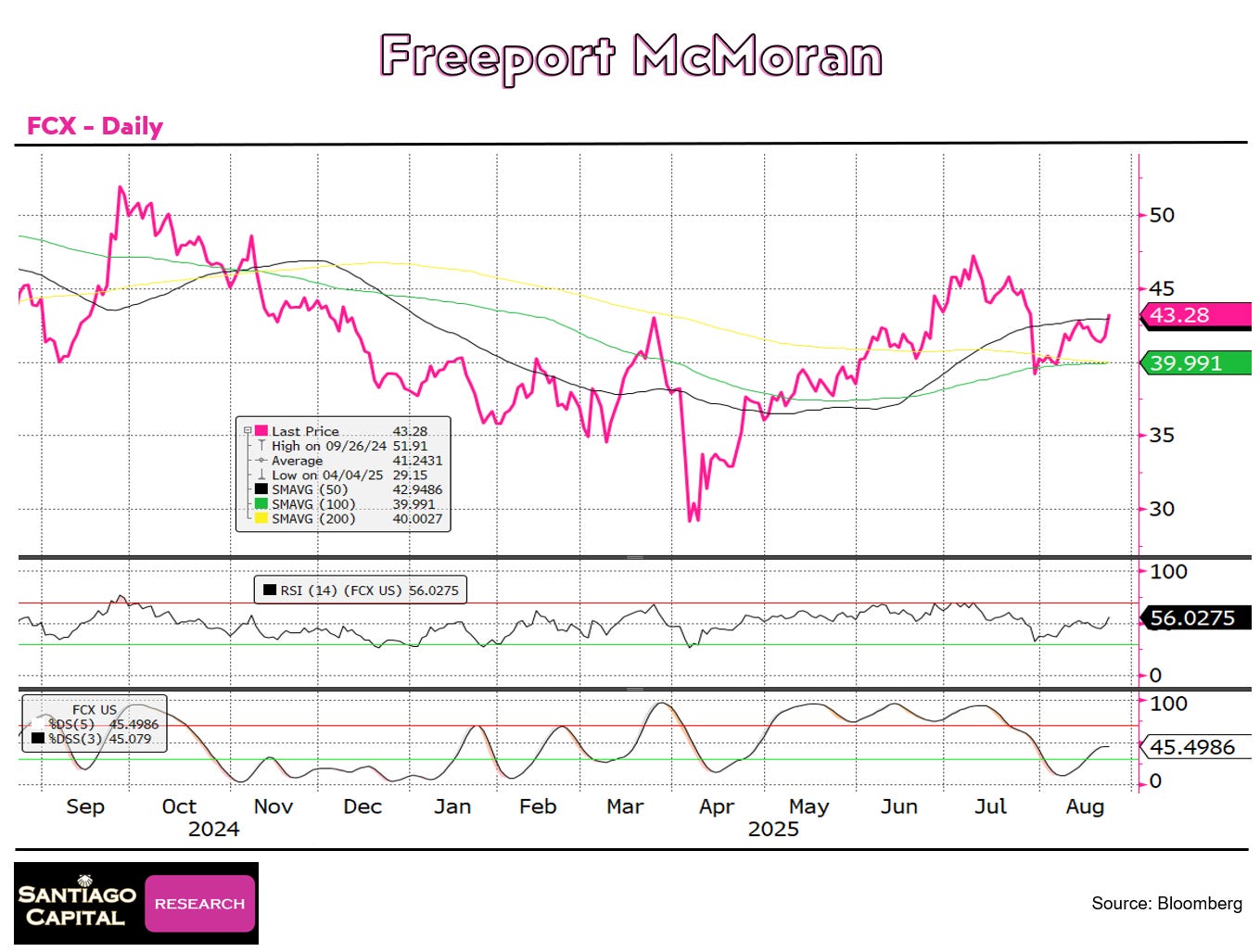

Freeport McMoRan (FCX – Daily)

Price recovering toward moving averages.

RSI mid-50s and rising.

Stochastics mid-40s and rising.

Trend fragile but stabilizing.

JP Morgan (JPM – Daily)

Price testing highs above moving averages.

RSI upper 50s and rising.

Stochastics high 30s and flat.

Trend supportive with modest momentum.

2Y UST

Yield slipping below moving averages.

RSI low 40s and falling.

Stochastics low 20s and flat oversold.

Momentum weak, oversold risk building.

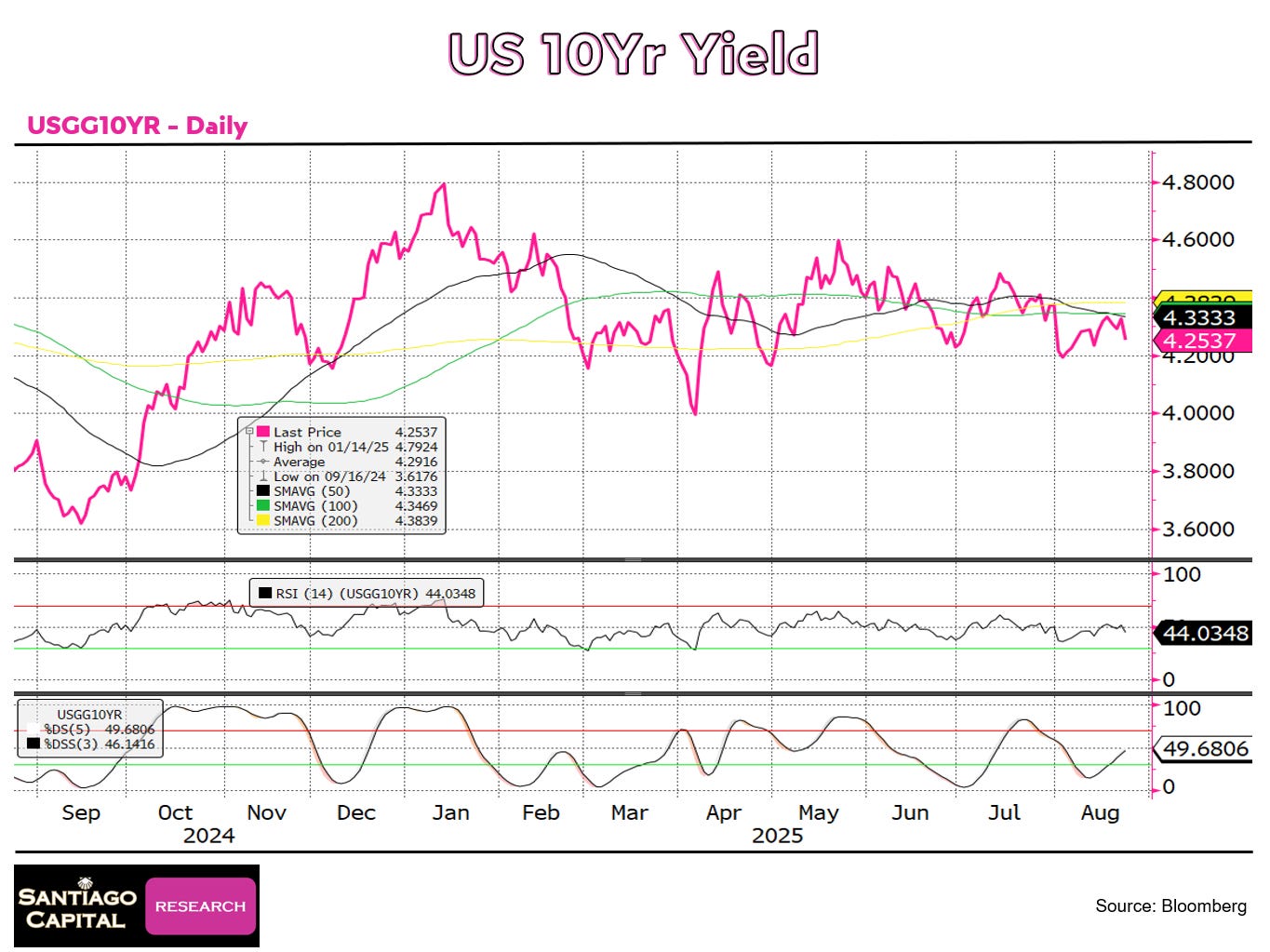

10Y UST

Yield near 50DMA.

RSI mid-40s and flat.

Stochastics mid-40s and flat.

Neutral momentum, directionless.

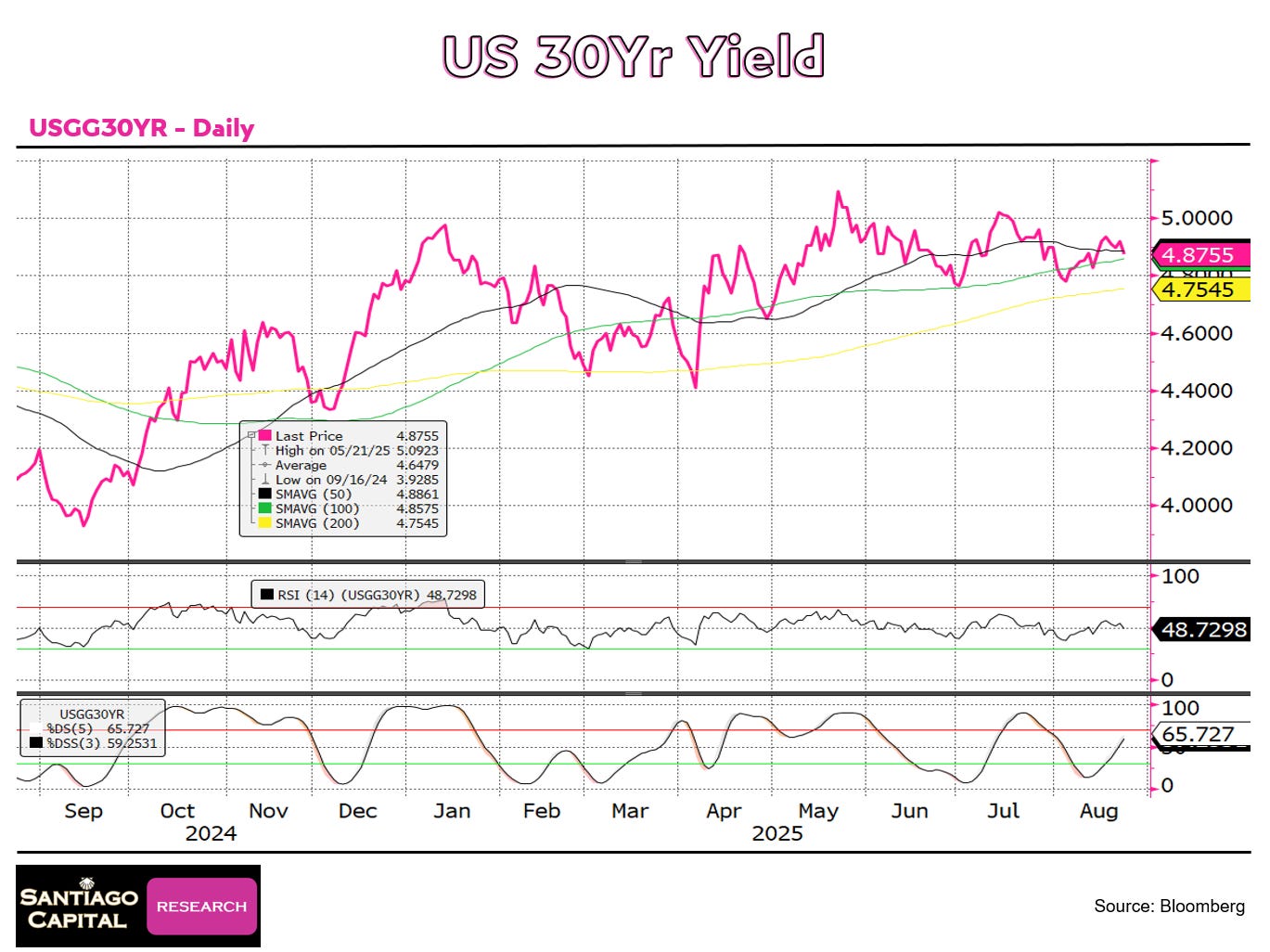

30Y UST

Yield above moving averages.

RSI high 40s and rising slightly.

Stochastics mid-60s and rising.

Momentum supportive of mild upside.

2s10s Spread

Spread steepening above averages.

RSI high 50s and rising.

Stochastics extreme overbought near 90.

Trend strong but stretched.

5s30s Spread

Spread surging higher.

RSI mid-60s and rising.

Stochastics extreme overbought near 97.

Momentum strong but extended.

IG OAS

Spreads grinding lower.

RSI high 30s and falling.

Stochastics extreme oversold near 10.

Very tight, stretched.

HY OAS

Spreads stable.

RSI mid-40s and flat.

Stochastics mid-30s and flat.

Neutral tone.

CDX IG 5Y

Index declining.

RSI just under 40 and falling.

Stochastics extreme oversold near 10.

Compressed, stretched.

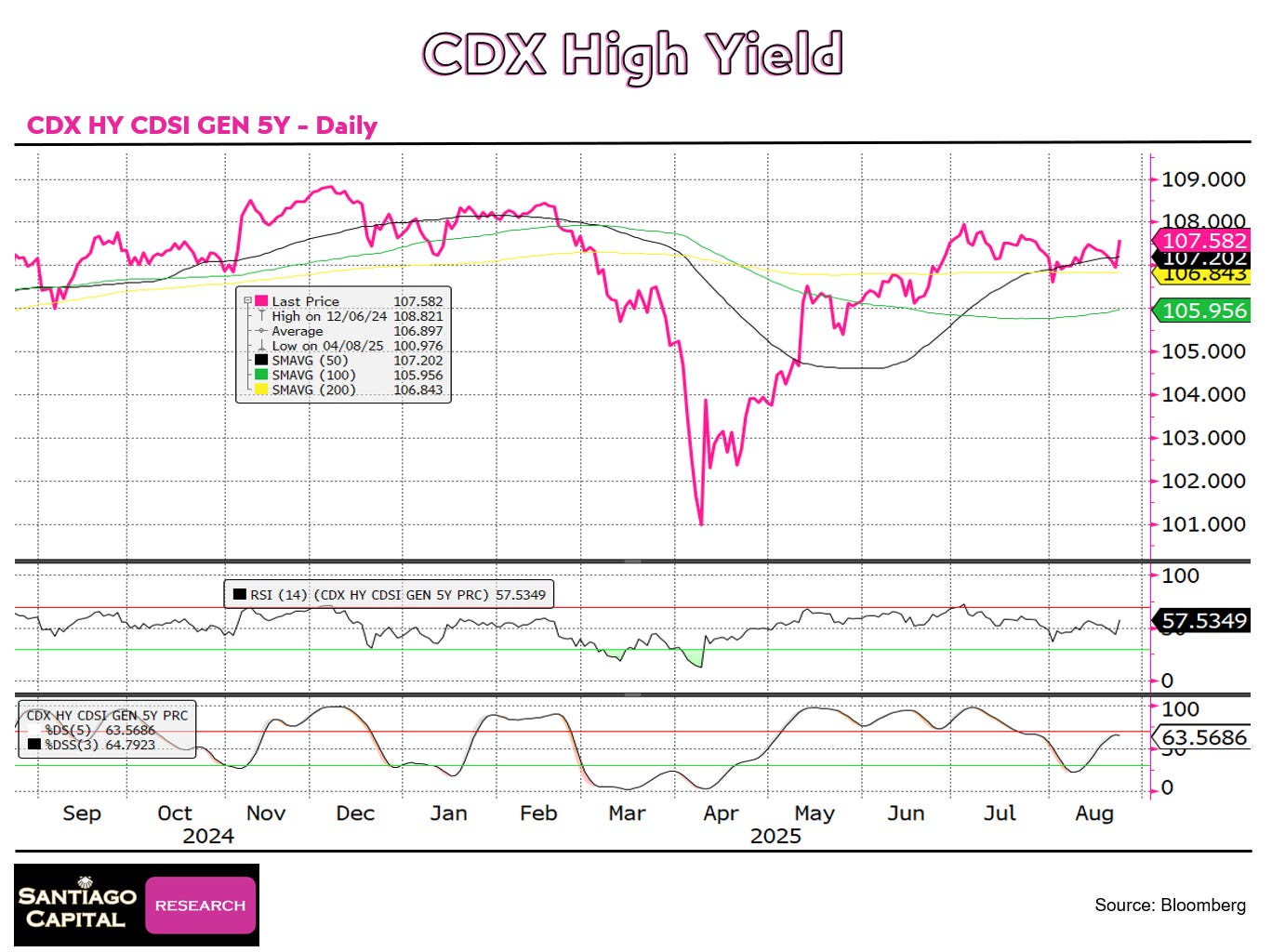

CDX HY 5Y

Index steady.

RSI upper 50s and rising.

Stochastics mid-60s and rising.

Momentum supportive.

WTI Crude

Price below moving averages.

RSI mid-40s and falling.

Stochastics near zero and flat.

Very weak, deeply oversold.

Brent Crude

Price below moving averages.

RSI neutral near 50. Stochastics low 10s and flat.

Weak but oversold.

Natural Gas

Price breaking lower. RSI mid-30s and falling.

Stochastics near zero and flat.

Momentum weak, oversold.

Gold

Price near highs.

RSI mid-50s and falling.

Stochastics low 30s and falling.

Momentum cooling, corrective tone.

Silver

Price near highs.

RSI low 60s and rising.

Stochastics low 50s and flat.

Momentum steady.

Copper

Price breaking lower below moving averages.

RSI mid-30s and falling. Stochastics near zero and flat.

Bearish momentum, oversold.

Wheat

Price below moving averages.

RSI near 40 and flat.

Stochastics near zero and flat.

Bearish and oversold.

Corn

Price below moving averages.

RSI high 40s and flat.

Stochastics low 30s and falling.

Weak momentum.

Gold positioning

Net commercial shorts rising but below historical peaks.

Price elevated, momentum softening.

Silver positioning

Commercial shorts moderate; price firm.

Positioning not overly stretched.

Copper positioning

Shorts elevated, price breakdown confirms bearish bias.

The Week Ahead

Looking ahead, the calendar is full of important data and events:

- Tuesday, Aug 27: U.S. Consumer Confidence (Conference Board) – will be watched for signs of household sentiment after recent equity gains.

- Wednesday, Aug 28: U.S. GDP (Second Estimate, Q2, BEA) – key update on growth momentum.

- Thursday, Aug 29: U.S. Jobless Claims (DOL) and PCE Price Index (BEA) – the Fed’s preferred inflation gauge.

- Friday, Aug 30: Eurozone CPI Flash Estimate (Eurostat) and Chicago PMI (ISM).

In addition, Fed officials are scheduled to speak in the wake of the Jackson Hole symposium, and their tone will be scrutinized given the ongoing steepening of the U.S. curve.

Investors will also be watching whether commodities like crude and copper stabilize from oversold levels, or if weakness persists.

Technical signals suggest equities may need to consolidate after becoming stretched, Treasuries could pause the steepening move, and commodities face key inflection points.

With major inflation and growth data due, the week ahead may offer catalysts for a shift in market tone.

“As on the Camino, each step reveals the path only as you take it.”

🔴 Thanks for reading. All future weekly reports will go behind the paywall starting next Sunday. If you find this report valuable then jump on the $399 Annual or the $2399 Pro level. This report will be included in those packages.

Really enjoying these weekly reports! Very concise and easily understood.